D-Wave Quantum (QBTS) Stock: Investigating Thursday's Price Decrease

Table of Contents

Analyzing the Market Conditions on Thursday

Several macroeconomic and sector-specific factors could have contributed to Thursday's decline in D-Wave Quantum (QBTS) stock.

Broader Market Trends

The overall market performance on Thursday played a role. A general downturn could have negatively impacted even fundamentally strong companies like D-Wave.

- The S&P 500 closed down [insert percentage]% on Thursday. [Link to relevant financial news source]

- The Nasdaq Composite experienced a similar drop of [insert percentage]%. [Link to relevant financial news source]

- This broad market weakness may have created a selling pressure across various sectors, including quantum computing.

Sector-Specific Factors

It's crucial to examine if other quantum computing stocks experienced similar drops. This would indicate sector-specific headwinds rather than issues solely related to D-Wave.

- [Competitor A] stock performance on Thursday: [insert percentage]% change. [Link to stock quote]

- [Competitor B] stock performance on Thursday: [insert percentage]% change. [Link to stock quote]

- A comparative analysis of competitor performance helps isolate whether the D-Wave Quantum (QBTS) stock price decrease was unique or part of a broader industry trend.

News and Events

Significant news or events surrounding D-Wave or the quantum computing industry could have influenced investor sentiment.

- [Mention any relevant press releases, e.g., a delayed product launch, a missed earnings expectation, or negative regulatory news. Include a link to the source.]

- [Mention any relevant industry news affecting investor confidence in the quantum computing sector. Include a link to the source.]

- Negative news, even unrelated directly to D-Wave, can sometimes trigger broader sell-offs in related sectors.

D-Wave Quantum's Recent Performance and Financials

Understanding D-Wave's recent financial performance and strategic moves is essential in analyzing Thursday's price decrease.

Recent Earnings Reports

Analyzing D-Wave's recent earnings reports reveals key insights into the company's financial health. Did the company meet or exceed expectations?

- [Summarize key financial figures from the last earnings report, such as revenue, profit margins, and guidance. Include a link to the earnings report.]

- [Highlight any significant discrepancies between expectations and actual results. This could explain investor reaction.]

- Any deviation from anticipated performance can influence stock prices.

Contract Wins and Partnerships

New contracts and partnerships can positively impact investor sentiment. A lack of such announcements might contribute to a negative outlook.

- [List any significant contract wins or partnerships recently announced by D-Wave. Include links to relevant sources.]

- [Discuss the potential financial impact of these contracts/partnerships on future earnings.]

- The absence of positive news in this area could contribute to uncertainty and selling pressure.

Technological Advancements

Technological progress is crucial for quantum computing companies. Positive or negative updates influence investor confidence.

- [Highlight any recent breakthroughs or setbacks in D-Wave's technological development. Include links to research papers or press releases.]

- [Discuss the market impact of these advancements or setbacks.]

- Significant progress can boost investor confidence, while setbacks may lead to selling.

Investor Sentiment and Trading Volume

Investor sentiment and trading volume offer insights into market dynamics surrounding the D-Wave Quantum (QBTS) stock price decrease.

Social Media Sentiment

Analyzing social media conversations reveals public perception of D-Wave Quantum.

- [Mention relevant social media platforms and summarize the overall sentiment expressed towards QBTS on Thursday. Did sentiment turn negative before the price drop?]

- Negative sentiment on platforms like Twitter or StockTwits can contribute to selling pressure.

- Tracking social media sentiment provides valuable context to price movements.

Trading Volume

Comparing Thursday's trading volume with previous days reveals investor activity.

- [Present data on Thursday's trading volume compared to the average volume over the preceding week or month.]

- [High volume might suggest a significant shift in investor sentiment, while low volume might indicate limited trading activity and possibly less impact.]

- Understanding volume helps determine the significance of the price change.

Analyst Ratings and Predictions

Analyst opinions influence investor decisions. Changes in ratings after Thursday's decline should be considered.

- [Summarize changes in analyst ratings and predictions following Thursday's price decrease. Include links to relevant analyst reports if available.]

- Downgrades or negative outlooks can exacerbate selling pressure.

- Analyst recommendations provide another layer of context to the price fluctuation.

Conclusion: Understanding the Fluctuations in D-Wave Quantum (QBTS) Stock

Thursday's price decrease in D-Wave Quantum (QBTS) stock likely resulted from a combination of broader market trends, sector-specific factors, D-Wave's recent performance, and investor sentiment. While a general market downturn may have contributed, analyzing D-Wave's financial reports, recent partnerships, and technological advancements, along with investor sentiment and trading volume, provides a more nuanced understanding. The complexity of stock market fluctuations highlights the importance of long-term perspective and thorough due diligence.

Key Takeaways: Understanding the interplay of macroeconomic conditions, company-specific performance, and investor sentiment is crucial when assessing stock price movements. The D-Wave Quantum (QBTS) stock price decrease serves as a reminder of the inherent volatility in the quantum computing sector.

Call to Action: Continue monitoring D-Wave Quantum (QBTS) stock and stay informed about developments in the quantum computing sector. Conduct thorough research and adopt responsible investment strategies before making any decisions concerning D-Wave Quantum (QBTS) stock or other quantum computing investments. Remember, informed investing is key to navigating the dynamic world of D-Wave Quantum (QBTS) stock and similar high-growth, high-risk assets.

Featured Posts

-

Social Media Buzz Everyones Saying The Same Thing About Peppa Pigs New Baby

May 21, 2025

Social Media Buzz Everyones Saying The Same Thing About Peppa Pigs New Baby

May 21, 2025 -

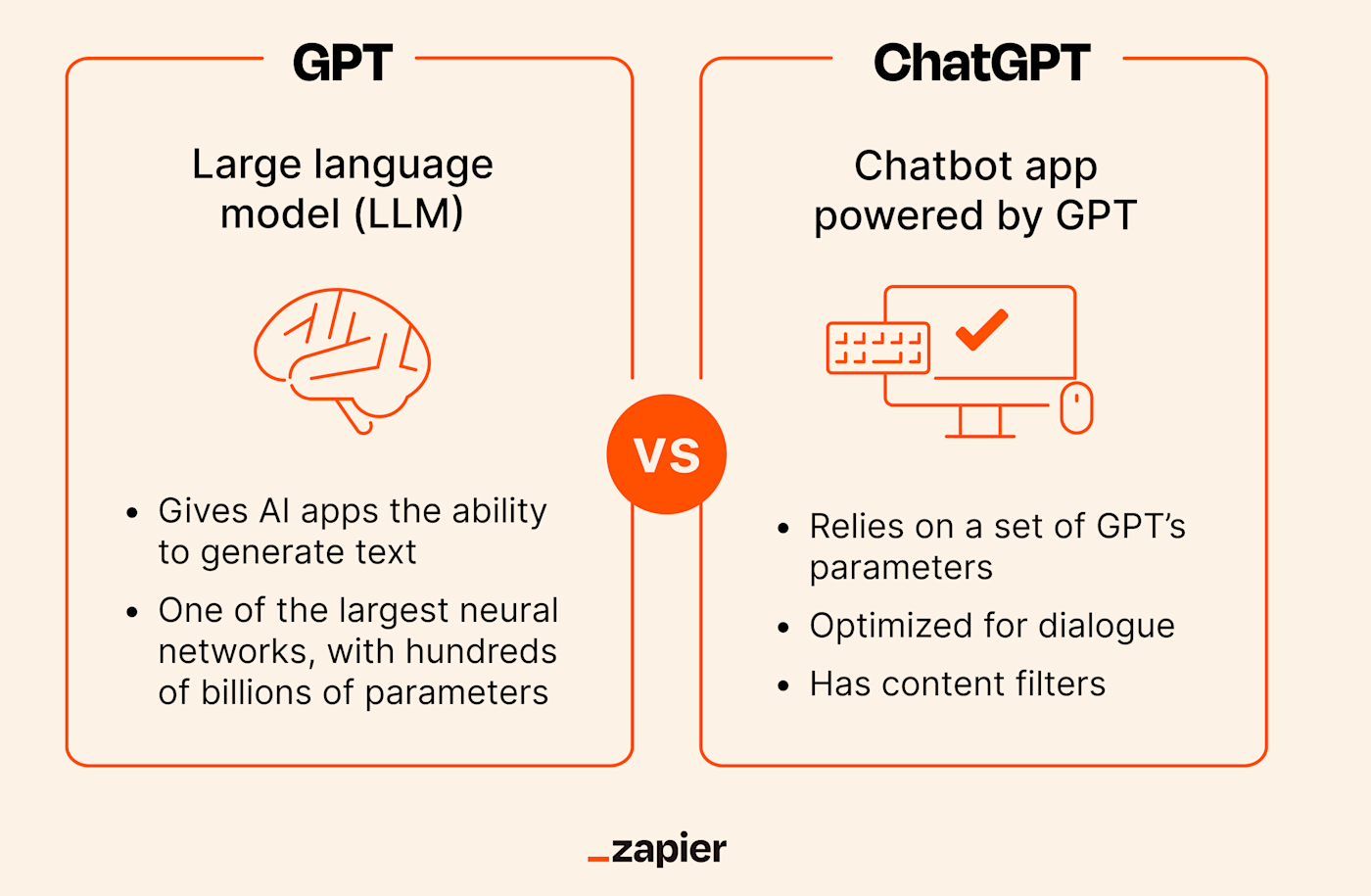

Revolutionizing Coding Chat Gpts New Ai Agent

May 21, 2025

Revolutionizing Coding Chat Gpts New Ai Agent

May 21, 2025 -

Representatives Pledge To Recoup 1 231 Billion From 28 Oil Companies

May 21, 2025

Representatives Pledge To Recoup 1 231 Billion From 28 Oil Companies

May 21, 2025 -

Man Breaks Australian Foot Race Speed Record

May 21, 2025

Man Breaks Australian Foot Race Speed Record

May 21, 2025 -

Paulina Gretzky Topless Selfie And Other Revealing Photos

May 21, 2025

Paulina Gretzky Topless Selfie And Other Revealing Photos

May 21, 2025

Latest Posts

-

Mntkhb Amryka Bwtshytynw Ydm Thlatht Njwm Lawl Mrt Fy Qaymth

May 22, 2025

Mntkhb Amryka Bwtshytynw Ydm Thlatht Njwm Lawl Mrt Fy Qaymth

May 22, 2025 -

Astdeaeat Jdydt Lmntkhb Amryka Bwtshytynw Yetmd Ela Thlatht Laebyn Lawl Mrt

May 22, 2025

Astdeaeat Jdydt Lmntkhb Amryka Bwtshytynw Yetmd Ela Thlatht Laebyn Lawl Mrt

May 22, 2025 -

Mfajat Bwtshytynw Thlatht Laebyn Jdd Fy Qaymt Mntkhb Amryka

May 22, 2025

Mfajat Bwtshytynw Thlatht Laebyn Jdd Fy Qaymt Mntkhb Amryka

May 22, 2025 -

Thlathy Jdyd Yndm Lmntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Thlathy Jdyd Yndm Lmntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025