CoreWeave IPO: Listing Price Set At $40, Below Expectations

Table of Contents

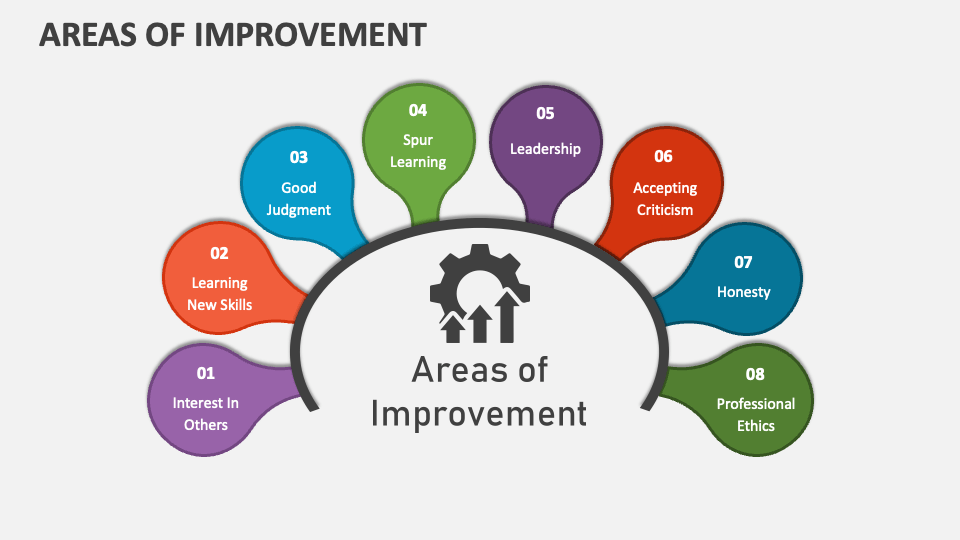

Reasons Behind the Lower-Than-Expected CoreWeave IPO Price

Several factors contributed to CoreWeave's IPO price falling short of initial expectations. Understanding these factors is crucial for grasping the current dynamics of the tech IPO market and the challenges faced by innovative companies in the cloud computing space.

Macroeconomic Headwinds: The current macroeconomic climate plays a significant role. High interest rates, persistent inflation, and overall investor uncertainty have dampened enthusiasm for tech stocks, particularly those undergoing IPOs. This general market pessimism has led to a more cautious approach from investors, resulting in lower valuations for many tech companies. The "risk-off" sentiment prevalent in the market made investors less willing to bet on high-growth, albeit less profitable, companies like CoreWeave.

CoreWeave's Financials: A careful examination of CoreWeave's financial performance reveals some key areas of concern. While the company boasts impressive revenue growth in the burgeoning AI infrastructure market, its profitability remains a point of discussion. Concerns surrounding its debt-to-equity ratio and profit margin relative to established competitors like AWS, Azure, and Google Cloud likely influenced the pricing. Investors are increasingly scrutinizing the financial health of companies, demanding demonstrable profitability before assigning high valuations. Analyzing the revenue growth rate against industry benchmarks provides a clearer picture of CoreWeave's competitive positioning.

Competitive Landscape in Cloud Computing: The cloud computing sector is fiercely competitive. Established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) already dominate the market. These established players possess significant resources, brand recognition, and extensive customer bases, presenting a formidable challenge to newer entrants like CoreWeave. The CoreWeave IPO price may reflect the market's perception of its ability to carve out a significant market share and establish a clear competitive advantage in this crowded space.

- Increased interest rates dampening investor enthusiasm for tech stocks.

- Concerns about CoreWeave's profitability relative to competitors.

- High valuation concerns compared to established players in the cloud market.

- General market uncertainty affecting IPO performance.

Impact on Investors and CoreWeave's Future

The lower-than-expected CoreWeave IPO price has significant implications for both early investors and the company's future trajectory.

Impact on Investors: Early investors who acquired shares at a higher valuation before the IPO are likely facing dilution. The lower IPO price translates to a reduced return on their initial investment. This underscores the inherent risks associated with pre-IPO investments in high-growth tech companies. The market capitalization of CoreWeave is directly affected by the listing price, impacting the overall value of the shares.

CoreWeave's Future: The lower IPO price could affect CoreWeave's ability to raise capital for future growth and expansion. Securing further funding might be more challenging at a lower valuation, potentially hindering the company's ambitious growth strategy. The company needs to demonstrate strong and sustainable revenue growth and improved profit margins to regain investor confidence and attract further investment. Maintaining its competitive positioning in the cloud computing market will also be crucial for long-term success.

- Potential dilution for early investors due to the lower IPO price.

- Challenges in attracting further investment at a lower valuation.

- Need for CoreWeave to demonstrate strong revenue growth and profitability.

- Impact on CoreWeave’s ability to compete effectively with larger cloud providers.

Expert Opinions and Market Analysis

Several financial analysts have weighed in on the CoreWeave IPO performance, offering diverse perspectives on its future prospects. Market research reports paint a picture of a rapidly evolving cloud computing sector, with intense competition and significant opportunities for innovation. The overall market sentiment towards CoreWeave post-IPO appears cautious, but not necessarily negative. The performance of similar tech IPOs in recent months provides a valuable benchmark for comparison.

- Quotes from financial analysts regarding CoreWeave's valuation.

- Statistics on the performance of similar tech IPOs.

- Summary of market forecasts for the cloud computing sector.

CoreWeave IPO: A Look Ahead

The CoreWeave IPO, while initially disappointing with its lower-than-expected listing price, doesn't necessarily signal an impending failure. The lower price reflects a confluence of macroeconomic factors, competitive pressures, and investor sentiment concerning the company's profitability. The path forward for CoreWeave involves demonstrating strong revenue growth, enhancing profitability, and solidifying its competitive positioning within the rapidly evolving AI infrastructure market. The success of the CoreWeave stock will depend heavily on its ability to execute its long-term strategy.

To stay informed about the evolving story of the CoreWeave IPO, its performance, and the wider cloud computing industry, follow our publication for regular updates on CoreWeave stock, cloud computing stocks, and in-depth IPO analysis. Keep abreast of this important development in the cloud computing landscape and stay updated on the trajectory of this significant player in the AI infrastructure market.

Featured Posts

-

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025 -

The Countrys Business Landscape Identifying Key Growth Areas

May 22, 2025

The Countrys Business Landscape Identifying Key Growth Areas

May 22, 2025 -

Northcote Gig Low Rock Legends Vapors Of Morphine

May 22, 2025

Northcote Gig Low Rock Legends Vapors Of Morphine

May 22, 2025 -

Occasionmarkt Bloeit Abn Amro Rapporteert Sterke Groei In Autoverkoop

May 22, 2025

Occasionmarkt Bloeit Abn Amro Rapporteert Sterke Groei In Autoverkoop

May 22, 2025 -

Abn Amro Impact Van Toegenomen Autobezit Op De Occasionmarkt

May 22, 2025

Abn Amro Impact Van Toegenomen Autobezit Op De Occasionmarkt

May 22, 2025

Latest Posts

-

Shooting In Washington D C Israeli Embassy Names Deceased Couple

May 22, 2025

Shooting In Washington D C Israeli Embassy Names Deceased Couple

May 22, 2025 -

Israeli Embassy Attack Young Couples Names Revealed Days Before Planned Wedding

May 22, 2025

Israeli Embassy Attack Young Couples Names Revealed Days Before Planned Wedding

May 22, 2025 -

German Chancellor Merz Denounces Abhorrent Washington Attack

May 22, 2025

German Chancellor Merz Denounces Abhorrent Washington Attack

May 22, 2025 -

Dc Terrorist Attack Victims Identified As Yaron Lischinsky And Sarah Milgrim

May 22, 2025

Dc Terrorist Attack Victims Identified As Yaron Lischinsky And Sarah Milgrim

May 22, 2025 -

Couple Slain In Dc Terror Attack Identified

May 22, 2025

Couple Slain In Dc Terror Attack Identified

May 22, 2025