Cuomo's $3 Million Nuclear Startup Investment: Unreported Stock Options Revealed

Table of Contents

The $3 Million Investment: A Deep Dive

Andrew Cuomo's investment in the nuclear startup, [Name of Startup], occurred in [Date of Investment]. The purported rationale behind the investment was likely multifaceted, encompassing both a commitment to advancing green energy initiatives and stimulating economic development within New York State. While details regarding the exact terms of the deal remain partially obscured, publicly available information reveals some key aspects of the investment:

- Amount Invested: $3,000,000

- Type of Investment: [Specify type of investment - e.g., equity stake, convertible notes, etc.]

- Expected Returns: [Information on expected returns, if available. If unavailable, state this clearly.]

[Insert links to any publicly available documents or statements regarding the initial investment here. Example: "A press release from [Source] detailing the initial investment can be found here: [Link]."]

Unreported Stock Options: The Controversy Ignites

The recent controversy surrounding Cuomo's investment stems from the revelation of unreported stock options granted to him. These options represent a significant potential for conflict of interest and raise serious ethical questions about the use of public office for personal financial gain. The key aspects of this controversy include:

- Number of Stock Options: [Specify number of options, if available. If not, state "The exact number of stock options remains undisclosed."]

- Value of the Options: [Specify value, if available. If not, state "The precise value of the options is currently unknown, but estimates range from..."]

- Timing of the Options Grant: [Specify timing, if available. If not, state "The timing of the options grant is a key point of contention, with accusations of..."]

- Legal Ramifications: [Discuss potential legal repercussions, including investigations and potential lawsuits.]

“[Insert quote from a relevant news source or official statement here, properly attributed. Example: "‘This raises serious concerns about the former governor’s ethical conduct,’ stated [Name and Title of source]."]

Potential Conflicts of Interest and Ethical Concerns

Cuomo's investment, coupled with the undisclosed stock options, presents a clear potential for conflict of interest. His position as Governor could have influenced decisions that directly benefited the nuclear startup, creating a situation where personal financial gain was potentially intertwined with his public duties. The ethical concerns are substantial and impact public trust:

- Use of Public Office for Personal Gain: The undisclosed stock options raise serious questions about whether Cuomo used his position to advance his personal financial interests.

- Transparency Issues: The failure to disclose the stock options represents a significant breach of transparency, undermining public confidence in government.

- Breach of Fiduciary Duty: Arguments could be made that Cuomo violated his fiduciary duty to the citizens of New York by prioritizing personal financial gain over the public interest.

[Reference relevant ethics codes and regulations here. Example: "This situation raises concerns about compliance with New York State's ethics laws, specifically [relevant section of the law]."]

Public Reaction and Ongoing Investigations

The revelation of the unreported stock options has sparked significant public outrage and calls for further investigation. The public response has been widespread and includes:

- Media Coverage: The story has received extensive coverage across numerous news outlets, generating intense public scrutiny.

- Public Opinion Polls: [Include details on public opinion polls, if available, showing public sentiment.]

- Calls for Investigations: Several calls for investigations have been made by [Mention specific groups or individuals calling for investigations].

The controversy has had a significant impact on Cuomo's reputation and his legacy as Governor. [Mention any political fallout or legal actions underway.]

Conclusion

Cuomo's $3 million nuclear startup investment, further complicated by the undisclosed stock options, represents a significant ethical lapse. The lack of transparency surrounding this investment raises profound questions about the use of public office for personal gain and the importance of ethical conduct in government. The unreported stock options cast a long shadow on Cuomo’s tenure and highlight the crucial need for transparency in political investments. Stay informed about further developments in Cuomo's $3 million nuclear startup investment and advocate for greater accountability from public officials. Demand transparency and ethical behavior from those in positions of power.

Featured Posts

-

Will Singapores Ruling Party Maintain Its Monopoly

May 04, 2025

Will Singapores Ruling Party Maintain Its Monopoly

May 04, 2025 -

Lizzo And Myke Wright Relationship Timeline Net Worth Comparison

May 04, 2025

Lizzo And Myke Wright Relationship Timeline Net Worth Comparison

May 04, 2025 -

Utrecht Wastewater Plant Netherlands Largest Heat Pump Launched

May 04, 2025

Utrecht Wastewater Plant Netherlands Largest Heat Pump Launched

May 04, 2025 -

New Spotify Payment Flexibility On I Phone

May 04, 2025

New Spotify Payment Flexibility On I Phone

May 04, 2025 -

Why The Cost Of Offshore Wind Power Is Pushing Energy Companies Away

May 04, 2025

Why The Cost Of Offshore Wind Power Is Pushing Energy Companies Away

May 04, 2025

Latest Posts

-

New York New Jersey Connecticut Snow Predictions

May 04, 2025

New York New Jersey Connecticut Snow Predictions

May 04, 2025 -

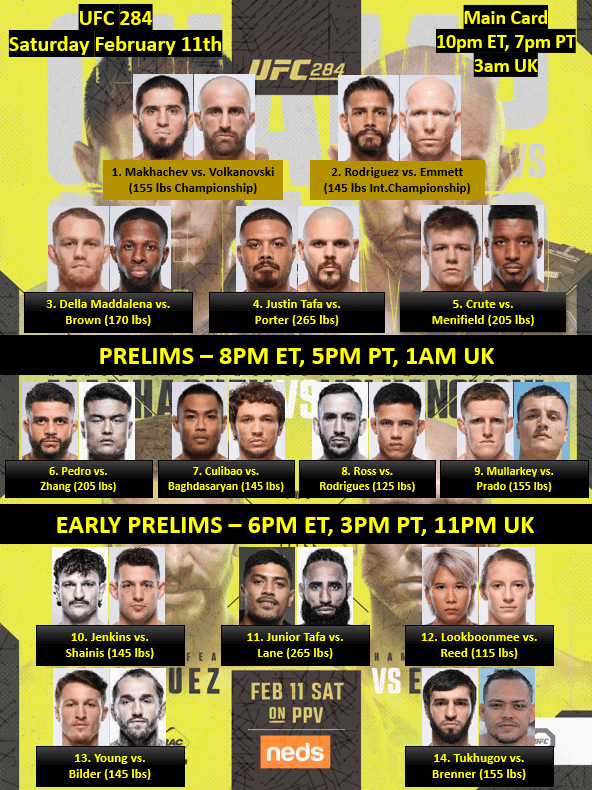

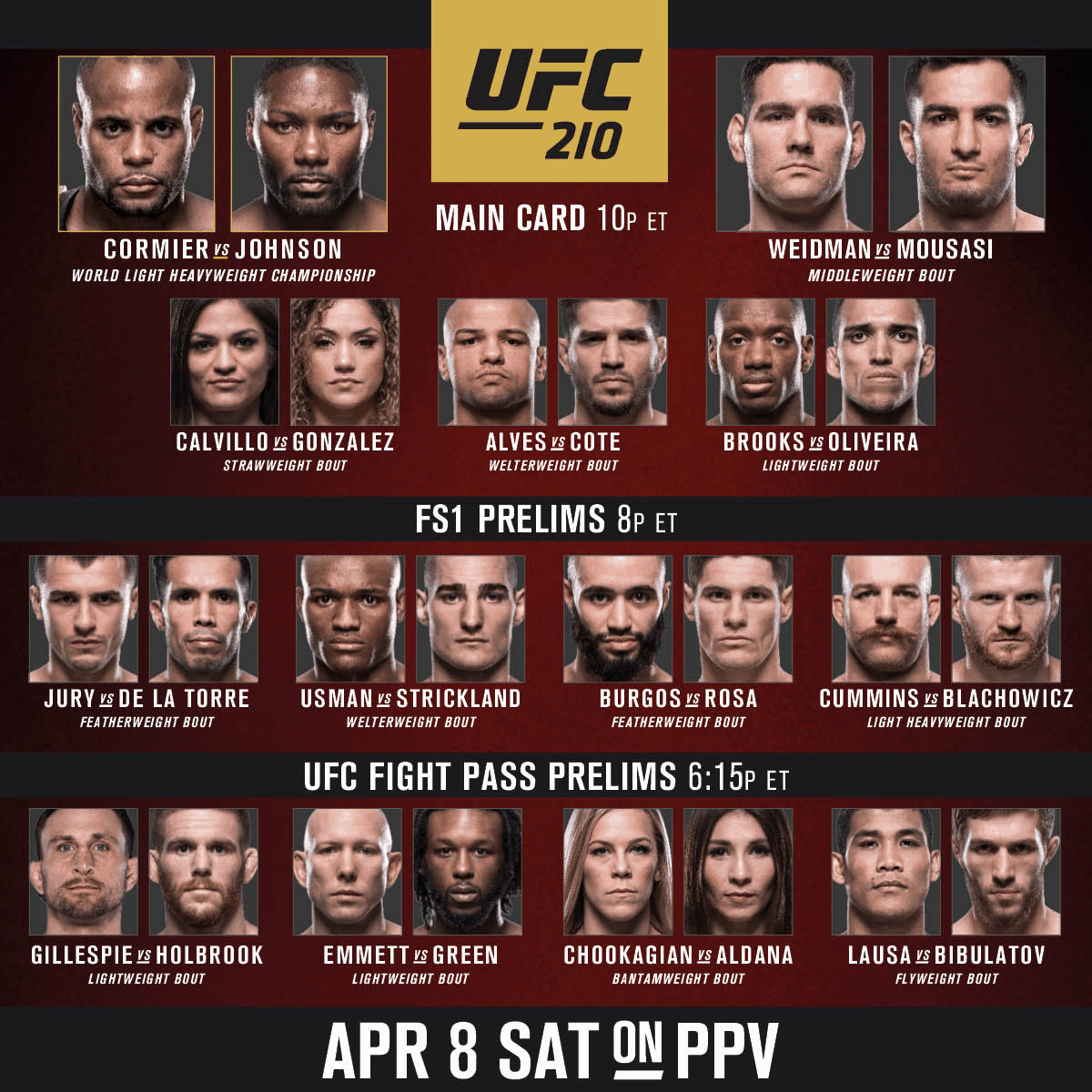

Official Ufc 314 Bout Order Main Card And Preliminary Fights Announced

May 04, 2025

Official Ufc 314 Bout Order Main Card And Preliminary Fights Announced

May 04, 2025 -

Ufc 314 Full Bout Order Revealed For Main Card And Prelims

May 04, 2025

Ufc 314 Full Bout Order Revealed For Main Card And Prelims

May 04, 2025 -

Ufc 314 Fight Card Main Event Prelims And Bout Order Announced

May 04, 2025

Ufc 314 Fight Card Main Event Prelims And Bout Order Announced

May 04, 2025 -

Improving Traffic Flow In Darjeeling Strategies And Challenges

May 04, 2025

Improving Traffic Flow In Darjeeling Strategies And Challenges

May 04, 2025