Data-Driven Analysis: X's Debt Sale And Its Effects On Company Performance

Table of Contents

The Debt Sale: Details and Context

Background of X's financial situation leading to the debt sale.

Before the debt sale, X Corporation was facing a challenging financial landscape. Several factors contributed to the decision to sell debt:

- Declining Revenue: Revenue had fallen by 15% year-over-year in the preceding two quarters, impacting profitability and cash flow.

- High Debt Levels: X carried a significant debt burden, with a debt-to-equity ratio of 2:1, exceeding industry averages.

- Decreased Profitability: Net profit margins had shrunk considerably, eroding investor confidence and hindering future investments.

X ultimately sold $500 million in high-yield corporate bonds to address these challenges, aiming to reduce its overall debt burden and improve its financial flexibility. The sale was structured to offer a competitive yield to attract investors in the current market conditions.

Market conditions at the time of the sale.

The debt sale occurred during a period of rising interest rates. This environment presented both challenges and opportunities.

- Rising Interest Rates: Higher interest rates increased the cost of borrowing, but simultaneously, they made fixed-income investments, such as corporate bonds, more attractive to yield-seeking investors.

- Investor Sentiment: Despite market volatility, investor sentiment towards X remained relatively positive due to its strong brand reputation and history of innovation. The announcement of the debt sale was initially met with a slight dip in the stock price, but the market quickly stabilized. This demonstrates the importance of clear communication with investors during such crucial events.

Immediate Effects on X's Financial Performance

Short-term impact on key financial metrics.

The immediate impact of the debt sale is evident in several key financial metrics:

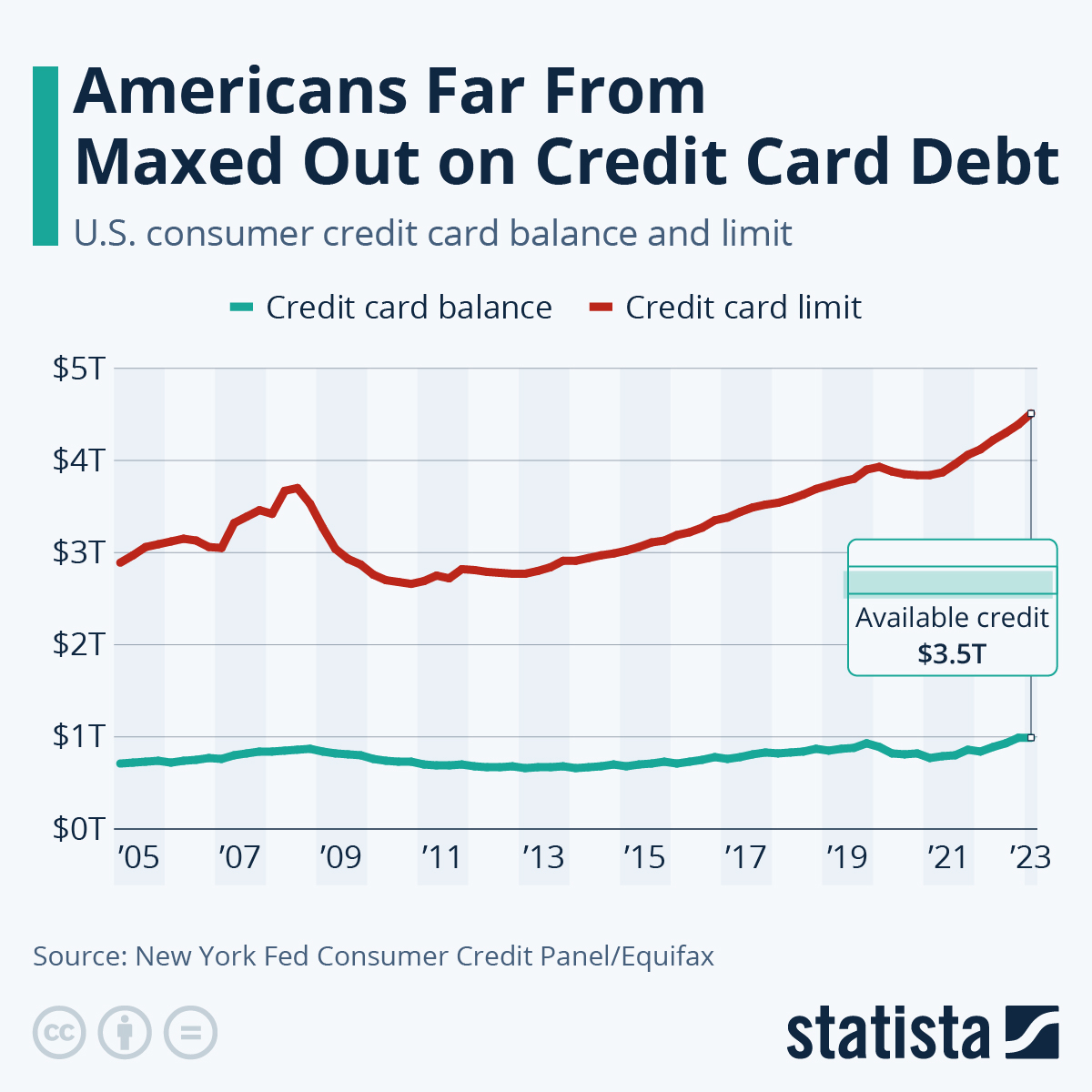

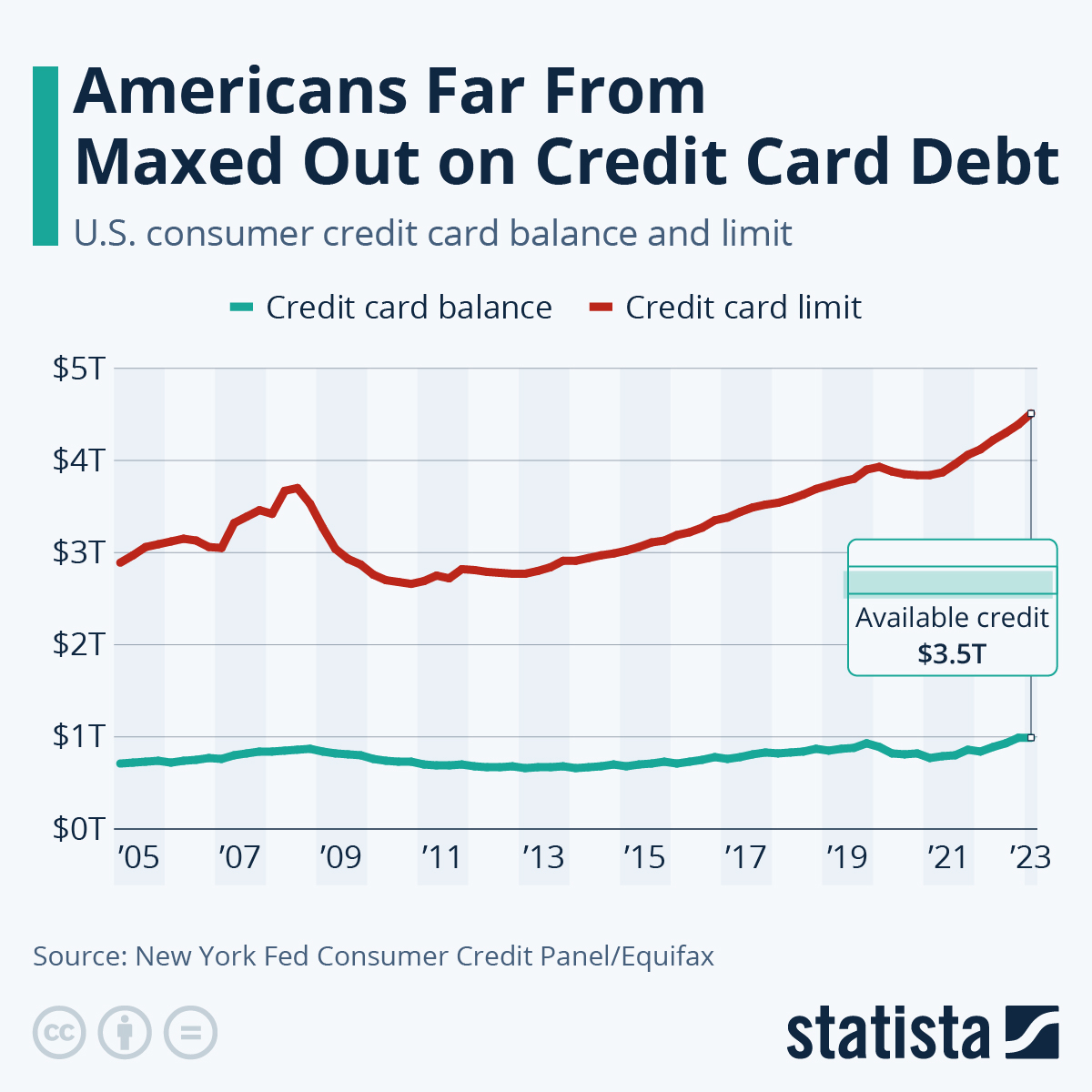

- Debt-to-Equity Ratio: The ratio improved from 2:1 to 1.7:1, indicating a reduction in financial leverage. (This will be illustrated with a chart showing the before-and-after ratio).

- Interest Expense: While the immediate interest expense might have risen slightly due to the new debt, the overall reduction in debt is expected to lower long-term interest expense. (A graph showing projected interest expense over the next five years is included here).

- Cash Flow: The influx of cash from the bond sale provided a much-needed boost to X's cash flow, enabling it to meet immediate financial obligations and invest in key areas.

Analysis of the impact on credit rating and investor confidence.

Following the debt sale, credit rating agencies conducted thorough reviews of X’s financial health. While an immediate upgrade wasn’t issued, the improved debt-to-equity ratio and enhanced cash flow position prevented any credit rating downgrades, signaling a positive perception of the company's financial strategy. This, coupled with the company's clear communication regarding its strategic plan, helped maintain investor confidence. The stock price showed a slight recovery following the initial dip, suggesting investor approval of the debt sale strategy.

Long-Term Implications for X's Strategic Direction

How the debt sale affects X's future investment plans.

The additional financial flexibility from the debt sale enables X to pursue several key strategic initiatives:

- Research and Development: The company can now invest more heavily in R&D, bolstering its innovative capabilities and developing new products and services.

- Targeted Acquisitions: The sale opens doors for strategic acquisitions to expand its market share and product portfolio.

- International Expansion: X can now consider expanding its operations into new international markets, broadening its customer base and revenue streams.

Potential changes to the company's capital structure and financial risk profile.

The debt sale has altered X’s capital structure, reducing its reliance on high-cost debt. This lowers its overall financial risk profile, making it less vulnerable to economic downturns. A carefully managed approach to debt repayment will further ensure long-term financial sustainability and enhance profitability.

The role of data-driven decision-making in navigating the post-sale landscape.

X’s success in managing the post-sale period depends heavily on data-driven decision-making. By using advanced analytics to monitor key performance indicators, the company can track the effectiveness of its strategies, make necessary adjustments, and proactively address potential challenges.

Conclusion: Data-Driven Insights and Future Outlook for X

This Data-Driven Analysis of X's Debt Sale reveals that the sale, while a significant event, appears to be a strategically sound move. The short-term impact has been positive, with improved key financial metrics and maintained investor confidence. The long-term outlook is promising, with X positioned to invest in strategic initiatives and enhance its long-term profitability and sustainability. The success of this strategy hinges on continued effective financial management and a commitment to data-driven decision-making. Conducting a thorough data-driven analysis, as demonstrated in this case study of X, is crucial for understanding the complex effects of debt sales on company performance. Learn how to leverage data-driven analysis for your own financial decisions.

Featured Posts

-

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

Nascar Jack Link 500 Your Guide To The Best Prop Bets At Talladega 2025

Apr 28, 2025

Nascar Jack Link 500 Your Guide To The Best Prop Bets At Talladega 2025

Apr 28, 2025 -

Gpu Price Volatility Understanding Recent Market Fluctuations

Apr 28, 2025

Gpu Price Volatility Understanding Recent Market Fluctuations

Apr 28, 2025 -

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

Apr 28, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

Apr 28, 2025