D-Wave Quantum (QBTS) Stock Market Performance: A Deep Dive Into Recent Gains

Table of Contents

Analyzing D-Wave Quantum's Recent Financial Performance

Analyzing the financial health of D-Wave Quantum is crucial to understanding its stock market performance. Examining key financial indicators paints a clearer picture of the company's growth trajectory.

Revenue Growth and Key Financial Indicators

D-Wave Quantum's recent quarterly and annual reports reveal important trends in its financial performance. While specific numbers will vary depending on the reporting period, investors should focus on key metrics to gauge the company's health:

- Revenue Growth: A consistent increase in revenue demonstrates increasing market adoption of D-Wave's quantum computing solutions. This growth should be analyzed in conjunction with the overall growth of the quantum computing market.

- Operating Expenses: Monitoring operating expenses helps assess the company's efficiency and profitability. A decrease in operating expenses relative to revenue growth is a positive sign.

- Net Income (or Loss): This metric reflects the overall profitability of D-Wave Quantum. While losses are common in the early stages of a high-growth technology company, investors should look for signs of narrowing losses or increasing profitability.

To properly assess QBTS's performance, it's essential to compare its financial data to competitors in the quantum computing sector. This comparative analysis will highlight D-Wave's strengths and weaknesses relative to the market. Visualizing this data through charts and graphs allows for a clearer understanding of QBTS financials and its trajectory within the quantum computing market share. Keywords: QBTS financials, revenue, profit, operating expenses, quantum computing market share, financial analysis, D-Wave Quantum performance.

Impact of New Contracts and Partnerships

Strategic partnerships and new contracts are major drivers of revenue growth for D-Wave Quantum. These collaborations often open doors to new markets and applications for the company's quantum computing technology.

- Significant Partnerships: D-Wave's partnerships with leading companies in various sectors (e.g., aerospace, finance, healthcare) demonstrate the versatility and applicability of its technology. Each partnership contributes to the company's revenue streams and enhances its market position.

- Impact on Revenue: The financial impact of these contracts should be carefully analyzed. Long-term contracts provide revenue predictability, while shorter-term projects contribute to near-term growth.

- Client Industries: The diversity of clients across different industries shows the broad appeal of D-Wave's quantum computing solutions. This diversification reduces the company's reliance on any single sector. Keywords: D-Wave Quantum partnerships, contracts, collaborations, clients, revenue growth drivers.

Market Trends Influencing QBTS Stock Price

The performance of QBTS stock is heavily influenced by broader market trends in the quantum computing industry and investor sentiment toward this emerging technology.

The Growing Interest in Quantum Computing

The global interest in quantum computing is rapidly expanding, fueling investment and driving market growth. Several factors are contributing to this growth:

- Increased Investment: Government funding and private investment in quantum computing research and development are fueling innovation and accelerating the adoption of quantum technologies.

- Market Projections: Market research reports project substantial growth for the quantum computing market in the coming years. These projections create optimism among investors and influence stock valuations.

- Technological Advancements: Ongoing advancements in quantum computing technology are leading to more powerful and accessible solutions. This progress reinforces investor confidence and further drives market growth. Keywords: quantum computing market, market growth, investment, government funding, future of quantum computing.

Competition and Market Positioning of D-Wave Quantum

The quantum computing industry is highly competitive, with several companies vying for market share. Understanding D-Wave Quantum's competitive positioning is vital to assessing its investment potential.

- Competitive Landscape: Analyzing D-Wave Quantum's competitive advantages is crucial. Understanding its unique technological offerings, such as its annealing-based approach, helps in differentiating its position in the market.

- Market Share: While quantifying market share in this emerging market can be challenging, monitoring D-Wave's relative position among its peers provides valuable insight.

- Technological Advantages: D-Wave Quantum’s focus on specific applications and its early-mover advantage are key aspects to consider in its competitive analysis. Keywords: quantum computing competitors, market share, competitive advantage, D-Wave technology, market positioning.

Future Outlook and Investment Considerations for QBTS

Looking forward, the potential for growth and the associated risks for D-Wave Quantum must be carefully considered by prospective investors.

Potential Growth Drivers and Challenges

Several factors could drive future growth for D-Wave Quantum, but potential challenges also exist:

- Growth Drivers: Continued innovation, strategic partnerships, expansion into new markets, and increasing demand for quantum computing solutions will fuel growth.

- Challenges and Risks: Competition, technological hurdles, regulatory changes, and the need for continued investment are key challenges. The inherent risks associated with investing in a relatively young company in a nascent industry must be recognized. Keywords: QBTS future growth, investment risks, technological advancements, regulatory environment.

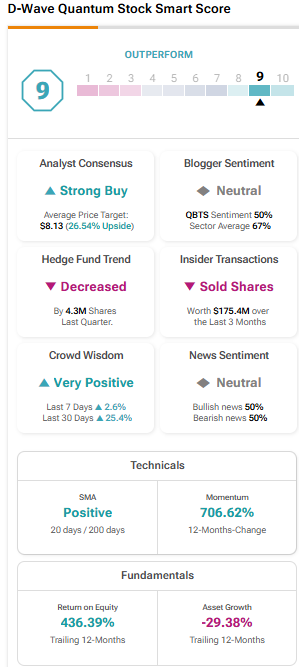

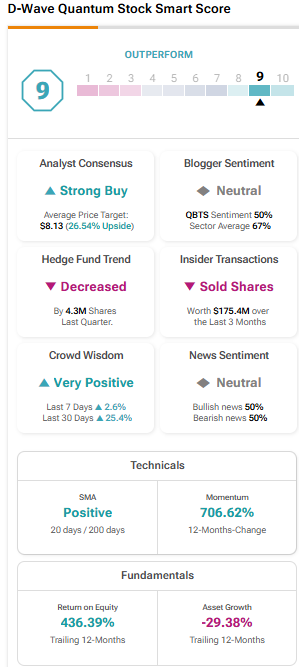

Expert Opinions and Analyst Ratings

To further inform investment decisions, reviewing expert opinions and analyst ratings on QBTS is essential:

- Analyst Ratings: Financial analysts provide buy, sell, or hold recommendations based on their analysis of the company's performance, market prospects, and risk profile.

- Expert Opinions: Insights from industry experts and thought leaders provide valuable context and perspective on the company's future trajectory within the broader quantum computing field.

- Stock Forecast: Analyzing various stock forecasts offers a glimpse into the potential future valuation of QBTS, though investors should exercise caution and use this information as a supplementary metric. Keywords: analyst ratings, expert opinions, QBTS stock forecast, investment recommendations.

Conclusion

This deep dive into D-Wave Quantum (QBTS) reveals a complex interplay of factors contributing to its recent stock market performance. Strong financial indicators, strategic partnerships, and the broader growth of the quantum computing market all play significant roles. However, investors should carefully consider potential risks alongside the opportunities. Understanding the current trajectory of D-Wave Quantum (QBTS) requires continuous monitoring of financial reports and market trends. Stay informed on the latest developments in the quantum computing sector to make informed decisions about your investment in D-Wave Quantum and other related quantum computing stocks.

Featured Posts

-

Secure Your Spot Vybz Kartels Historic New York Show

May 21, 2025

Secure Your Spot Vybz Kartels Historic New York Show

May 21, 2025 -

Scott Saville A Cyclists Dedication Ragbrai And Beyond

May 21, 2025

Scott Saville A Cyclists Dedication Ragbrai And Beyond

May 21, 2025 -

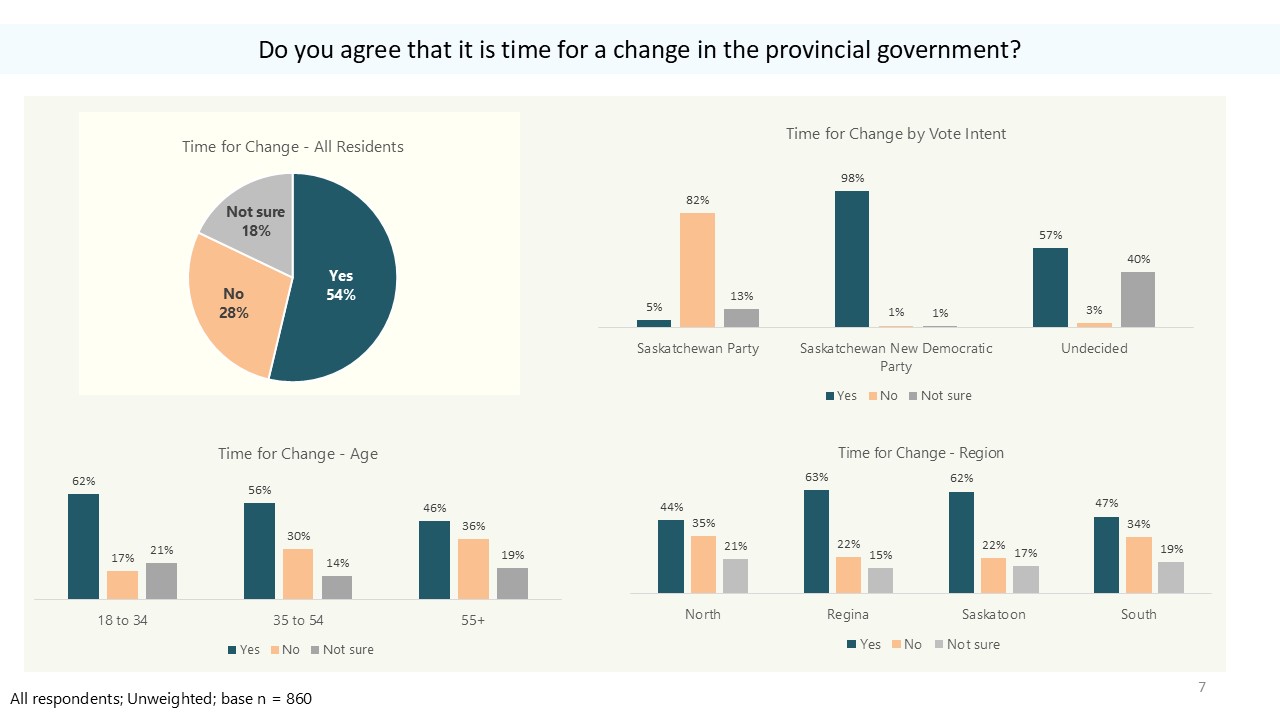

Saskatchewan Political Panel Discussion Federal Election Implications

May 21, 2025

Saskatchewan Political Panel Discussion Federal Election Implications

May 21, 2025 -

Vybz Kartel Speaks Prison Life Freedom Family And New Music

May 21, 2025

Vybz Kartel Speaks Prison Life Freedom Family And New Music

May 21, 2025 -

Jail Sentence For Tory Politicians Wife Stands After Migrant Remarks In Southport

May 21, 2025

Jail Sentence For Tory Politicians Wife Stands After Migrant Remarks In Southport

May 21, 2025

Latest Posts

-

Tweet Leads To Imprisonment Southport Stabbing Case And Mothers Home Confinement

May 22, 2025

Tweet Leads To Imprisonment Southport Stabbing Case And Mothers Home Confinement

May 22, 2025 -

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025 -

Connolly Loses Appeal Former Tory Councillors Wife Sentenced For Racial Hatred Post

May 22, 2025

Connolly Loses Appeal Former Tory Councillors Wife Sentenced For Racial Hatred Post

May 22, 2025 -

Tory Politicians Wife Remains Jailed After Migrant Rant In Southport

May 22, 2025

Tory Politicians Wife Remains Jailed After Migrant Rant In Southport

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025