CoreWeave Stock Price Analysis: Trends And Predictions

Table of Contents

Current Market Position and Competitive Landscape

Understanding CoreWeave's current market position and competitive landscape is crucial for any CoreWeave stock analysis. This involves examining its market share in the rapidly expanding cloud computing and AI infrastructure markets. The CoreWeave market capitalization reflects investor confidence in its growth potential, but a detailed competitive analysis is necessary.

-

Market Share and Competition: CoreWeave faces competition from established giants like AWS, Google Cloud, and Microsoft Azure, as well as other specialized AI infrastructure providers. However, CoreWeave's competitive advantage lies in its highly specialized hardware and software solutions optimized for AI workloads, attracting a growing customer base of AI-focused companies. Determining CoreWeave's precise market share requires in-depth market research reports, but its rapid growth indicates a substantial presence within the niche market.

-

Growth Potential: The cloud computing and AI markets are experiencing explosive growth. This presents significant opportunities for CoreWeave, especially considering its focus on the high-demand AI infrastructure segment. The potential for expansion into new markets and the development of innovative solutions further bolsters its growth prospects. Analysts predict continued high growth rates for the AI infrastructure market for the foreseeable future, positioning CoreWeave for substantial benefit.

-

Financial Performance: A thorough examination of CoreWeave's financial performance, including revenue growth, profitability, and debt levels, is vital for assessing its financial health and predicting future stock price movements. Analyzing financial reports, such as quarterly earnings releases, will reveal crucial insights into the company's operational efficiency and financial stability. Access to these reports, often available on the company's investor relations website, is critical for informed investment decisions.

Key Factors Influencing CoreWeave Stock Price

Several key factors significantly influence the CoreWeave stock price. Understanding these drivers is essential for accurate CoreWeave stock predictions.

-

AI Adoption Rate: The increasing adoption of AI across various industries directly impacts CoreWeave's revenue. Higher AI adoption leads to increased demand for CoreWeave's specialized cloud infrastructure, thereby driving revenue growth and potentially boosting the CoreWeave stock price. Tracking AI adoption trends across key sectors is therefore crucial for forecasting CoreWeave's performance.

-

Cloud Computing Spending: Overall spending on cloud computing services has a strong correlation with CoreWeave's performance. Increased investment in cloud infrastructure, fueled by the growing demand for AI and other cloud-based applications, positively impacts CoreWeave's revenue and stock price. Market analysis reports focusing on global cloud spending can provide valuable insights.

-

Financial Reports and Investor Sentiment: CoreWeave's financial reports (earnings, revenue growth, and other key financial metrics) play a crucial role in shaping investor sentiment. Positive earnings reports and strong revenue growth often lead to increased investor confidence and a rise in the CoreWeave stock price. Conversely, disappointing financial results can negatively affect investor sentiment and cause a price drop.

-

Regulatory Environment and Geopolitical Events: Changes in the regulatory environment or significant geopolitical events can impact the CoreWeave stock price. Regulatory changes affecting data privacy, security, or cloud computing in general could impact investor confidence and the stock price. Similarly, geopolitical instability can create market uncertainty and influence the stock's performance.

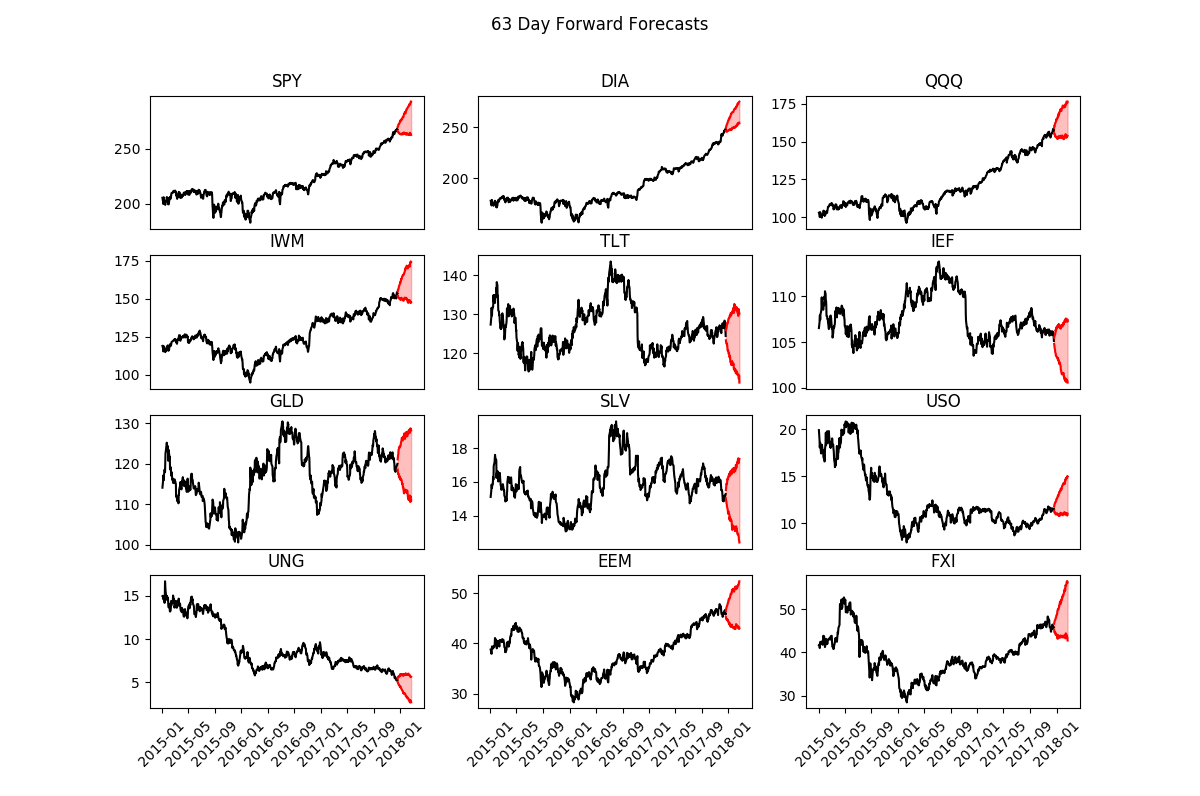

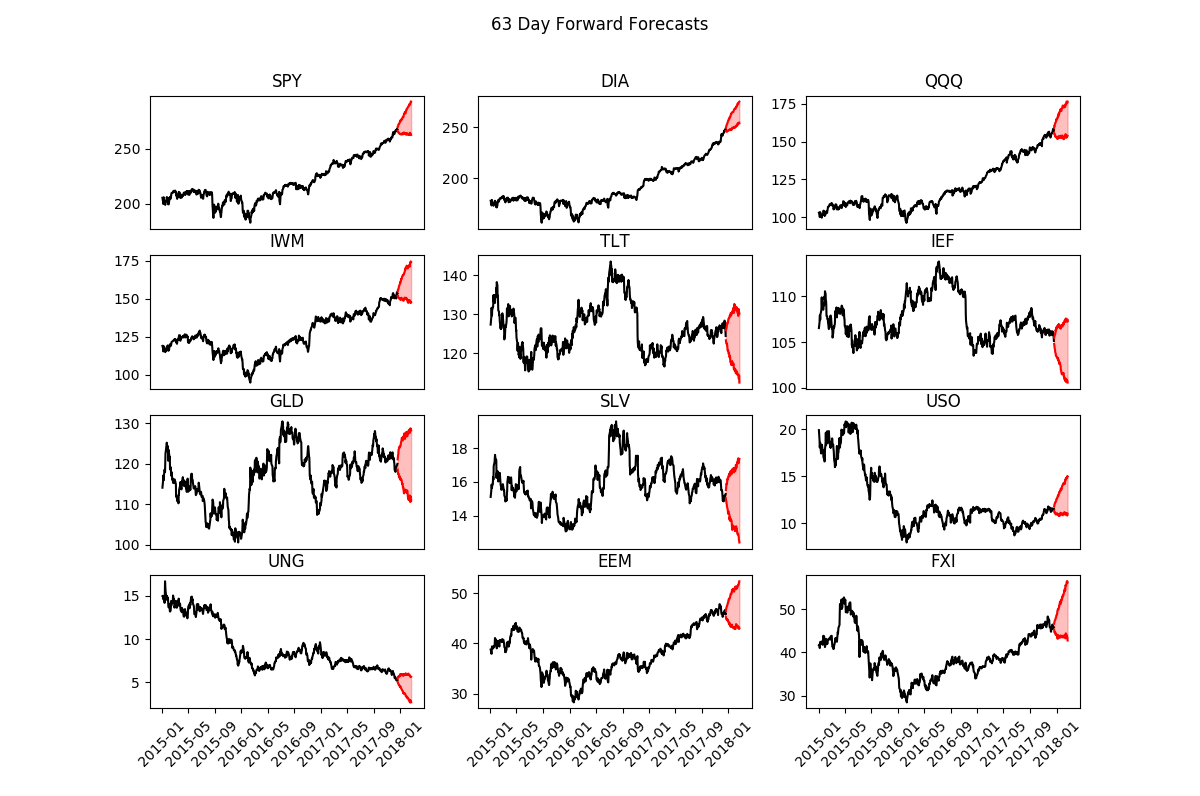

Technical Analysis of CoreWeave Stock

Technical analysis of CoreWeave's stock chart offers another perspective on potential price movements.

-

Support and Resistance Levels: Identifying key support and resistance levels on the CoreWeave stock chart can help predict potential price reversals or breakouts. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Conversely, resistance levels mark price points where selling pressure is expected to exceed buying pressure, potentially halting price advances.

-

Technical Indicators: Using technical indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can provide insights into the stock's momentum and potential future price direction. These indicators help assess the strength of the current trend and identify potential buying or selling opportunities.

-

Trading Volume: Examining trading volume alongside price movements can offer further insights. High trading volume during price increases suggests strong buying pressure, while high volume during price declines points to significant selling pressure. Low volume can indicate a lack of conviction in the current trend.

-

Chart Patterns: Recognizing chart patterns, such as head and shoulders, triangles, or double tops/bottoms, can provide clues about potential future price movements. These patterns, formed by connecting price highs and lows, can offer signals for potential reversals or breakouts.

CoreWeave Stock Price Predictions and Future Outlook

Predicting the CoreWeave stock price involves considering all the factors discussed previously. This section provides a potential outlook, but it's crucial to remember that these are just predictions, not guaranteed outcomes.

-

Short-Term and Long-Term Predictions: A short-term prediction might focus on the next few months or quarters, considering the immediate impact of factors like upcoming financial reports or market trends. A long-term prediction would examine the company's long-term growth potential, taking into account factors like market expansion, technological advancements, and competitive landscape developments. These predictions should be supported by the analysis presented in earlier sections.

-

Potential Scenarios: Different scenarios can affect these predictions. Increased competition could put downward pressure on the stock price, while successful product launches or strategic partnerships could drive upward momentum. Economic downturns generally impact technology stocks, and CoreWeave would not be immune to such broader market forces.

-

Valuation and Investment Opportunity: Evaluating CoreWeave's valuation relative to its peers and its growth potential is vital to determine whether it presents a good investment opportunity. Metrics such as price-to-earnings ratio (P/E) and price-to-sales ratio (P/S) can be compared to similar companies to gauge whether CoreWeave is overvalued or undervalued.

-

Risk Factors: Investing in CoreWeave stock carries inherent risks, including the volatility of the technology sector, competition, and the relatively early stage of the company's development. These risks should be carefully weighed against the potential rewards before making any investment decisions.

Conclusion

This CoreWeave stock price analysis has examined CoreWeave's current market position, key influencing factors, and potential future trends. The company holds significant promise within the rapidly growing AI infrastructure market, but careful consideration of the risks is essential. While the potential for substantial growth exists, it's vital to remember that investing in any stock involves risk.

Call to Action: For informed decision-making regarding CoreWeave stock price and investment opportunities, continuous monitoring of market trends, financial reports, and ongoing technical analysis is crucial. Stay updated on the latest CoreWeave stock price developments and adjust your investment strategy accordingly. Remember that this analysis is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

I Hope You Rot In Hell A Pub Landlords Explosive Reaction To A Resignation

May 22, 2025

I Hope You Rot In Hell A Pub Landlords Explosive Reaction To A Resignation

May 22, 2025 -

Pozitsiya Yevrokomisara Schodo Peregovoriv Pro Priyednannya Ukrayini Do Nato

May 22, 2025

Pozitsiya Yevrokomisara Schodo Peregovoriv Pro Priyednannya Ukrayini Do Nato

May 22, 2025 -

Ispanya Nato Goeruesmesi Elektrik Kesintileri Ve Guevenlik Tartismalari

May 22, 2025

Ispanya Nato Goeruesmesi Elektrik Kesintileri Ve Guevenlik Tartismalari

May 22, 2025 -

Federal Election Impact A Saskatchewan Political Panel Perspective

May 22, 2025

Federal Election Impact A Saskatchewan Political Panel Perspective

May 22, 2025 -

Dexter Funko Pop Figures A Collectors Guide

May 22, 2025

Dexter Funko Pop Figures A Collectors Guide

May 22, 2025

Latest Posts

-

Israeli Embassy In London Heightens Security Following Us Events

May 22, 2025

Israeli Embassy In London Heightens Security Following Us Events

May 22, 2025 -

Usilenie Sanktsiy Protiv Rossii Zayavlenie Senata S Sh A

May 22, 2025

Usilenie Sanktsiy Protiv Rossii Zayavlenie Senata S Sh A

May 22, 2025 -

Yaron And Sara Tragic Loss In Washington D C Shooting

May 22, 2025

Yaron And Sara Tragic Loss In Washington D C Shooting

May 22, 2025 -

Embassy Employee Murders Suspect Apprehended

May 22, 2025

Embassy Employee Murders Suspect Apprehended

May 22, 2025 -

Washington D C Terror Attack Remembering Yaron And Sara

May 22, 2025

Washington D C Terror Attack Remembering Yaron And Sara

May 22, 2025