De Minimis Tariffs On Chinese Goods: A G-7 Discussion

Table of Contents

The Current State of De Minimis Tariffs on Chinese Goods within the G7

De minimis tariffs represent a crucial aspect of international trade policy. They define the value limit below which imported goods are exempt from tariffs. While seemingly minor, these thresholds significantly affect consumer access to cheaper goods and the competitiveness of domestic businesses. The impact varies greatly across G7 nations, leading to an uneven playing field. Each G7 country has its own unique de minimis threshold for Chinese imports, creating inconsistencies in the application of import tariffs.

-

Variations in De Minimis Thresholds: The thresholds differ substantially; some countries may have higher limits, allowing for a greater volume of Chinese goods to enter duty-free, while others maintain stricter, lower thresholds. This variation leads to complexities in managing cross-border trade and can create competitive disadvantages for businesses in countries with lower thresholds.

-

China-G7 Trade Relationship: The trade relationship between China and the G7 countries is complex and multifaceted. China is a major trading partner for all G7 members, and a considerable volume of goods enters under de minimis tariffs.

-

Differences in Tariff Levels: The tariffs imposed on Chinese goods vary significantly, impacting the cost and competitiveness of products across different sectors. For example, textiles might face higher tariffs in some countries compared to electronics.

-

Impact on Specific Industries: Industries like textiles, electronics, and consumer goods are particularly affected by these varying thresholds. Businesses in these sectors often face challenges adapting to different regulatory environments across G7 markets.

-

Examples of Specific Goods Affected: Numerous everyday consumer products—from clothing and electronics to small household items—are impacted by de minimis tariff policies. The volume of these goods imported under these exemptions is substantial, affecting the overall trade balance.

-

-

Data on Import Volume: Reliable data on the precise volume of Chinese goods imported under de minimis tariffs varies among G7 nations. However, estimates consistently indicate a significant flow of goods entering duty-free, highlighting the importance of understanding and managing these thresholds.

Economic Impacts of Varying De Minimis Tariffs on Chinese Imports

Varying de minimis thresholds have considerable economic implications. Higher thresholds can lead to lower consumer prices due to cheaper imports, but they might also negatively affect domestic industries by increasing competition. Lower thresholds, conversely, could protect domestic businesses but might lead to higher prices for consumers.

-

Impact on Consumer Prices:

- Effects on Inflation: A flood of cheap imports could suppress inflation in the short term, but a long-term reliance on cheaper goods may hinder innovation and productivity within domestic industries.

- Changes in Purchasing Power: Lower prices due to higher thresholds increase purchasing power, benefitting consumers, particularly those with lower incomes. However, the long term consequences of losing domestic manufacturing capabilities must be considered.

- Impacts on Socioeconomic Groups: The effects are not evenly distributed across socioeconomic groups. Lower-income consumers benefit most from lower prices, while domestic workers in competing industries might face job losses.

-

Implications for Domestic Industries and Businesses:

- Increased Competition from Cheaper Imports: Higher de minimis thresholds increase competition for domestic businesses, potentially leading to reduced market share and profitability.

- Potential Job Losses or Gains: While lower prices might boost consumer spending in some sectors, domestic industries might experience job losses due to increased competition. However, new jobs might arise in other sectors related to the import, distribution, and sale of these goods.

- Effects on Small and Medium-Sized Enterprises (SMEs): SMEs are particularly vulnerable to competition from cheaper imports, as they often lack the resources to compete with larger, multinational companies.

Political and Geopolitical Considerations in the G7 Discussion

The approaches adopted by different G7 countries towards de minimis tariffs on Chinese imports are often driven by a complex mix of economic, political, and geopolitical considerations. These factors influence the political landscape and the G7's role in shaping global trade policies.

-

Political Motivations: Domestic political pressures, concerns about national security, and the desire to protect specific industries heavily influence a country's stance on de minimis tariffs.

-

G7's Role in Shaping Global Trade Policies:

- Influence on World Trade Organization (WTO) Rules: The G7's actions significantly influence the WTO's rules and regulations regarding tariffs and trade practices.

- Impacts on Bilateral Trade Agreements: De minimis tariffs are often incorporated into bilateral trade agreements, impacting trade relations between individual G7 members and China.

- Potential for Future Trade Negotiations: The G7's approach to de minimis tariffs plays a critical role in future negotiations and agreements involving China and other trading partners.

-

Geopolitical Implications: De minimis tariffs are not just about economics; they're also a tool in geopolitical strategies. Differing approaches might affect alliances, influence relations with China, and shape the global distribution of economic power.

Potential Solutions and Future Outlook for De Minimis Tariffs

Harmonizing de minimis tariffs within the G7 is a complex undertaking, but it’s crucial for ensuring a level playing field and reducing trade friction. Alternative approaches are needed to balance consumer benefits and the protection of domestic industries.

-

Harmonizing De Minimis Tariffs: A unified approach to de minimis tariffs could reduce complexities and improve fairness in international trade.

-

Alternative Approaches: This could involve exploring alternative regulatory mechanisms, such as stricter product safety standards, to manage the influx of cheaper imports.

-

Future Changes in De Minimis Thresholds:

- Impact of Technological Advancements: Technological advancements might necessitate adjustments in de minimis thresholds to account for changes in production costs and supply chains.

- Effects of Changing Global Economic Conditions: Economic downturns or shifts in global trade patterns can significantly influence the desirability of varying de minimis thresholds.

- Influence of Future G7 Summits and International Trade Agreements: Future summits and agreements will play a critical role in determining the future direction of de minimis tariffs.

Conclusion: The Future of De Minimis Tariffs on Chinese Goods: A G7 Imperative

Understanding de minimis tariffs on Chinese goods is crucial for navigating the complexities of international trade. The economic, political, and geopolitical implications are significant, and finding a balanced approach that protects domestic industries while promoting fair competition is essential. The G7 plays a vital role in shaping global trade policies. Managing de minimis tariff implications requires collaborative efforts to optimize de minimis tariff policies, moving towards a more harmonized approach that minimizes trade friction and fosters a healthier global trading environment. The G7 must prioritize further discussion and collaboration to create a unified and effective strategy, leading to fairer and more predictable trade practices.

Featured Posts

-

Will Itv Survive Another Countdown After Holly Willoughbys Exit

May 23, 2025

Will Itv Survive Another Countdown After Holly Willoughbys Exit

May 23, 2025 -

10 Terrifying Arthouse Horror Films You Need To See

May 23, 2025

10 Terrifying Arthouse Horror Films You Need To See

May 23, 2025 -

Joe Jonas The Unexpected Fallout From A Couples Argument

May 23, 2025

Joe Jonas The Unexpected Fallout From A Couples Argument

May 23, 2025 -

Julianne Moore And Milly Alcock Star In Netflixs Cult Thriller Sirens

May 23, 2025

Julianne Moore And Milly Alcock Star In Netflixs Cult Thriller Sirens

May 23, 2025 -

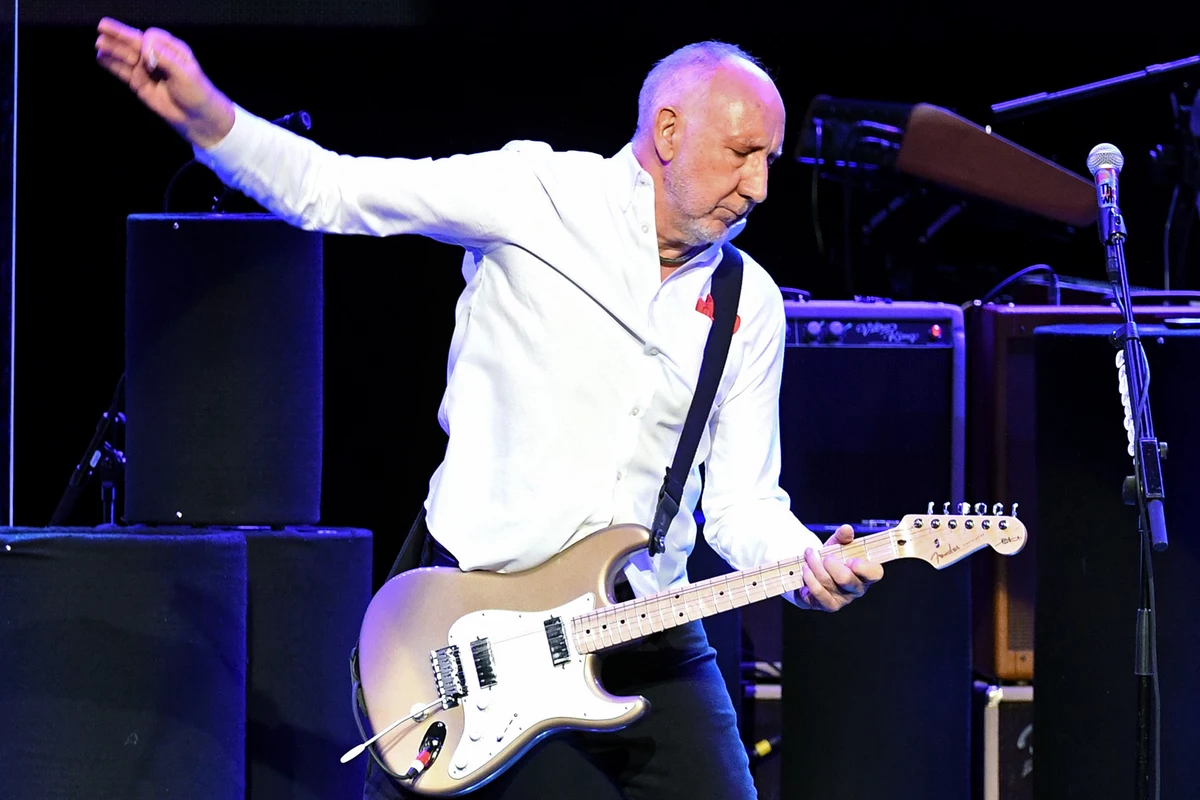

Every Pete Townshend Solo Album Ranked A Critical Overview

May 23, 2025

Every Pete Townshend Solo Album Ranked A Critical Overview

May 23, 2025

Latest Posts

-

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025 -

Sejarah Dan Evolusi Porsche 356 Di Pabrik Zuffenhausen Jerman

May 24, 2025

Sejarah Dan Evolusi Porsche 356 Di Pabrik Zuffenhausen Jerman

May 24, 2025 -

Find Your Dream Car Pts Riviera Blue Porsche 911 S T Available

May 24, 2025

Find Your Dream Car Pts Riviera Blue Porsche 911 S T Available

May 24, 2025 -

Jejak Sejarah Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda Otomotif

May 24, 2025

Jejak Sejarah Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda Otomotif

May 24, 2025 -

Riviera Blue Porsche 911 S T Exceptional Condition Private Sale

May 24, 2025

Riviera Blue Porsche 911 S T Exceptional Condition Private Sale

May 24, 2025