CoreWeave Stock: What's Happening Now?

Table of Contents

Recent CoreWeave Stock Performance & Price Analysis

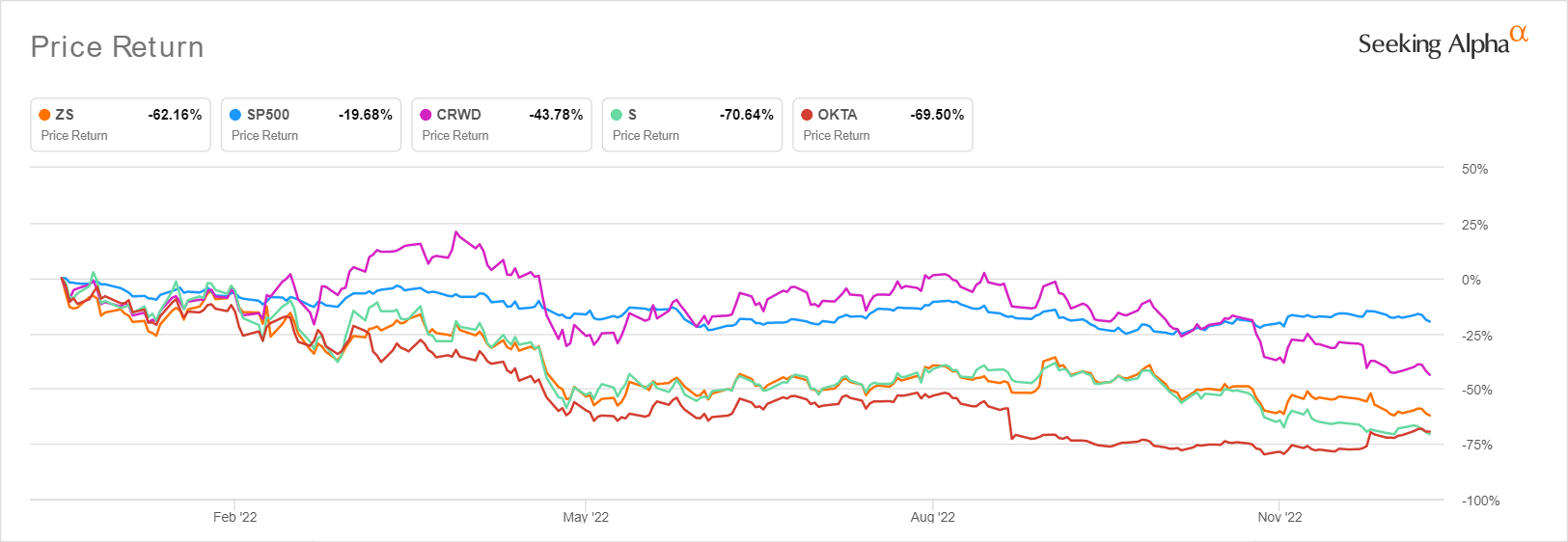

CoreWeave's stock performance has been [insert description of recent performance: e.g., "volatile," "showing steady growth," "experiencing a period of consolidation"]. [Insert a chart or graph visualizing the stock's performance over the past 3-6 months. Clearly label the axes and include a source for the data]. Several factors contribute to these price fluctuations. Market sentiment plays a significant role, with broader shifts in the tech sector impacting CoreWeave stock price. News events, such as new partnerships or product launches, can also trigger significant price changes. Furthermore, CoreWeave's financial reports and earnings announcements heavily influence investor confidence and, consequently, the stock price.

- Analysis of trading volume: [Describe the trading volume trends. Is it increasing, decreasing, or remaining stable? What does this suggest about investor interest?]

- Comparison to competitor stock performance: [Compare CoreWeave's stock performance to competitors like NVIDIA or AWS. How does it stack up? What are the key differences in their performance?]

- Significant price changes and their causes: [Discuss any significant price jumps or drops. Identify the specific news or events that likely caused these changes.]

CoreWeave's Business Model and Future Prospects

CoreWeave's core business revolves around providing cloud computing infrastructure specifically optimized for AI workloads. Its competitive advantage lies in [mention key competitive advantages, e.g., its use of GPU-optimized infrastructure, its focus on a specific niche, its strong partnerships]. CoreWeave targets businesses and researchers with high-performance computing needs, particularly in the AI, machine learning, and high-performance computing sectors.

The future prospects for CoreWeave look promising, given the explosive growth of the AI market. However, several challenges exist. Increased competition and potential economic downturns could impact future growth.

- Key partnerships and collaborations: [List and discuss key partnerships. What benefits do these collaborations bring to CoreWeave?]

- Expansion plans and market penetration strategies: [Describe CoreWeave's plans for expansion into new markets or customer segments.]

- Potential risks and threats: [Identify potential risks, such as competition, technological disruption, and economic factors.]

- Upcoming product launches or services: [Mention any upcoming product launches that could significantly impact the company’s future.]

Financial Performance and Key Metrics

[If publicly available, analyze CoreWeave's financial statements, focusing on key metrics. If not available, state this clearly and provide alternative information such as funding rounds or revenue projections]. Analyzing key performance indicators (KPIs) provides crucial insights into the company's financial health and stability.

- Revenue growth rate: [State the revenue growth rate, if available. Is it accelerating, decelerating, or stable?]

- Profit margins: [Discuss profit margins. Are they healthy and sustainable?]

- Debt-to-equity ratio: [Analyze the debt-to-equity ratio to assess the company’s financial leverage.]

- Cash flow analysis: [If available, discuss the company's cash flow situation. Is it generating positive cash flow?]

Analyst Ratings and Investor Sentiment

Analyst ratings for CoreWeave stock vary, with some [mention specific analyst firms and their ratings, including price targets and buy/sell recommendations]. Overall investor sentiment appears to be [describe the overall sentiment – bullish, bearish, or neutral – and support this with evidence]. Any significant changes in analyst opinions can have a substantial impact on the CoreWeave stock price.

- Average price target from analysts: [State the average price target from various analysts.]

- Buy/sell/hold recommendations: [Summarize the overall consensus from buy/sell/hold recommendations.]

- Significant upgrades or downgrades: [Highlight any notable upgrades or downgrades from analysts and their potential impact on the stock price.]

Conclusion

CoreWeave stock presents both opportunities and risks. Its position in the rapidly growing AI and cloud computing sectors offers significant long-term potential. However, investors should carefully consider the company's financial performance, competitive landscape, and overall market conditions before making any investment decisions. The current state of CoreWeave stock reflects a [reiterate the overall sentiment – e.g., “dynamic and evolving market,” “period of growth and consolidation,” etc.].

To stay informed about CoreWeave stock and make well-informed decisions, it's crucial to monitor CoreWeave stock performance closely, stay updated on industry news, and conduct thorough due diligence. Learn more about investing in CoreWeave stock by staying abreast of financial news and analyst reports. Remember, this analysis does not constitute financial advice. Always conduct your own research before investing in any stock.

Featured Posts

-

Core Weave Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025

Core Weave Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025 -

Rodgers Steelers Visit A Sign Of Potential Trade

May 22, 2025

Rodgers Steelers Visit A Sign Of Potential Trade

May 22, 2025 -

Exploring The Rich Flavors Of Cassis Blackcurrant From Cocktails To Cuisine

May 22, 2025

Exploring The Rich Flavors Of Cassis Blackcurrant From Cocktails To Cuisine

May 22, 2025 -

Jaw Dropping Antiques Roadshow Find Couple Arrested For National Treasure Crime

May 22, 2025

Jaw Dropping Antiques Roadshow Find Couple Arrested For National Treasure Crime

May 22, 2025 -

The Factors Contributing To Core Weaves Crwv Stock Performance Last Week

May 22, 2025

The Factors Contributing To Core Weaves Crwv Stock Performance Last Week

May 22, 2025

Latest Posts

-

Partido Mexico Vs Panama Todo Sobre La Final De La Concacaf

May 22, 2025

Partido Mexico Vs Panama Todo Sobre La Final De La Concacaf

May 22, 2025 -

A Que Hora Juega Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025

A Que Hora Juega Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025 -

Liga De Naciones Concacaf Mexico Vs Panama Informacion Del Partido Final

May 22, 2025

Liga De Naciones Concacaf Mexico Vs Panama Informacion Del Partido Final

May 22, 2025 -

Cuando Y Donde Ver La Final Concacaf Mexico Contra Panama

May 22, 2025

Cuando Y Donde Ver La Final Concacaf Mexico Contra Panama

May 22, 2025 -

La Real Sociedad Y El Virus Fifa Un Calendario Inflexible Sin Descanso

May 22, 2025

La Real Sociedad Y El Virus Fifa Un Calendario Inflexible Sin Descanso

May 22, 2025