Court Approves Hudson's Bay Company's Request For Extended Creditor Protection

Table of Contents

Details of the Court's Decision

The court's ruling grants HBC an extension of creditor protection for a period of six months, providing crucial breathing room to implement its financial recovery plan. This extension comes with specific conditions imposed by the court to ensure transparency and accountability. The terms of approval include:

- Length of Extension: A six-month extension of creditor protection, allowing HBC time to execute its restructuring strategy.

- Conditions Imposed: HBC is required to submit monthly financial reports detailing its progress, adhere to strict operational guidelines, and refrain from making significant asset disposals without court approval. These conditions aim to protect creditor interests during the restructuring process.

- Court's Reasoning: The court acknowledged the challenging retail environment and HBC's efforts to restructure, deeming the extension necessary to allow a viable reorganization plan to be implemented. The judge emphasized the importance of preserving jobs and ensuring a fair outcome for all stakeholders.

- Dissenting Opinions: No significant dissenting opinions were voiced during the proceedings, indicating a broad consensus on the need for extended creditor protection.

The legal process involved a detailed review of HBC's financial situation, the proposed restructuring plan, and its potential impact on creditors. The court carefully considered evidence presented by HBC and its creditors before reaching its decision.

HBC's Restructuring Plans and Strategies

HBC's restructuring strategy centers on a multi-pronged approach focused on debt reduction, improved operational efficiency, and strategic asset management. Key elements include:

- Debt Reduction: HBC plans to negotiate with creditors to reduce its overall debt burden, potentially through debt-for-equity swaps or other restructuring mechanisms.

- Cost-Cutting Initiatives: The company is implementing significant cost-cutting measures, including streamlining operations, reducing administrative expenses, and potentially closing underperforming stores.

- Asset Sales: HBC is exploring the sale of non-core assets to generate cash and reduce debt. This could include the sale of individual properties or entire business units.

- Store Closures: While not explicitly detailed, the possibility of further store closures is anticipated as part of the overall restructuring strategy to optimize operational efficiency.

The viability of HBC's restructuring strategy hinges on its ability to successfully negotiate with creditors, improve operational efficiency, and adapt to the evolving retail landscape. Challenges include potential difficulties in securing favorable terms with creditors and navigating a highly competitive retail market. This plan builds on previous restructuring efforts but incorporates more aggressive cost-cutting and asset-optimization strategies.

Impact on Stakeholders

HBC's extended creditor protection has significant ramifications for its various stakeholders:

- Employees: The restructuring plan could lead to job losses, though HBC has committed to minimizing layoffs wherever possible. Employee morale and retention remain crucial factors for the success of the restructuring.

- Customers: Customers might experience temporary disruptions in store operations or product availability during the restructuring process. However, HBC aims to maintain essential services throughout the process.

- Creditors: The court-approved process protects creditor interests by providing a structured framework for repayment. The outcome will depend on the success of the overall restructuring plan and the final terms reached with creditors.

- Suppliers: Suppliers may face delayed payments or renegotiated terms during the restructuring. Maintaining positive relationships with key suppliers will be essential for HBC's future operations.

- Shareholders: Shareholders face potential dilution of their holdings if the restructuring involves issuing new equity. The long-term value of their investment will depend on the success of HBC’s recovery plan.

The overall risk assessment for stakeholders varies. While creditors have a degree of protection, employees face the greatest immediate uncertainty regarding job security. Customers and suppliers face potential disruptions but should experience minimal long-term negative effects if the restructuring is successful.

Future Outlook for Hudson's Bay Company

The future prospects for HBC depend heavily on the successful implementation of its restructuring plan. Several key factors will determine its long-term viability:

- Successful Debt Restructuring: Reaching favorable agreements with creditors is paramount to easing the company’s financial burden.

- Improved Operational Efficiency: Cost reductions and streamlined operations will significantly impact profitability.

- Adapting to the Competitive Landscape: Navigating the evolving retail landscape and adapting to changing consumer preferences will be critical for long-term success.

Potential outcomes range from a successful recovery and return to profitability to partial success or, in a worst-case scenario, potential liquidation. Market analysis indicates a challenging but not insurmountable path to recovery for HBC, provided its restructuring plan is effectively implemented and consumer confidence is maintained.

Conclusion

The court's approval of extended creditor protection provides a temporary reprieve for the Hudson's Bay Company, allowing them time to implement their restructuring plans. The success of this strategy will depend on various factors, impacting all stakeholders. The coming months will be crucial in determining HBC's long-term viability. Careful management of its debt, operational efficiency improvements, and a robust response to the evolving retail landscape will all play critical roles in whether the company successfully emerges from this period of financial restructuring and creditor protection.

Call to Action: Stay informed about the ongoing developments in the Hudson's Bay Company's financial restructuring. Follow our updates for the latest news and analysis on HBC's journey towards financial recovery and creditor protection.

Featured Posts

-

David Pastrnak Och Vm Tjeckiens Hopp Om Framgang

May 15, 2025

David Pastrnak Och Vm Tjeckiens Hopp Om Framgang

May 15, 2025 -

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025 -

Understanding Androids Latest Design Refresh

May 15, 2025

Understanding Androids Latest Design Refresh

May 15, 2025 -

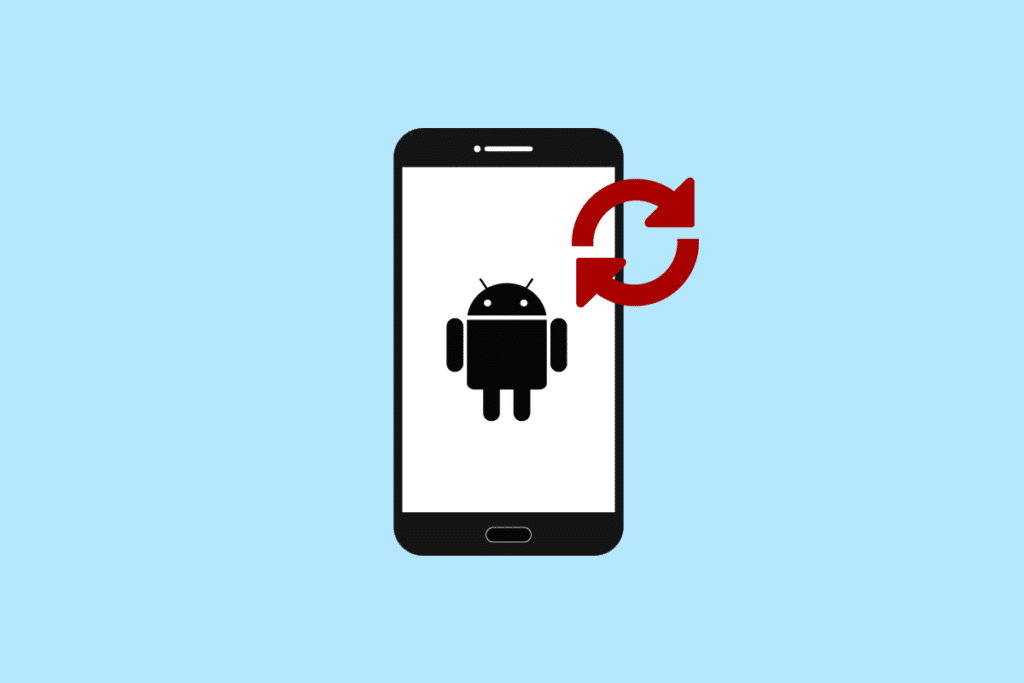

Top Baby Names Of 2024 Familiar Favorites And Fresh Trends

May 15, 2025

Top Baby Names Of 2024 Familiar Favorites And Fresh Trends

May 15, 2025 -

Padres Pregame Report Merrill Returns Campusano Optioned

May 15, 2025

Padres Pregame Report Merrill Returns Campusano Optioned

May 15, 2025

Latest Posts

-

Georgia Southwestern State University Lifts Lockdown Following Campus Incident

May 15, 2025

Georgia Southwestern State University Lifts Lockdown Following Campus Incident

May 15, 2025 -

Barkleys Bold Prediction Who Wins The Warriors Timberwolves Series

May 15, 2025

Barkleys Bold Prediction Who Wins The Warriors Timberwolves Series

May 15, 2025 -

Man Shot At Ohio City Apartment Complex Police Investigating

May 15, 2025

Man Shot At Ohio City Apartment Complex Police Investigating

May 15, 2025 -

Ahy China Dan Proyek Giant Sea Wall Studi Kasus Investasi Infrastruktur

May 15, 2025

Ahy China Dan Proyek Giant Sea Wall Studi Kasus Investasi Infrastruktur

May 15, 2025 -

Georgia Southwestern State University All Clear After Campus Incident

May 15, 2025

Georgia Southwestern State University All Clear After Campus Incident

May 15, 2025