CoreWeave (CRWV) Stock Surge: Reasons Behind Today's Jump

Table of Contents

The Impact of Artificial Intelligence (AI) on CoreWeave's Growth

The explosive growth of artificial intelligence (AI) and machine learning is undeniably a primary driver of CoreWeave's recent success. The increasing demand for high-performance computing resources perfectly aligns with CoreWeave's specialized services.

Increased Demand for High-Performance Computing

The training of sophisticated AI models demands immense processing power. CoreWeave's infrastructure, built on a foundation of cutting-edge technology, is specifically optimized for these demanding AI workloads. This positions them as a key player in the rapidly expanding AI landscape.

- AI model training requires significant processing power: Modern AI models, particularly large language models (LLMs) and generative AI, require vast computational resources to train effectively.

- CoreWeave's infrastructure is optimized for AI workloads: The company leverages advanced GPUs (Graphics Processing Units) and other specialized hardware to deliver the performance needed for AI training and inference.

- Growing partnerships with AI companies are driving revenue growth: CoreWeave is actively forging strategic alliances with prominent players in the AI industry, securing substantial contracts and fueling revenue expansion.

- Increased utilization of CoreWeave's data centers directly correlates with AI advancements: As AI adoption accelerates, so does the demand for CoreWeave's high-performance cloud computing services, leading to increased capacity utilization and revenue streams.

Strategic Partnerships and Collaborations

CoreWeave's strategic alliances are a crucial factor in its market dominance and subsequent stock price appreciation. These partnerships provide access to new markets, technologies, and resources, further solidifying its position as a leader in AI-focused cloud computing.

- Highlight specific partnerships and their contributions to the surge: While specific details may be confidential, any publicly announced partnerships with major AI developers or research institutions should be mentioned and their significance highlighted. For example, a partnership enabling access to a large dataset for training would be a strong positive signal.

- Mention any recent announcements or collaborations: Any recent news releases concerning new partnerships or collaborations should be included, as these events often directly impact investor sentiment and stock price.

- Discuss the potential for future partnerships to further propel growth: The potential for future collaborations with other key players in the AI and cloud computing industry should be discussed to illustrate the company's ongoing growth trajectory.

CoreWeave's Unique Business Model and Competitive Advantages

CoreWeave’s success isn't solely dependent on the growth of AI; it's also driven by its innovative business model and distinct competitive advantages.

Sustainable and Efficient Data Centers

CoreWeave distinguishes itself through its commitment to building sustainable and highly efficient data center infrastructure. This approach not only reduces operational costs but also enhances the company's environmental profile, making it attractive to environmentally conscious investors.

- Discuss the use of GPUs (Graphics Processing Units) and their importance in AI: The company’s strategic deployment of GPUs is a key differentiator, enabling unparalleled processing power for AI workloads.

- Highlight any unique technological innovations or approaches: Mention any proprietary technologies or unique architectural designs that contribute to CoreWeave's operational efficiency and cost advantages.

- Explain how sustainability initiatives contribute to the company's appeal: CoreWeave's commitment to sustainability enhances its brand image and attracts investors prioritizing Environmental, Social, and Governance (ESG) factors.

Strong Financial Performance and Growth Projections

CoreWeave's strong financial performance and promising growth projections are key factors driving investor confidence and the recent stock surge.

- Mention recent revenue figures and growth rates: Include any recent financial reports that demonstrate substantial revenue growth and profitability.

- Highlight any positive analyst predictions or upgrades: Mention any upward revisions in analyst ratings or price targets, as these are strong indicators of positive market sentiment.

- Discuss any indicators of sustained, long-term growth: Highlight any factors suggesting that the current growth trajectory is sustainable in the long term, such as a robust pipeline of new contracts or ongoing technological innovation.

Overall Market Sentiment and Investor Confidence

The overall market sentiment surrounding cloud computing and AI, coupled with specific factors related to CoreWeave, significantly influenced the recent stock price surge.

Positive Market Reaction to Industry Trends

The broader market's positive outlook on the future of cloud computing and AI is a crucial factor. The increasing adoption of AI across various industries is creating a favorable environment for companies like CoreWeave.

- Mention any related positive news impacting the sector: Include any positive news or announcements from other major players in the AI or cloud computing sector that might have contributed to a generally positive market sentiment.

- Explain how investor confidence in the AI market is influencing CRWV’s valuation: Investor confidence in the long-term potential of the AI market is directly translating into increased valuations for companies like CoreWeave that are well-positioned to benefit from this growth.

Short Squeeze or Other Speculative Activity

While fundamental factors are primary drivers, it's important to consider the possibility of short squeezes or other speculative trading activities contributing to the stock's dramatic price increase.

- Discuss the percentage of shorted shares (if available): If data on short interest is available, discuss its potential role in amplifying the price movement.

- Explain the mechanisms of a short squeeze and its potential impact: Briefly explain how short squeezes work and their potential to create exaggerated price fluctuations.

- Address any other potential speculative factors: Consider other potential factors like social media hype or broader market trends that might have contributed to the surge.

Conclusion

The CoreWeave (CRWV) stock surge today is a result of several interconnected factors: the explosive growth of the AI sector, CoreWeave's strategic positioning within this rapidly expanding market, its unique business model and competitive advantages, and positive overall market sentiment. The company’s strong financial performance, coupled with its focus on sustainable and efficient data center infrastructure, positions it favorably for continued growth. For investors seeking exposure to the burgeoning AI market, close monitoring of CoreWeave (CRWV) stock and its future developments is crucial. Understanding the reasons behind today's jump provides valuable insight into the potential of this high-growth technology company. Stay informed about further developments in the CoreWeave (CRWV) market and consider adding it to your investment strategy if it aligns with your risk tolerance and financial goals.

Featured Posts

-

Trans Australia Run Will A New Record Be Set

May 22, 2025

Trans Australia Run Will A New Record Be Set

May 22, 2025 -

Juergen Klopp Efsane Yeniden Basliyor

May 22, 2025

Juergen Klopp Efsane Yeniden Basliyor

May 22, 2025 -

Fuel Costs Climb Across The Mid Hudson Valley

May 22, 2025

Fuel Costs Climb Across The Mid Hudson Valley

May 22, 2025 -

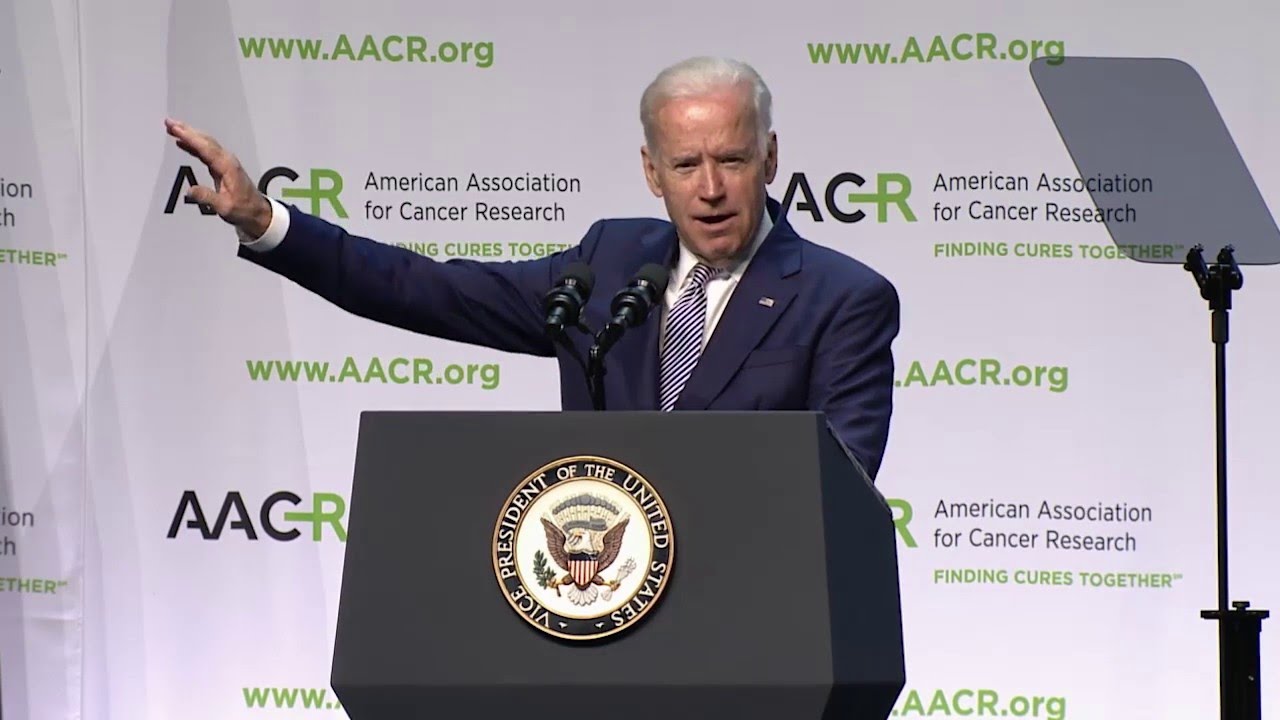

Prostate Cancer Screening The Case Of President Bidens 2014 Checkup

May 22, 2025

Prostate Cancer Screening The Case Of President Bidens 2014 Checkup

May 22, 2025 -

Dropout Kings Lose Vocalist Adam Ramey

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey

May 22, 2025

Latest Posts

-

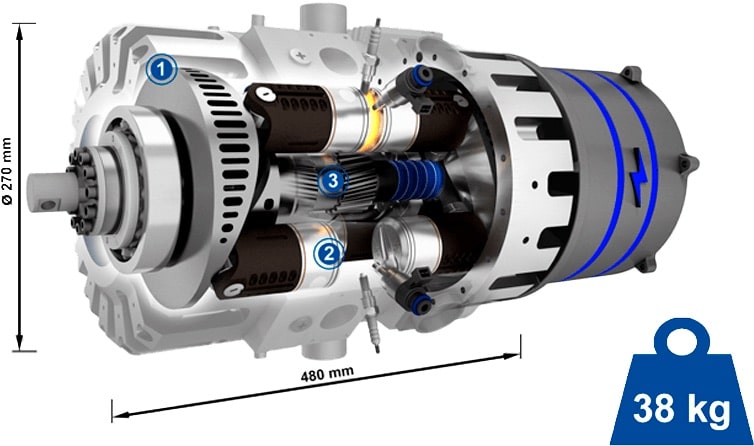

El Reino Unido Lidera La Innovacion Motor De Combustion A Base De Agua

May 23, 2025

El Reino Unido Lidera La Innovacion Motor De Combustion A Base De Agua

May 23, 2025 -

Cientificos Britanicos Crean Motor Que Funciona Con Agua

May 23, 2025

Cientificos Britanicos Crean Motor Que Funciona Con Agua

May 23, 2025 -

Motor De Combustion Con Agua Un Avance Cientifico Del Reino Unido

May 23, 2025

Motor De Combustion Con Agua Un Avance Cientifico Del Reino Unido

May 23, 2025 -

Successful Hydrogen Engine Project A Celebration By Cummins And Partners

May 23, 2025

Successful Hydrogen Engine Project A Celebration By Cummins And Partners

May 23, 2025 -

Reino Unido Desarrolla Motor De Combustion Revolucionario Quema Particulas De Agua

May 23, 2025

Reino Unido Desarrolla Motor De Combustion Revolucionario Quema Particulas De Agua

May 23, 2025