CoreWeave (CRWV) And OpenAI: Jim Cramer's Investment Analysis

Table of Contents

CoreWeave (CRWV): A Deep Dive into the Company and its Business Model

CoreWeave is a rapidly growing player in the cloud computing landscape, specializing in high-performance computing (HPC) infrastructure. Its focus on providing GPU-accelerated computing resources has positioned it perfectly to capitalize on the explosive growth of artificial intelligence.

CoreWeave's Infrastructure-as-a-Service (IaaS) Offering

CoreWeave's core business revolves around its Infrastructure-as-a-Service (IaaS) offering, which caters specifically to the needs of AI companies and research institutions. This involves providing scalable, cloud-based infrastructure built around powerful GPUs.

- GPU-accelerated computing: CoreWeave leverages the power of Graphics Processing Units (GPUs) to significantly accelerate computationally intensive tasks, crucial for training large AI models.

- Cloud-based infrastructure: Its cloud-based platform offers flexibility and scalability, allowing clients to easily adjust their computing resources as needed.

- High scalability: CoreWeave's infrastructure can handle massive workloads, making it ideal for training large language models (LLMs) and other complex AI algorithms.

- Target clientele: The company serves a diverse range of clients, including prominent AI companies, research institutions, and enterprises focused on AI development. This diversified client base mitigates risk and provides a solid foundation for growth.

This focus on GPU cloud computing and high-performance computing (HPC) infrastructure positions CoreWeave as a key player in the burgeoning AI infrastructure market.

CoreWeave's Financial Performance and Growth Projections

While specific financial details are subject to change and require further investigation via official company reports and financial news outlets, CoreWeave has demonstrated strong revenue growth and expansion in recent years. Its market capitalization reflects investor confidence in its potential. Analyzing CRWV stock price trends alongside key financial metrics, such as revenue, earnings, and growth rates, is crucial for any potential investor. It’s important to consult reputable sources like financial news websites and SEC filings for the most up-to-date information on CoreWeave financials and market analysis for a comprehensive investment assessment. Looking at any significant partnerships or investments further enhances the picture of CoreWeave's valuation and investment potential.

The OpenAI Connection: Understanding the Synergy and its Impact on CRWV

OpenAI's groundbreaking work in artificial intelligence relies heavily on access to immense computing power. This need for massive computational resources is where CoreWeave's expertise comes into play.

OpenAI's Reliance on Powerful Computing Resources

Training large language models (LLMs) and other advanced AI technologies requires vast computational resources. OpenAI's scale necessitates access to state-of-the-art cloud infrastructure capable of handling incredibly demanding workloads. The sheer size of these models and the complexity of their training processes present significant challenges in managing these computationally intensive workloads.

CoreWeave's Role in OpenAI's Infrastructure

While the specifics of any direct partnership between CoreWeave and OpenAI may not be publicly available, CoreWeave’s specialized services in providing AI cloud provider infrastructure make it highly likely that they service OpenAI or companies within the OpenAI ecosystem. The scale of such potential partnerships could significantly impact CoreWeave's growth trajectory, solidifying its position as a key player in the AI infrastructure landscape. Further research into CoreWeave OpenAI partnership details can provide clearer insight into this strategic alliance.

Jim Cramer's Investment Analysis and Commentary on CRWV

Jim Cramer, through his appearances on Mad Money and other platforms, has offered his opinions on CoreWeave (CRWV). It's crucial to analyze these statements objectively, remembering that investment advice should always be considered within a broader context.

Analyzing Cramer's Statements

A thorough review of Jim Cramer’s publicly available statements regarding CRWV is necessary to understand his perspective. This includes examining his assessment of the risks and rewards associated with investing in CoreWeave. His overall investment recommendation (if any) should be carefully weighed against other sources of information. Note that direct quotes should be cited with proper attribution.

Contextualizing Cramer's Perspective

It’s important to contextualize Cramer's perspective, comparing his views with those of other financial analysts. Understanding broader market trends and the prevailing market sentiment towards AI infrastructure companies is equally important. This comparative analysis helps assess the reliability of Cramer's predictions and his overall investment strategy. Determining whether his opinion aligns with the broader market consensus provides a more complete picture.

Conclusion: Investing in CoreWeave (CRWV) – A Final Assessment Based on Jim Cramer's Analysis

This analysis has explored the relationship between CoreWeave (CRWV), OpenAI, and Jim Cramer's insights. CoreWeave’s specialization in GPU cloud computing and its potential connection to OpenAI present both significant opportunities and inherent risks. The company's growth prospects in the rapidly expanding AI cloud computing market are noteworthy, but potential investors must carefully weigh these prospects against market dynamics and inherent investment risks.

Investing in CoreWeave (CRWV) requires thorough due diligence. While Jim Cramer's analysis provides one perspective, it's crucial to conduct your own research before making any investment decisions. Learn more about CoreWeave’s potential and the implications of Jim Cramer’s analysis on your investment strategy. Continue your research into CoreWeave (CRWV) and its position in the AI cloud computing market to make informed investment choices.

Featured Posts

-

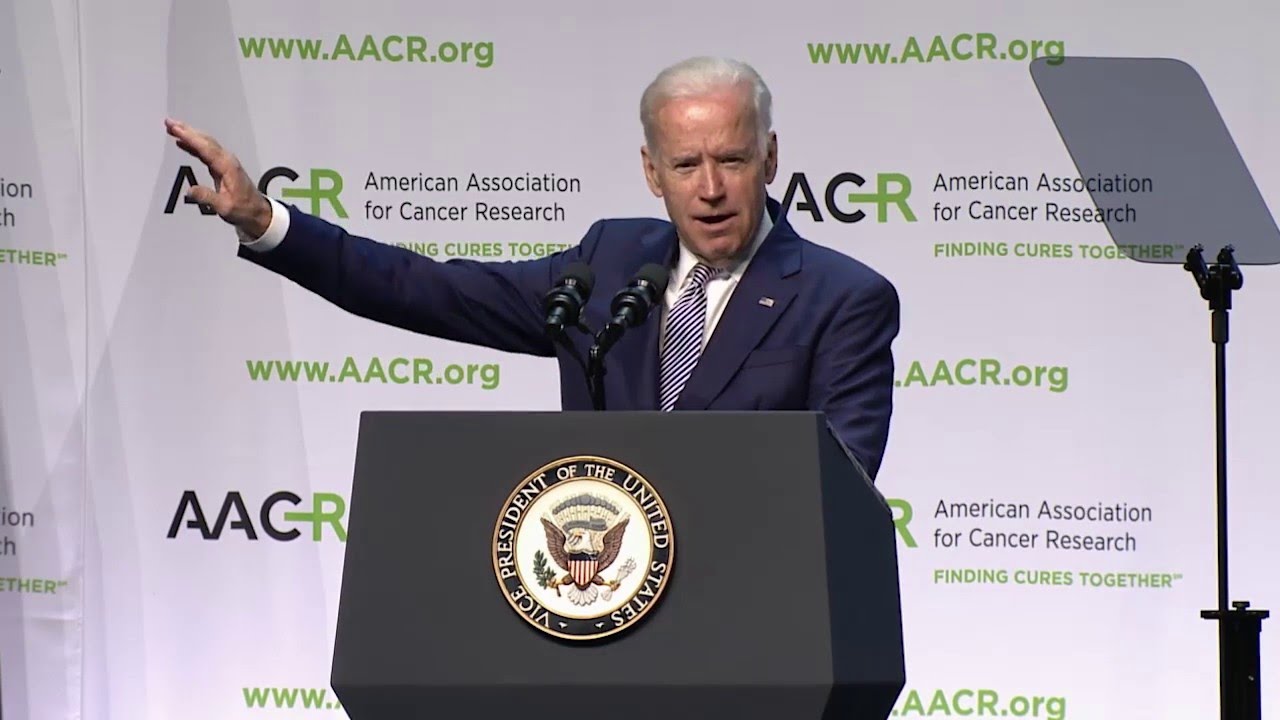

Prostate Cancer Screening The Case Of President Bidens 2014 Checkup

May 22, 2025

Prostate Cancer Screening The Case Of President Bidens 2014 Checkup

May 22, 2025 -

Joint Statement Switzerland And China Prioritize Tariff Dialogue

May 22, 2025

Joint Statement Switzerland And China Prioritize Tariff Dialogue

May 22, 2025 -

Blake Lively And Taylor Swift Friendship Under Strain Following Subpoena Developments

May 22, 2025

Blake Lively And Taylor Swift Friendship Under Strain Following Subpoena Developments

May 22, 2025 -

Making Virtual Meetings More Efficient Googles Methods

May 22, 2025

Making Virtual Meetings More Efficient Googles Methods

May 22, 2025 -

Vanja I Sime Fotografije Koje Su Razoruzale Fanove Gospodina Savrsenog

May 22, 2025

Vanja I Sime Fotografije Koje Su Razoruzale Fanove Gospodina Savrsenog

May 22, 2025

Latest Posts

-

Lindsi Grem Ta Posilennya Sanktsiy Proti Rf Detali Zakonoproektu

May 22, 2025

Lindsi Grem Ta Posilennya Sanktsiy Proti Rf Detali Zakonoproektu

May 22, 2025 -

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025 -

Senat S Sh A Ugrozhaet Uzhestochit Sanktsii Protiv Rossii Novye Detali

May 22, 2025

Senat S Sh A Ugrozhaet Uzhestochit Sanktsii Protiv Rossii Novye Detali

May 22, 2025 -

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Yikh Posilenni

May 22, 2025

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Yikh Posilenni

May 22, 2025 -

Dodatkovi Sanktsiyi Proti Rf Lindsi Grem Ta Noviy Zakonoproekt

May 22, 2025

Dodatkovi Sanktsiyi Proti Rf Lindsi Grem Ta Noviy Zakonoproekt

May 22, 2025