CoreWeave Inc. (CRWV) Stock's Positive Performance On Tuesday: Causes And Implications

Table of Contents

Analyzing the Reasons Behind CoreWeave (CRWV) Stock's Rise

Several factors contributed to the impressive jump in CoreWeave (CRWV) stock on Tuesday. Understanding these factors is crucial for assessing the sustainability of this growth and informing future investment decisions.

Positive Earnings Report and Revenue Growth

CoreWeave's recent earnings report played a pivotal role in boosting investor confidence. The company exceeded expectations across several key metrics, signaling strong financial health and robust growth potential.

- Exceeding Expectations: The Q[Quarter] earnings report showcased significant outperformance compared to analyst projections. Specific details regarding earnings per share (EPS) and revenue figures should be included here, referencing the actual report for accuracy. For example: "CoreWeave reported an EPS of $[EPS figure], surpassing analyst estimates by $[difference] and demonstrating a [percentage]% increase year-over-year."

- Revenue Growth: Impressive revenue growth across various segments further fueled the positive market reaction. Highlighting specific areas of strength, such as cloud computing services, AI infrastructure solutions, and high-performance computing, is essential. For instance: "Revenue from high-performance computing services alone showed a [percentage]% increase, demonstrating strong demand in this key market segment."

- Growth Drivers: Detail the specific drivers behind this growth. Was it increased customer acquisition, higher spending per customer, expansion into new markets, or a combination of factors? Analyzing these specific aspects provides a clearer picture of the company's trajectory.

Increased Investor Confidence and Market Sentiment

The positive earnings report wasn't the only contributor; the overall market sentiment also played a significant role.

- Bullish Market Conditions: Analyze the broader market trends on Tuesday. Was it a generally positive day for the tech sector or the overall market? Mentioning relevant indices and their performance on that day provides context.

- Positive News and Announcements: Were there any other news items or announcements, related to CoreWeave or the broader industry, that might have influenced investor perception? This could include positive analyst ratings, new strategic partnerships, or industry-wide positive news.

- Analyst Upgrades: Highlight any upgrades or positive analyst ratings issued around the time of the price surge. Analyst opinions carry significant weight in shaping investor sentiment and can drive significant market movements.

Strategic Partnerships and Technological Advancements

CoreWeave's strategic actions also contribute to investor confidence.

- New Partnerships: Detail any recent partnerships or collaborations that might have influenced investor perception. The impact of these partnerships on revenue streams, market reach, and technological capabilities should be explicitly discussed. For example: "The newly formed partnership with [Partner Name] provides access to [Partner's asset/resource], bolstering CoreWeave's position in the [market segment] sector."

- Technological Innovation: Highlight any significant technological advancements that CoreWeave has recently made or announced. These advancements should be positioned as catalysts for future growth. For example: "CoreWeave's innovative approach to [technology] has proven highly effective in [benefit], which is anticipated to lead to a substantial increase in efficiency and revenue."

Implications for Investors and Future Outlook of CoreWeave (CRWV) Stock

Understanding the implications of Tuesday's price surge requires considering both short-term and long-term perspectives.

Short-Term vs. Long-Term Investment Strategies

The short-term outlook for CoreWeave (CRWV) stock appears positive, given the strong earnings report and positive market sentiment. However, investors should proceed cautiously.

- Short-Term Volatility: Short-term traders might consider taking profits given the recent price increase, but should be aware of potential short-term volatility.

- Long-Term Growth Potential: Long-term investors should assess the company's overall growth trajectory, considering the competitive landscape and potential challenges. A long-term outlook necessitates thorough due diligence and a comprehensive understanding of the company's long-term strategy.

Risk Assessment and Potential Challenges

While the outlook is positive, investors must acknowledge potential risks.

- Competition: The cloud computing market is highly competitive. Identifying key competitors and analyzing CoreWeave's competitive advantages and disadvantages is crucial.

- Economic Factors: Macroeconomic factors, such as interest rate hikes or economic downturns, can significantly impact investor sentiment and the stock's performance.

- Technological Disruptions: Rapid technological advancements could render some of CoreWeave's offerings obsolete over time.

Comparative Analysis with Competitors

Comparing CoreWeave's performance to its major competitors provides a more nuanced perspective.

- Competitive Advantages: Highlight CoreWeave's unique strengths, such as its focus on specific niches or its innovative technologies. For example: "CoreWeave's specialization in [niche market] sets it apart from larger, more generalist competitors."

- Market Share: Analyze CoreWeave's market share and its growth trajectory compared to its main rivals.

Conclusion

CoreWeave (CRWV) stock's impressive performance on Tuesday stemmed from a confluence of factors: strong Q[Quarter] earnings exceeding expectations, positive investor sentiment, and strategic partnerships. While the short-term outlook seems promising, long-term investors need to consider potential risks such as competition and macroeconomic factors. While Tuesday's surge in CoreWeave (CRWV) stock offers exciting prospects, careful consideration of both the positive factors and potential risks is crucial for informed investment decisions. Further research into the company's financial statements and future plans is recommended before investing in CoreWeave (CRWV) stock. Stay updated on the latest news and developments surrounding CoreWeave to make well-informed decisions about your investment strategy in CoreWeave (CRWV) stock.

Featured Posts

-

Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025 -

Tuerkiye Nin Nato Daki Yuekselen Yildizi Ittifakin Gelecegini Sekillendirecek Rolue

May 22, 2025

Tuerkiye Nin Nato Daki Yuekselen Yildizi Ittifakin Gelecegini Sekillendirecek Rolue

May 22, 2025 -

China And Us Trade A Race Against Time To Secure Trade Deal Benefits

May 22, 2025

China And Us Trade A Race Against Time To Secure Trade Deal Benefits

May 22, 2025 -

The Increasing Importance Of Succession Planning For Ultra High Net Worth Families

May 22, 2025

The Increasing Importance Of Succession Planning For Ultra High Net Worth Families

May 22, 2025

Latest Posts

-

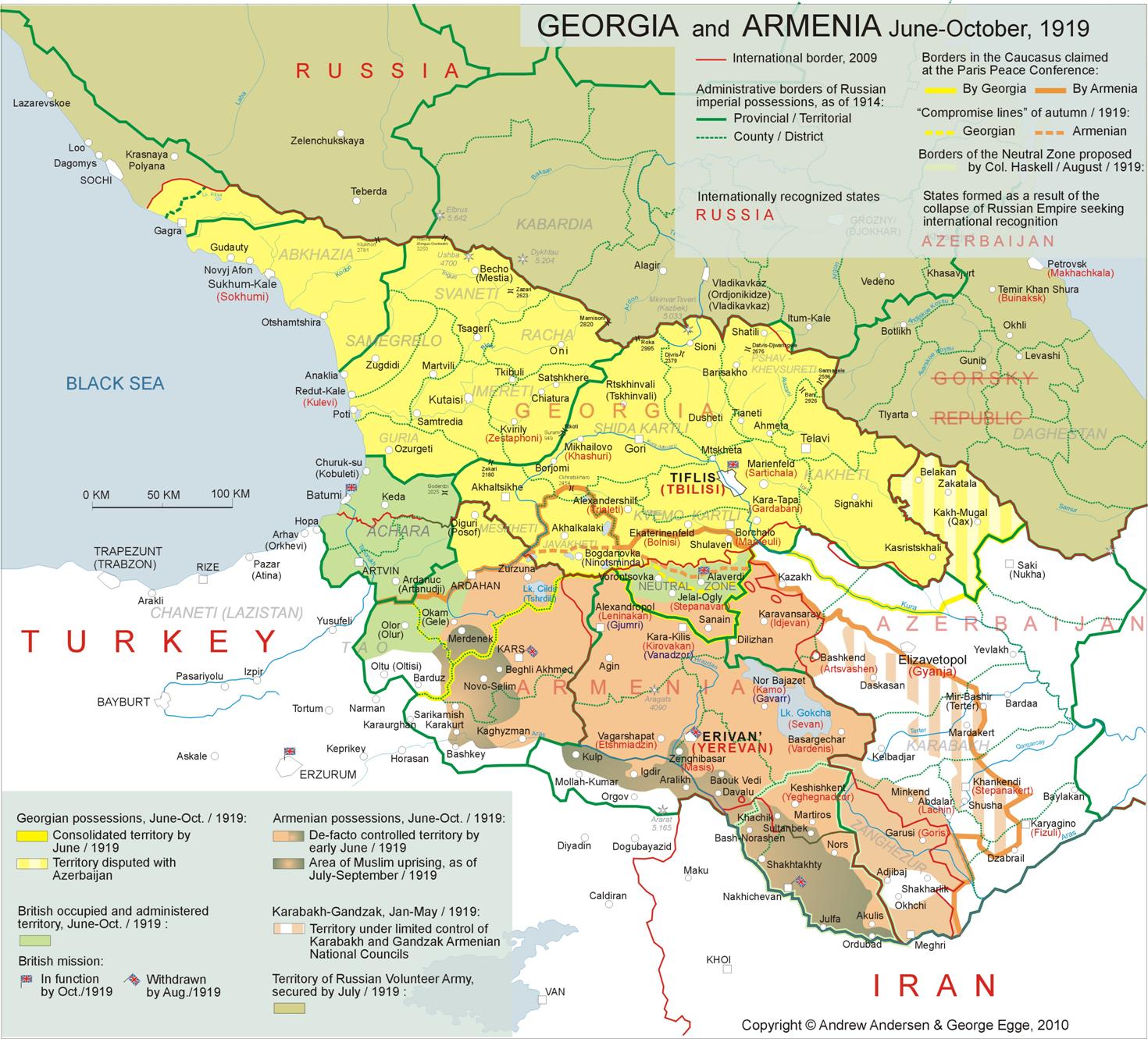

Liga Natiunilor Scor Devastator Pentru Armenia Invinsa De Georgia Cu 6 1

May 22, 2025

Liga Natiunilor Scor Devastator Pentru Armenia Invinsa De Georgia Cu 6 1

May 22, 2025 -

Victorie Categorica Pentru Georgia In Liga Natiunilor 6 1 Contra Armeniei

May 22, 2025

Victorie Categorica Pentru Georgia In Liga Natiunilor 6 1 Contra Armeniei

May 22, 2025 -

Los Memes Que Dejo La Derrota De Panama En La Final De La Liga De Naciones

May 22, 2025

Los Memes Que Dejo La Derrota De Panama En La Final De La Liga De Naciones

May 22, 2025 -

Georgia Invinge Armenia Cu 6 1 In Liga Natiunilor

May 22, 2025

Georgia Invinge Armenia Cu 6 1 In Liga Natiunilor

May 22, 2025 -

Panama Vs Mexico Los Memes Que Inundaron Las Redes Sociales Tras La Final

May 22, 2025

Panama Vs Mexico Los Memes Que Inundaron Las Redes Sociales Tras La Final

May 22, 2025