CoreWeave (CRWV) Stock Rise On Wednesday: Analysis And Factors

Table of Contents

Positive Market Sentiment and Investor Confidence

The Wednesday rally in CRWV stock wasn't solely due to company-specific news; broader market sentiment played a significant role. A generally positive outlook for the technology sector, particularly within the rapidly expanding AI and cloud computing markets, contributed to increased investor confidence. This positive sentiment spilled over into individual stocks, including CoreWeave.

- Positive analyst ratings and price target increases: Several financial analysts issued positive ratings and increased their price targets for CRWV stock, boosting investor confidence. These upward revisions often signal a belief in the company's future growth potential.

- Increased institutional investment: Large institutional investors may have increased their holdings in CRWV, further driving up demand and pushing the stock price higher. Institutional buying often reflects a long-term positive outlook on a company's prospects.

- General positive sentiment towards the AI and cloud computing sector: The overall excitement surrounding advancements in artificial intelligence and the growing demand for cloud computing infrastructure created a favorable environment for AI computing stocks like CoreWeave. This sector-wide positivity translates into increased investor interest.

- Increased media coverage highlighting CoreWeave's potential: Positive media coverage often influences investor perception. Any recent articles or news segments focusing on CoreWeave's innovative technology or strong growth trajectory likely contributed to the stock's rise.

CoreWeave's Business Performance and Growth Prospects

CoreWeave's strong business performance and promising growth prospects also fueled the Wednesday stock surge. Analyzing the company's recent financial results and strategic initiatives reveals a picture of consistent growth and innovation.

- Strong revenue growth in the last quarter: Solid revenue growth demonstrates the company's ability to capture market share and generate strong financial performance. This is a key indicator of a healthy and growing business.

- Successful new customer acquisitions: Securing new clients, especially large enterprises, signifies the market's acceptance of CoreWeave's products and services. This translates into increased revenue streams and strengthens the company's position in the market.

- Expansion into new markets or service offerings: CoreWeave's strategic expansion into new markets or the launch of new service offerings demonstrates its ability to adapt and capitalize on emerging opportunities within the AI computing space.

- Technological advancements and innovations: Continuous innovation in its infrastructure and AI solutions allows CoreWeave to maintain a competitive edge and attract more clients. This demonstrates a forward-thinking approach to business.

- Partnerships and collaborations that are boosting growth: Strategic alliances with other companies within the AI ecosystem can significantly boost CoreWeave's reach and accelerate its growth.

Impact of the AI Computing Boom on CRWV Stock

CoreWeave is exceptionally well-positioned to capitalize on the burgeoning demand for AI computing. Its specialized infrastructure and strategic partnerships are key drivers of its success in this rapidly growing market.

- CoreWeave's specialized infrastructure for AI workloads: CoreWeave's infrastructure is specifically designed to handle the demanding computational requirements of AI training and inference, giving it a competitive advantage.

- Partnerships with leading AI companies: Collaborations with major players in the AI industry provide CoreWeave with access to new markets and technologies, accelerating its growth trajectory.

- Growth opportunities in the AI training and inference markets: These are two of the fastest-growing segments within the AI industry, and CoreWeave is perfectly positioned to capture significant market share.

- Competitive advantages in terms of cost-efficiency or performance: CoreWeave may offer advantages in terms of cost-effectiveness or superior performance compared to competitors, making it an attractive option for clients.

- Potential for future revenue streams related to AI services: As the AI market continues to expand, CoreWeave has significant potential to generate new revenue streams through the provision of additional AI-related services.

Technical Analysis of the CRWV Stock Chart

Analyzing the CRWV stock chart on Wednesday reveals potential reasons for the price increase. (Disclaimer: This is not financial advice.)

- Analysis of trading volume on Wednesday: A significant increase in trading volume on Wednesday could indicate strong buying pressure, supporting the price surge.

- Identification of key price levels that indicate potential future movements: Identifying support and resistance levels on the chart can help predict potential future price movements. (Disclaimer: This is not financial advice).

- Mention of any noticeable chart patterns (e.g., breakout from a consolidation): A breakout from a period of consolidation could be an indicator of a new upward trend. (Disclaimer: This is not financial advice).

- Disclaimer: This is not financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Conclusion: CoreWeave (CRWV) Stock—Investment Outlook and Next Steps

The CoreWeave (CRWV) stock rise on Wednesday was a result of a confluence of factors: positive market sentiment, strong company performance, the burgeoning AI computing market, and potentially favorable technical indicators. Understanding these factors is essential for making informed investment decisions. While this analysis offers insights, it's crucial to conduct thorough due diligence before investing in any stock.

Continue monitoring the CoreWeave (CRWV) stock price and its performance to make informed investment decisions. Stay informed about CoreWeave's progress in the rapidly evolving AI computing sector. Consider adding CoreWeave to your watchlist to track its future performance. Remember to always seek professional financial advice before making any investment choices.

Featured Posts

-

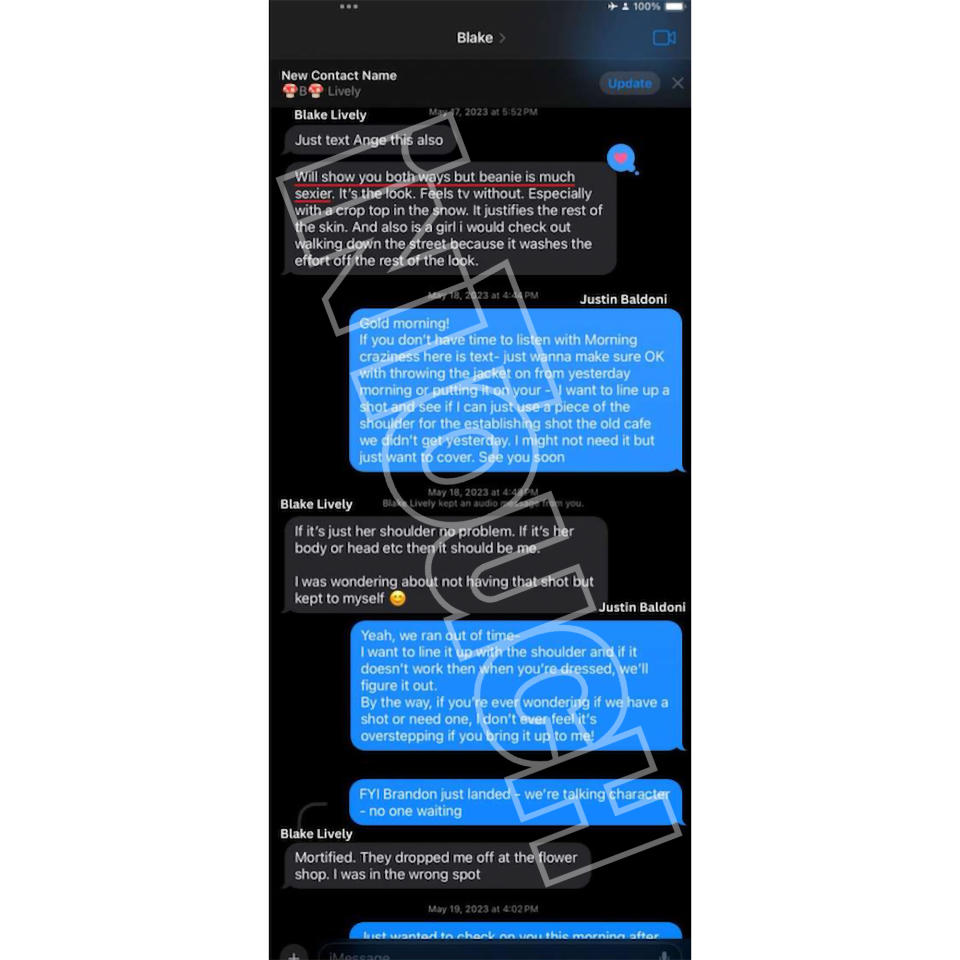

Is Blake Livelys Public Image A Carefully Crafted Illusion Examining Recent Allegations

May 22, 2025

Is Blake Livelys Public Image A Carefully Crafted Illusion Examining Recent Allegations

May 22, 2025 -

Dexter Original Sin Steelbook Blu Ray A Collectors Must Have

May 22, 2025

Dexter Original Sin Steelbook Blu Ray A Collectors Must Have

May 22, 2025 -

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Blake Lively Alleged Controversies And Recent News

May 22, 2025 -

Penn Relays 2024 Allentown Boys Achieve Sub 43 Second In 4x100m

May 22, 2025

Penn Relays 2024 Allentown Boys Achieve Sub 43 Second In 4x100m

May 22, 2025 -

Improving Virtual Meetings New Features From Google

May 22, 2025

Improving Virtual Meetings New Features From Google

May 22, 2025

Latest Posts

-

Government Response To Antisemitic Threats Against Israeli Embassies

May 22, 2025

Government Response To Antisemitic Threats Against Israeli Embassies

May 22, 2025 -

Israeli Diplomat Yaron Lischinsky Murdered In Washington D C

May 22, 2025

Israeli Diplomat Yaron Lischinsky Murdered In Washington D C

May 22, 2025 -

Blood Libel Accusations Prompt Heightened Security At Israeli Embassies

May 22, 2025

Blood Libel Accusations Prompt Heightened Security At Israeli Embassies

May 22, 2025 -

Increased Security Measures At Israeli Embassies Worldwide

May 22, 2025

Increased Security Measures At Israeli Embassies Worldwide

May 22, 2025 -

Suspect Arrested Following Deadly Shooting At Israeli Embassy In Washington

May 22, 2025

Suspect Arrested Following Deadly Shooting At Israeli Embassy In Washington

May 22, 2025