CoreWeave, Inc. (CRWV) Stock Soared: A Deep Dive Into The Reasons

Table of Contents

The AI Boom Fuels CoreWeave's Growth

The current AI boom is undeniably a significant driver of CoreWeave, Inc. (CRWV) stock's performance. This surge is fueled by increased demand for high-performance computing (HPC) resources, particularly Graphics Processing Units (GPUs).

Increased Demand for High-Performance Computing

The demand for GPUs and HPC is exploding, driven primarily by the advancements in AI. Training and deploying complex AI models, especially large language models (LLMs) and generative AI applications, require immense computing power.

- GPUs are essential: GPUs are significantly faster and more efficient than CPUs for parallel processing tasks crucial for AI model training and inference.

- AI applications driving demand: Generative AI, large language models like GPT-4, and AI-powered drug discovery are just a few examples of applications fueling this demand.

- Market growth projections: The market for AI and HPC is projected to grow exponentially in the coming years, providing a massive tailwind for CoreWeave. Reports suggest a compound annual growth rate (CAGR) exceeding 30% for the next decade.

CoreWeave's Strategic Positioning in the AI Market

CoreWeave is strategically positioned to capitalize on this AI boom. Their competitive advantage lies in their specialized cloud infrastructure tailored for AI workloads.

- GPU-optimized cloud infrastructure: CoreWeave offers a cloud platform optimized for GPUs, providing the processing power needed for demanding AI tasks.

- Strategic partnerships: Collaborations with key players in the AI industry provide access to cutting-edge technologies and a broader customer base.

- Sustainability focus: Their commitment to sustainable and energy-efficient data centers is attractive to environmentally conscious AI companies.

CoreWeave's Robust Cloud Computing Infrastructure

CoreWeave's success is further underpinned by its powerful and efficient cloud computing infrastructure. This infrastructure is a major draw for AI companies needing scalable and high-performance solutions.

Scalability and Performance

CoreWeave's cloud platform boasts exceptional scalability and performance, making it ideal for the fluctuating demands of AI workloads.

- GPU-optimized cloud services: Their services are specifically designed to maximize the utilization of GPUs, ensuring optimal performance for AI applications.

- Elastic scaling: The ability to scale computing resources up or down as needed allows for efficient cost management and optimized performance.

- Easy integration: CoreWeave's infrastructure seamlessly integrates with popular AI tools and frameworks, simplifying deployment and development.

Cost-Effectiveness and Efficiency

CoreWeave offers cost-effective solutions for AI development and deployment, a crucial factor for businesses of all sizes.

- Competitive pricing models: Their pricing strategies are designed to be competitive while offering significant value for money.

- Efficiency gains: Optimizations in their infrastructure lead to significant cost savings for clients compared to competitors.

- Client case studies: Demonstrated cost savings for clients through optimized resource allocation and efficient processing.

Strong Financial Performance and Investor Confidence

CoreWeave's impressive financial performance has significantly contributed to the surge in its stock price. Positive financial results and strong investor sentiment reinforce confidence in the company's future growth.

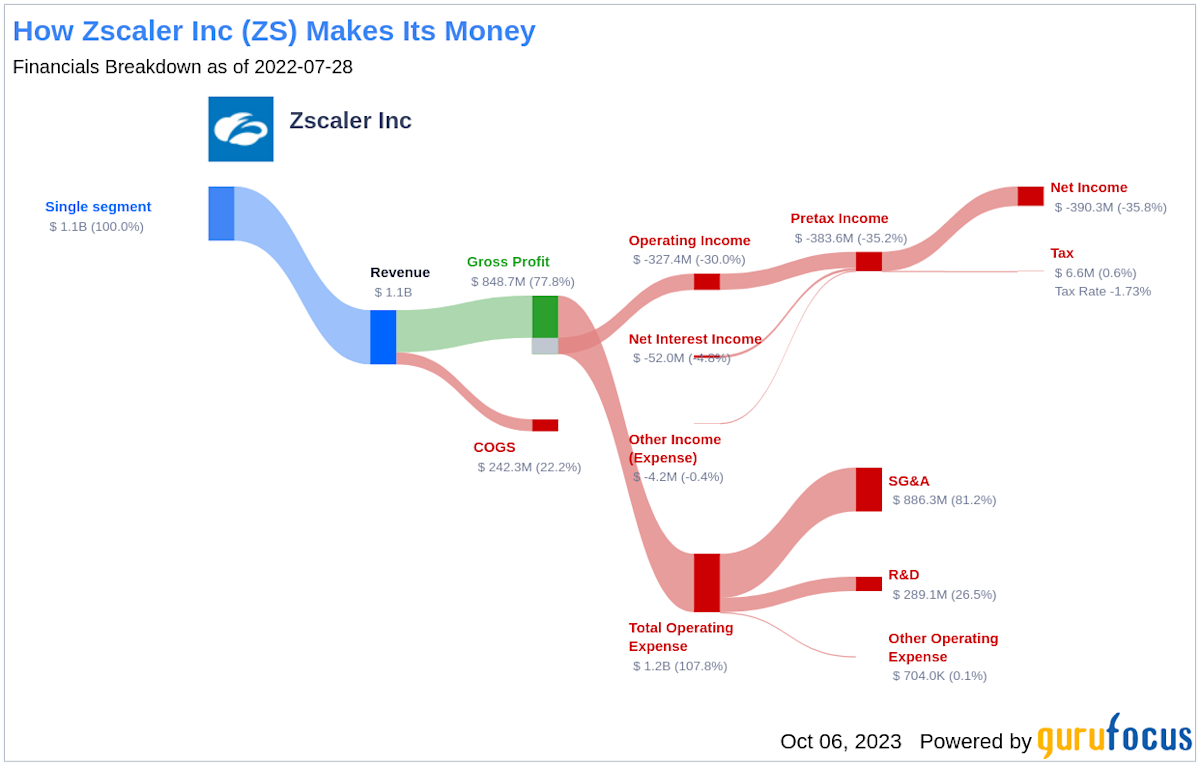

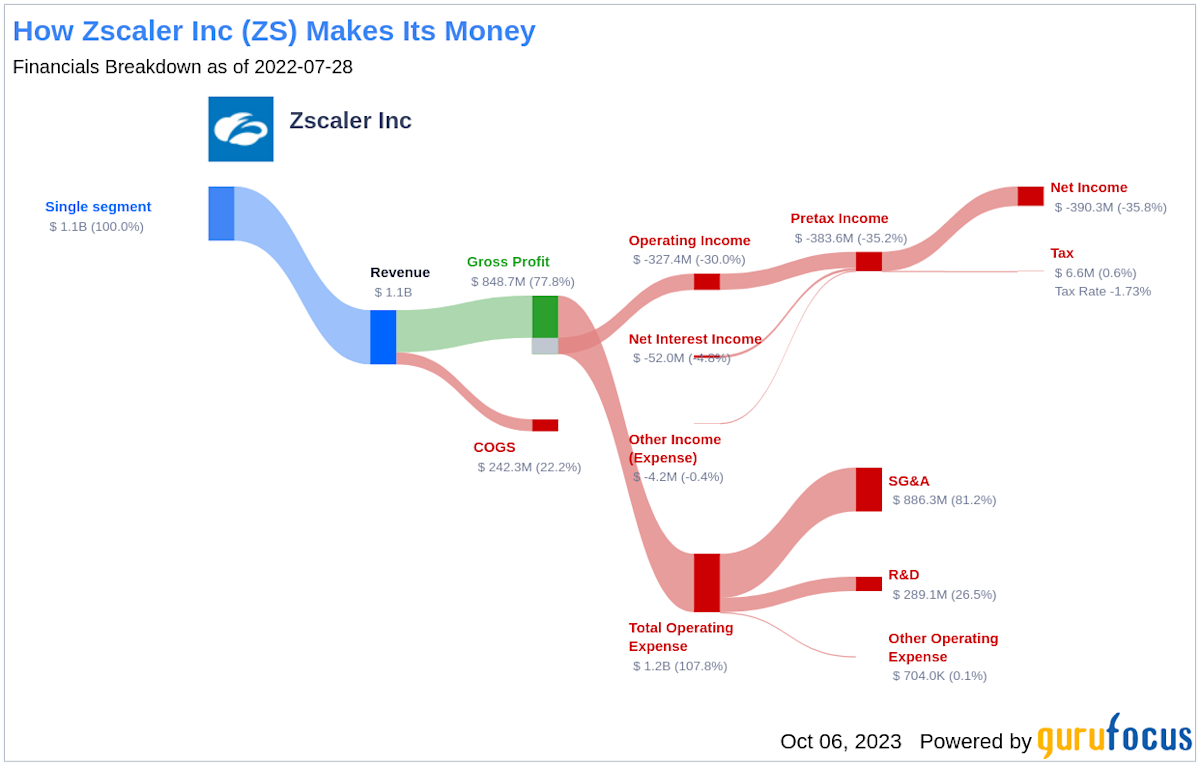

Positive Financial Results

CoreWeave has reported consistently strong financial results, showcasing impressive revenue growth and expanding customer acquisition.

- Revenue growth: Significant year-over-year revenue increases demonstrate the growing demand for their services.

- Profitability: Positive profitability indicators signal a healthy and sustainable business model.

- Positive analyst ratings: Favorable analyst ratings and upgrades reflect confidence in the company's prospects.

Investor Sentiment and Market Reaction

Positive investor sentiment towards CoreWeave is a key factor contributing to the stock's increase.

- Investment rounds: Recent successful investment rounds indicate strong investor confidence and a belief in CoreWeave's potential.

- Media coverage: Positive media coverage and analyst reports further enhance investor confidence.

- Market reaction: The market has reacted favorably to CoreWeave's performance, leading to a significant increase in its stock price.

Conclusion

The recent surge in CoreWeave, Inc. (CRWV) stock is a result of its strategic positioning within the rapidly expanding AI market. The company's robust cloud infrastructure, optimized for high-performance computing and AI workloads, combined with strong financial performance and positive investor sentiment, has driven significant growth. CoreWeave's focus on cost-effective and sustainable solutions further enhances its attractiveness. Stay informed about the future of CoreWeave, Inc. (CRWV) stock and its impact on the AI cloud computing landscape. Consider adding CoreWeave, Inc. (CRWV) to your investment portfolio and capitalize on the growth potential in the AI market.

Featured Posts

-

Shifting Strategies Otter Conservation In Wyoming Reaches A Turning Point

May 22, 2025

Shifting Strategies Otter Conservation In Wyoming Reaches A Turning Point

May 22, 2025 -

Dissecting Core Weave Inc Crwv Stocks Rise On Tuesday

May 22, 2025

Dissecting Core Weave Inc Crwv Stocks Rise On Tuesday

May 22, 2025 -

Mntkhb Amryka Thlath Mfajat Fy Qaymt Bwtshytynw Aljdydt

May 22, 2025

Mntkhb Amryka Thlath Mfajat Fy Qaymt Bwtshytynw Aljdydt

May 22, 2025 -

Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025 -

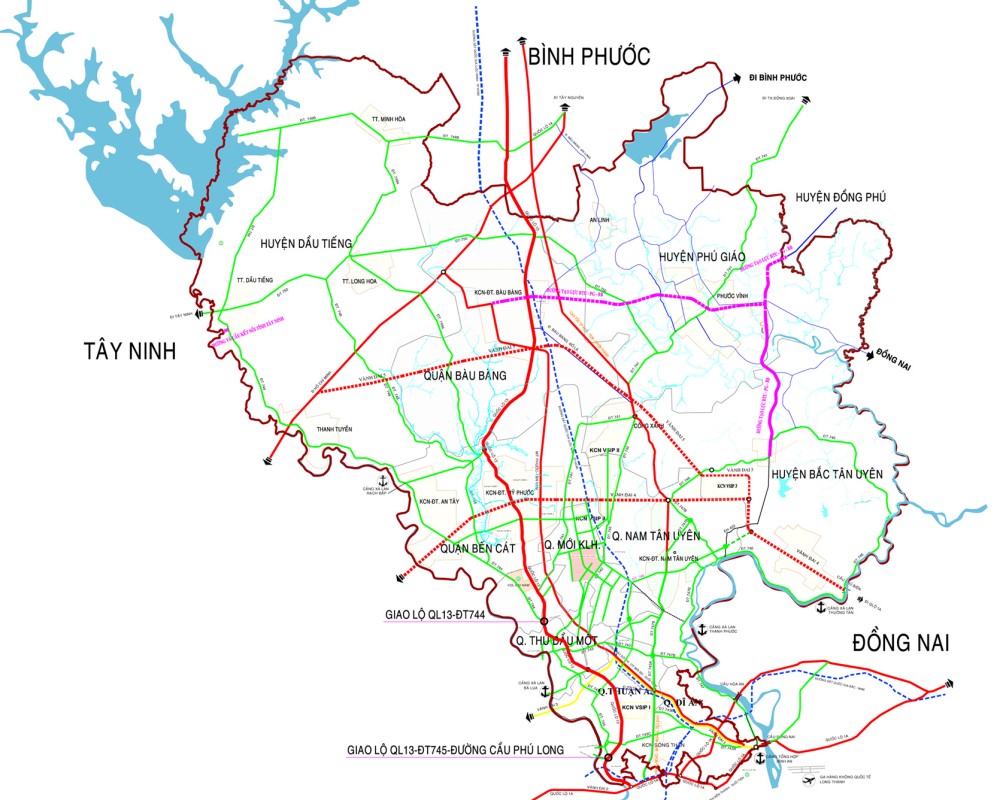

Dau Tu Ha Tang Tp Hcm Binh Duong Tac Dong Den Giao Thong Vung

May 22, 2025

Dau Tu Ha Tang Tp Hcm Binh Duong Tac Dong Den Giao Thong Vung

May 22, 2025

Latest Posts

-

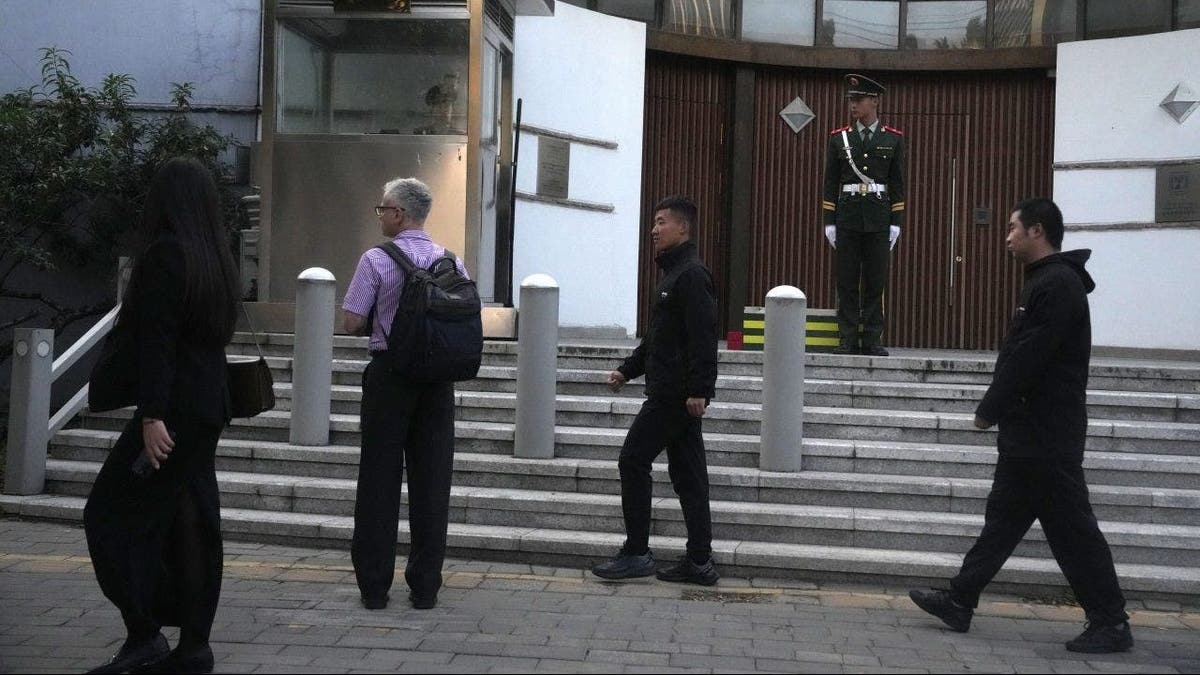

Understanding The Israeli Diplomat Shooting Incident In Washington

May 22, 2025

Understanding The Israeli Diplomat Shooting Incident In Washington

May 22, 2025 -

Shooting Near Dc Jewish Museum Two Israeli Embassy Employees Killed

May 22, 2025

Shooting Near Dc Jewish Museum Two Israeli Embassy Employees Killed

May 22, 2025 -

Shooting In Washington D C Israeli Embassy Names Deceased Couple

May 22, 2025

Shooting In Washington D C Israeli Embassy Names Deceased Couple

May 22, 2025 -

Israeli Embassy Attack Young Couples Names Revealed Days Before Planned Wedding

May 22, 2025

Israeli Embassy Attack Young Couples Names Revealed Days Before Planned Wedding

May 22, 2025 -

German Chancellor Merz Denounces Abhorrent Washington Attack

May 22, 2025

German Chancellor Merz Denounces Abhorrent Washington Attack

May 22, 2025