Dax: Bundestag Elections And Business Figures – A Key Influence

Table of Contents

Political Uncertainty and Market Volatility

The period surrounding Bundestag elections is often characterized by increased market volatility. This uncertainty directly impacts the DAX and its constituent companies.

Pre-Election Jitters

- Increased uncertainty surrounding potential policy changes: As the election approaches, investors grapple with the unknown. Different political parties present contrasting economic platforms, creating uncertainty about future regulations, taxation, and government spending. This uncertainty often leads to cautious investment strategies and increased market volatility.

- Investors react to shifting political landscapes and potential coalition scenarios: The formation of a coalition government after the election can take time, leading to prolonged uncertainty. The composition of the coalition and the resulting policy compromises significantly affect investor sentiment and market behavior. Investors carefully scrutinize the manifestos and potential alliances to predict future policy directions.

- Examples of past election cycles and their immediate impact on the Dax: Examining past Bundestag elections reveals clear patterns. For example, the 2017 election, with its close results and subsequent coalition negotiations, saw significant fluctuations in the DAX until a stable government was formed. Analyzing these past trends provides valuable insights into predicting future market reactions.

Post-Election Adjustments

Once the election results are clear, the market usually undergoes a period of adjustment. This adjustment reflects the market's interpretation of the new government's policies and their anticipated impact on the German economy.

- Analysis of the new government's coalition agreement and its implications for the economy: Investors carefully examine the coalition agreement, focusing on key policy commitments affecting businesses. Specific commitments on taxation, environmental regulations, and infrastructure spending become central to investor analysis.

- Focus on key policy areas affecting the DAX, such as taxation, regulation, and infrastructure spending: Changes in corporate tax rates, environmental regulations (particularly impacting the automotive sector), and government investment in infrastructure projects directly influence the profitability and prospects of DAX-listed companies.

- Examples of how different government policies have impacted specific Dax companies in the past: Examining historical data reveals how specific policies have affected particular sectors. For example, changes in renewable energy subsidies directly impact energy companies listed on the DAX, while automotive emission regulations significantly influence car manufacturers.

Sector-Specific Impacts

The impact of Bundestag elections isn't uniform across all sectors. Certain industries are more sensitive to specific policy changes than others.

Automotive Industry and the DAX

The automotive industry is a cornerstone of the German economy and a major component of the DAX. Election outcomes directly influence its fortunes.

- Analysis of the influence of environmental policies on car manufacturers within the DAX: Stringent emission regulations can necessitate significant investments in new technologies, impacting profitability. Conversely, government incentives for electric vehicles can boost the sector.

- Impact of trade deals and tariffs on automotive exports and the DAX: The German automotive industry relies heavily on exports. Changes in international trade agreements, tariffs, and trade disputes directly influence the performance of DAX-listed automotive companies.

Energy Sector and the DAX

The energy sector is particularly sensitive to government policy. Decisions concerning renewable energy sources and nuclear power heavily influence the DAX.

- Examination of past energy policies and their impact on energy companies listed on the DAX: Analyzing past policy decisions (e.g., the phasing out of nuclear power) demonstrates the significant influence of government actions on the energy sector and, consequently, the DAX.

- Analysis of the effect of government subsidies for renewable energy on the DAX: Subsidies for renewable energy sources can positively impact companies involved in this sector, while reducing support for fossil fuels can have the opposite effect.

Long-Term Economic Outlook and the Dax

The long-term economic outlook significantly impacts the DAX. The policies of the newly elected government play a crucial role in shaping this outlook.

Fiscal Policy and the DAX

The government's fiscal policy – its approach to taxation and spending – is a key driver of long-term economic growth.

- Analyzing how tax policies influence corporate profitability and investor confidence: Changes in corporate tax rates directly affect the profitability of DAX-listed companies. Tax cuts can boost investor confidence, while increased taxes may have a negative impact.

- The role of government spending on infrastructure and its impact on the DAX: Government investments in infrastructure projects (e.g., roads, transportation, digital infrastructure) stimulate economic activity and can positively impact related sectors in the DAX.

Economic Growth and the Dax

A stable government with clear economic policies usually fosters investor confidence.

- Correlation between government stability and DAX performance: Historically, periods of stable government with predictable policies tend to correlate with positive DAX performance.

- How investor confidence impacts DAX trading volumes and overall market capitalization: High investor confidence leads to increased trading volumes and a higher overall market capitalization for the DAX.

Conclusion

The DAX is significantly influenced by Bundestag elections and the subsequent policies of the newly formed government. From pre-election uncertainty to sector-specific impacts and long-term economic considerations, the relationship is complex and multifaceted. Understanding this intricate interplay between politics and the market is crucial for investors and business leaders alike. To stay informed about the ongoing influence of Bundestag elections on the Dax and German business figures, continue researching and analyzing the policies of the ruling government and their projected impacts. Stay ahead of the curve by consistently monitoring the Dax Bundestag Elections landscape and its implications for your investment strategies.

Featured Posts

-

Offenlegungspflicht Pne Ag Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Offenlegungspflicht Pne Ag Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025 -

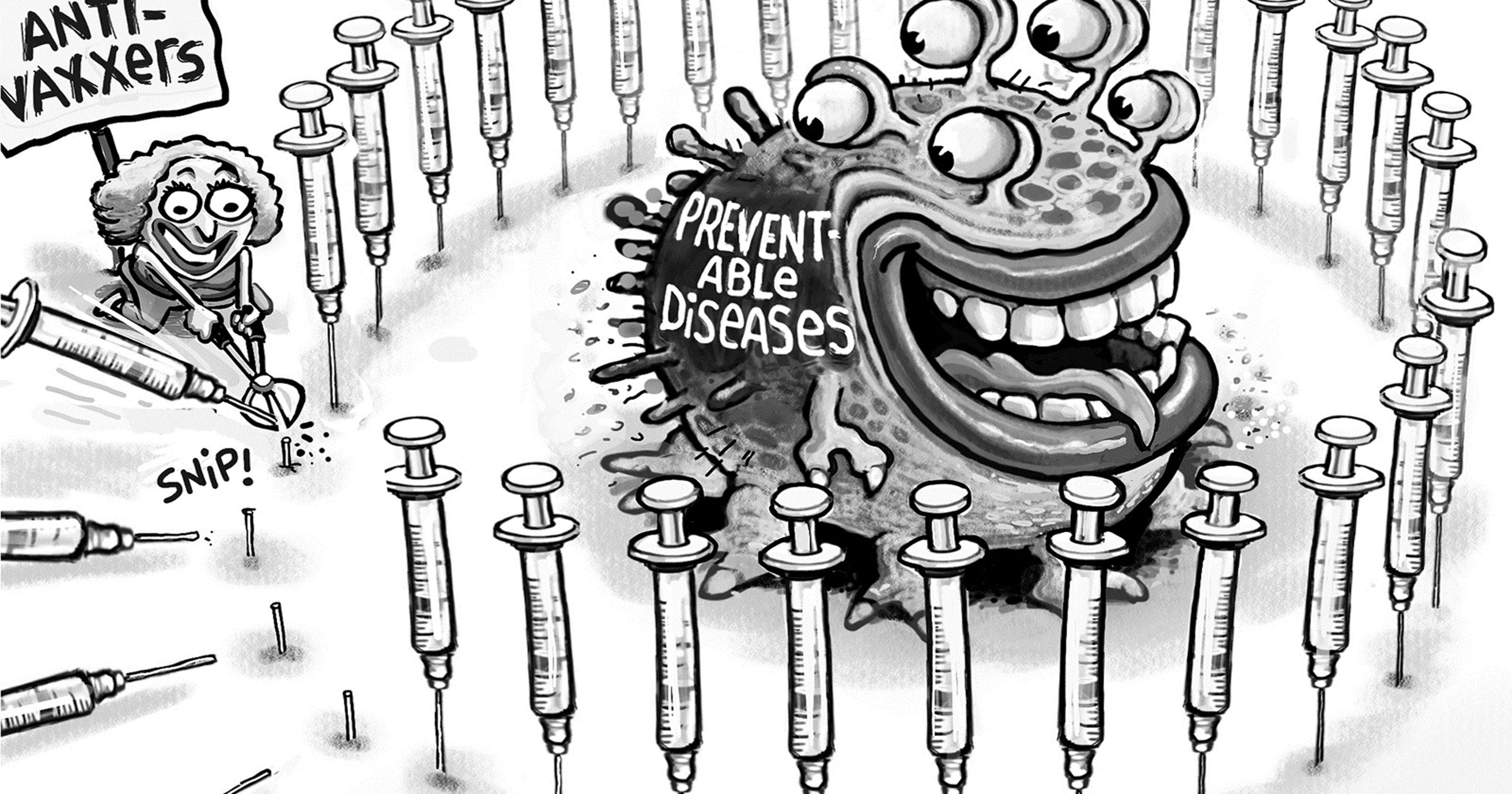

Public Outcry Anti Vaxxer Appointed To Lead Autism Research

Apr 27, 2025

Public Outcry Anti Vaxxer Appointed To Lead Autism Research

Apr 27, 2025 -

Kalinskaya Defeats Keys In Thrilling Charleston Quarterfinal

Apr 27, 2025

Kalinskaya Defeats Keys In Thrilling Charleston Quarterfinal

Apr 27, 2025 -

Is Canada The New Top Tourist Destination A Look At The Numbers

Apr 27, 2025

Is Canada The New Top Tourist Destination A Look At The Numbers

Apr 27, 2025

Latest Posts

-

Cybercriminals Office365 Scheme Millions Gained From Executive Inbox Breaches

Apr 28, 2025

Cybercriminals Office365 Scheme Millions Gained From Executive Inbox Breaches

Apr 28, 2025 -

Federal Investigation Millions Made From Executive Office365 Account Hacks

Apr 28, 2025

Federal Investigation Millions Made From Executive Office365 Account Hacks

Apr 28, 2025 -

Office365 Data Breach Hacker Makes Millions Targeting Executive Inboxes

Apr 28, 2025

Office365 Data Breach Hacker Makes Millions Targeting Executive Inboxes

Apr 28, 2025 -

Millions Stolen Office365 Breach Nets Criminal Millions Fbi Investigation Reveals

Apr 28, 2025

Millions Stolen Office365 Breach Nets Criminal Millions Fbi Investigation Reveals

Apr 28, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025