CoreWeave (CRWV) Stock Soars: Analyzing The Factors Contributing To Recent Growth

Table of Contents

Strong Fundamentals Driving CoreWeave's Growth

CoreWeave's recent success isn't a fluke; it's built on a foundation of robust fundamentals. Several key factors contribute to its rapid growth and market traction.

Rapid Adoption of CoreWeave's Cloud Services

The demand for high-performance computing services is exploding, fueled by the advancements in artificial intelligence (AI), machine learning (ML), and other data-intensive applications. CoreWeave, with its specialized GPU-accelerated computing infrastructure, is perfectly positioned to meet this surging demand.

- AI and Machine Learning: The explosive growth of AI and ML models requires massive computational power, driving significant adoption of CoreWeave's cloud services.

- Gaming: The gaming industry relies heavily on high-performance cloud infrastructure for rendering and streaming, making CoreWeave a critical partner.

- Financial Modeling: Sophisticated financial institutions leverage CoreWeave's capabilities for complex simulations and risk modeling.

- Scientific Research: Researchers in fields like genomics and climate modeling benefit from CoreWeave's scalable cloud infrastructure for data analysis and processing. Recent reports suggest a 30% year-on-year growth in CoreWeave's cloud infrastructure utilization within these sectors.

Strategic Partnerships and Collaborations

CoreWeave's strategic alliances have significantly boosted its market reach and product offerings. These partnerships provide access to new technologies, customer bases, and industry expertise.

- Nvidia Partnership: CoreWeave's close collaboration with Nvidia, a leading GPU manufacturer, ensures access to cutting-edge hardware and technologies.

- Software Integrations: Partnerships with leading software providers seamlessly integrate CoreWeave's services into existing workflows, enhancing user experience and adoption.

- Data Center Expansions: Strategic partnerships with data center providers facilitate expansion into new geographic markets, ensuring wider availability of CoreWeave's cloud infrastructure.

Innovative Technology and Infrastructure

CoreWeave differentiates itself through its innovative technology and sustainable data center infrastructure. This focus on efficiency and scalability provides a competitive edge in the cloud computing market.

- Scalability: CoreWeave's cloud infrastructure effortlessly scales to meet fluctuating demand, offering unparalleled flexibility for users.

- Efficiency: Optimized resource allocation and advanced cooling technologies ensure cost-effectiveness and energy efficiency.

- Sustainability: CoreWeave invests in renewable energy sources, aligning with growing environmental concerns and attracting environmentally conscious clients.

Market Conditions Favorable to CoreWeave's Success

The current market landscape is exceptionally favorable for CoreWeave's continued growth. Several macro trends are driving increased demand for its services.

Booming Demand for AI and Machine Learning

The AI revolution is fueling a massive increase in demand for high-performance computing resources. CoreWeave's specialized GPU-based infrastructure is ideally suited to support the development and deployment of sophisticated AI and ML models.

- Increased Investment: Venture capital and corporate investments in AI are skyrocketing, driving the need for robust cloud infrastructure.

- Generative AI: The rise of generative AI models like large language models (LLMs) places immense pressure on computing resources, further bolstering demand for CoreWeave's services.

- Data Growth: The exponential growth of data necessitates powerful computational capabilities for effective analysis and processing, benefitting CoreWeave's offerings.

Increased Investment in Cloud Computing

The overall cloud computing market is experiencing robust growth, driven by the digital transformation of businesses across various sectors. This macro trend significantly benefits CoreWeave.

- Cloud Adoption: Companies are increasingly migrating their workloads to the cloud, creating significant demand for cloud computing resources.

- Market Forecasts: Industry analysts predict continued strong growth in the cloud computing market for the foreseeable future, reinforcing CoreWeave's long-term growth potential.

- Hybrid Cloud Solutions: CoreWeave is well-positioned to cater to the growing adoption of hybrid cloud solutions that combine on-premise and cloud-based infrastructure.

Potential Risks and Challenges Facing CoreWeave

Despite its strong fundamentals and favorable market conditions, CoreWeave faces certain risks and challenges.

Competition in the Cloud Computing Market

The cloud computing market is highly competitive, with established players and emerging competitors vying for market share. CoreWeave needs to maintain its competitive edge to sustain its growth trajectory.

- Amazon Web Services (AWS): AWS remains the dominant player in the cloud computing market, posing a significant competitive challenge.

- Microsoft Azure: Azure is a strong competitor, offering a broad range of cloud services.

- Google Cloud Platform (GCP): GCP is also a major player, with a strong focus on AI and machine learning.

- Specialized Competitors: Other companies are also focusing on providing GPU-based cloud services, increasing competition.

Economic Uncertainty and its Impact

Economic downturns can impact technology spending, potentially affecting CoreWeave's revenue growth. Maintaining resilience during periods of economic uncertainty is crucial.

- Reduced IT Budgets: Companies may reduce their IT budgets during economic slowdowns, affecting demand for cloud services.

- Increased Pricing Pressure: Competition may intensify during economic downturns, potentially leading to price wars and reduced profit margins.

Conclusion: Investing in the Future of CoreWeave (CRWV)

The recent surge in CoreWeave (CRWV) stock is driven by a confluence of factors, including strong fundamentals, a favorable market environment, and increasing demand for high-performance computing. While competitive pressures and economic uncertainty represent potential risks, the company's innovative technology, strategic partnerships, and the booming AI and cloud computing markets suggest a positive long-term outlook. Learn more about CoreWeave (CRWV) stock and its future potential. Consider adding CoreWeave (CRWV) to your investment portfolio after conducting thorough due diligence and consulting a financial advisor. Remember to carefully consider your personal risk tolerance and investment goals before making any investment decisions related to CoreWeave (CRWV) or any other stock.

Featured Posts

-

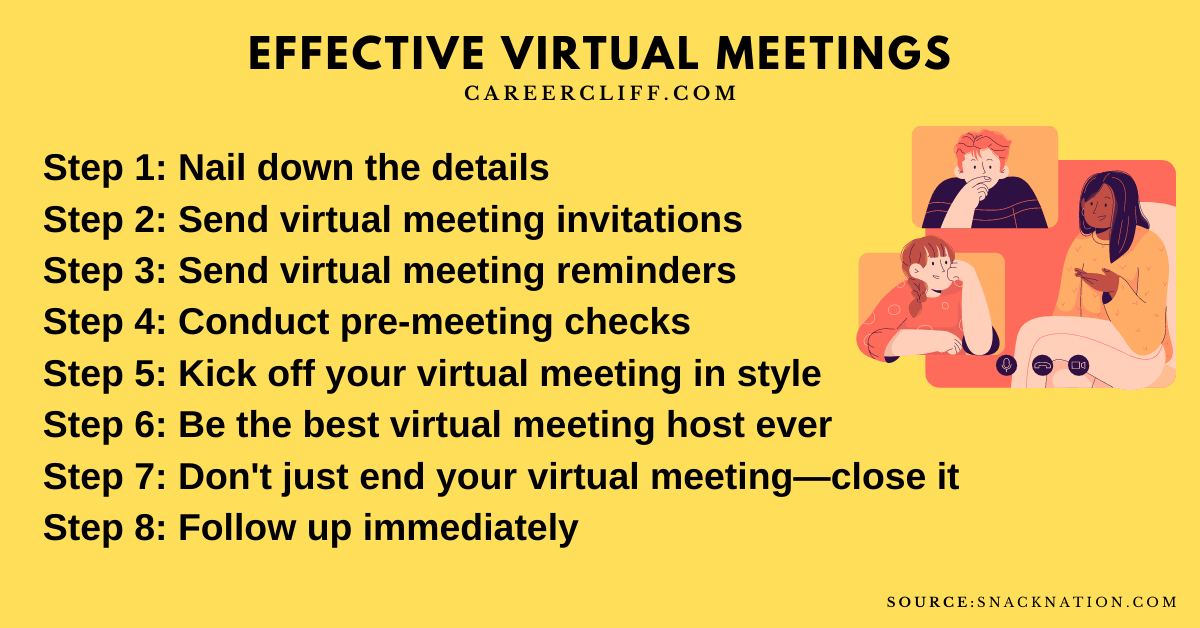

How Google Is Making Virtual Meetings Better

May 22, 2025

How Google Is Making Virtual Meetings Better

May 22, 2025 -

Mulhouse Une Selection Hellfest Au Noumatrouff

May 22, 2025

Mulhouse Une Selection Hellfest Au Noumatrouff

May 22, 2025 -

News And Speculation Surrounding Blake Livelys Alleged Involvement

May 22, 2025

News And Speculation Surrounding Blake Livelys Alleged Involvement

May 22, 2025 -

Rio Tinto Rebuts Forrests Wasteland Claim Pilbara Defence

May 22, 2025

Rio Tinto Rebuts Forrests Wasteland Claim Pilbara Defence

May 22, 2025 -

Adios A Las Enfermedades Cronicas El Poder Del Superalimento Para Un Envejecimiento Activo

May 22, 2025

Adios A Las Enfermedades Cronicas El Poder Del Superalimento Para Un Envejecimiento Activo

May 22, 2025

Latest Posts

-

Zakonoproekt Grem Posilennya Sanktsiynogo Tisku Na Rosiyu

May 22, 2025

Zakonoproekt Grem Posilennya Sanktsiynogo Tisku Na Rosiyu

May 22, 2025 -

Rosiya Pid Zagrozoyu Novikh Sanktsiy Initsiativa Lindsi Grem

May 22, 2025

Rosiya Pid Zagrozoyu Novikh Sanktsiy Initsiativa Lindsi Grem

May 22, 2025 -

Lindsi Grem Ta Posilennya Sanktsiy Proti Rf Detali Zakonoproektu

May 22, 2025

Lindsi Grem Ta Posilennya Sanktsiy Proti Rf Detali Zakonoproektu

May 22, 2025 -

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025 -

Senat S Sh A Ugrozhaet Uzhestochit Sanktsii Protiv Rossii Novye Detali

May 22, 2025

Senat S Sh A Ugrozhaet Uzhestochit Sanktsii Protiv Rossii Novye Detali

May 22, 2025