CoreWeave IPO Pricing: $40 Reflects Market Conditions

Table of Contents

Factors Influencing CoreWeave's $40 IPO Price

Understanding how a company arrives at its IPO price requires examining a complex interplay of factors. The process involves careful assessment by underwriters who analyze the company's financials, growth prospects, and market conditions to determine a fair value. Several key elements shaped CoreWeave's $40 IPO price:

-

Current Market Sentiment Towards Tech Stocks: The overall health of the tech sector significantly influences IPO valuations. Negative sentiment, driven by factors like inflation or interest rate hikes, tends to depress prices. Conversely, positive sentiment can boost valuations. The current market's appetite for cloud computing stocks, specifically, plays a crucial role.

-

Competition within the Cloud Computing Market: CoreWeave operates in a competitive landscape populated by established giants like AWS, Azure, and Google Cloud. The intensity of competition, CoreWeave's market share, and its competitive differentiation directly affect investor perception and, therefore, the IPO price.

-

CoreWeave's Financial Performance and Growth Projections: The company's historical revenue, profitability, and projected future growth are paramount. Strong financials and promising growth trajectories usually translate to higher valuations. Investors scrutinize CoreWeave's revenue growth, customer acquisition costs, and operating margins.

-

Investor Demand and Market Appetite for the Offering: The level of interest from institutional and individual investors determines the success of an IPO. High demand typically pushes the price upward, while lukewarm interest can lead to downward pressure. The number of pre-orders and overall market response are crucial indicators.

-

The Role of Underwriters and Their Assessment of Risk: Underwriters play a critical role in setting the IPO price. They assess the inherent risks associated with the company and the market, aiming to find a price that balances risk and reward for investors. Their expertise and reputation significantly influence investor confidence.

Comparison with Competitor IPO Valuations

To gauge whether the $40 CoreWeave IPO price is justified, we need to compare it with similar companies in the cloud computing space that have recently gone public. The following table offers a comparison of key metrics:

| Company | Revenue (Millions) | Growth Rate (%) | Valuation Multiple |

|---|---|---|---|

| CoreWeave | [Insert Data] | [Insert Data] | 40 |

| Competitor A | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor B | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor C | [Insert Data] | [Insert Data] | [Insert Data] |

(Note: Replace bracketed data with actual figures for a more accurate comparison.)

Analyzing this data allows us to determine whether CoreWeave's $40 valuation reflects a premium, discount, or aligns with market averages for similar companies. Variations may reflect differences in growth potential, market share, or risk profiles.

Assessing the Risks and Potential Returns of the CoreWeave IPO

Investing in any IPO, particularly in a volatile market, involves inherent risks. CoreWeave is no exception. Potential risks include:

-

Market Fluctuations and Their Impact on Stock Price: Broad market downturns can negatively impact even the most promising companies. The CoreWeave stock price is susceptible to overall market sentiment.

-

Competition and Potential Market Share Erosion: The cloud computing market is fiercely competitive. CoreWeave's ability to maintain and expand its market share will be crucial for its long-term success.

-

Execution Risk Related to CoreWeave's Business Strategy: The company's ability to execute its growth plans is crucial. Any unforeseen challenges in scaling operations or technological hurdles could impact the stock price.

-

Dependence on Key Clients or Technologies: Over-reliance on a few large clients or specific technologies can expose CoreWeave to significant risks if those relationships falter or technologies become obsolete.

Despite these risks, CoreWeave's growth projections and the potential of the cloud computing market suggest significant potential returns for investors. However, these returns are not guaranteed and depend on the company’s execution and market conditions.

The Impact of Macroeconomic Conditions on CoreWeave IPO Pricing

Broader economic factors significantly impact IPO valuations. Inflation, interest rates, and geopolitical events all influence investor sentiment and risk appetite. High inflation and rising interest rates typically reduce investor willingness to take on risk, potentially suppressing IPO prices. Geopolitical instability can also create uncertainty, further affecting valuations. Different macroeconomic scenarios could lead to variations in CoreWeave's stock performance post-IPO.

Conclusion: Understanding the CoreWeave IPO Pricing and its Implications

The $40 CoreWeave IPO price reflects a complex interplay of factors, including market sentiment, competition, the company's financial performance, investor demand, and macroeconomic conditions. While the valuation seems reasonable in comparison to competitors (pending data insertion), it's crucial to recognize the inherent risks associated with investing in a newly public company. Investors should carefully assess these risks and potential rewards before making any investment decisions related to the CoreWeave IPO. Stay informed about CoreWeave IPO pricing and market developments to make informed investment decisions.

Featured Posts

-

Occasionverkoop Abn Amro Flinke Toename Dankzij Meer Autobezit

May 22, 2025

Occasionverkoop Abn Amro Flinke Toename Dankzij Meer Autobezit

May 22, 2025 -

Cao Toc Bien Vung Tau Chuan Bi Thong Xe 2 9

May 22, 2025

Cao Toc Bien Vung Tau Chuan Bi Thong Xe 2 9

May 22, 2025 -

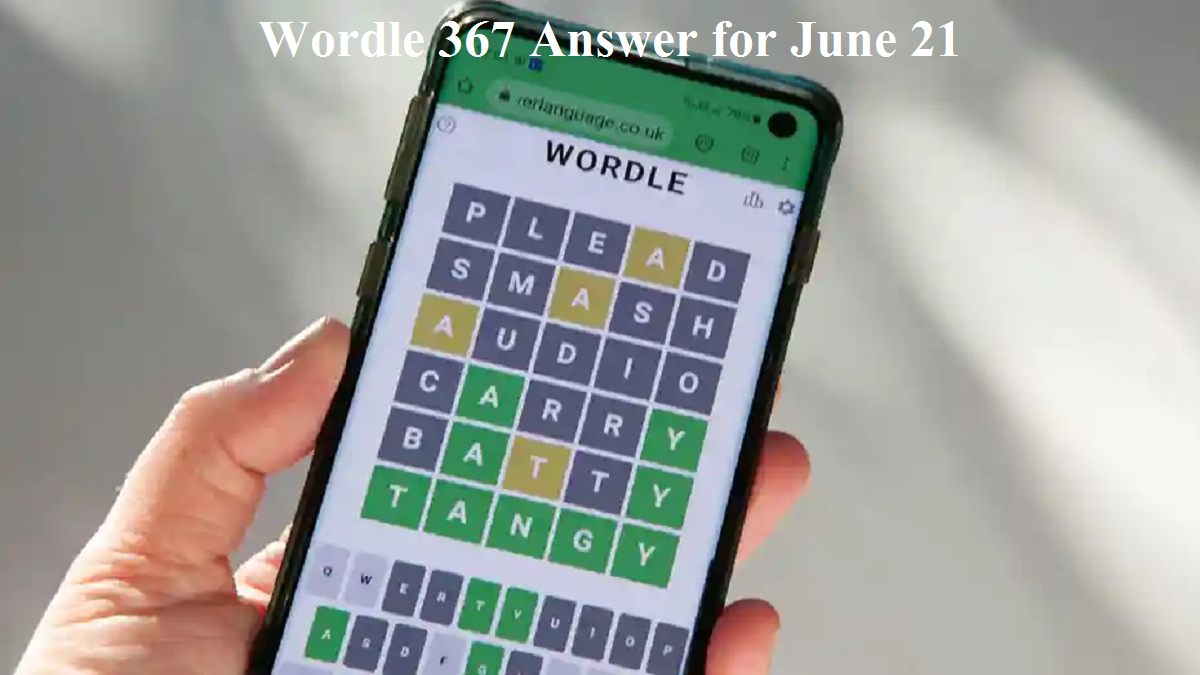

Wordle 367 Hints And Answer March 17th Monday Solution

May 22, 2025

Wordle 367 Hints And Answer March 17th Monday Solution

May 22, 2025 -

Penn Relays Allentown Boys Make History With Record Breaking 4x100m Relay

May 22, 2025

Penn Relays Allentown Boys Make History With Record Breaking 4x100m Relay

May 22, 2025 -

Kritichno Vazhlivi Telekanali Ukrayini Ofitsiyne Pidtverdzhennya Vid Minkulturi

May 22, 2025

Kritichno Vazhlivi Telekanali Ukrayini Ofitsiyne Pidtverdzhennya Vid Minkulturi

May 22, 2025

Latest Posts

-

Liga Natiunilor Scor Devastator Pentru Armenia Invinsa De Georgia Cu 6 1

May 22, 2025

Liga Natiunilor Scor Devastator Pentru Armenia Invinsa De Georgia Cu 6 1

May 22, 2025 -

Victorie Categorica Pentru Georgia In Liga Natiunilor 6 1 Contra Armeniei

May 22, 2025

Victorie Categorica Pentru Georgia In Liga Natiunilor 6 1 Contra Armeniei

May 22, 2025 -

Los Memes Que Dejo La Derrota De Panama En La Final De La Liga De Naciones

May 22, 2025

Los Memes Que Dejo La Derrota De Panama En La Final De La Liga De Naciones

May 22, 2025 -

Georgia Invinge Armenia Cu 6 1 In Liga Natiunilor

May 22, 2025

Georgia Invinge Armenia Cu 6 1 In Liga Natiunilor

May 22, 2025 -

Panama Vs Mexico Los Memes Que Inundaron Las Redes Sociales Tras La Final

May 22, 2025

Panama Vs Mexico Los Memes Que Inundaron Las Redes Sociales Tras La Final

May 22, 2025