D-Wave Quantum (QBTS) Stock Plunge: Reasons Behind Monday's Decline

Table of Contents

Main Points: Deconstructing the QBTS Stock Drop

QBTS Earnings Miss Expectations: Impact on Stock Price

The most immediate catalyst for the QBTS stock plunge was D-Wave Quantum's disappointing earnings report. Key metrics fell significantly short of analyst predictions, triggering a sell-off by investors. The report revealed:

- Revenue Shortfall: Revenue for the [Quarter] reached $[Revenue Figure], considerably lower than the $[Previous Quarter Revenue] reported in the previous quarter and far below analyst estimates of $[Analyst Estimate]. This significant shortfall indicated slower-than-anticipated adoption of D-Wave's quantum computing solutions.

- Increased Operating Expenses: Operating expenses increased to $[Operating Expenses], further impacting profitability and squeezing margins. This rise, despite the lower revenue, raised concerns about the company's cost management strategies.

- Lower-than-Expected Customer Adoption: The earnings report highlighted lower-than-projected customer adoption of D-Wave's quantum computing technology, signifying challenges in penetrating the market and converting leads into paying customers. This underwhelming customer adoption rate contributed significantly to the negative market reaction.

Intensifying Competition in the Quantum Computing Market: A Threat to QBTS?

The quantum computing sector is experiencing a surge in competition. The emergence of new players and advancements from established companies like IBM, Google, and IonQ are creating a more crowded landscape. This increased competition puts pressure on D-Wave's market share and future growth potential.

- Emergence of New Players: Several startups and established tech giants are aggressively investing in diverse quantum computing technologies, posing a substantial threat to D-Wave's market dominance.

- Increased Investment in Competing Technologies: The significant increase in investment in competing technologies, such as superconducting qubits and trapped ions, indicates a growing shift in market focus, diverting attention and resources from D-Wave's annealing-based approach.

- Market Saturation Concerns: As more players enter the market, the concern of market saturation is growing, impacting investor confidence in the long-term prospects of QBTS and its ability to maintain a competitive edge.

Macroeconomic Factors and the Tech Sector Slowdown: QBTS's Vulnerability

The broader macroeconomic environment also played a role in the QBTS stock plunge. A general downturn in the technology sector, fueled by rising interest rates and economic uncertainty, impacted investor sentiment negatively. High-growth stocks, particularly those in the nascent quantum computing field, are especially vulnerable during such periods.

- Impact of Rising Interest Rates: Rising interest rates increase the cost of borrowing and decrease the attractiveness of high-growth, yet currently unprofitable, companies like D-Wave.

- Investor Concerns about Economic Recession: Fears of an impending recession have led investors to shift their focus towards more stable, less speculative investments, impacting the valuation of technology stocks.

- General Market Volatility: The overall market volatility has created a climate of uncertainty, leading to a sell-off in many technology stocks, including D-Wave Quantum.

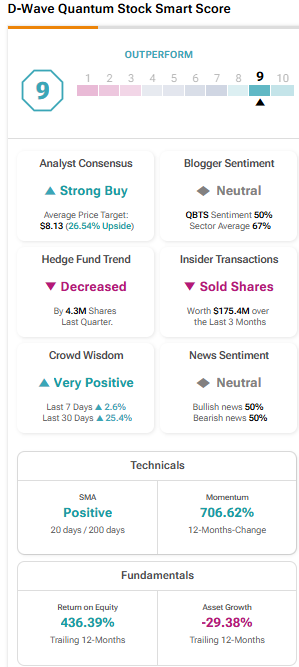

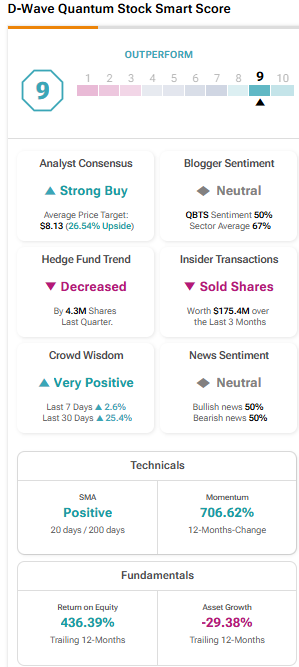

Analyst Reactions to the QBTS Plunge: Price Target Adjustments

Following the disappointing earnings report, several analysts downgraded D-Wave Quantum's stock and revised their price targets downwards. This negative analyst sentiment further fueled the sell-off.

- Analyst Downgrades: [Analyst Name] and [Analyst Name] both downgraded QBTS, citing concerns about [Reason 1] and [Reason 2] respectively.

- Revised Price Targets: The new price targets, averaging $[Average Price Target], reflect a significant decrease in the predicted value of D-Wave Quantum stock.

- Impact of Negative Sentiment: The negative analyst outlook contributed significantly to the negative investor sentiment and reinforced selling pressure on the stock.

Conclusion: Navigating the D-Wave Quantum (QBTS) Stock Future

The D-Wave Quantum (QBTS) stock plunge was a result of several interconnected factors: disappointing earnings, intensifying competition, a broader tech sector downturn, and negative analyst reactions. While the challenges are real, D-Wave Quantum's pioneering role in the quantum computing industry presents long-term opportunities. Monitoring the company's performance, along with broader market conditions and industry trends, will be crucial for investors. To stay informed about future developments in the "D-Wave Quantum (QBTS) stock" and the quantum computing sector, follow reputable financial news sources and continue your own research. Understanding the evolving dynamics of the QBTS stock and the broader quantum computing market is essential for navigating the future of this exciting technology.

Featured Posts

-

Play Station 5 Hercule Poirot A Prezzo Scontato Meno Di 10 E Su Amazon

May 20, 2025

Play Station 5 Hercule Poirot A Prezzo Scontato Meno Di 10 E Su Amazon

May 20, 2025 -

Cunha To Man Utd Transfer News Potential Deal And Backup Option

May 20, 2025

Cunha To Man Utd Transfer News Potential Deal And Backup Option

May 20, 2025 -

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025 -

D Wave Quantum Qbts Stock Mondays Drop And Its Implications

May 20, 2025

D Wave Quantum Qbts Stock Mondays Drop And Its Implications

May 20, 2025 -

Lecons A Tirer De L Affaire De Maltraitance A La Fieldview Care Home Maurice

May 20, 2025

Lecons A Tirer De L Affaire De Maltraitance A La Fieldview Care Home Maurice

May 20, 2025

Latest Posts

-

Determined Germany Faces Italy In Crucial World Cup Quarterfinal

May 20, 2025

Determined Germany Faces Italy In Crucial World Cup Quarterfinal

May 20, 2025 -

How To Watch Live Bundesliga Matches A Step By Step Guide

May 20, 2025

How To Watch Live Bundesliga Matches A Step By Step Guide

May 20, 2025 -

Germany Italy Quarterfinal A Crucial Match Preview

May 20, 2025

Germany Italy Quarterfinal A Crucial Match Preview

May 20, 2025 -

Experience Live Bundesliga Schedules Teams And Top Players

May 20, 2025

Experience Live Bundesliga Schedules Teams And Top Players

May 20, 2025 -

Germany Vs Italy Quarterfinal Showdown

May 20, 2025

Germany Vs Italy Quarterfinal Showdown

May 20, 2025