CoreWeave Inc. (CRWV) Stock Drop On Thursday: Reasons And Analysis

Table of Contents

On Thursday, CoreWeave Inc. (CRWV) experienced a significant stock price drop, leaving investors surprised and seeking explanations. This article delves into the potential reasons behind this market reaction, analyzing the contributing factors and offering insights to help navigate the volatility surrounding CRWV stock. Understanding the forces impacting CRWV's price is crucial for making informed investment decisions.

The Impact of Broad Market Downturn on CRWV

Overall Market Sentiment

Thursday's market presented a challenging landscape for many tech stocks, including CoreWeave. The overall market sentiment was negative, influenced by several factors.

- The Nasdaq Composite, a key indicator for tech performance, experienced a notable decline.

- Concerns about rising interest rates and potential economic slowdown contributed to widespread investor anxiety.

- Negative news impacting other major tech companies created a ripple effect, impacting investor confidence across the sector.

- CRWV's stock price demonstrated a clear correlation with broader market trends, mirroring the downward movement seen in the overall tech sector.

Sector-Specific Pressures

The cloud computing and AI sectors, where CoreWeave operates, faced unique challenges on Thursday.

- Intense competition within the cloud computing market continues to pressure profit margins for all players, including CoreWeave.

- Some analysts expressed concerns about potential AI market saturation or overvaluation, leading to a reassessment of valuations within the sector.

- Regulatory scrutiny and potential future legislation impacting data privacy and AI development add uncertainty to the landscape.

Company-Specific Factors Contributing to the CRWV Stock Drop

Lack of Recent Positive News/Announcements

The absence of positive catalysts further contributed to the CRWV stock drop.

- No significant partnerships or product launches were announced recently to buoy investor confidence.

- The lack of positive news created a void, leaving the stock vulnerable to external market pressures.

- Any missed earnings expectations, if applicable, could have also exacerbated the negative sentiment.

Increased Investor Concerns

Emerging concerns about CoreWeave's future prospects added fuel to the fire.

- Analyst downgrades, if any, would likely increase pressure on the stock price.

- Increased debt levels or concerns about the company's ability to maintain profitability could raise red flags for investors.

- Any perceived weaknesses in CoreWeave's business model might trigger selling pressure.

Potential Impact of Short Selling

Increased short selling activity could have amplified the downward pressure on CRWV's stock price.

- While specific data on short interest may not be readily available to the public, a significant increase in short selling can create a self-fulfilling prophecy, leading to further price declines.

- Short sellers bet against the stock, adding selling pressure to an already weakening market.

Analyzing the CRWV Stock Drop: A Technical Perspective

Chart Analysis

A technical analysis of CRWV's stock chart on Thursday might reveal key insights.

- Key support and resistance levels may have been breached, indicating a significant shift in momentum.

- A high trading volume coupled with the price decline would support the argument of significant selling pressure.

- (Note: Detailed technical chart analysis requires expertise and specific chart data; this section keeps it brief for a broader audience).

Trading Volume and Volatility

The unusual trading volume observed on Thursday underscores the magnitude of the market reaction.

- High volume accompanied by a sharp price drop suggests a significant number of investors were simultaneously selling their CRWV shares.

- This high volatility reflects the uncertainty and risk perception surrounding the stock.

Conclusion

CoreWeave Inc.'s (CRWV) stock drop on Thursday stemmed from a confluence of factors. Broader market downturns affecting the tech sector, particularly cloud computing and AI, played a significant role. Additionally, the absence of positive company-specific news, growing investor concerns, and potentially increased short selling activity all contributed to the decline. The magnitude of the drop and the high trading volume highlight the significant uncertainty surrounding the stock.

While the CoreWeave Inc. (CRWV) stock drop presents challenges, understanding the contributing factors is crucial for informed investment decisions. Continue to monitor the CRWV stock price, stay updated on company news and market trends, and conduct thorough due diligence before making any investment decisions in CRWV or similar cloud computing and AI stocks. Stay informed about future developments surrounding CoreWeave and its stock performance.

Featured Posts

-

Gumball Expect The Unexpected

May 22, 2025

Gumball Expect The Unexpected

May 22, 2025 -

From Boardroom To Courtroom The Downfall Of A Ceo Couple

May 22, 2025

From Boardroom To Courtroom The Downfall Of A Ceo Couple

May 22, 2025 -

Milly Alcock And Her House Of The Dragon Acting Coach Experience

May 22, 2025

Milly Alcock And Her House Of The Dragon Acting Coach Experience

May 22, 2025 -

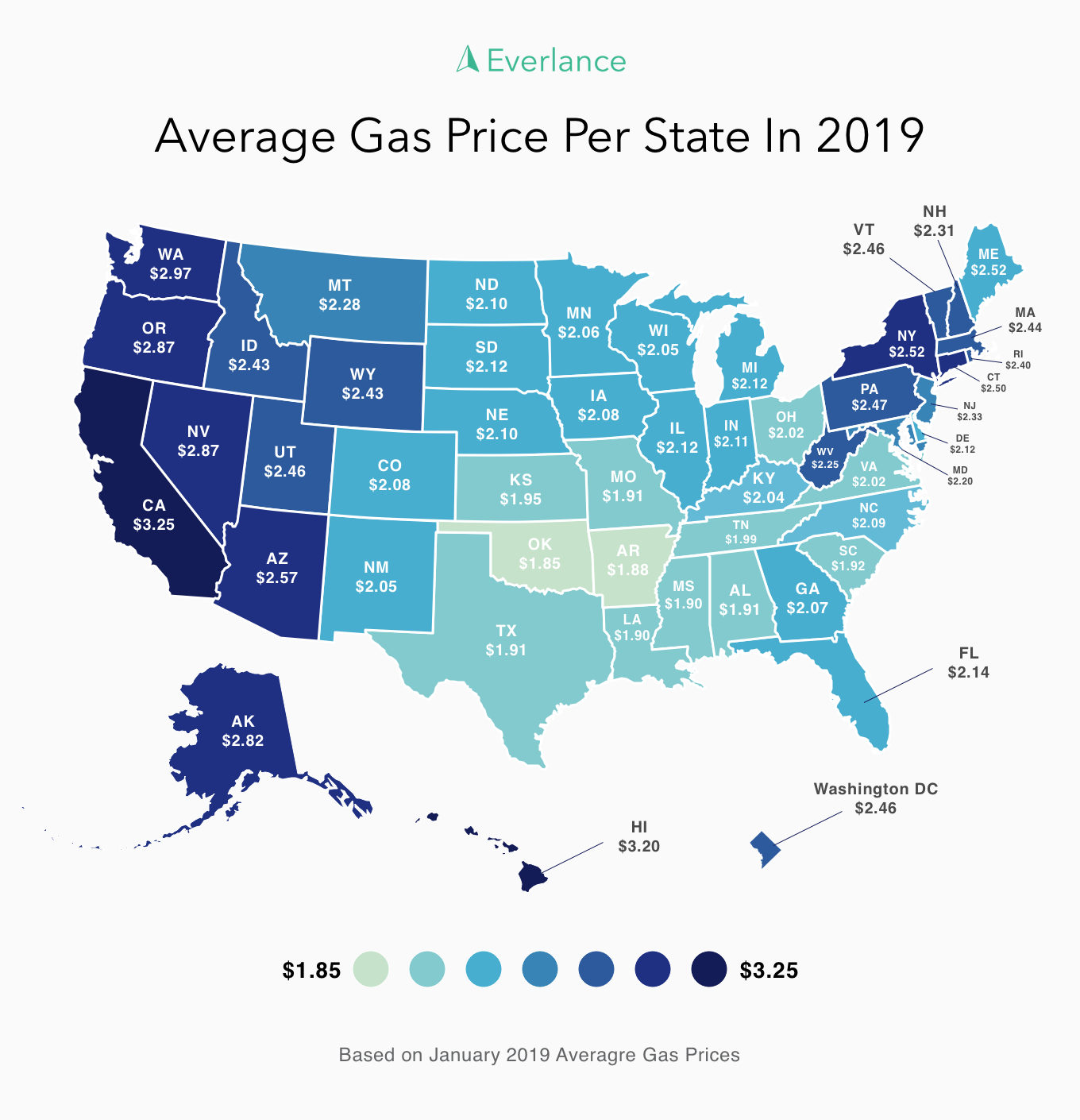

Significant Reduction In Virginias Gas Prices 50c Gallon Savings

May 22, 2025

Significant Reduction In Virginias Gas Prices 50c Gallon Savings

May 22, 2025 -

Lancaster City Stabbing Investigation Underway

May 22, 2025

Lancaster City Stabbing Investigation Underway

May 22, 2025

Latest Posts

-

Panama Vs Mexico Los Memes Que Inundaron Las Redes Sociales Tras La Final

May 22, 2025

Panama Vs Mexico Los Memes Que Inundaron Las Redes Sociales Tras La Final

May 22, 2025 -

Rezultat Zdrobitor In Liga Natiunilor Georgia Armenia 6 1

May 22, 2025

Rezultat Zdrobitor In Liga Natiunilor Georgia Armenia 6 1

May 22, 2025 -

La Derrota De Panama Una Recopilacion De Los Mejores Memes

May 22, 2025

La Derrota De Panama Una Recopilacion De Los Mejores Memes

May 22, 2025 -

Liga Natiunilor Georgia Domina Armenia Cu 6 1

May 22, 2025

Liga Natiunilor Georgia Domina Armenia Cu 6 1

May 22, 2025 -

Memes De La Final De La Liga De Naciones Panama Vs Mexico

May 22, 2025

Memes De La Final De La Liga De Naciones Panama Vs Mexico

May 22, 2025