D-Wave Quantum (QBTS): Understanding Its Significant Stock Decline In 2025

Table of Contents

Macroeconomic Factors Impacting QBTS Stock

Several macroeconomic factors contributed to the decline in D-Wave Quantum (QBTS) stock during 2025. The quantum computing industry, while promising, is highly susceptible to broader economic trends.

The broader tech market downturn

The overall performance of the technology sector significantly impacted QBTS. 2025 saw a general contraction in the tech market, driven by factors such as:

- Correlation between QBTS and NASDAQ performance: The NASDAQ Composite, a key benchmark for technology stocks, experienced a considerable drop in 2025, mirroring a similar trend in QBTS stock price. This strong negative correlation highlights the vulnerability of growth stocks, like D-Wave, to broader market sentiment.

- Impact of general investor risk aversion: Increased interest rates and recessionary fears led investors to adopt a more risk-averse approach. Investment in speculative growth stocks like D-Wave Quantum, with its long-term focus, suffered as a result.

- Analysis of investor sentiment towards growth stocks in 2025: A shift in investor preference towards more established, stable companies resulted in capital flowing away from high-growth, but potentially volatile, sectors like quantum computing.

Increased competition in the quantum computing space

The quantum computing landscape is rapidly evolving, with numerous players vying for market share. This increased competition put pressure on D-Wave's valuation and investor confidence.

- Mention specific competitors and their advancements: Companies like IBM, Google, and Rigetti Computing made significant strides in their respective quantum computing technologies in 2025, introducing new hardware and software solutions that posed a threat to D-Wave's market position.

- Analysis of market share trends: The competitive landscape led to a shrinking market share for D-Wave, impacting investor perception of its long-term prospects.

- Impact of competitive pricing strategies: Aggressive pricing strategies by competitors further eroded D-Wave's profitability and market attractiveness.

D-Wave Quantum's Company-Specific Challenges

Beyond macroeconomic factors, internal challenges within D-Wave Quantum also contributed to the stock decline.

Financial performance and revenue projections

D-Wave's financial performance in 2025 fell short of investor expectations, impacting the D-Wave Quantum (QBTS) stock price.

- Analysis of revenue growth or decline: Revenue growth slowed considerably, failing to meet projected targets. This lack of significant revenue generation raised concerns about the company's long-term financial viability.

- Examination of profitability and margins: Profitability remained elusive, with operating margins continuing to be negative. This lack of profitability fueled investor concerns about the company's sustainability.

- Discussion of R&D spending and its impact on the bottom line: While significant R&D investments are crucial for a technology company like D-Wave, the high expenditure without commensurate revenue growth negatively impacted the company's bottom line.

Technological advancements and market adoption

The rate of technological progress and market adoption of D-Wave's technology were key factors influencing investor sentiment regarding D-Wave Quantum (QBTS) stock.

- Analysis of D-Wave's technological progress in 2025: While D-Wave made advancements, the pace was perceived as slower compared to competitors, raising questions about its technological leadership in the field.

- Evaluation of market adoption rates and customer acquisition: The acquisition of new customers and expansion into new markets remained slower than anticipated, highlighting challenges in bringing D-Wave's technology to the wider market.

- Discussion of any technological setbacks or delays: Potential delays or setbacks in technological development further dampened investor confidence, affecting the D-Wave Quantum (QBTS) stock price.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation played a critical role in the decline of D-Wave Quantum (QBTS) stock.

News and media coverage impacting QBTS

Negative news coverage and analyst reports significantly influenced investor perception of D-Wave Quantum.

- Examples of influential news stories or analyst reports: Negative press surrounding the company's financial performance, technological challenges, and competitive landscape impacted investor confidence.

- Analysis of social media sentiment towards QBTS: Negative sentiment on social media platforms further exacerbated the decline in stock price.

- The impact of short-selling and negative speculation: Short-selling activities and negative speculation amplified the downward pressure on QBTS stock.

Changes in investor expectations

Shifts in expectations regarding the timeline for commercial viability of quantum computing also contributed to the decline.

- Discussion of revised timelines for quantum computing breakthroughs: The initial hype surrounding quantum computing's potential gave way to more realistic assessments of its development timeline. This shift affected investor expectations.

- Impact of changing investor focus on short-term versus long-term gains: The focus on short-term gains led investors to move away from long-term investments like D-Wave Quantum, particularly in light of the company's immediate financial challenges.

- Analysis of the impact of hype versus reality in the quantum computing sector: The gap between the initial hype surrounding quantum computing and the slower-than-expected progress in commercial applications influenced investor behavior.

Conclusion

The significant decline in D-Wave Quantum (QBTS) stock during 2025 was likely a multifaceted issue resulting from a combination of macroeconomic headwinds, company-specific challenges, and shifts in investor sentiment. Understanding these factors is crucial for investors seeking to navigate the complexities of the quantum computing market. Further research into D-Wave Quantum's future plans, technological advancements, and market positioning is vital for assessing the long-term potential of the D-Wave Quantum (QBTS) stock. Stay informed about D-Wave Quantum (QBTS) stock and other quantum computing investments by continuously monitoring market trends and company performance. Careful analysis of D-Wave Quantum (QBTS) stock and the broader quantum computing sector is essential for making informed investment decisions.

Featured Posts

-

Transfert De Melvyn Jaminet Kylian Jaminet Denonce Un Montant Excessif

May 20, 2025

Transfert De Melvyn Jaminet Kylian Jaminet Denonce Un Montant Excessif

May 20, 2025 -

450 000 E Reglement De L Affaire Jaminet Et Le Stade Toulousain

May 20, 2025

450 000 E Reglement De L Affaire Jaminet Et Le Stade Toulousain

May 20, 2025 -

Nyt Mini Crossword Answers March 22

May 20, 2025

Nyt Mini Crossword Answers March 22

May 20, 2025 -

Did Michael Strahan Outmaneuver The Competition For That Big Interview

May 20, 2025

Did Michael Strahan Outmaneuver The Competition For That Big Interview

May 20, 2025 -

Why Did Michael Strahan Leave Good Morning America Exploring His Exit

May 20, 2025

Why Did Michael Strahan Leave Good Morning America Exploring His Exit

May 20, 2025

Latest Posts

-

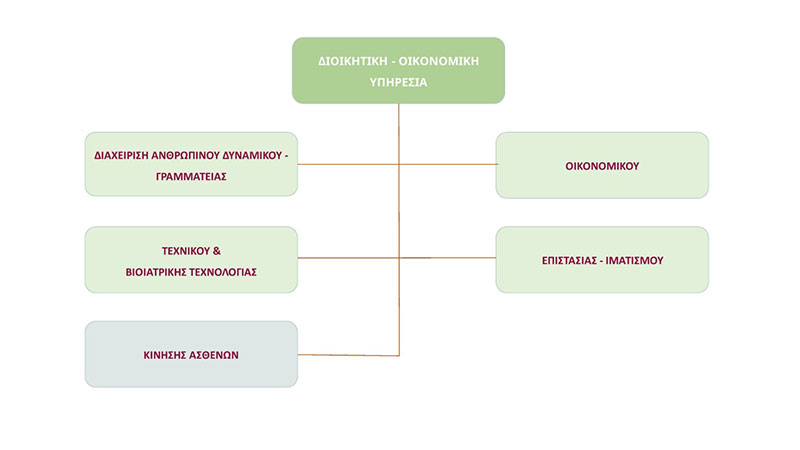

Poy Tha Vreite Efimereyontes Giatroys Stin Patra 10 And 11 Maioy

May 20, 2025

Poy Tha Vreite Efimereyontes Giatroys Stin Patra 10 And 11 Maioy

May 20, 2025 -

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025 -

Efimeries Giatron Patra 10 11 Maioy Pliris Lista

May 20, 2025

Efimeries Giatron Patra 10 11 Maioy Pliris Lista

May 20, 2025 -

I Tragodia Giakoymaki Mathimata Gia Tin Prostasia Tis Aksias Toy Atomoy

May 20, 2025

I Tragodia Giakoymaki Mathimata Gia Tin Prostasia Tis Aksias Toy Atomoy

May 20, 2025 -

Baggelis Giakoymakis Kai I Simasia Toy Sevasmoy Stin Anthropini Aksioprepeia

May 20, 2025

Baggelis Giakoymakis Kai I Simasia Toy Sevasmoy Stin Anthropini Aksioprepeia

May 20, 2025