Crude Oil Market Report: News And Insights For May 16

Table of Contents

Crude Oil Price Movements on May 16

Opening, High, Low, and Closing Prices

On May 16th, the benchmark West Texas Intermediate (WTI) crude oil opened at $75.10 per barrel, reaching a high of $76.50 before experiencing a slight dip to a low of $75.00. The closing price settled at $76.20, representing a significant increase of approximately $1.50 compared to the previous day's closing price. Brent crude oil followed a similar trend, showcasing strong price movements reflective of the overall crude oil market sentiment.

Price Volatility and Factors

The day's crude oil volatility was primarily driven by the OPEC+ production cut announcement. This decision, coupled with other factors, resulted in noticeable price fluctuations throughout the trading session.

- OPEC+ Production Cuts: The unexpected reduction in oil supply significantly impacted prices, driving them upwards.

- Geopolitical Risks: Ongoing geopolitical tensions in several oil-producing regions contributed to market uncertainty and increased crude oil price volatility.

- US Dollar Strength: A strengthening US dollar can often exert downward pressure on crude oil prices, but this effect was largely offset by the supply concerns.

- Speculative Trading: Increased speculative activity in crude oil futures markets exacerbated price swings.

- Inventory Data: While current inventory levels were not dramatically low, the perceived tightening of the market due to the OPEC+ cuts influenced investor sentiment and pushed WTI crude oil and Brent crude oil prices higher.

Global Supply and Demand Dynamics

OPEC+ Production Levels and Compliance

OPEC+ announced a further reduction in oil production, exceeding market expectations. The compliance rate with previous production cuts has been a subject of ongoing discussion, and the recent announcement highlights a concerted effort to support crude oil prices.

US Crude Oil Production

US crude oil production continues to remain robust, but growth has slowed recently. Current output levels are substantial, however, the impact of the OPEC+ cuts on global supply could lead to a re-evaluation of future production projections.

Global Oil Demand

Global oil demand is showing signs of resilience despite persistent economic uncertainty in some regions. Strong demand from Asia, particularly China and India, continues to offset weaker demand in Europe and parts of North America.

- Asia's Growing Demand: Continued industrial growth and population expansion in Asian economies are major drivers of global oil demand.

- European Demand Slowdown: Economic uncertainty and energy transition initiatives have resulted in decreased oil demand in Europe.

- Seasonal Factors: Increased demand during the summer driving season will likely influence future crude oil inventory levels.

Geopolitical Influences on the Crude Oil Market

Impact of Geopolitical Events

The ongoing conflict in Eastern Europe and the associated sanctions on Russian oil production have significantly influenced the crude oil market. These events, along with political instability in other oil-producing regions, continue to represent significant risks.

Specific Geopolitical Risks

- Middle East Oil: Political tensions and potential conflicts in the Middle East pose a constant threat to oil supply, potentially leading to drastic crude oil price increases.

- Russia Oil Production: Sanctions and potential production disruptions in Russia continue to be a significant factor impacting the global oil supply chain.

- Venezuela's Oil Industry: The ongoing challenges in Venezuela's oil sector limit its ability to contribute to global global oil production.

Market Sentiment and Investor Behavior

Investor Confidence and Trading Activity

Investor confidence in the crude oil market is currently mixed. While the OPEC+ announcement initially boosted crude oil prices, concerns remain about the global economic outlook and potential future supply disruptions. Oil trading volume reflects this uncertainty, with significant volatility observed throughout the day.

Hedge Fund Positions

Major hedge funds have adjusted their positions, largely increasing their long positions following the OPEC+ announcement. This indicates a significant belief in rising crude oil futures and crude oil prices in the short to medium term.

- Increased Long Positions: This reflects confidence in higher crude oil prices and increased investment in the market.

- Impact of Speculation: Speculative trading significantly influences daily crude oil volatility, and hedge fund activity plays a significant role in this dynamic.

Conclusion: Key Takeaways and Next Steps

May 16th saw considerable crude oil price movements, primarily driven by the unexpected OPEC+ production cut. Global oil supply concerns, coupled with resilient demand, particularly from Asia, have created a bullish sentiment. Geopolitical risks and investor behavior also significantly impacted market activity. For accurate oil price forecast, continued monitoring of geopolitical events, OPEC+ actions, and economic indicators is crucial.

To stay informed on future crude oil market developments and receive regular oil market updates, including in-depth crude oil price analysis, subscribe to our newsletter on [link to newsletter signup]. Stay updated on the latest energy market insights by regularly checking our website for new crude oil market reports.

Featured Posts

-

Knicks Shamet Trade Keep Or Cut Analyzing The Options

May 17, 2025

Knicks Shamet Trade Keep Or Cut Analyzing The Options

May 17, 2025 -

Todays Mlb Matchup Yankees Vs Mariners Predictions And Best Odds

May 17, 2025

Todays Mlb Matchup Yankees Vs Mariners Predictions And Best Odds

May 17, 2025 -

Brunsons Podcast Perkins Call For Cancellation

May 17, 2025

Brunsons Podcast Perkins Call For Cancellation

May 17, 2025 -

From Disaster To Success Thibodeaus Coaching Evolution And The Knicks Turnaround

May 17, 2025

From Disaster To Success Thibodeaus Coaching Evolution And The Knicks Turnaround

May 17, 2025 -

Jeffrey Dean Morgan Discusses His Fortnite Negan Role

May 17, 2025

Jeffrey Dean Morgan Discusses His Fortnite Negan Role

May 17, 2025

Latest Posts

-

Previsiones Deportivas Semanales Analisis Y Pronosticos De Prensa Latina

May 17, 2025

Previsiones Deportivas Semanales Analisis Y Pronosticos De Prensa Latina

May 17, 2025 -

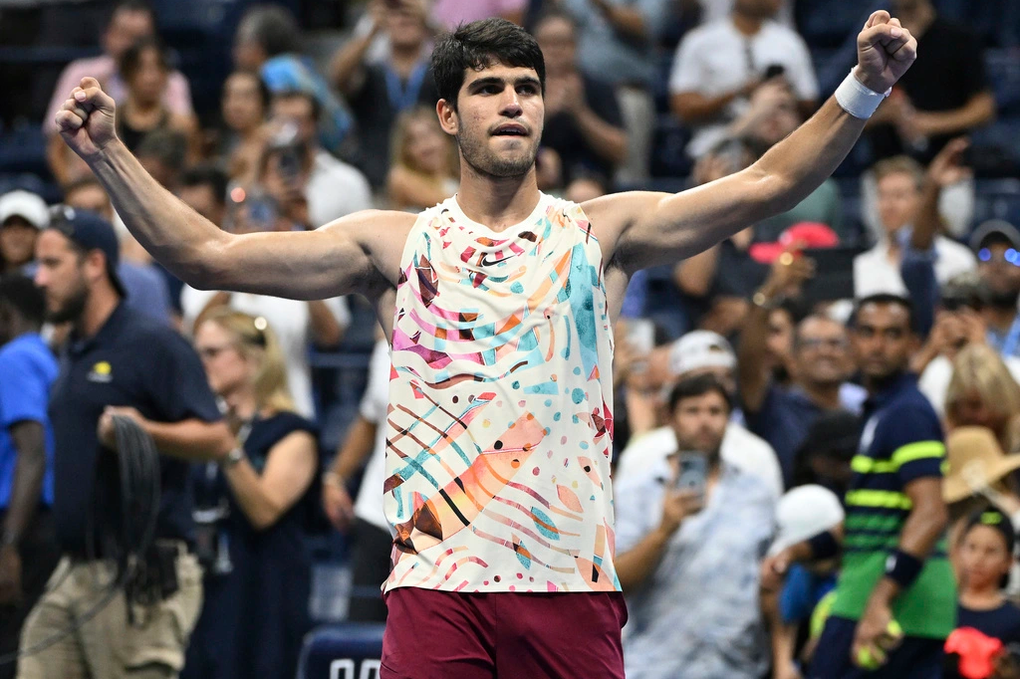

Alcaraz La Alegria Del Triunfo En Montecarlo

May 17, 2025

Alcaraz La Alegria Del Triunfo En Montecarlo

May 17, 2025 -

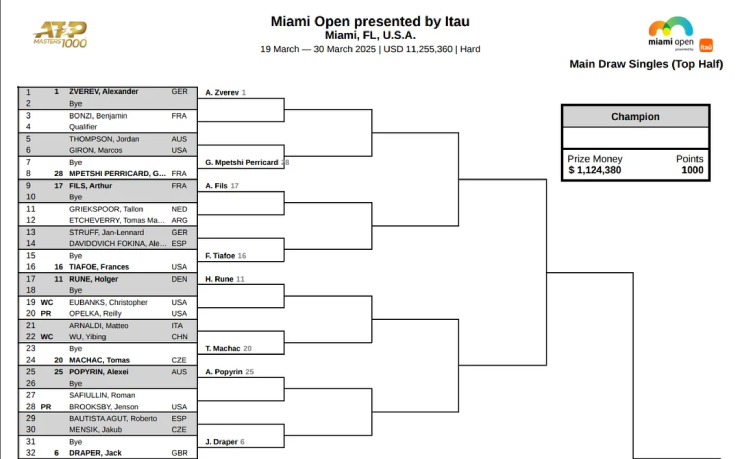

Cuoc Doi Dau Duoc Cho Doi Djokovic Va Alcaraz Cung Nhanh Tai Miami Open 2025

May 17, 2025

Cuoc Doi Dau Duoc Cho Doi Djokovic Va Alcaraz Cung Nhanh Tai Miami Open 2025

May 17, 2025 -

Novace I Dokovic Prica O Prijateljstvu I Uspehu

May 17, 2025

Novace I Dokovic Prica O Prijateljstvu I Uspehu

May 17, 2025 -

Nhanh Dau Ban Ket Miami Open 2025 Djokovic Doi Dau Alcaraz

May 17, 2025

Nhanh Dau Ban Ket Miami Open 2025 Djokovic Doi Dau Alcaraz

May 17, 2025