Cryptocurrency's Resilience Amidst Trade Wars: A Winning Prospect

Table of Contents

Decentering Dependence: Decentralization as a Shield Against Geopolitical Instability

Cryptocurrencies operate outside the traditional, centralized banking systems that are often vulnerable to government policies and trade restrictions. This inherent decentralization acts as a powerful shield against geopolitical instability.

Reduced Dependence on Traditional Financial Systems

- Sanctions and trade disputes can significantly impact traditional markets. For instance, sanctions imposed on a specific country can freeze assets held in traditional banks, limiting access to funds and disrupting trade. However, cryptocurrencies, by their very nature, bypass these restrictions.

- Borderless transactions are a defining feature of cryptocurrencies. Unlike traditional financial systems which rely on international regulations and banking relationships, cryptocurrencies can facilitate transactions across borders with minimal interference, even in the face of trade wars. This is evident in regions with volatile political landscapes where cryptocurrencies have been used to circumvent financial blockades and facilitate cross-border payments.

- Examples include the use of Bitcoin in Venezuela during periods of hyperinflation and political turmoil, demonstrating the ability of cryptocurrencies to function independently of traditional financial infrastructure.

Diversification and Risk Mitigation

Adding cryptocurrencies to an investment portfolio offers valuable diversification benefits, especially during periods of geopolitical uncertainty.

- Portfolio diversification is a cornerstone of risk management. By diversifying holdings across different asset classes, investors can reduce the impact of negative performance in any single asset. The relatively low correlation between cryptocurrency prices and traditional asset classes like stocks and bonds makes them an attractive addition to a diversified portfolio.

- Strategies such as allocating a percentage of your investment portfolio (e.g., 5-10%) to cryptocurrencies can help to mitigate the overall risk.

- This low correlation can be especially beneficial during times of economic stress caused by trade wars, as cryptocurrency prices may not necessarily move in tandem with traditional markets.

Safe Haven in Stormy Seas: Cryptocurrency as a Safe Haven Asset During Economic Uncertainty

Cryptocurrencies are increasingly viewed as a potential safe haven asset, offering a degree of protection during periods of economic uncertainty fueled by trade wars.

Inflation Hedge Potential

- Inflation erodes the purchasing power of fiat currencies. During periods of economic instability, such as those often triggered by trade wars, inflation can rise rapidly, diminishing the value of traditional currencies.

- Limited supply cryptocurrencies, like Bitcoin, have a fixed maximum supply. This scarcity can make them attractive as a hedge against inflation. As the supply of fiat currency increases due to inflationary pressures, the value of cryptocurrencies with limited supply might remain stable or even appreciate.

- Several factors, however, affect cryptocurrency price stability including regulatory changes, technological developments, and market sentiment.

Increased Demand During Times of Crisis

Investor behavior during economic crises often shows a flight to safety, resulting in increased demand for safe-haven assets.

- Historically, investors have sought refuge in gold, government bonds, or other perceived safe assets during times of global uncertainty. Similar trends are emerging in the cryptocurrency space, with investors viewing certain cryptocurrencies as a store of value during times of economic stress.

- Analysis of cryptocurrency market behavior during periods of heightened global uncertainty reveals increased trading volume and, in some cases, price increases. This suggests that cryptocurrencies can indeed function as a safe haven during times of heightened risk.

Technological Advancements Strengthening Cryptocurrency's Foundation

Ongoing technological advancements are further enhancing the stability and appeal of cryptocurrencies.

Improved Scalability and Efficiency

The evolution of blockchain technology is constantly improving transaction speeds and lowering fees.

- Layer-2 scaling solutions and other technological innovations are addressing previous limitations in cryptocurrency transaction processing, enhancing their usability and appeal, particularly during periods of high market volatility.

- These improvements make cryptocurrencies a more efficient and viable alternative to traditional payment systems, even during times of uncertainty.

Growing Institutional Adoption

The increasing involvement of institutional investors in the cryptocurrency market adds a significant layer of credibility and stability.

- Major financial institutions and investment firms are now allocating capital to cryptocurrencies, signaling growing confidence in the asset class.

- This institutional adoption significantly boosts market liquidity and can help to stabilize prices, making cryptocurrencies a more reliable investment option.

Conclusion: Navigating Uncertainty with Cryptocurrency's Resilience

In summary, Cryptocurrency's Resilience Amidst Trade Wars stems from its decentralized nature, its potential as a safe haven asset, and the ongoing advancements in blockchain technology that are increasing its efficiency and appeal. The growing institutional adoption further strengthens its position as a viable investment option.

We encourage you to further research and consider incorporating cryptocurrencies into your investment strategies as a potential hedge against the risks associated with trade wars and global economic uncertainty. Understanding cryptocurrency's resilience is crucial in today's volatile market landscape. Explore reputable resources and financial advisors to learn more about navigating the exciting world of cryptocurrency investment.

Featured Posts

-

Lotto Plus 1 And Lotto Plus 2 Results Check The Winning Numbers

May 08, 2025

Lotto Plus 1 And Lotto Plus 2 Results Check The Winning Numbers

May 08, 2025 -

Get Ready For Andor Season 2 A Pre Show Guide

May 08, 2025

Get Ready For Andor Season 2 A Pre Show Guide

May 08, 2025 -

U S Intensifies Greenland Surveillance Exclusive Intelligence Agency Directive

May 08, 2025

U S Intensifies Greenland Surveillance Exclusive Intelligence Agency Directive

May 08, 2025 -

Rogues Team Affiliation A Marvel Fans Dilemma

May 08, 2025

Rogues Team Affiliation A Marvel Fans Dilemma

May 08, 2025 -

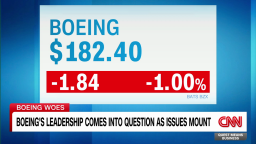

Antisemitism Investigation Boeing Seattle Campus Under Scrutiny

May 08, 2025

Antisemitism Investigation Boeing Seattle Campus Under Scrutiny

May 08, 2025