CoreWeave, Inc. (CRWV) Stock Surge: Reasons Behind Last Week's Rise

Table of Contents

Strong Financial Performance and Growth Projections

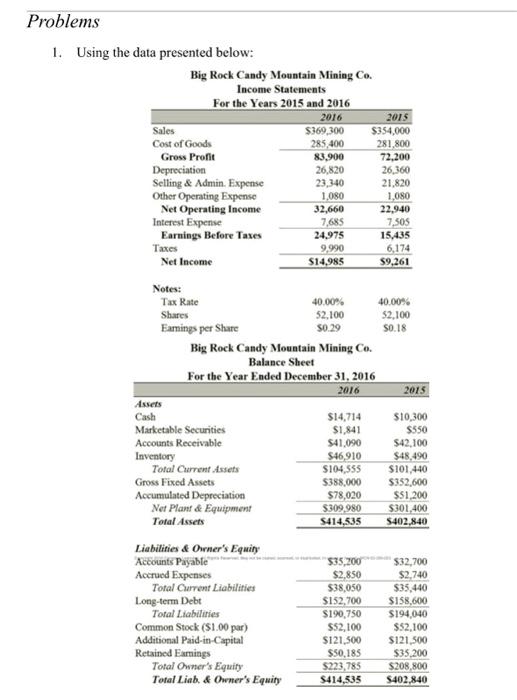

CoreWeave's recent financial success is a major driver of its stock surge. While specific numbers may vary depending on the reporting period, positive financial results, including strong revenue growth and potentially exceeding earnings expectations, have significantly boosted investor confidence. This positive momentum is further strengthened by robust growth projections from analysts. Many analysts have revised their target prices upwards, indicating a bullish outlook for CoreWeave's future performance.

- Specific revenue figures and growth percentages: (Insert recent financial data here, citing the source). For example: "Q[Quarter] 2024 revenue showed a [Percentage]% increase year-over-year, exceeding analyst expectations by [Percentage]%."

- Key metrics demonstrating financial health: Focus on metrics like gross margin, operating income, and customer acquisition costs to showcase the company’s financial strength. (Insert relevant data and analysis here.)

- Positive analyst ratings and target price increases: Mention specific examples of upward revisions in target prices by reputable financial analysts and their rationale. (Insert examples here, citing sources.)

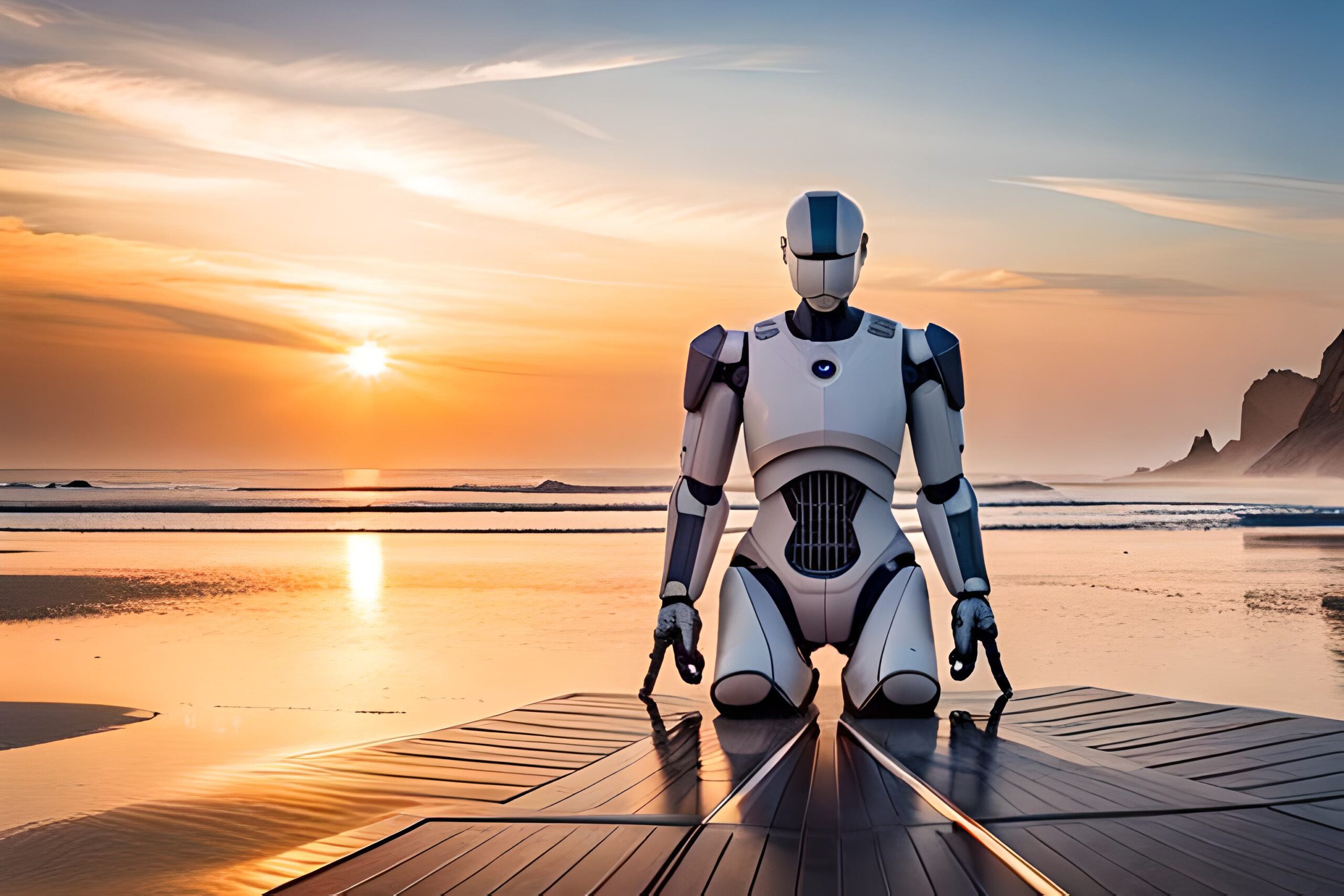

Increased Demand for GPU-Accelerated Cloud Computing

The explosive growth of artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC) has fueled an unprecedented demand for GPU-accelerated cloud services. CoreWeave is exceptionally well-positioned to capitalize on this trend. Their specialized infrastructure, designed to meet the demanding computational needs of AI and ML workloads, gives them a substantial competitive edge.

- Growth of the AI and ML markets: Highlight the projected growth rates of these markets and their reliance on GPU computing power. (Cite industry reports and statistics.)

- Demand for GPU compute resources: Explain the scarcity of high-performance GPU resources and how CoreWeave is addressing this critical need.

- CoreWeave's competitive advantages: Emphasize CoreWeave’s sustainable energy sources, advanced data center infrastructure, and superior network connectivity as key differentiators in the market.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions play a crucial role in boosting CoreWeave's market presence and expanding its service offerings. These alliances create synergistic benefits, allowing CoreWeave to tap into new markets and enhance its technological capabilities.

- Names of key partners and details of the collaborations: List any recent significant partnerships and briefly describe the nature of their collaborations. (Provide specifics and links to official announcements when available.)

- Impact of the partnerships on revenue generation: Explain how these partnerships contribute to revenue growth and market expansion. (Provide quantifiable data or projections when possible.)

- Synergistic benefits of acquisitions: If CoreWeave has made any recent acquisitions, analyze the synergistic advantages gained and how these acquisitions contribute to overall growth.

Positive Industry Sentiment and Market Trends

The overall positive sentiment towards the cloud computing sector further enhances CoreWeave's stock appeal. Industry reports consistently forecast strong growth for the cloud market, and this positive outlook benefits companies like CoreWeave that are at the forefront of this expansion.

- Positive industry reports and forecasts: Cite relevant industry reports and forecasts that support the positive outlook for the cloud computing sector.

- Market trends supporting the growth of GPU-based cloud computing: Highlight specific market trends driving the demand for GPU-based cloud services, such as the increasing adoption of AI and ML in various industries.

- Overall investor sentiment towards the sector: Discuss the overall positive investor sentiment towards the cloud computing sector and how this sentiment positively impacts CoreWeave's stock valuation.

Conclusion: Investing in the Future of CoreWeave (CRWV)

The recent surge in CoreWeave (CRWV) stock price is a result of a combination of factors: strong financial performance, the burgeoning demand for GPU-accelerated cloud computing, strategic partnerships, and positive industry sentiment. The company's innovative approach and strategic positioning within a rapidly expanding market paint a promising picture for its future. This positive outlook makes CoreWeave stock a compelling investment opportunity for those interested in the future of cloud computing and AI. Learn more about CoreWeave's investment prospects and consider adding CRWV to your portfolio. Research CoreWeave stock to make informed investment decisions. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Steelers 2024 Schedule Early Takeaways And Predictions

May 22, 2025

Steelers 2024 Schedule Early Takeaways And Predictions

May 22, 2025 -

Record Breaking Australian Trans Influencer Faces Questions Of Authenticity

May 22, 2025

Record Breaking Australian Trans Influencer Faces Questions Of Authenticity

May 22, 2025 -

Dong Nai Kien Nghi Xay Duong 4 Lan Xe Xuyen Rung Ma Da Noi Lien Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Xay Duong 4 Lan Xe Xuyen Rung Ma Da Noi Lien Binh Phuoc

May 22, 2025 -

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025 -

Le Matin Auto Decouvre L Alfa Romeo Junior 1 2 Turbo Speciale

May 22, 2025

Le Matin Auto Decouvre L Alfa Romeo Junior 1 2 Turbo Speciale

May 22, 2025

Latest Posts

-

The Big Rig Rock Report 3 12 97 1 Double Q Explained

May 23, 2025

The Big Rig Rock Report 3 12 97 1 Double Q Explained

May 23, 2025 -

Big Rig Rock Report 3 12 97 1 Double Q A Detailed Breakdown

May 23, 2025

Big Rig Rock Report 3 12 97 1 Double Q A Detailed Breakdown

May 23, 2025 -

Decoding The Big Rig Rock Report 3 12 97 1 Double Q

May 23, 2025

Decoding The Big Rig Rock Report 3 12 97 1 Double Q

May 23, 2025 -

Analyzing The Big Rig Rock Report 3 12 And The Big 100

May 23, 2025

Analyzing The Big Rig Rock Report 3 12 And The Big 100

May 23, 2025 -

Advanced Brief Writing Techniques Mastering Nuance And Persuasion

May 23, 2025

Advanced Brief Writing Techniques Mastering Nuance And Persuasion

May 23, 2025