Could A 10x Bitcoin Multiplier Reshape Wall Street? Chart Analysis

Table of Contents

Keywords: 10x Bitcoin, Bitcoin price prediction, Bitcoin impact on Wall Street, cryptocurrency, Wall Street, Bitcoin chart analysis, financial markets, crypto investment, Bitcoin price surge.

The possibility of Bitcoin experiencing a 10x multiplier effect – a surge to prices exceeding $400,000 – has captivated both crypto enthusiasts and Wall Street veterans. This article delves into a detailed chart analysis to explore the potential ramifications of such a dramatic price increase on traditional financial markets and the future of cryptocurrency investment. We’ll examine the potential ripple effects across various sectors and assess the likelihood of this scenario unfolding.

Historical Bitcoin Price Volatility and Growth Patterns

Analyzing past Bitcoin price movements is crucial for understanding potential future scenarios. Bitcoin's history is marked by significant volatility, showcasing both explosive bull markets and dramatic bear markets.

- Review of Major Bull and Bear Markets: Bitcoin's price has experienced several cycles of rapid growth followed by sharp corrections. The 2017 bull run, for instance, saw a price increase of over 2000%, only to be followed by a significant downturn. Understanding these cycles is key to predicting future behavior.

- Factors Influencing Past Price Swings: Various factors have influenced Bitcoin's price, including:

- Regulatory Changes: Government pronouncements and regulations significantly impact market sentiment and investor confidence.

- Institutional Adoption: Increased adoption by major financial institutions signals greater legitimacy and potential for price appreciation.

- Market Sentiment: Public perception and media coverage heavily influence Bitcoin's price. Fear, uncertainty, and doubt (FUD) can lead to crashes, while positive news fuels bull runs.

- Comparing Historical Growth to a 10x Multiplier: While past performance doesn't guarantee future results, comparing the historical growth rates of Bitcoin to a potential 10x multiplier allows us to assess the magnitude of such a move. A 10x increase would represent an unprecedented surge in value, dwarfing previous bull runs.

[Insert Chart Here: A chart illustrating Bitcoin's historical price performance, including major bull and bear markets. Consider adding technical indicators like moving averages (e.g., 200-day MA) and RSI to support the analysis.]

The Impact of a 10x Bitcoin Multiplier on Traditional Financial Markets

A 10x Bitcoin price surge would send shockwaves through traditional financial markets, potentially altering the landscape significantly.

- Effects on the Stock Market: While correlation between Bitcoin and the stock market isn't always consistent, a significant Bitcoin price increase could lead to increased capital flowing into crypto markets and potentially away from traditional equities, impacting stock prices.

- Impact on Gold and Other Precious Metals: Gold, often seen as a safe-haven asset, might face competition from Bitcoin if it establishes itself as a more reliable store of value. A 10x Bitcoin multiplier could lead to a reallocation of investment away from gold.

- Implications for the US Dollar and Other Fiat Currencies: A dramatic rise in Bitcoin's market capitalization could challenge the dominance of fiat currencies, potentially impacting their value and role in the global economy. Increased Bitcoin adoption could exert downward pressure on fiat currencies.

- Consequences for Hedge Funds and Institutional Investors: Institutional investors who haven't already diversified into crypto could face pressure to allocate funds to Bitcoin, potentially reshaping investment strategies and portfolio compositions. Those who have already invested could see enormous gains.

Increased regulatory scrutiny and government intervention are likely responses to such a dramatic market shift. Governments may introduce stricter regulations for cryptocurrency trading and investment to manage the risks associated with a highly volatile asset.

Potential Economic and Social Implications of a 10x Bitcoin Increase

A 10x Bitcoin increase would have profound economic and social implications on a global scale.

- Increased Wealth Inequality: The vast majority of Bitcoin is currently held by a relatively small number of investors. A 10x increase would significantly widen the wealth gap, potentially exacerbating existing social and economic inequalities.

- Effects on Global Economic Growth and Stability: Such a significant shift in market capitalization could destabilize existing financial systems and impact global economic growth. The volatility could also increase systemic risk across the financial sector.

- Widespread Adoption as a Store of Value and Medium of Exchange: A 10x increase could accelerate Bitcoin's adoption as a store of value and potentially as a medium of exchange, particularly in regions with unstable fiat currencies.

- Social Impacts and Increased Access to Financial Services: Wider Bitcoin adoption could potentially increase access to financial services for underserved communities, providing alternative financial tools in regions with limited banking infrastructure.

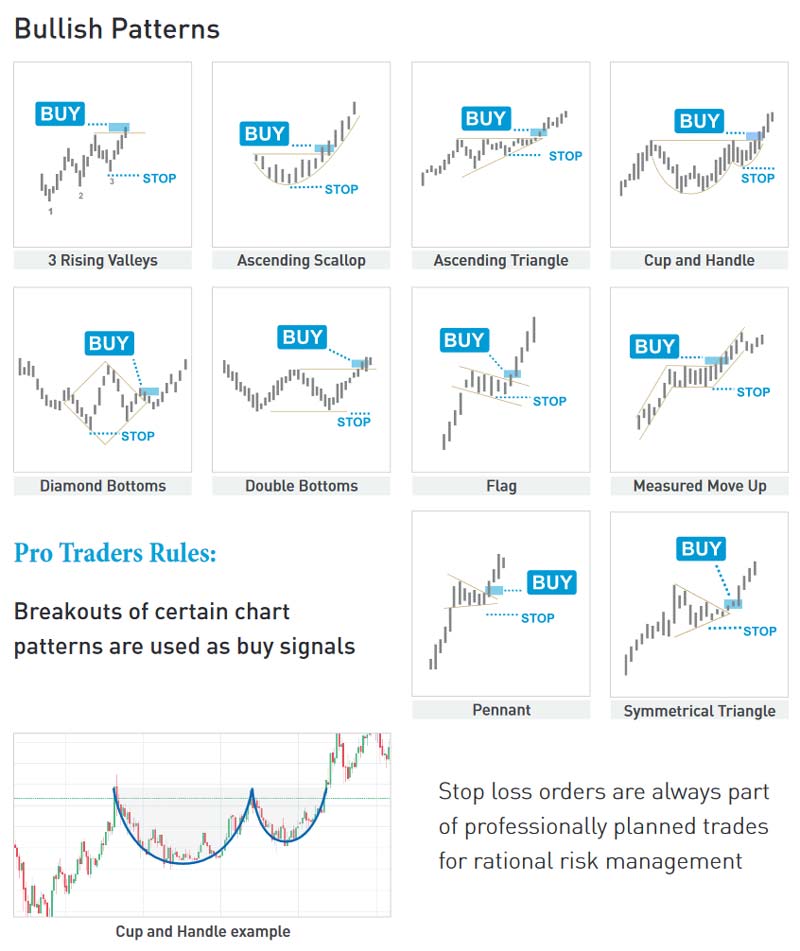

Chart Analysis: Identifying Potential Support and Resistance Levels

Technical analysis of Bitcoin charts is crucial for identifying potential price targets and obstacles for a 10x scenario.

- Technical Indicators: Various indicators, including moving averages (e.g., 20, 50, 200-day MA), Fibonacci retracements, and RSI (Relative Strength Index), help identify potential support and resistance levels and predict future price movements.

- Key Support and Resistance Levels: Identifying historical price levels where significant buying or selling pressure occurred can help predict potential price reversal points. These levels represent obstacles or thresholds that Bitcoin's price might struggle to overcome or break through.

- Potential Scenarios Based on Chart Patterns: Analyzing chart patterns like head and shoulders, double tops, and triangles can offer insights into potential future price action, helping to assess the likelihood of a 10x scenario.

[Insert Chart Here: A detailed chart of Bitcoin's price with key support and resistance levels highlighted, along with relevant technical indicators and chart patterns.]

Conclusion

A 10x Bitcoin multiplier remains a speculative scenario, but analyzing its potential impact on Wall Street and the global economy is crucial. Our chart analysis highlights the significant volatility of Bitcoin and the potential for dramatic consequences across various asset classes and economic sectors. The uncertainties and risks associated with such a dramatic price increase are substantial. However, understanding these potential implications is key for navigating the ever-evolving cryptocurrency landscape. Further research and analysis of Bitcoin charts and market trends are essential to inform investment decisions. Continue to stay informed about the latest developments in the 10x Bitcoin discussion and its potential impact on Wall Street. Understanding the potential of a 10x Bitcoin price surge is crucial for informed investment strategies in the rapidly evolving crypto market.

Featured Posts

-

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Kpss Sarti

May 08, 2025

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Kpss Sarti

May 08, 2025 -

Angels Pari Delivers Walk Off Win Against White Sox In Rain Shortened Game

May 08, 2025

Angels Pari Delivers Walk Off Win Against White Sox In Rain Shortened Game

May 08, 2025 -

Dojs Google Antitrust Proposal Impacts On User Trust And Search Results

May 08, 2025

Dojs Google Antitrust Proposal Impacts On User Trust And Search Results

May 08, 2025 -

James Gunns Superman 5 Minute Krypto The Superdog Preview Released

May 08, 2025

James Gunns Superman 5 Minute Krypto The Superdog Preview Released

May 08, 2025 -

Doha New Home For Psgs Global Innovation Labs

May 08, 2025

Doha New Home For Psgs Global Innovation Labs

May 08, 2025