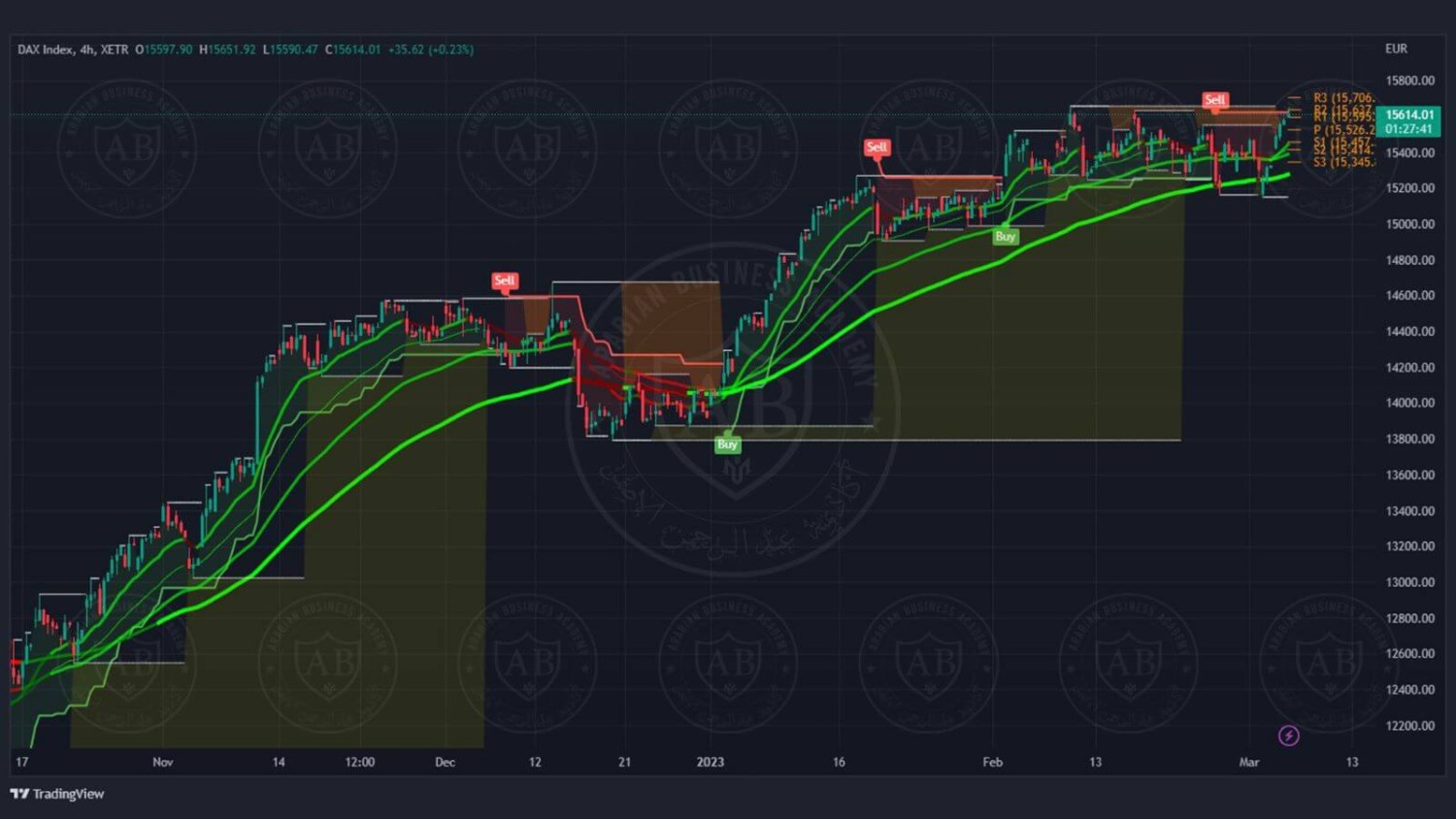

DAX Falls Below 24,000: Frankfurt Stock Market Closing Report

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors contributed to today's sharp decline in the DAX. Understanding these underlying issues is crucial for assessing the market's future trajectory.

Impact of Rising Inflation and Interest Rates

The ongoing surge in inflation across Europe is significantly impacting the DAX. High inflation erodes consumer spending power, leading to reduced demand for goods and services. This directly affects company profits, particularly for businesses heavily reliant on consumer spending.

- Reduced Consumer Spending: Inflation at its current level is forcing consumers to cut back on discretionary spending, hitting retail and other consumer-facing sectors hard.

- Increased Borrowing Costs: Rising interest rates, implemented by the European Central Bank (ECB) to combat inflation, increase borrowing costs for businesses. This makes expansion and investment more challenging, hindering economic growth.

- Data Points: Germany's recent inflation figures (insert specific data if available) show persistent inflationary pressure, exceeding the ECB's target. These high inflation rates and subsequent interest rate hikes are directly impacting the DAX's performance.

Geopolitical Uncertainty and its Influence

Geopolitical risks remain a significant headwind for the DAX. The ongoing war in Ukraine continues to disrupt global supply chains, driving up energy prices and creating uncertainty for businesses.

- Ukraine War's Impact: The conflict in Ukraine has created substantial uncertainty in energy markets, leading to volatile energy prices and impacting German industries heavily reliant on imported resources.

- US-China Relations: Strained US-China relations contribute to broader global uncertainty, creating further volatility in financial markets and investor sentiment. Concerns about potential trade conflicts or escalations negatively affect investor confidence.

- Expert Opinions: Many financial experts point to the ongoing geopolitical instability as a key factor dampening investor sentiment and contributing to the DAX decline (cite specific expert opinions and sources here).

Energy Crisis and its Ripple Effect

The energy crisis in Europe, particularly impacting Germany's reliance on Russian natural gas, is significantly impacting industrial production and company profits.

- High Energy Prices: Soaring energy prices increase production costs for numerous German companies, squeezing profit margins and potentially leading to job losses.

- Impact on Industries: Energy-intensive sectors, such as manufacturing and automotive, are particularly vulnerable to these price hikes.

- Economic Growth Concerns: The energy crisis threatens to significantly hamper Germany's economic growth, further contributing to the negative sentiment reflected in the DAX decline.

Sector-Specific Performance within the DAX

The DAX decline wasn't uniform across all sectors. Some were hit harder than others, reflecting their varying exposure to the factors discussed above.

Analysis of the Hardest-Hit Sectors

The energy, technology, and automotive sectors experienced the most significant declines today.

- Energy Sector: Energy companies were particularly hard hit due to volatile energy prices and uncertainty around future supply. (Cite specific company examples and their stock performance).

- Technology Sector: The tech sector faced pressure from rising interest rates, which typically impact growth stocks more severely. (Cite specific company examples and their stock performance).

- Automotive Sector: The automotive sector is facing challenges due to supply chain disruptions, rising energy costs, and reduced consumer demand. (Cite specific company examples and their stock performance).

Sectors Showing Relative Resilience

Despite the overall market downturn, some sectors demonstrated relative resilience.

- Defensive Stocks: Defensive sectors, such as consumer staples and healthcare, generally performed better than the broader market, reflecting their less cyclical nature and relative immunity to economic downturns. (Cite examples).

- Resilient Sectors: Other sectors, such as utilities (depending on their energy source), showed better resistance to the broader market decline, due to their relatively stable nature. (Cite examples).

Analyst Predictions and Market Outlook

Predicting the future trajectory of the DAX remains challenging, with varying opinions among analysts.

Expert Opinions on the Future of the DAX

Financial analysts offer diverse perspectives on the DAX's potential recovery.

- Short-Term Outlook: Some analysts predict a short-term rebound, suggesting the current decline is an overreaction to recent events.

- Long-Term Outlook: Others express more cautious optimism, anticipating a prolonged period of volatility before a sustained recovery. They emphasize the need to address underlying economic and geopolitical challenges. (Cite specific analyst predictions and sources here).

Conclusion:

The DAX's fall below 24,000 marks a significant downturn in the Frankfurt Stock Market, driven by a confluence of factors including rising inflation, geopolitical uncertainty, and the ongoing energy crisis. Several sectors experienced sharp declines, while others showed more resilience. Analyst predictions vary, highlighting the uncertainty surrounding the market's future trajectory. The performance of the DAX index and the Frankfurt Stock Market will continue to be closely watched.

Call to Action: Stay informed on the latest developments affecting the DAX and the Frankfurt Stock Market. Continuously monitor the DAX index for crucial updates and analysis related to the DAX's performance and its implications for the German economy. For detailed analysis and expert insights, visit [link to your website/financial news source].

Featured Posts

-

Adae Daks Alalmany Thlyl Lawl Mwshr Awrwby Ytjawz Mstwa Mars

May 24, 2025

Adae Daks Alalmany Thlyl Lawl Mwshr Awrwby Ytjawz Mstwa Mars

May 24, 2025 -

Dazi Trump Sul 20 Impatto Sul Settore Moda Europeo

May 24, 2025

Dazi Trump Sul 20 Impatto Sul Settore Moda Europeo

May 24, 2025 -

La Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025

La Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025 -

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025 -

M6 Closed Van Overturns Leading To Hours Of Delays

May 24, 2025

M6 Closed Van Overturns Leading To Hours Of Delays

May 24, 2025

Latest Posts

-

De Marktdraai Van Europese Aandelen Oorzaken Gevolgen En Toekomstperspectief

May 24, 2025

De Marktdraai Van Europese Aandelen Oorzaken Gevolgen En Toekomstperspectief

May 24, 2025 -

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse En Vooruitzichten

May 24, 2025

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse En Vooruitzichten

May 24, 2025 -

Vergelijking Europese En Amerikaanse Aandelenmarkten Recente Ontwikkelingen En Vooruitzichten

May 24, 2025

Vergelijking Europese En Amerikaanse Aandelenmarkten Recente Ontwikkelingen En Vooruitzichten

May 24, 2025 -

Is De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Blijvend

May 24, 2025

Is De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Blijvend

May 24, 2025 -

Amsterdam Stock Market 7 Plunge At Opening Reflects Trade War Anxiety

May 24, 2025

Amsterdam Stock Market 7 Plunge At Opening Reflects Trade War Anxiety

May 24, 2025