DAX Rally: Can The US Market's Performance Affect German Growth?

Table of Contents

The Transatlantic Economic Interdependence

Germany and the US share deep economic ties, creating a significant interdependence that impacts both nations' economic trajectories. This close relationship is woven through intricate trade relationships, substantial foreign investment flows, and complex, globally integrated supply chains. Understanding this interdependence is crucial to analyzing the influence of the US market on the DAX rally.

- Germany is a major exporter to the US: German manufactured goods, from automobiles to machinery, are significant components of US imports. A strong US economy directly translates into higher demand for these German exports.

- US consumer demand significantly impacts German manufacturing: The purchasing power of American consumers directly affects the production levels of German industries geared towards the US market. A decline in US consumer confidence can quickly dampen German manufacturing output.

- German companies have substantial investments in the US: Many German corporations have significant operations and investments in the United States. The success of these ventures directly impacts their profitability and, consequently, the DAX performance.

- Global supply chain disruptions affect both economies: Both countries are deeply embedded in global supply chains. Any disruption, whether due to geopolitical events or natural disasters, can impact production, trade, and ultimately, stock market performance in both the US and Germany.

The impact of US economic policies, especially interest rate hikes by the Federal Reserve, reverberates across the Atlantic. Higher interest rates in the US can strengthen the dollar, making German exports more expensive and potentially weakening the DAX. Conversely, lower interest rates can stimulate the US economy, benefiting German exporters and boosting investor confidence in the DAX.

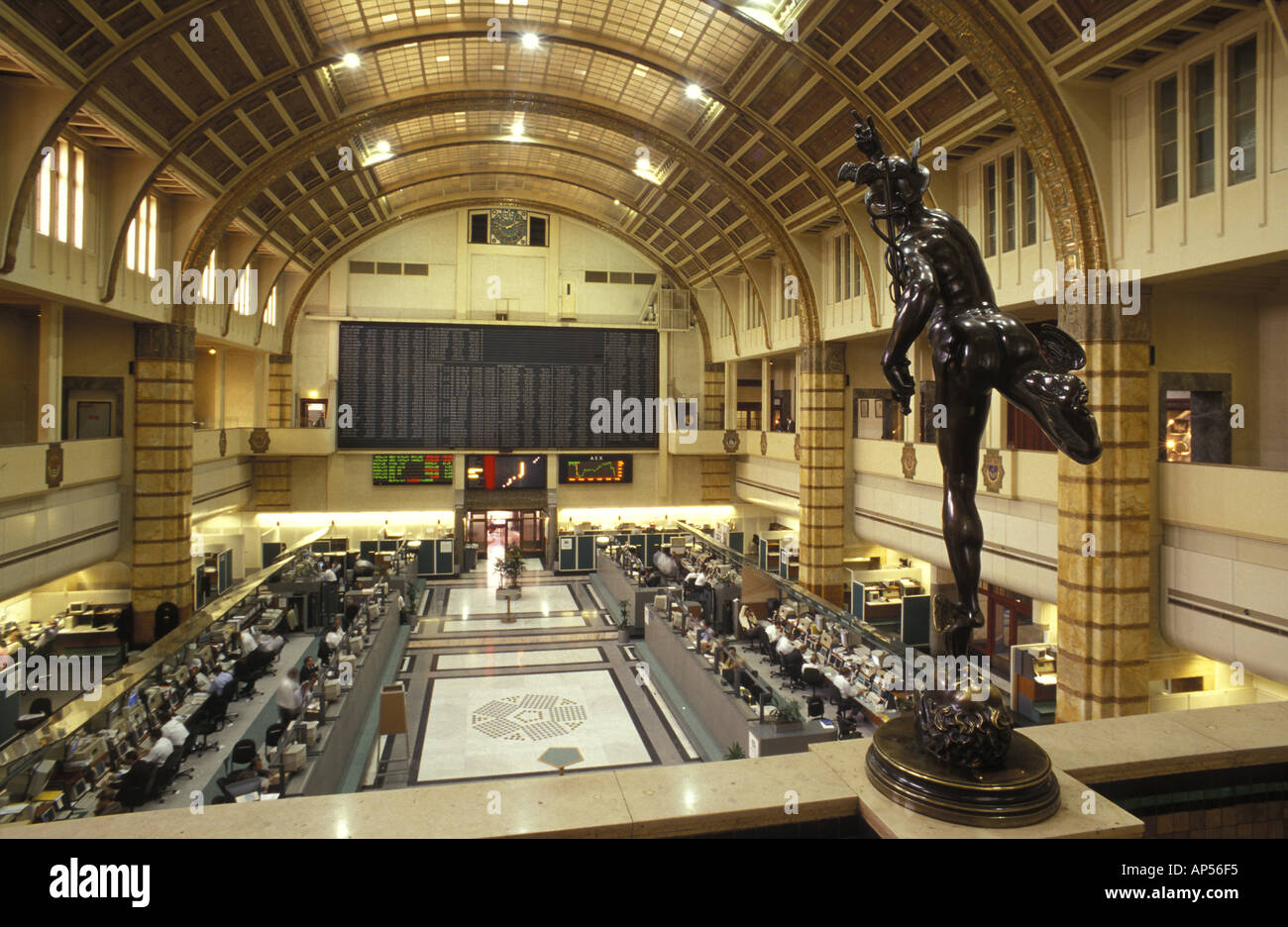

Impact of US Market Volatility on the DAX

Fluctuations in major US stock market indices, such as the Dow Jones Industrial Average and the S&P 500, have a direct and often immediate impact on the DAX. This influence stems from several key factors:

- Correlation between US and German stock market indices: A strong positive correlation exists between the performance of the DAX and US indices. When US markets rise, investor sentiment often improves globally, leading to a DAX rally. Conversely, US market downturns tend to negatively affect the DAX.

- Impact of investor confidence and risk aversion: Investor sentiment is highly contagious. Negative news from the US market can trigger risk aversion among global investors, leading to capital outflows from the DAX and a market correction.

- Role of international portfolio diversification strategies: Many international investors hold diversified portfolios including both US and German stocks. Adjustments to these portfolios based on US market performance can influence DAX trading activity.

[Insert chart/graph illustrating the correlation between DAX and US indices]. The chart clearly demonstrates the interconnectedness, showing how periods of US market volatility tend to mirror similar trends in the DAX. Global market sentiment plays a crucial role, often acting as a powerful amplifier of trends originating in the US market.

Sector-Specific Impacts: Examining Key German Industries

The impact of US market performance is not uniform across all German sectors. Some industries are more sensitive to US economic fluctuations than others.

- US demand for German automobiles: The US is a major market for German automakers. Changes in US consumer spending and economic confidence directly impact sales and production levels in this crucial sector.

- Impact of US tech sector growth on German tech companies: The success of the US tech sector often benefits German tech companies involved in software development, hardware manufacturing, or related services. A booming US tech market can boost the performance of German tech stocks.

- Influence of US consumer spending on German luxury goods: German luxury goods manufacturers, including brands known for automobiles, fashion, and accessories, are heavily reliant on US consumer spending. A slowdown in the US economy can significantly impact sales and profitability within this sector.

Analyzing how different sectors react to changes in the US economy highlights their individual vulnerabilities and strengths. For example, while the automotive sector might be more susceptible to short-term fluctuations, the technology sector may benefit from longer-term trends in US innovation.

The Role of the Euro and the Dollar Exchange Rate

Fluctuations in the EUR/USD exchange rate significantly impact German exports and imports and consequently the DAX.

- Impact of a strong dollar on German exports to the US: A stronger dollar makes German goods more expensive for US consumers, potentially reducing demand and impacting German exporters' profitability.

- Impact of a weak dollar on US imports from Germany: Conversely, a weaker dollar makes German goods cheaper for US consumers, potentially boosting demand and benefiting German companies.

- How exchange rate fluctuations affect German company profits: Companies with significant US operations or exports experience direct impacts on their profitability due to exchange rate shifts. This directly affects their stock prices and the overall DAX performance.

Beyond the Stock Market: Macroeconomic Factors at Play

Beyond stock market performance, broader macroeconomic factors influence both the US and German economies, affecting the DAX independently of US stock market fluctuations.

- Inflation rates in both countries: High inflation rates in either the US or Germany can lead to tighter monetary policies, potentially dampening economic growth and impacting the DAX.

- Interest rate policies and their impact: Interest rate decisions by central banks in both countries directly influence borrowing costs, investment decisions, and overall economic activity, which all impact the DAX.

- Geopolitical risks and their influence: Global events, such as geopolitical instability or trade wars, can create uncertainty and negatively affect investor sentiment, impacting both the US market and the DAX.

Conclusion

The future of the DAX rally is intricately linked to the performance of the US market and the broader global economy. While the transatlantic economic interdependence is undeniable, understanding the nuances of this relationship – including sector-specific vulnerabilities, exchange rate fluctuations, and macroeconomic factors – is crucial for investors and policymakers alike. Staying informed about both the US market and the broader global economic climate is vital for navigating the complexities of the DAX and making informed decisions related to the DAX rally and German growth. Continuous monitoring of the interplay between the US market and the DAX is essential for developing sound investment strategies.

Featured Posts

-

Ai Stuwt Relx Door Economische Recessie Positieve Vooruitzichten Tot 2025

May 25, 2025

Ai Stuwt Relx Door Economische Recessie Positieve Vooruitzichten Tot 2025

May 25, 2025 -

Analyse Hogere Kapitaalmarktrentes En De Sterke Euro

May 25, 2025

Analyse Hogere Kapitaalmarktrentes En De Sterke Euro

May 25, 2025 -

Onrust Op Wall Street Positieve Aex Prestaties Verklaard

May 25, 2025

Onrust Op Wall Street Positieve Aex Prestaties Verklaard

May 25, 2025 -

Significant Fall In Amsterdam Stock Exchange Aex Index At One Year Low

May 25, 2025

Significant Fall In Amsterdam Stock Exchange Aex Index At One Year Low

May 25, 2025 -

The Demna Gvasalia Effect On Guccis Future

May 25, 2025

The Demna Gvasalia Effect On Guccis Future

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025