CoreWeave's IPO: $40 Listing Price Falls Short Of Initial Projections

Table of Contents

Initial Expectations and the Reality of the CoreWeave IPO

The CoreWeave IPO generated substantial pre-listing buzz, with initial projections suggesting a higher price range. While the exact projected range varied depending on the source, many analysts predicted a listing price considerably above the eventual $40. This discrepancy between the anticipated CoreWeave IPO price and the final valuation raises crucial questions about market assessment of the company's potential.

- Initial projected price range: While precise figures varied, many analysts predicted a range significantly higher than $40.

- Final listing price: The CoreWeave stock debuted at $40 per share.

- Percentage difference between projection and reality: The difference between the anticipated and final price represents a substantial shortfall, indicating a less enthusiastic response from investors than initially expected. This percentage should be calculated and included once the precise initial projections are publicly available.

- Impact on CoreWeave's market capitalization: The lower-than-expected listing price directly affected CoreWeave's initial market capitalization, impacting its overall valuation and investor perception.

Factors Contributing to CoreWeave's Lower-Than-Expected IPO Price

Several interconnected factors likely contributed to CoreWeave's lower-than-expected IPO price. These include prevailing market conditions, concerns regarding the company's future growth trajectory, competition within the fiercely competitive cloud computing market, and broader macroeconomic influences impacting investor confidence.

- Overall market volatility and its impact on tech IPOs: The current market climate shows volatility, particularly impacting technology IPOs. Investor risk aversion in a fluctuating market can lead to lower valuations.

- Concerns about CoreWeave's growth trajectory compared to competitors: Investors may have harbored concerns about CoreWeave's ability to sustain rapid growth in a crowded market, comparing its potential to established giants and emerging competitors. A detailed analysis of CoreWeave's competitive positioning is crucial in understanding this factor.

- Impact of rising interest rates and inflation on investor appetite for tech stocks: Rising interest rates and persistent inflation negatively affect investor confidence in high-growth tech stocks, often leading to lower valuations during IPOs.

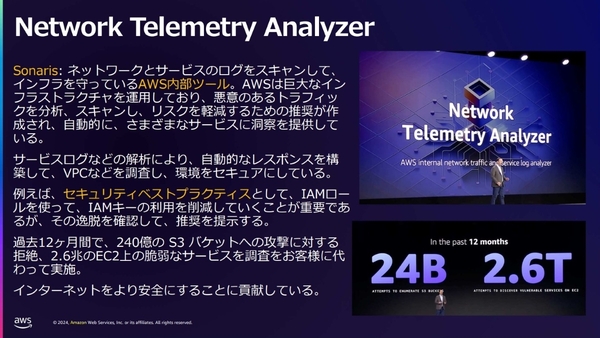

- Analysis of CoreWeave’s competitive landscape: The intense competition within the cloud computing sector, with established players like AWS, Azure, and GCP, undoubtedly played a role in shaping investor expectations. CoreWeave's differentiation strategy and its capacity to capture market share need careful consideration.

Analysis of Post-IPO Performance and Investor Reaction

Analyzing the post-IPO performance of CoreWeave's stock price is crucial in understanding investor reaction to the initial pricing. The initial trading days following the IPO will be key in gauging market sentiment.

- Initial day's trading volume and price movements: High trading volume and significant price fluctuations on the first day are common. The direction of these movements will signal whether investors consider the $40 price point a bargain or an overvaluation.

- Short-term and long-term outlook based on market trends: A thorough analysis of market trends and expert predictions is crucial in projecting the short-term and long-term performance of CoreWeave stock.

- Analyst predictions and ratings for CoreWeave stock: Post-IPO, financial analysts will issue ratings and predictions, providing additional insights into the stock’s potential. Monitoring these predictions is essential for assessing the long-term outlook.

- Comparison to the performance of other recent tech IPOs: Comparing CoreWeave's post-IPO performance to that of other recent tech IPOs in similar sectors will provide valuable context and insight into broader market trends.

Conclusion

CoreWeave's IPO ultimately fell short of initial expectations, primarily due to a confluence of factors, including broader market volatility impacting tech IPOs, concerns surrounding CoreWeave's competitive landscape and growth trajectory within the cloud computing sector, and prevailing macroeconomic headwinds. Close monitoring of CoreWeave's stock performance in the coming weeks and months, coupled with an analysis of analyst predictions, is crucial in understanding its long-term prospects.

Call to Action: Stay informed on the ongoing developments surrounding the CoreWeave IPO and its impact on the cloud computing sector. Continue to monitor CoreWeave stock performance and future announcements to gain a complete understanding of the company's trajectory. Follow our updates for further analysis of the CoreWeave IPO and its implications for future tech offerings. Learn more about the CoreWeave IPO and its implications by visiting [link to relevant resource].

Featured Posts

-

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025 -

Phan Tich 7 Diem Nut Giao Thong Quan Trong Tp Hcm Long An

May 22, 2025

Phan Tich 7 Diem Nut Giao Thong Quan Trong Tp Hcm Long An

May 22, 2025 -

Improving Virtual Meetings New Features From Google

May 22, 2025

Improving Virtual Meetings New Features From Google

May 22, 2025 -

Core Weave Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025

Core Weave Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025 -

Update Wyomings Otter Management Under New House Bill

May 22, 2025

Update Wyomings Otter Management Under New House Bill

May 22, 2025

Latest Posts

-

Ser Aldhhb Fy Qtr Alywm Alithnyn 24 Mars 2024

May 23, 2025

Ser Aldhhb Fy Qtr Alywm Alithnyn 24 Mars 2024

May 23, 2025 -

Police Cite Safety Concerns Regarding Kartels Restrictions

May 23, 2025

Police Cite Safety Concerns Regarding Kartels Restrictions

May 23, 2025 -

Trinidad And Tobago Newsday Kartels Security Restrictions Explained

May 23, 2025

Trinidad And Tobago Newsday Kartels Security Restrictions Explained

May 23, 2025 -

Kartels Restrictions A Police Source Explains The Safety Measures

May 23, 2025

Kartels Restrictions A Police Source Explains The Safety Measures

May 23, 2025 -

Barclay Center To Host Vybz Kartel Concert In April

May 23, 2025

Barclay Center To Host Vybz Kartel Concert In April

May 23, 2025