Crypto Market Volatility: Billions In Bitcoin And Ethereum Options Expire This Week

Table of Contents

Understanding Options Expiry in Crypto

Options contracts are agreements that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset—in this case, Bitcoin or Ethereum—at a specific price (strike price) on or before a certain date (expiry date). Expiry is the point when these contracts mature. If a call option holder doesn't exercise their right to buy before expiry, the contract becomes worthless. Similarly, for put options.

- Types of Options: Call options profit when the price of the underlying asset rises above the strike price at expiry. Put options profit when the price falls below the strike price. This dynamic significantly influences market price movements leading up to and immediately following expiry.

- Mechanics of Crypto Options Trading: Crypto options trading happens on various exchanges, often mirroring traditional options markets but with unique characteristics tied to the digital nature of cryptocurrencies.

- Market Makers and Institutional Investors: Large institutional investors and market makers play a crucial role, providing liquidity and influencing price discovery through their trading activities in these options markets. Their actions can significantly amplify or dampen the impact of options expiry.

The Billions at Stake: Analyzing the Expiry Volume

The sheer volume of Bitcoin and Ethereum options expiring this week is staggering, amounting to billions of dollars. This significant sum has the potential to trigger substantial price volatility. A massive influx of buy or sell orders resulting from options expiry could create significant upward or downward pressure on prices.

- Data Sources: Data on options volume and open interest (the number of outstanding contracts) is typically available through dedicated cryptocurrency data providers and exchanges. Analyzing this data is critical for assessing the potential market impact.

- Historical Analysis: Examining historical options expiry events reveals a strong correlation between large expiry volumes and increased short-term volatility. Past events serve as a useful, albeit imperfect, guide for forecasting potential outcomes this week.

- Comparison with Previous Expirys: Comparing the current expiry volume with those of similar magnitude in the past can help establish a context for potential price movements and volatility levels.

Factors Contributing to Crypto Market Volatility This Week

Several factors beyond the options expiry itself could amplify crypto market volatility this week. A confluence of macroeconomic events, regulatory actions, and Bitcoin/Ethereum-specific news can significantly influence price behavior.

- Macroeconomic Indicators: Inflation data, interest rate announcements by central banks, and overall economic sentiment heavily impact investor confidence, consequently influencing cryptocurrency prices.

- Regulatory Developments: New regulations or proposed legislation concerning cryptocurrencies in major jurisdictions can create uncertainty and drive volatility. Any significant regulatory news can cause immediate market reactions.

- Bitcoin and Ethereum News: Major events impacting Bitcoin and Ethereum, such as network upgrades, significant adoption announcements by large companies, or technological breakthroughs, can influence market sentiment and prices.

Predicting the Impact: Potential Scenarios for the Crypto Market

Predicting the exact market outcome following the options expiry is impossible. However, we can outline potential scenarios based on current market conditions and historical precedent.

- Scenario 1: Relatively Calm Expiry: The expiry could transpire with minimal market impact if options positions are relatively balanced and there are no significant external factors influencing prices.

- Scenario 2: Significant Price Swings: A large concentration of either call or put options expiring in-the-money (profitable) could trigger significant price increases (for calls) or decreases (for puts).

- Scenario 3: Increased Volatility and Uncertainty: The expiry could amplify existing market uncertainty, leading to increased volatility and prolonged periods of price fluctuations.

Conclusion: Navigating Crypto Market Volatility

The upcoming options expiry presents a significant event with the potential to significantly impact crypto market volatility. Billions of dollars are at stake, underscoring the importance of understanding the implications. Investors should proactively manage risk during periods of high volatility by diversifying their portfolios, utilizing stop-loss orders, and staying informed about market developments.

Stay informed about the latest developments in the crypto market and learn effective strategies to navigate crypto market volatility. Understand the intricacies of options trading and develop a comprehensive risk management plan to protect your investments. The inherent volatility of cryptocurrencies demands careful consideration and proactive risk management strategies.

Featured Posts

-

Liga De Quito Vs Flamengo Resultado Del Partido De Libertadores

May 08, 2025

Liga De Quito Vs Flamengo Resultado Del Partido De Libertadores

May 08, 2025 -

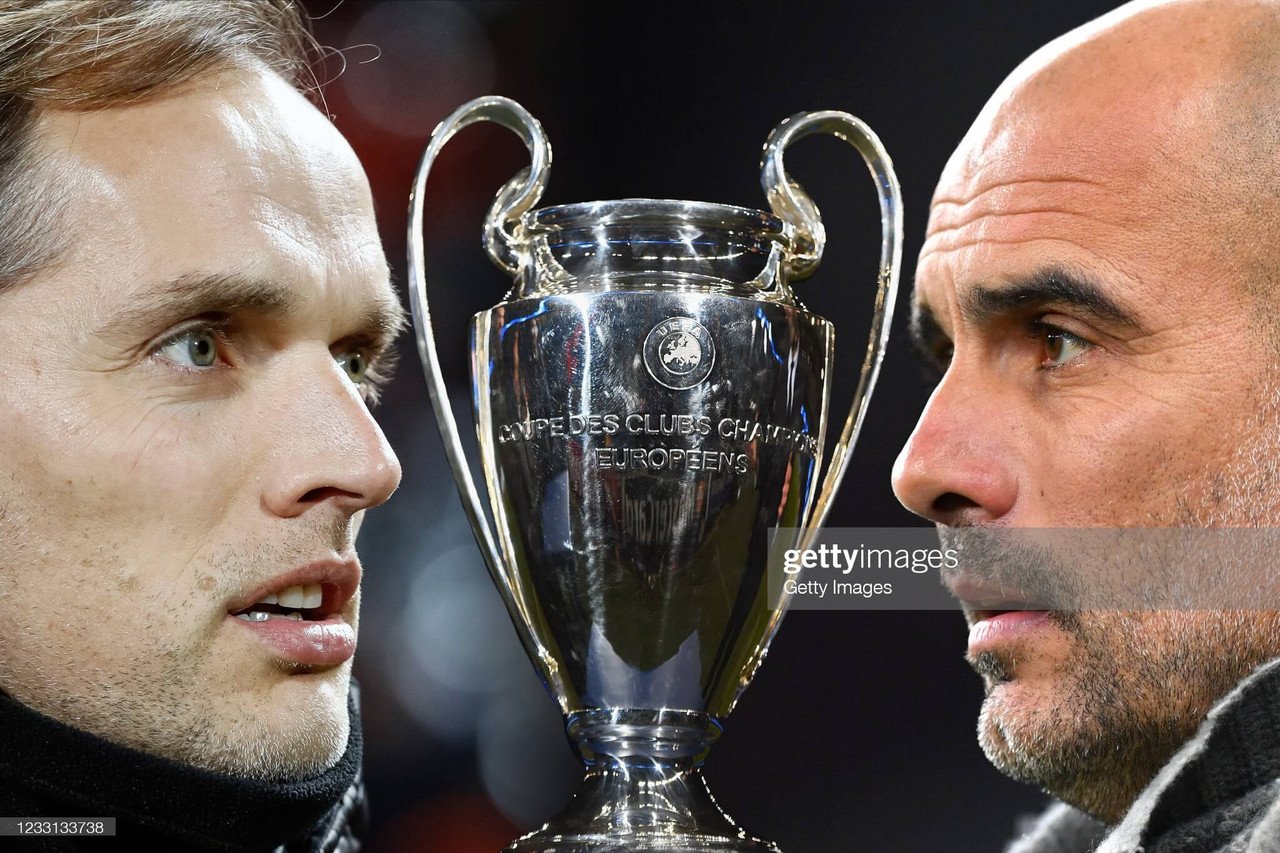

Champions League Final Preview Hargreaves On Arsenal Vs Psg

May 08, 2025

Champions League Final Preview Hargreaves On Arsenal Vs Psg

May 08, 2025 -

Awdhw Ka Armghan Kys Myn Pwlys Ky Nakamy Ka Aetraf

May 08, 2025

Awdhw Ka Armghan Kys Myn Pwlys Ky Nakamy Ka Aetraf

May 08, 2025 -

Unforgettable Tales Exploring The Best Krypto Stories

May 08, 2025

Unforgettable Tales Exploring The Best Krypto Stories

May 08, 2025 -

The Impact Of Trumps Xrp Backing On Institutional Interest

May 08, 2025

The Impact Of Trumps Xrp Backing On Institutional Interest

May 08, 2025