D-Wave Quantum Inc. (QBTS): Deciphering The 2025 Stock Market Plunge

Table of Contents

Main Points: Analyzing the Factors Contributing to the QBTS Stock Decline

Several intertwined factors could have contributed to a hypothetical decline in D-Wave Quantum Inc. (QBTS) stock in 2025. Let's delve into the key areas:

H2: Macroeconomic Factors and Their Impact on QBTS

Macroeconomic headwinds can significantly impact even the most promising tech companies. A hypothetical QBTS stock plunge in 2025 could be linked to:

H3: Global Economic Slowdown and its effect on tech investments.

- Reduced Investment Appetite: A global economic slowdown would likely lead to reduced risk tolerance among investors. High-growth sectors like quantum computing, often characterized by high valuations and longer-term returns, are the first to suffer during economic uncertainty.

- Decreased Venture Capital Funding: Startups and even established companies like D-Wave rely heavily on venture capital. A global recession would severely limit the availability of this crucial funding, impacting growth and potentially triggering layoffs.

- Correlation with Tech Sector Indicators: A decline in the Nasdaq Composite Index or other technology-focused indices would almost certainly correlate with a drop in D-Wave Quantum Inc. (QBTS) stock price.

H3: Rising Interest Rates and Their Influence on QBTS Valuation.

- Increased Discount Rates: Higher interest rates make future earnings less valuable in present-day terms. This directly impacts the valuation of growth stocks like QBTS, which are often valued based on future potential rather than current profitability.

- Shift in Investor Sentiment: Rising interest rates often make bonds and other fixed-income investments more attractive, diverting capital away from riskier growth stocks. This shift in investor sentiment can drive down the price of QBTS.

- Attractive Alternatives: Investors might seek higher, more certain returns in safer assets like government bonds, leaving less capital available for high-growth, speculative investments such as D-Wave Quantum stock.

H2: Company-Specific Challenges Faced by D-Wave Quantum Inc. (QBTS)

Internal company challenges could also contribute to a stock price decline.

H3: Competition from other Quantum Computing Companies.

- Increased Competition: The quantum computing field is rapidly evolving, with numerous companies developing competing technologies. Increased competition from companies like IBM, Google, and IonQ could erode D-Wave's market share and pressure its valuation.

- Technological Differentiation: D-Wave's adiabatic quantum computing approach faces competition from gate-based models. A failure to demonstrate a clear and sustained technological advantage could negatively impact investor confidence.

- Market Share Erosion: A loss of market share to competitors could translate into lower revenue and reduced profitability, leading to a stock price decline.

H3: Technological Hurdles and Development Delays.

- Missed Milestones: Failure to meet projected technological milestones, such as the development of more powerful quantum computers or the demonstration of significant advancements, would severely impact investor confidence.

- Unforeseen Technical Challenges: Unforeseen technical challenges could lead to project delays and increased development costs, further damaging investor perception.

- Impact on Future Projections: Delays in technological breakthroughs would likely force downward revisions of future revenue and profit projections, leading to a reassessment of QBTS's valuation.

H3: Financial Performance and Profitability Concerns.

- Revenue Shortfalls: Failure to meet revenue targets, particularly in a challenging economic climate, would be a significant negative signal to investors.

- Increased Operational Costs: High research and development costs inherent in the quantum computing field could strain profitability, especially during an economic downturn.

- Unsustainable Business Model: Concerns about the long-term sustainability of D-Wave's business model, including its revenue streams and cost structure, could lead to investor concern and a drop in the stock price.

H2: Investor Sentiment and Market Speculation surrounding QBTS

Investor psychology plays a crucial role in stock market fluctuations.

H3: Impact of Negative News and Media Coverage.

- Negative Press: Negative news coverage, particularly highlighting technological setbacks, financial challenges, or increased competition, can quickly erode investor confidence and trigger selling pressure.

- Social Media Sentiment: Negative social media sentiment, even if unfounded, can influence investor perception and drive down the stock price.

- Market Narratives: Negative narratives about the future prospects of quantum computing or D-Wave's specific position within the market can quickly become self-fulfilling prophecies.

H3: Short Selling and Market Manipulation.

- Short Selling Pressure: A significant increase in short selling, where investors bet against the stock, can exacerbate downward pressure on the price.

- Market Manipulation: While difficult to prove, concerns about market manipulation could lead to further uncertainty and contribute to the stock price decline.

- Regulatory Scrutiny: Regulatory bodies would likely investigate any suspected market manipulation, further impacting investor confidence.

Conclusion: Lessons Learned and Future Outlook for D-Wave Quantum Inc. (QBTS)

The hypothetical 2025 D-Wave Quantum Inc. (QBTS) stock market decline highlights the complex interplay between macroeconomic conditions, company-specific challenges, and investor sentiment. Understanding these factors is crucial for navigating the inherent volatility of the quantum computing market.

Key Takeaways: Investing in high-growth technology stocks like D-Wave Quantum stock requires a thorough understanding of both macroeconomic trends and company-specific risks. Even the most promising companies can be susceptible to market downturns.

Future Outlook: While the future is uncertain, D-Wave Quantum Inc. (QBTS) remains a significant player in the quantum computing field. Continued technological advancements, strategic partnerships, and a demonstrably sustainable business model will be critical to future success. The inherent volatility of the quantum computing market, however, should be carefully considered.

Call to Action: Before investing in D-Wave Quantum Inc. (QBTS) or any other quantum computing stocks, conduct thorough research, understand the risks involved, and diversify your portfolio accordingly. Consider the broader implications of macroeconomic trends and the competitive landscape of the quantum computing market. Don't solely rely on hype; focus on making informed investment decisions based on a comprehensive analysis of D-Wave Quantum stock, QBTS investment opportunities, and the broader quantum computing stocks market.

Featured Posts

-

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025 -

Best Deals On Hugo Boss Perfumes Amazon Spring Sale 2025

May 20, 2025

Best Deals On Hugo Boss Perfumes Amazon Spring Sale 2025

May 20, 2025 -

How Michael Strahan Secured A Key Interview During A Fierce Ratings Battle

May 20, 2025

How Michael Strahan Secured A Key Interview During A Fierce Ratings Battle

May 20, 2025 -

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025 -

Bucharest Tiriac Open Flavio Cobolli Wins Maiden Atp Championship

May 20, 2025

Bucharest Tiriac Open Flavio Cobolli Wins Maiden Atp Championship

May 20, 2025

Latest Posts

-

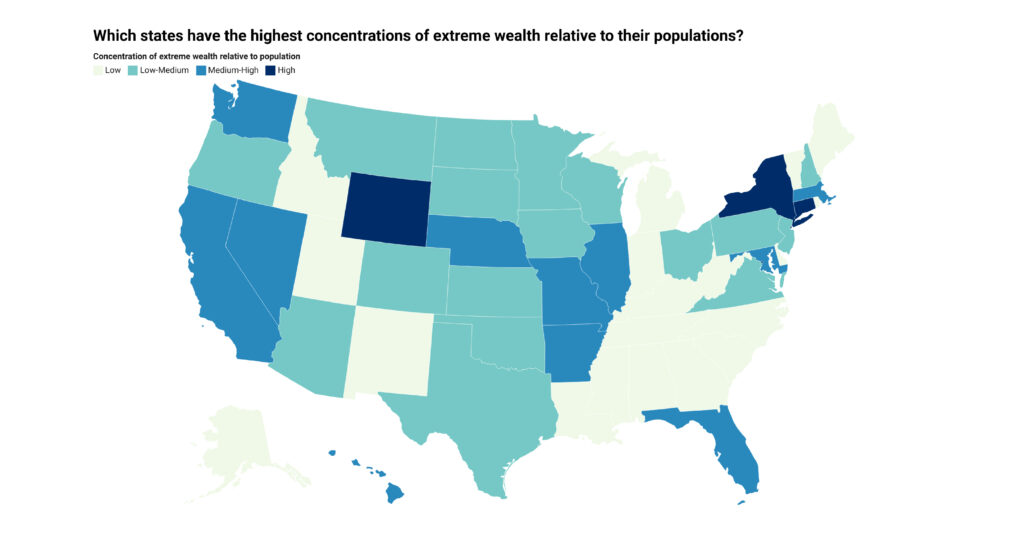

The Future Of Billionaire Boys Legacy Responsibility And Change

May 20, 2025

The Future Of Billionaire Boys Legacy Responsibility And Change

May 20, 2025 -

Raising A Billionaire Boy The Unique Parenting Challenges Of Extreme Wealth

May 20, 2025

Raising A Billionaire Boy The Unique Parenting Challenges Of Extreme Wealth

May 20, 2025 -

The Challenges Faced By Billionaire Boys Pressure Expectations And Privacy

May 20, 2025

The Challenges Faced By Billionaire Boys Pressure Expectations And Privacy

May 20, 2025 -

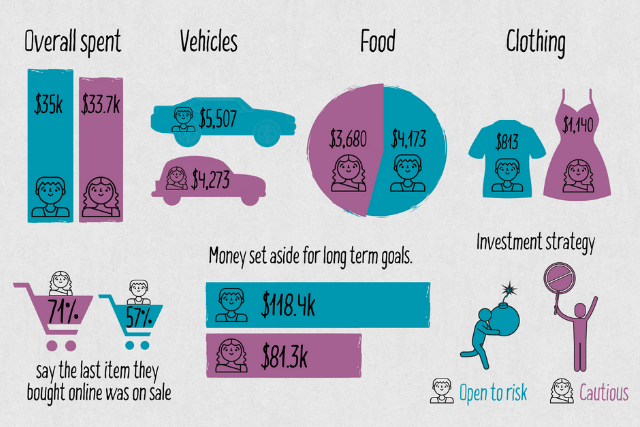

How Billionaire Boys Spend Their Money Investments Philanthropy And Excess

May 20, 2025

How Billionaire Boys Spend Their Money Investments Philanthropy And Excess

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025