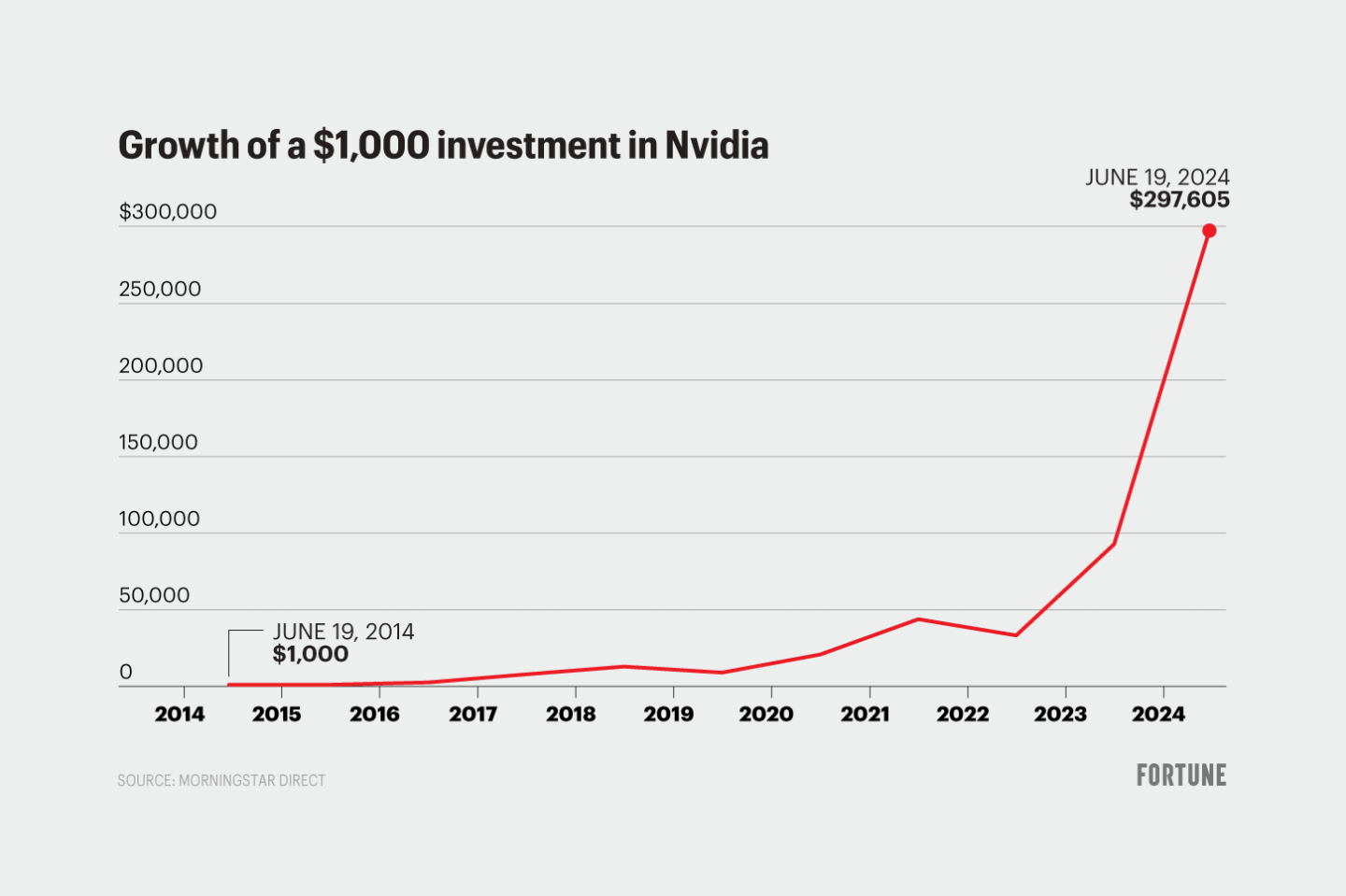

CoreWeave (CRWV) Stock Surge: Nvidia Investment Fuels Growth

Table of Contents

Nvidia's Strategic Investment and its Impact on CoreWeave (CRWV)

The Significance of the Partnership

Nvidia's investment in CoreWeave represents a significant strategic move for both companies. While the exact financial details might not be publicly available immediately after the investment, the implications are clear. The partnership validates CoreWeave's innovative approach to cloud computing and its potential to disrupt the market.

- Amount invested: (Insert amount if available, otherwise state "a substantial amount" or similar).

- Equity stake acquired: (Insert percentage if available, otherwise state "a significant equity stake").

- Implications for CoreWeave's valuation: The investment significantly boosts CoreWeave's valuation, attracting further investor interest and enhancing its credibility.

- Potential future collaborations: The partnership opens doors for joint marketing efforts, product integration, and the development of cutting-edge technologies leveraging Nvidia's GPUs and CoreWeave's cloud infrastructure.

The synergy between Nvidia's high-performance GPUs and CoreWeave's specialized cloud platform is undeniable. Nvidia's GPUs are crucial for accelerating AI and high-performance computing (HPC) workloads, making CoreWeave's platform even more attractive to clients demanding powerful and efficient cloud solutions.

Boosting CoreWeave's Market Position

The Nvidia partnership dramatically enhances CoreWeave's competitive standing in the fiercely competitive cloud computing market.

- Increased brand credibility: Association with a tech giant like Nvidia instantly boosts CoreWeave's brand recognition and trust among potential clients.

- Access to Nvidia's vast resources: This includes access to Nvidia's technological expertise, sales channels, and extensive network of partners.

- Potential for joint marketing efforts: Combined marketing campaigns will reach a broader audience, increasing CoreWeave's visibility and market penetration.

- Expansion into new markets: Leveraging Nvidia's global reach, CoreWeave can tap into new geographic markets and customer segments more effectively.

This strategic alliance gives CoreWeave a significant competitive edge, particularly in the rapidly expanding markets for AI-powered applications and high-performance computing solutions. CoreWeave's specialized infrastructure is exceptionally well-suited for these demanding workloads, and the Nvidia partnership solidifies its position as a leading provider in this niche.

CoreWeave's (CRWV) Underlying Business Model and Growth Potential

Focus on AI and High-Performance Computing

CoreWeave's cloud platform is specifically designed to meet the demanding requirements of AI and HPC workloads. This focus distinguishes it from more general-purpose cloud providers.

- Key features of their cloud platform: (List key features like dedicated GPU instances, high-bandwidth networking, specialized software stacks, etc.)

- Target customer segments: AI researchers, data scientists, financial institutions, life sciences companies, and other organizations with intensive computing needs are key target markets.

- Competitive advantages in terms of performance and scalability: CoreWeave's architecture provides superior performance and scalability compared to more general cloud providers, making it ideal for computationally intensive tasks.

The platform's technical sophistication and ability to handle complex AI models and large datasets are crucial factors contributing to its market appeal and growth potential.

Market Demand and Future Projections

The market for cloud computing services is booming, and CoreWeave is well-positioned to benefit from this rapid expansion.

- Market size estimations: (Cite market research data and projections for the cloud computing market and segments relevant to CoreWeave).

- Projected growth rates: (Include data on expected growth rates for AI and HPC cloud services).

- CoreWeave's market penetration strategy: (Discuss CoreWeave's plans for expanding its market share through partnerships, product development, and targeted marketing).

- Potential for international expansion: (Discuss CoreWeave's potential for growth in international markets, particularly regions with high demand for AI and HPC resources).

The impressive growth projections for the AI and HPC cloud computing markets suggest significant opportunities for CoreWeave to capture substantial market share.

Analyzing the Risk Factors Associated with CoreWeave (CRWV) Stock

Competition in the Cloud Computing Market

The cloud computing industry is highly competitive, and CoreWeave faces challenges from established giants and emerging players.

- Major competitors: Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), and other smaller cloud providers pose significant competition.

- Potential competitive threats: New entrants, technological advancements, and price wars could impact CoreWeave's market position.

- Strategies to mitigate competition: CoreWeave needs to continue innovating, building strong partnerships, and focusing on providing superior performance and customer service to maintain a competitive advantage.

Understanding the competitive landscape is crucial for evaluating the risks associated with investing in CoreWeave (CRWV) stock.

Financial Performance and Future Outlook

Analyzing CoreWeave's financial performance and future projections is essential for assessing investment risk.

- Key financial metrics: (Review revenue growth, profitability, cash flow, and other relevant financial indicators. If available, include data points.)

- Growth trajectory: (Analyze historical growth and projected future growth based on available information).

- Potential risks related to financial performance: (Identify potential financial risks, such as dependence on key customers, fluctuating demand, and operating expenses).

- Investor sentiment: (Analyze investor sentiment towards CoreWeave (CRWV) stock through news articles, analyst reports, and social media discussions.)

Investors should carefully examine CoreWeave's financial health and growth trajectory to assess its long-term viability and potential for delivering returns.

Conclusion

The recent surge in CoreWeave (CRWV) stock is undeniably linked to its strategic partnership with Nvidia, significantly enhancing its competitive standing in the cloud computing market. The partnership offers immense growth potential fueled by the ever-increasing demand for AI and high-performance computing resources. While competitive pressures and financial risks exist, CoreWeave's innovative platform and strong strategic alliances present a compelling investment opportunity. However, thorough due diligence, including independent research into CoreWeave (CRWV) stock, its financials, and market dynamics is crucial before making any investment decisions. Remember to consult with a financial advisor before investing in any stock, including CoreWeave (CRWV) stock.

Featured Posts

-

The Blake Lively Allegations Fact Or Fiction

May 22, 2025

The Blake Lively Allegations Fact Or Fiction

May 22, 2025 -

Core Weave Crwv Unpacking The Recent Stock Price Appreciation

May 22, 2025

Core Weave Crwv Unpacking The Recent Stock Price Appreciation

May 22, 2025 -

Generations Of Photography The Traverso Family At Cannes

May 22, 2025

Generations Of Photography The Traverso Family At Cannes

May 22, 2025 -

Zebra Mussel Infestation Discovered On Casper Boat Lift

May 22, 2025

Zebra Mussel Infestation Discovered On Casper Boat Lift

May 22, 2025 -

Hieu Ro Hai Lo Vuong Nho Tren Dau Noi Usb Cua Ban

May 22, 2025

Hieu Ro Hai Lo Vuong Nho Tren Dau Noi Usb Cua Ban

May 22, 2025

Latest Posts

-

Partido Mexico Vs Panama Todo Sobre La Final De La Concacaf

May 22, 2025

Partido Mexico Vs Panama Todo Sobre La Final De La Concacaf

May 22, 2025 -

A Que Hora Juega Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025

A Que Hora Juega Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025 -

Liga De Naciones Concacaf Mexico Vs Panama Informacion Del Partido Final

May 22, 2025

Liga De Naciones Concacaf Mexico Vs Panama Informacion Del Partido Final

May 22, 2025 -

Cuando Y Donde Ver La Final Concacaf Mexico Contra Panama

May 22, 2025

Cuando Y Donde Ver La Final Concacaf Mexico Contra Panama

May 22, 2025 -

La Real Sociedad Y El Virus Fifa Un Calendario Inflexible Sin Descanso

May 22, 2025

La Real Sociedad Y El Virus Fifa Un Calendario Inflexible Sin Descanso

May 22, 2025