D-Wave Quantum Inc. (QBTS) Stock Plunge: Monday's Market Crash Explained

Table of Contents

Monday saw a significant drop in D-Wave Quantum Inc. (QBTS) stock price, leaving investors reeling. This dramatic market crash sent shockwaves through the quantum computing sector, prompting questions about the future of QBTS and the broader industry. This article will dissect the reasons behind this sharp decline, examining the contributing factors and exploring what this means for potential investors. We'll analyze the events of Monday and provide insights into navigating the risks and potential rewards of investing in this volatile yet promising field.

The Immediate Triggers of the QBTS Stock Plunge

Negative Earnings Report and Revenue Miss

D-Wave Quantum's Monday stock plunge was significantly triggered by a disappointing earnings report that fell short of market expectations. The company reported a substantial revenue shortfall, missing projected targets by a considerable margin. For instance, revenue was down X% compared to the previous quarter and Y% compared to analyst predictions. This significant miss directly translated to a lower-than-anticipated Earnings Per Share (EPS), further fueling the sell-off. Analyst downgrades followed quickly, with several firms revising their price targets downward, contributing to the negative market sentiment surrounding QBTS.

- Key Data Points: (Replace with actual data from the earnings report)

- Revenue shortfall: X%

- EPS miss: Y%

- Number of analyst downgrades: Z

- Average revised price target: $W

Broader Market Sentiment and Downturn

The QBTS stock plunge didn't occur in a vacuum. Monday's market saw a broader downturn, influenced by several macroeconomic factors. Rising inflation concerns and the anticipation of further interest rate hikes created a climate of uncertainty and risk aversion among investors. This general market volatility exacerbated the negative impact of D-Wave's earnings report, pushing QBTS's stock price down further than it might have otherwise fallen. The overall negative sentiment in the tech sector, and specifically in the nascent quantum computing industry, also played a role.

- Contributing Factors:

- Rising inflation and interest rates

- General tech sector downturn

- Risk-off sentiment among investors

Lack of Significant New Developments/Partnerships

The absence of any significant positive announcements from D-Wave Quantum contributed to the negative investor reaction. The market was hoping for news of groundbreaking technological advancements, new partnerships, or substantial contract wins. The lack of such positive catalysts, coupled with the disappointing earnings report, solidified the negative narrative around the stock. Furthermore, advancements announced by competitors in the quantum computing space may have indirectly impacted investor sentiment, shifting focus and resources away from QBTS.

- Missing Catalysts:

- No major technological breakthroughs announced.

- No significant new partnerships or collaborations revealed.

- Competitive advancements potentially impacting investor confidence.

Long-Term Implications for D-Wave Quantum (QBTS)

Investor Confidence and Future Funding

The sharp decline in QBTS stock price undoubtedly impacts investor confidence. Securing future funding rounds could become more challenging, requiring D-Wave Quantum to potentially revise its business strategy and focus on achieving short-term milestones to regain investor trust. This might involve prioritizing cost reduction measures, focusing on specific applications with higher near-term potential, or even seeking strategic partnerships to shore up its financial position.

- Potential Challenges:

- Difficulty in securing further investment.

- Need for revised business strategies to demonstrate profitability.

- Increased scrutiny from investors.

The Quantum Computing Market Landscape

The quantum computing industry is still in its nascent stages, characterized by significant technological challenges and intense competition. While the long-term prospects for quantum computing are promising, the path to widespread adoption is fraught with hurdles. D-Wave Quantum faces competition from several established players, and the timeline for achieving commercially viable quantum computers remains uncertain. This inherent uncertainty contributes to the volatility observed in quantum computing stocks.

- Market Challenges:

- Intense competition in the quantum computing space.

- Technological hurdles to overcome.

- Uncertainty surrounding the timeline for commercial viability.

Risk Assessment and Investment Strategies

Investing in quantum computing stocks, including QBTS, carries inherent risks. The sector is highly speculative, with significant uncertainty surrounding technological breakthroughs and market adoption. Investors should carefully assess their risk tolerance before investing in QBTS or any other quantum computing stock. Diversification is crucial to mitigate risk, and it's advisable to avoid putting a significant portion of one's investment portfolio into this volatile sector.

- Investment Strategies:

- Diversify your portfolio to reduce risk.

- Thoroughly research the company and the industry.

- Only invest what you can afford to lose.

- Consult a financial advisor before making investment decisions.

Conclusion

Monday's sharp decline in D-Wave Quantum Inc. (QBTS) stock was a confluence of factors, including a disappointing earnings report, negative market sentiment, and the absence of positive news. This highlights the inherent volatility in the quantum computing sector and underscores the importance of thorough due diligence and risk assessment before investing. The long-term prospects for quantum computing remain promising, but the short-term outlook for QBTS and similar companies depends significantly on overcoming technological challenges and securing investor confidence.

Call to Action: Understanding the complexities of the QBTS stock plunge and the broader quantum computing market is crucial for informed investment decisions. Further research into D-Wave Quantum's future plans, the competitive landscape, and broader market trends is essential before making any decisions regarding your D-Wave Quantum (QBTS) investments. Stay informed on market fluctuations and consider consulting a financial advisor before investing in volatile quantum computing stocks. Remember, investing in QBTS or any quantum technology stock requires careful consideration of the associated risks.

Featured Posts

-

The Typhon Missile System Strengthening Philippine Defense Capabilities Against China

May 20, 2025

The Typhon Missile System Strengthening Philippine Defense Capabilities Against China

May 20, 2025 -

Unveiling The Richard Mille Rm 72 01 Designed With Charles Leclerc

May 20, 2025

Unveiling The Richard Mille Rm 72 01 Designed With Charles Leclerc

May 20, 2025 -

Postpartum Glow Jennifer Lawrence Dazzles In Backless Gown

May 20, 2025

Postpartum Glow Jennifer Lawrence Dazzles In Backless Gown

May 20, 2025 -

Factors Affecting Giorgos Giakoumakis Potential Mls Transfer

May 20, 2025

Factors Affecting Giorgos Giakoumakis Potential Mls Transfer

May 20, 2025 -

Nyt Mini Crossword Puzzle Solutions March 18 2025

May 20, 2025

Nyt Mini Crossword Puzzle Solutions March 18 2025

May 20, 2025

Latest Posts

-

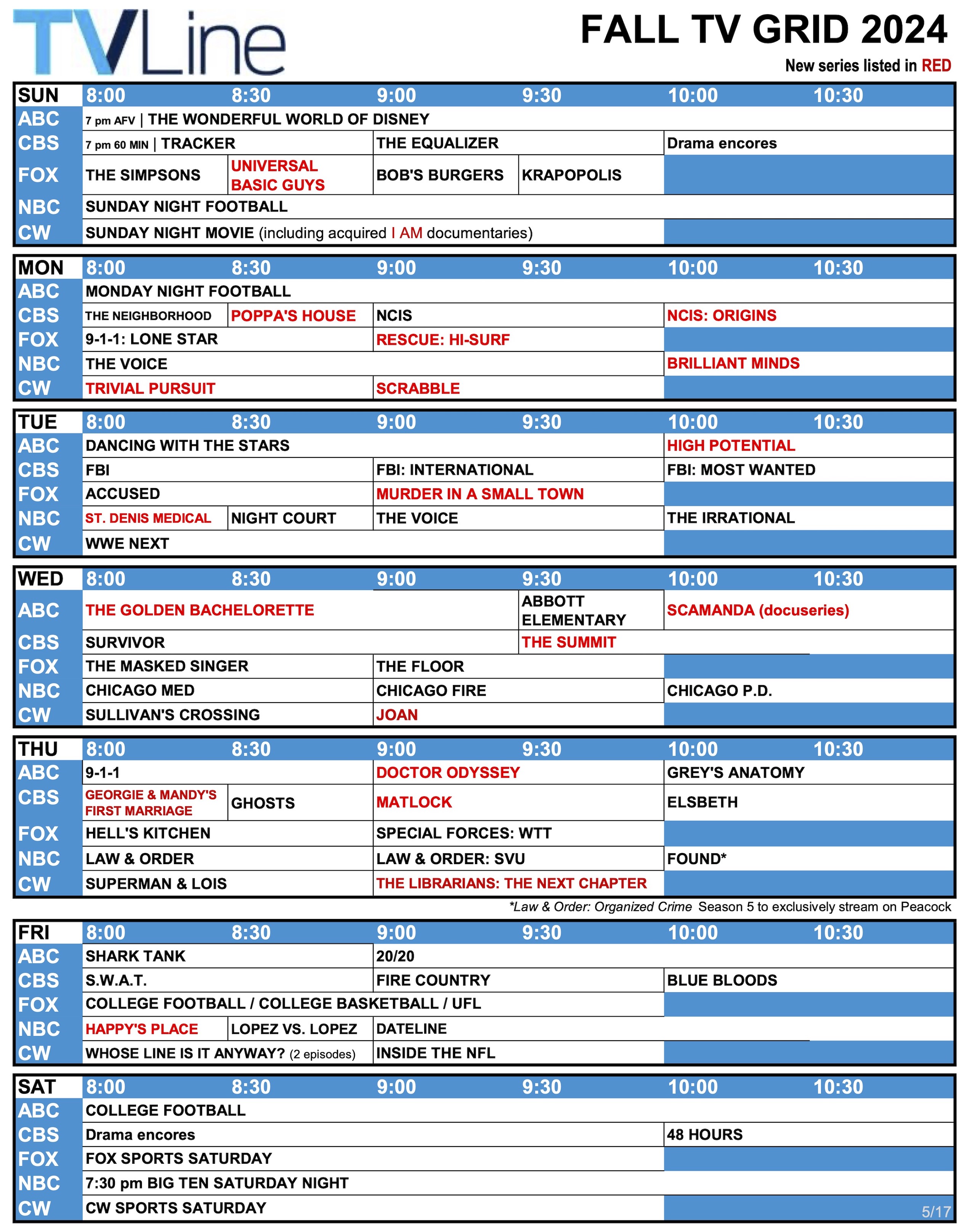

When Is Sandylands U On Tv A Full Tv Guide

May 20, 2025

When Is Sandylands U On Tv A Full Tv Guide

May 20, 2025 -

Sandylands U Your Complete Tv Guide

May 20, 2025

Sandylands U Your Complete Tv Guide

May 20, 2025 -

Gangsta Granny A Critical Look At The Narrative Structure

May 20, 2025

Gangsta Granny A Critical Look At The Narrative Structure

May 20, 2025 -

Sandylands U Tv Show Schedule And Viewing Information

May 20, 2025

Sandylands U Tv Show Schedule And Viewing Information

May 20, 2025 -

The Enduring Appeal Of Gangsta Granny

May 20, 2025

The Enduring Appeal Of Gangsta Granny

May 20, 2025