Could 3% Mortgage Rates Reignite Canada's Housing Market?

Table of Contents

The Historical Impact of Low Mortgage Rates on Canadian Housing

Examining past cycles reveals a strong correlation between low mortgage rates and significant activity in Canada's housing market. The early 2000s, for example, saw a period of low interest rates that fueled a surge in home sales and construction. This period was characterized by increased affordability, stimulating demand and leading to a notable rise in home prices across various segments.

Examining Past Cycles:

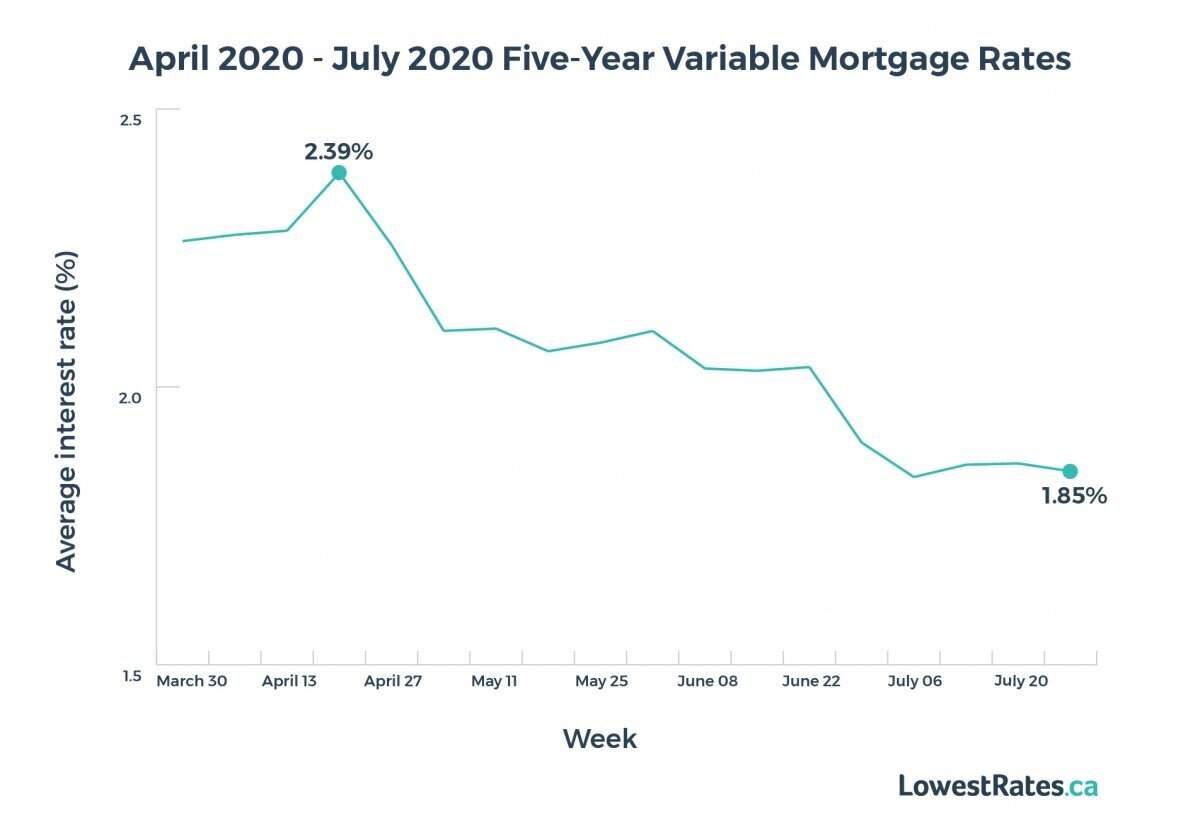

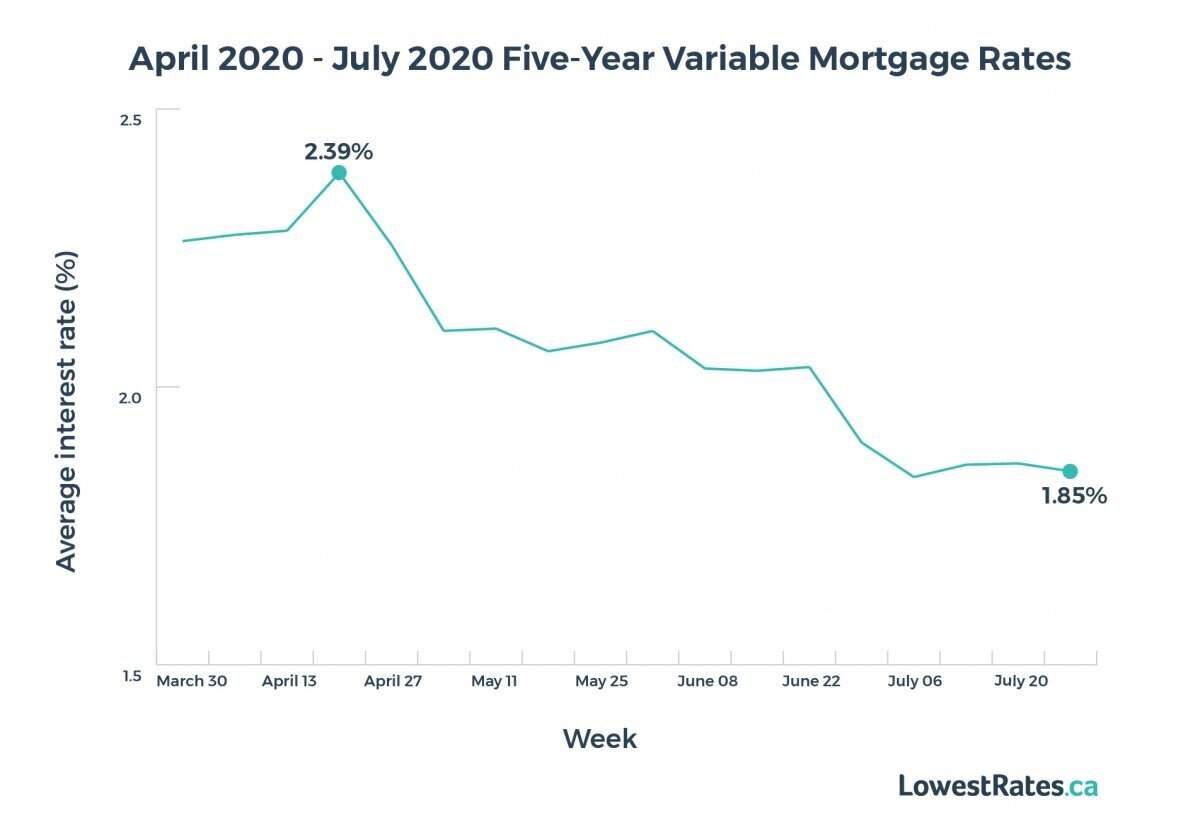

Analyzing historical data from periods with low mortgage rates, such as the early 2000s, offers valuable insights. Charts showing the relationship between interest rates and key housing market indicators (sales, prices, construction starts) would provide compelling visual evidence. For instance, we can observe a clear correlation between declining interest rates and the subsequent increase in housing starts and sales.

- Increased affordability leading to higher demand: Lower rates made homeownership more accessible, attracting a larger pool of potential buyers.

- Stimulation of new housing construction: Builders responded to the increased demand by undertaking more construction projects.

- Impact on different housing segments (condos, single-family homes): The impact wasn't uniform; certain segments, such as condos in urban centers, often experienced more pronounced effects.

- Mention any potential downsides from past cycles (e.g., market bubbles): It's crucial to acknowledge the potential downsides of rapid growth, such as the formation of speculative bubbles and subsequent market corrections.

Affordability and the 3% Mortgage Rate Dream

The allure of 3% mortgage rates lies primarily in their impact on affordability. Let's illustrate this with some concrete examples.

Calculating the Impact:

Consider a $500,000 mortgage and a $750,000 mortgage, both amortized over 25 years. A simple calculation comparing monthly payments at 3% versus current rates (which vary but are significantly higher) would demonstrate the substantial reduction in monthly costs achievable with lower interest rates.

- Significant reduction in monthly payments: The difference in monthly payments could be thousands of dollars, making homeownership significantly more attainable for many.

- Increased purchasing power for potential buyers: Lower monthly payments would allow buyers to afford more expensive homes or to allocate more funds towards a larger down payment.

- Impact on different income brackets: The impact would be disproportionately beneficial for lower- and middle-income households, potentially bridging the affordability gap for many first-time homebuyers.

- Mention potential limitations (e.g., still needing a substantial down payment): Even with lower interest rates, securing a significant down payment remains a major hurdle for many prospective buyers.

Beyond Interest Rates: Other Factors Influencing the Market

While 3% mortgage rates would undoubtedly have a significant impact, it's crucial to consider other factors influencing Canada's housing market.

Economic Conditions:

The overall economic climate, employment rates, and inflation levels play a vital role. A strong economy with low unemployment generally supports higher housing demand, while high inflation can erode affordability even with lower interest rates. The interplay between these factors is complex and needs careful consideration.

Government Policies:

Government policies, such as mortgage stress tests and housing incentives, significantly influence market dynamics. Changes in these policies can either amplify or dampen the effects of lower interest rates.

- Impact of immigration on housing demand: Canada's immigration policies have a direct impact on housing demand, as newcomers contribute significantly to the need for housing.

- Supply chain issues and their effect on new housing construction: Construction delays and material shortages constrain the supply of new homes, potentially pushing prices upward even with lower interest rates.

- The role of investor activity in the market: Investor activity, including purchases of properties for rental purposes, influences both demand and prices.

Potential Risks and Challenges of a 3% Mortgage Rate Scenario

A sudden drop to 3% mortgage rates, while potentially beneficial, also carries risks.

Risk of a Housing Bubble:

A rapid increase in demand fueled by significantly lower rates could lead to a renewed housing bubble, characterized by unsustainable price increases followed by a sharp correction.

Increased Competition:

Lower rates would likely attract more buyers, resulting in increased competition and potentially driving prices upward more rapidly.

- Risk of overvaluation: Prices might exceed their fundamental value, creating a vulnerable market susceptible to a downturn.

- Potential for rapid price increases followed by a correction: A rapid price escalation could be unsustainable, leading to a market correction with potential negative consequences for homeowners and the broader economy.

- Increased pressure on first-time homebuyers: Increased competition from more affluent buyers with greater purchasing power could intensify pressure on first-time homebuyers.

Conclusion: Will 3% Mortgage Rates Reignite Canada's Housing Market? A Look Ahead

The potential impact of a return to 3% mortgage rates on Canada's housing market is complex. While lower rates would undoubtedly boost affordability and potentially stimulate demand, the interplay of economic conditions, government policies, and the risk of a housing bubble must be considered. The historical impact of low rates shows a strong correlation with market activity, but past performance is not necessarily indicative of future results.

Understanding the potential impact of 3% mortgage rates on Canada's housing market is crucial for both buyers and sellers. Stay tuned for future updates and analyses as we continue to monitor this evolving landscape. Making informed decisions regarding real estate requires careful consideration of all relevant factors, including prevailing interest rates and broader economic trends.

Featured Posts

-

Sylvester Stallones Dochter Foto Lokt Bewondering Uit

May 12, 2025

Sylvester Stallones Dochter Foto Lokt Bewondering Uit

May 12, 2025 -

Confirmed One Indy Car Driver Skipping The 2025 Indy 500

May 12, 2025

Confirmed One Indy Car Driver Skipping The 2025 Indy 500

May 12, 2025 -

Celtics Guards Unexpected Nba Award Stance

May 12, 2025

Celtics Guards Unexpected Nba Award Stance

May 12, 2025 -

Russ Voughts Inheritance From Trumps Budget To Doges Future

May 12, 2025

Russ Voughts Inheritance From Trumps Budget To Doges Future

May 12, 2025 -

Hamas Announces Release Of Final U S Hostage In Gaza

May 12, 2025

Hamas Announces Release Of Final U S Hostage In Gaza

May 12, 2025

Latest Posts

-

Your Guide To Senior Trips Activities And Events Calendar

May 13, 2025

Your Guide To Senior Trips Activities And Events Calendar

May 13, 2025 -

Senior Travel And Activities 2024 Calendar Of Events

May 13, 2025

Senior Travel And Activities 2024 Calendar Of Events

May 13, 2025 -

Planning Senior Trips A Complete Activities And Events Calendar

May 13, 2025

Planning Senior Trips A Complete Activities And Events Calendar

May 13, 2025 -

Best Senior Trips Activities And Events Calendar

May 13, 2025

Best Senior Trips Activities And Events Calendar

May 13, 2025 -

Be Realistic The Importance Of Keeping A Key Tasman Road Open

May 13, 2025

Be Realistic The Importance Of Keeping A Key Tasman Road Open

May 13, 2025