Crack The Code: 5 Do's And Don'ts To Land Your Dream Private Credit Role

Table of Contents

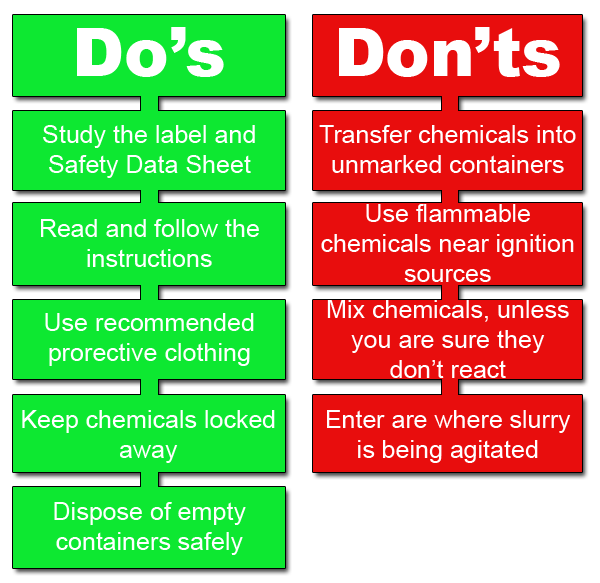

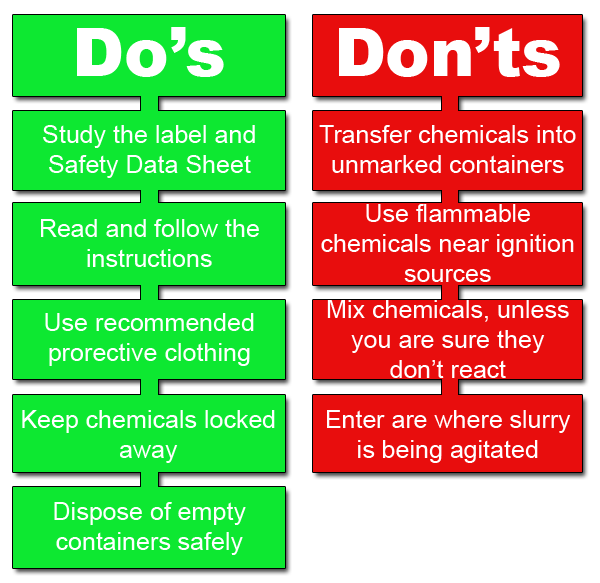

5 DO's to Land Your Dream Private Credit Role

1. DO Showcase Deep Financial Modeling Expertise

Mastering financial modeling is paramount in private credit. Prospective employers want to see that you can confidently handle complex financial analyses.

- Master financial modeling software: Become proficient in Excel, Argus, and other relevant software used for debt financing analysis. Demonstrate your ability to create sophisticated models, not just basic spreadsheets.

- Highlight proficiency in key valuation techniques: Your resume and cover letter should prominently feature your expertise in discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation methods crucial for private lending.

- Prepare for detailed technical questions: Interviewers will delve into your modeling capabilities. Be ready to explain your assumptions, interpret your results, and confidently defend your models. Expect questions on sensitivity analysis and scenario planning.

- Demonstrate experience with financial statement analysis and credit reports: Showcase your ability to analyze financial statements (balance sheets, income statements, cash flow statements) and credit reports to assess the creditworthiness of borrowers. This is critical in private credit.

- Keywords: Financial Modeling, DCF Analysis, LBO Modeling, Valuation, Financial Statements, Credit Reports, Argus, Excel, Debt Financing

2. DO Network Strategically within the Private Credit Industry

Networking is not just beneficial; it's essential for securing a private credit role. Building relationships within the industry can open doors to opportunities you wouldn't find through online applications alone.

- Attend industry conferences and events: These events provide invaluable opportunities to meet professionals, learn about current trends in private lending, and make connections.

- Connect with professionals on LinkedIn: Actively engage with professionals in private credit on LinkedIn, joining relevant groups and participating in discussions.

- Informational interviews are crucial: Reach out to individuals working in your target roles for informational interviews. These conversations provide insights into the industry and can lead to referrals.

- Build genuine relationships: Show genuine interest in the people you meet, demonstrating your passion for private credit and building lasting professional relationships.

- Keywords: Networking, Private Credit Networking, LinkedIn, Informational Interviews, Industry Conferences, Private Lending

3. DO Tailor Your Resume and Cover Letter to Each Application

A generic application will likely be overlooked. Each private credit job requires a customized approach that demonstrates your understanding of the specific firm and role.

- Highlight relevant experience and skills: Focus on the skills and experiences most relevant to each specific job description. Quantify your achievements whenever possible (e.g., "increased efficiency by 15%").

- Use keywords found in job descriptions: Incorporate keywords directly from the job description into your resume and cover letter to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

- Demonstrate a clear understanding of the firm: Research the target firm's investment strategy, portfolio companies, and recent transactions. Show that you understand their business.

- Keywords: Resume, Cover Letter, Job Application, Private Credit Job, Tailored Resume, Private Credit Role, Investment Strategy

4. DO Prepare for Behavioral and Technical Interview Questions

Private credit interviews are rigorous, demanding both technical and behavioral preparedness.

- Practice answering common behavioral questions: Prepare for questions like "Tell me about a time you failed" or "Describe a challenging situation you overcame." Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Prepare for in-depth technical questions: Expect detailed questions on financial modeling, valuation, credit analysis, and your understanding of debt financing structures.

- Research the firm's portfolio companies and recent transactions: Demonstrating your knowledge of the firm's activities shows genuine interest and initiative.

- Prepare thoughtful questions to ask the interviewer: Asking insightful questions demonstrates your engagement and interest in the role and the firm.

- Keywords: Interview Preparation, Behavioral Interview, Technical Interview, Private Credit Interview Questions, Financial Analyst Interview

5. DO Follow Up After Each Interview

Following up demonstrates your continued interest and professionalism.

- Send a thank-you note: Send a personalized thank-you email within 1-2 business days, reiterating your key qualifications and enthusiasm for the role.

- Reiterate your key qualifications: Briefly highlight 1-2 key skills or experiences that align with the role's requirements.

- Keywords: Follow Up, Thank You Note, Interview Follow Up

5 DON'Ts to Avoid When Seeking a Private Credit Role

1. DON'T Neglect the Importance of Soft Skills

Technical skills are crucial, but strong soft skills are equally important in private credit.

- Demonstrate strong communication skills: Clearly articulate your thoughts and ideas during interviews and networking events.

- Highlight teamwork experiences: Showcase your ability to collaborate effectively within a team. Private credit often involves working collaboratively with colleagues and external parties.

- Keywords: Soft Skills, Communication Skills, Teamwork, Relationship Building

2. DON'T Submit a Generic Resume and Cover Letter

A generic application shows a lack of effort and interest. Always tailor your application materials to each specific private credit opportunity.

- Research the firm's investment strategy and culture: Understanding the firm's values and investment philosophy is essential.

- Customize your resume and cover letter: Highlight the experiences and skills that directly align with the specific job requirements.

- Keywords: Generic Resume, Generic Cover Letter, Customized Application

3. DON'T Underestimate the Importance of Due Diligence

Thorough research demonstrates your commitment and understanding of the industry.

- Show your genuine interest: Demonstrate your understanding of the firm's investment strategy, portfolio companies, and the current market landscape.

- Demonstrate your understanding of the industry landscape: Stay up-to-date on industry trends and news.

- Keywords: Due Diligence, Firm Research, Industry Research, Private Lending

4. DON'T Be Unprepared for Technical Questions

Technical proficiency is a cornerstone of success in private credit. Practice your technical skills extensively.

- Practice financial modeling and valuation techniques: Master the tools and techniques used in debt financing analysis.

- Review fundamental accounting principles: Ensure you have a solid understanding of accounting principles.

- Keywords: Technical Questions, Financial Modeling, Accounting Principles, Debt Financing

5. DON'T Neglect Networking

Networking is crucial for uncovering hidden opportunities and building relationships.

- Attend industry events: Network with professionals at conferences and industry gatherings.

- Connect with people on LinkedIn: Actively engage with people working in private credit on LinkedIn.

- Seek informational interviews: Reach out to professionals for informational interviews to gain insights and build connections.

- Keywords: Networking, Industry Events, LinkedIn, Informational Interviews, Private Credit

Conclusion

Securing your dream private credit role requires a strategic and multifaceted approach. By following these five "dos" and avoiding the five "don'ts," you'll significantly improve your chances of success. Mastering financial modeling, networking effectively, tailoring your applications, preparing meticulously for interviews, and following up diligently are all crucial steps. Start applying these strategies today and take the first step towards landing your dream private credit career!

Featured Posts

-

Rihanna Pregnant With Baby 3 Updates And News

May 07, 2025

Rihanna Pregnant With Baby 3 Updates And News

May 07, 2025 -

Building A Resilient Future The Third Ldc Future Forums Action Plan

May 07, 2025

Building A Resilient Future The Third Ldc Future Forums Action Plan

May 07, 2025 -

Ralph Macchio On My Cousin Vinny Reboot Latest News And Joe Pescis Status

May 07, 2025

Ralph Macchio On My Cousin Vinny Reboot Latest News And Joe Pescis Status

May 07, 2025 -

Secure Your Cavs Round 2 Playoff Tickets Now

May 07, 2025

Secure Your Cavs Round 2 Playoff Tickets Now

May 07, 2025 -

V Kocanih In Drugod Pokop Zrtev Pozara V Nocnem Klubu

May 07, 2025

V Kocanih In Drugod Pokop Zrtev Pozara V Nocnem Klubu

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025