Credit Suisse Whistleblowers To Share $150 Million

Table of Contents

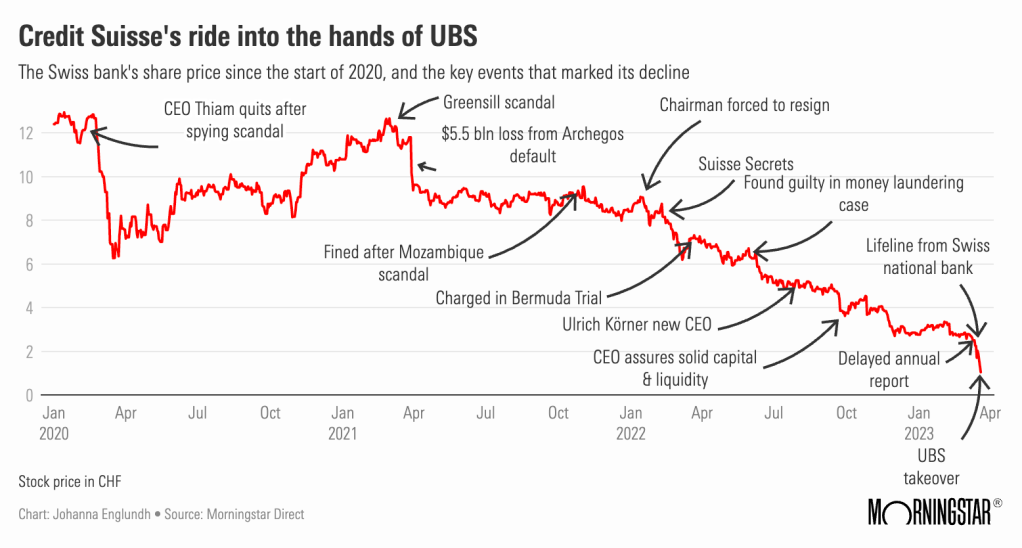

The Allegations Against Credit Suisse

The allegations against Credit Suisse involved a complex web of alleged financial misconduct, encompassing various practices that violated both internal regulations and external laws. While specifics remain partially under wraps due to confidentiality agreements, reports suggest that the claims center around issues such as tax evasion, money laundering, and potentially insider trading. These accusations paint a picture of systemic failures within the bank's internal controls and compliance systems, allowing potentially illegal activities to flourish. Reputable news sources, including the Financial Times and the Wall Street Journal, have extensively covered the evolving situation, providing valuable context to the ongoing investigations.

- Specific examples of alleged fraudulent activities: The complaints reportedly detail specific transactions and schemes used to circumvent tax laws and engage in questionable financial dealings. These examples allegedly involved high-net-worth individuals and complex offshore accounts.

- The scale and impact of the alleged misconduct: The scale of the alleged misconduct is significant, potentially impacting millions of dollars and raising serious concerns about the integrity of the global financial system.

- Key individuals involved (if publicly known): While specific individuals haven't been publicly named in all instances due to ongoing investigations, the settlement suggests that individuals at various levels within Credit Suisse were involved.

- The role of regulatory bodies like the SEC in investigating the allegations: The Securities and Exchange Commission (SEC) and other regulatory bodies played a crucial role in investigating the allegations, collaborating with the whistleblowers to build a robust case against Credit Suisse.

The Role of the Whistleblowers

The courage and dedication of the Credit Suisse whistleblowers are central to this landmark settlement. These individuals, acting with considerable personal risk, played a pivotal role in bringing these alleged illegal activities to light. Their actions serve as a powerful testament to the importance of ethical conduct and corporate accountability within the financial industry.

- How the whistleblowers discovered the alleged misconduct: The whistleblowers reportedly uncovered the alleged misconduct through internal investigations and scrutiny of financial documents.

- The methods used to report the information: They likely utilized both internal reporting mechanisms within Credit Suisse and external channels, including regulatory bodies like the SEC, to report the information.

- The challenges faced by the whistleblowers during the process: Whistleblowers often face significant challenges, including potential retaliation from their employers, legal complexities, and the emotional toll of exposing wrongdoing.

- The legal representation and support they received: Access to skilled legal counsel specializing in whistleblower protection was crucial in guiding the whistleblowers through the process and ensuring their rights were protected.

The $150 Million Settlement

The $150 million settlement represents a substantial financial award to the Credit Suisse whistleblowers, marking one of the largest payouts in the history of whistleblower rewards. This amount reflects the seriousness of the alleged misconduct and the significant value of the information provided.

- Breakdown of the settlement amount: The exact breakdown of how the $150 million will be distributed among the whistleblowers remains confidential, but it’s likely to be allocated based on their individual contributions and the level of risk involved in their reporting.

- The significance of this payout in the context of other whistleblower rewards: This settlement is unprecedented in its size, signifying a heightened awareness of the importance of whistleblower protection and the severe consequences of corporate wrongdoing.

- The implications of this settlement for future whistleblower cases: This case sets a new benchmark, potentially encouraging more individuals to come forward with information about corporate misconduct, knowing that substantial rewards are possible.

- Any stipulations or conditions attached to the settlement: Confidentiality clauses are likely a part of the settlement, restricting public disclosure of certain details related to the investigation and the identities of the whistleblowers.

Implications for Corporate Governance

The Credit Suisse settlement has profound implications for corporate governance and regulatory oversight. It sends a clear message that tolerance for financial misconduct will not be accepted.

- Increased pressure on companies to enhance internal controls and compliance programs: Corporations are now under increased scrutiny to implement robust internal controls and compliance programs to prevent and detect financial wrongdoing.

- Strengthened incentives for whistleblowing within organizations: The significant reward offered in this case strengthens the incentive for employees to report suspected illegal activity within their organizations.

- The potential impact on future corporate behavior and risk management: Companies are likely to reassess their risk management strategies and internal controls to mitigate the risk of similar scandals.

- The role of regulatory bodies in protecting whistleblowers: Regulatory bodies have a critical role in protecting whistleblowers from retaliation and ensuring that their information is handled securely and efficiently.

Future of Whistleblowing and Corporate Accountability

The Credit Suisse case marks a turning point in the landscape of corporate accountability and whistleblower protection.

- Increased awareness of whistleblower protection laws: The case has raised public awareness about the existence and importance of whistleblower protection laws.

- The potential for more whistleblowers to come forward: The substantial reward and the publicity surrounding the case are likely to encourage more individuals to report suspected corporate wrongdoing.

- Changes in corporate culture regarding ethical conduct and transparency: The settlement will likely drive changes in corporate culture, emphasizing the importance of ethical conduct and greater transparency.

- Further regulatory reforms to strengthen whistleblower protections: This case may lead to further regulatory reforms to strengthen whistleblower protections and make it easier for individuals to report suspected misconduct.

Conclusion

The $150 million settlement awarded to Credit Suisse whistleblowers marks a watershed moment for corporate accountability and whistleblower protection. This landmark case underscores the vital role of whistleblowers in uncovering financial misconduct and highlights the significant consequences for corporations that engage in illegal activities. The sheer scale of the payout serves as a potent deterrent against future wrongdoing and a powerful endorsement of the courage of those who choose to speak out.

Call to Action: Are you aware of potential financial misconduct within your organization? Learn more about whistleblower rights and protections. If you have information about potential wrongdoing, consider reporting it – you could play a crucial role in uncovering the truth and protecting the integrity of the financial system. Don't hesitate to search for resources on Credit Suisse whistleblowers and whistleblower protection laws to understand your rights and options.

Featured Posts

-

Blue Origin Rocket Launch Cancelled Subsystem Issue Delays Mission

May 09, 2025

Blue Origin Rocket Launch Cancelled Subsystem Issue Delays Mission

May 09, 2025 -

Addressing West Hams 25 Million Financial Deficit

May 09, 2025

Addressing West Hams 25 Million Financial Deficit

May 09, 2025 -

Expensive Babysitting Costs Lead To Even Higher Daycare Fees A Dads Dilemma

May 09, 2025

Expensive Babysitting Costs Lead To Even Higher Daycare Fees A Dads Dilemma

May 09, 2025 -

Stiven King I Ego Kritika Trampa I Maska Chto Proizoshlo

May 09, 2025

Stiven King I Ego Kritika Trampa I Maska Chto Proizoshlo

May 09, 2025 -

2025 82000

May 09, 2025

2025 82000

May 09, 2025