D-Wave Quantum (QBTS) Stock Plunges: Kerrisdale Capital's Valuation Concerns

Table of Contents

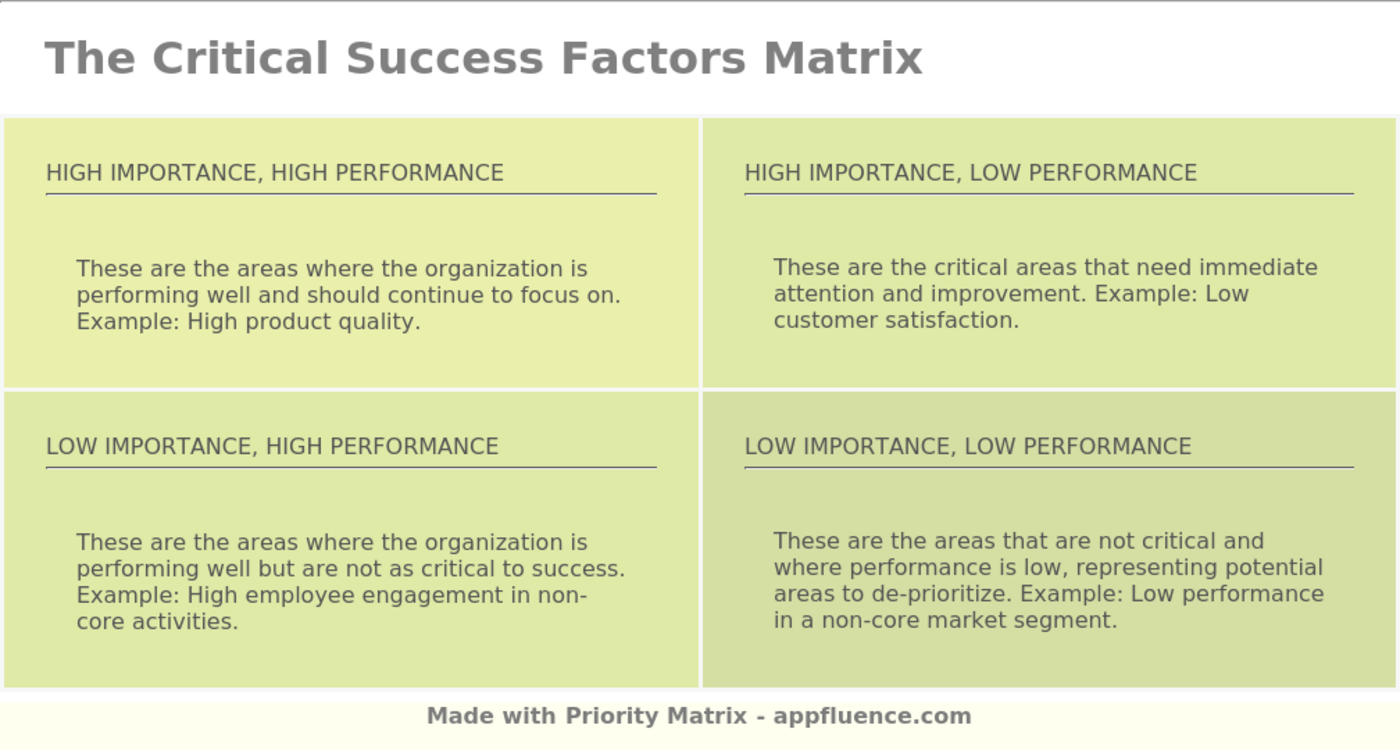

Kerrisdale Capital's Key Arguments Against D-Wave's Valuation

Kerrisdale Capital's report delivered a powerful critique of D-Wave's valuation, arguing that the company's current market capitalization significantly overestimates its technology's true worth and market potential. Their core arguments can be summarized as follows:

-

Overvaluation of Technology and Market Potential: Kerrisdale argued that D-Wave's quantum annealing approach, while innovative, faces significant limitations compared to other quantum computing technologies like gate-based quantum computing. They questioned the market size for D-Wave's specific technology and its ability to capture significant market share.

-

Concerns about Revenue Model and Profitability: The report expressed doubts about D-Wave's ability to generate substantial revenue and achieve profitability in the foreseeable future. Specific criticisms included concerns about the limited number of customers and the high cost of their quantum computers.

-

Doubt on the Long-Term Viability of Quantum Annealing: Kerrisdale questioned the long-term viability of D-Wave's focus on quantum annealing, suggesting that other approaches may prove more commercially successful in the long run. This casts doubt on the sustainability of their business model.

-

Comparative Valuation Analysis: The report included a comparative analysis of D-Wave with other companies in the technology sector, arguing that D-Wave's valuation is significantly higher than warranted based on its current financial performance and future prospects. Specific financial metrics and revenue forecasts were used to support this claim.

-

Limited Market Adoption: The report highlighted the limited adoption of D-Wave's technology in the real-world applications, raising doubts about the company's ability to achieve significant market penetration.

Market Reaction to Kerrisdale Capital's Report

The release of Kerrisdale Capital's report immediately impacted QBTS stock price, causing a significant and swift decline. Trading volume surged following the report's publication as investors reacted to the negative news. Investor sentiment turned overwhelmingly negative, reflecting widespread concerns about D-Wave's valuation and future prospects. Several news outlets reported on the stock's plunge and the impact of Kerrisdale's report, further influencing market sentiment. Some analysts subsequently lowered their price targets for QBTS, reflecting the increased uncertainty surrounding the company's future.

D-Wave Quantum's Response to the Criticism

D-Wave Quantum has responded to Kerrisdale Capital's report, though the effectiveness of this response in addressing investor concerns remains debatable. [Insert details of D-Wave's response here, citing official statements or press releases]. The company’s response [insert analysis of the effectiveness of the response – did it effectively address the concerns raised? Did they offer new information or counterarguments?]. The market's reaction to D-Wave's response will be a key indicator of whether investors are convinced by their arguments.

Analyzing the Future of D-Wave Quantum (QBTS)

The controversy surrounding Kerrisdale Capital's report has significant long-term implications for D-Wave Quantum. The future of the company hinges on several factors: its ability to secure further funding, its success in developing new applications for its quantum annealing technology, and the broader trajectory of the quantum computing industry. Technological advancements in competing quantum computing technologies could further challenge D-Wave’s market position. Several scenarios are possible: a strong recovery driven by technological breakthroughs, sustained stagnation, or a more significant decline. The future of D-Wave and quantum annealing's place within the broader quantum computing landscape remains uncertain. Keywords: quantum annealing, quantum computing stocks, future of quantum computing.

Conclusion: Investing in D-Wave Quantum (QBTS) – Assessing the Risks and Rewards

The D-Wave Quantum (QBTS) stock plunge, catalyzed by Kerrisdale Capital's critical report, highlights the significant risks involved in investing in early-stage quantum computing companies. Kerrisdale presented a compelling case regarding valuation concerns, emphasizing doubts about the company's revenue model, the long-term viability of quantum annealing, and market adoption. D-Wave, in its response, attempted to counter these arguments [summarize key points of D-Wave's counter-arguments]. Investing in QBTS presents both significant risks and potential rewards. The quantum computing industry is still nascent, and the long-term success of any specific technology is far from guaranteed. Before investing in D-Wave Quantum (QBTS) or any other quantum computing stock, conduct thorough due diligence, carefully weigh the risks and potential rewards, and consult with a financial advisor. Consider your own risk tolerance and investment goals when assessing D-Wave investment opportunities and thoroughly analyze QBTS stock and the broader quantum computing stock market.

Featured Posts

-

Ai And The Trump Bill Victory Yes But Cautious Optimism Needed

May 21, 2025

Ai And The Trump Bill Victory Yes But Cautious Optimism Needed

May 21, 2025 -

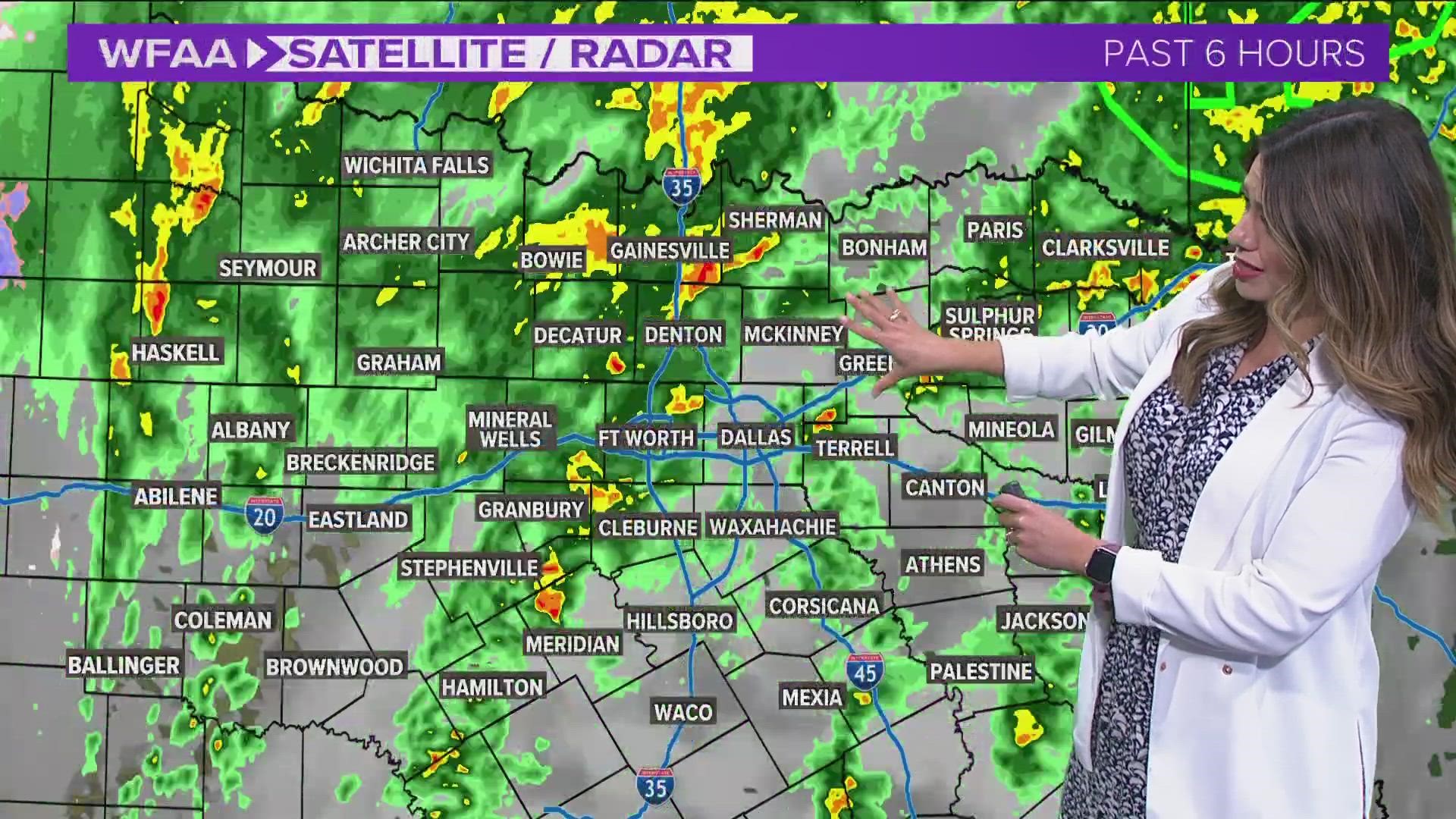

Current Rain Forecast Precise Timing And Location Updates

May 21, 2025

Current Rain Forecast Precise Timing And Location Updates

May 21, 2025 -

The Traverso Family Legacy Cannes Film Festival Photography

May 21, 2025

The Traverso Family Legacy Cannes Film Festival Photography

May 21, 2025 -

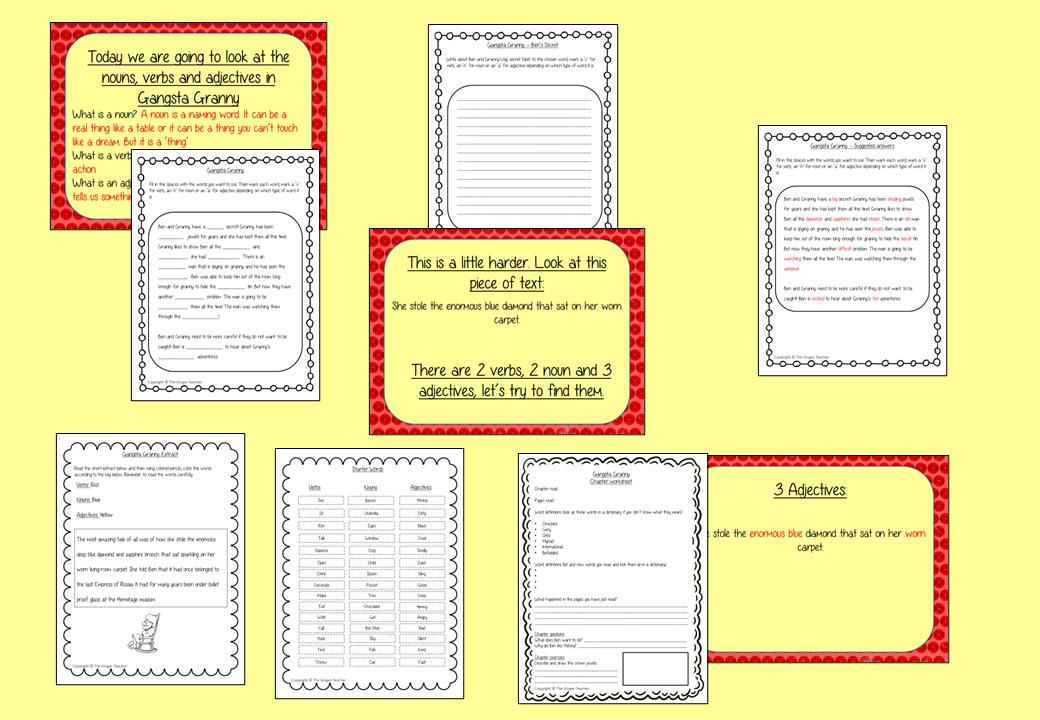

Is Gangsta Granny Appropriate For Young Readers A Parents Guide

May 21, 2025

Is Gangsta Granny Appropriate For Young Readers A Parents Guide

May 21, 2025 -

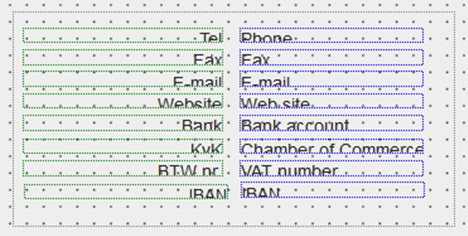

Van Bankrekening Naar Tikkie Essentiele Nederlandse Bankzaken

May 21, 2025

Van Bankrekening Naar Tikkie Essentiele Nederlandse Bankzaken

May 21, 2025

Latest Posts

-

Kartels Trinidad Show Defence Minister Proposes Age And Song Restrictions

May 22, 2025

Kartels Trinidad Show Defence Minister Proposes Age And Song Restrictions

May 22, 2025 -

Exploring The Success Of The Goldbergs A Critical Analysis

May 22, 2025

Exploring The Success Of The Goldbergs A Critical Analysis

May 22, 2025 -

The Goldbergs Lasting Impact And Cultural Relevance

May 22, 2025

The Goldbergs Lasting Impact And Cultural Relevance

May 22, 2025 -

The Goldbergs A Retrospective On The Popular Sitcom

May 22, 2025

The Goldbergs A Retrospective On The Popular Sitcom

May 22, 2025 -

Skin Bleaching And Self Image Insights From Vybz Kartels Experience

May 22, 2025

Skin Bleaching And Self Image Insights From Vybz Kartels Experience

May 22, 2025