Deciphering The XRP Chart: $2 Support And Future Price Prediction

Table of Contents

Analyzing the $2 Support Level for XRP

The $2 price point holds significant importance as a support level for XRP. Technical analysis of the XRP chart reveals this level has acted as both a strong support and resistance point in the past. Understanding this level is crucial for any XRP price prediction.

- Historical Price Data: Examining historical XRP price data shows multiple instances where the price has bounced off the $2 level, indicating its strength as support. These instances provide evidence of buyer interest at this price point.

- Psychological Impact: The $2 mark carries psychological significance for traders. It represents a psychological barrier that can influence buying and selling decisions, potentially leading to price fluctuations.

- Volume and Trading Activity: Analyzing trading volume around the $2 level offers valuable insights. High volume at this level suggests strong buyer or seller conviction, impacting the likelihood of a break above or below this support.

- Breakout Scenarios: A successful break above $2 could signal a bullish trend, potentially leading to further price increases. Conversely, a breakdown below $2 could trigger a bearish trend, potentially pushing the price lower. Analyzing the volume and momentum surrounding any breakout is critical for accurate XRP price prediction.

Factors Influencing XRP Price

Numerous factors contribute to XRP's price fluctuations. These factors span fundamental analysis (assessing the underlying value) and technical analysis (studying price charts and indicators). Accurately predicting XRP price requires a holistic understanding of these elements.

- The SEC vs. Ripple Lawsuit: The ongoing legal battle between the SEC and Ripple significantly impacts XRP's price. A favorable outcome could lead to a substantial price surge, while an unfavorable outcome could cause a decline. The uncertainty surrounding the lawsuit creates volatility.

- XRP Adoption: Growing adoption of XRP by payment providers and financial institutions is a key bullish factor. Increased usage boosts demand and potentially drives up the price.

- Market Sentiment: The overall cryptocurrency market sentiment and specific sentiment towards XRP significantly influence its price. Positive news and increased investor confidence usually lead to higher prices, while negative news can cause price drops.

- Regulatory Changes: Regulatory developments concerning cryptocurrencies globally, and specifically in key jurisdictions, have a significant impact on XRP's price. Clearer regulations could lead to increased institutional investment and price stability.

- Technical Indicators: Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages provide signals that can aid in short-term XRP price prediction. However, these should be used in conjunction with fundamental analysis.

The Role of Ripple's Developments

Ripple's technological advancements and strategic partnerships significantly influence XRP's price. The utility and adoption of XRP within Ripple's ecosystem are key drivers.

- RippleNet Expansion: The expansion of RippleNet, Ripple's global payment network, increases XRP's usage and demand, positively impacting its price. More institutions using RippleNet means more demand for XRP.

- Partnerships and Collaborations: Strategic partnerships with financial institutions and other businesses boost XRP's credibility and adoption, contributing to its price appreciation. Significant partnerships often result in increased market interest.

- XRP Utility: The utility of XRP within the Ripple ecosystem is crucial. Its use in cross-border payments and other financial transactions directly affects its demand and ultimately, its price.

Potential Future Price Predictions for XRP

Predicting XRP's future price is inherently challenging due to the volatile nature of the cryptocurrency market. However, based on the factors discussed above, we can outline potential scenarios.

- Technical Analysis Price Targets: Based on technical indicators and chart patterns, certain price targets can be estimated. However, these are just projections and should not be considered guarantees.

- Impact of Lawsuit Outcome: The outcome of the SEC vs. Ripple lawsuit will significantly shape XRP's future price. A positive outcome could lead to a substantial price increase, potentially reaching and surpassing $2, while a negative outcome could lead to a prolonged period of lower prices.

- Realistic Price Range: Considering the various factors, a realistic range of potential price movements can be projected, but it's essential to remember that these are speculative estimates.

- Risk Management: Cryptocurrency investments involve significant risks. Diversification and careful risk management are crucial for any investment strategy, including investments in XRP.

Conclusion

Understanding the XRP chart and its potential is key to navigating the crypto market. The $2 support level plays a crucial role, acting as a significant psychological and technical barrier. Various factors, from the SEC lawsuit to Ripple's technological advancements and market sentiment, influence XRP's price. While predicting the precise future price of XRP is impossible, analyzing these factors allows for a more informed investment approach. Conduct your own thorough research and make informed decisions about your XRP investment strategy. Remember that any XRP price prediction carries inherent risk.

Featured Posts

-

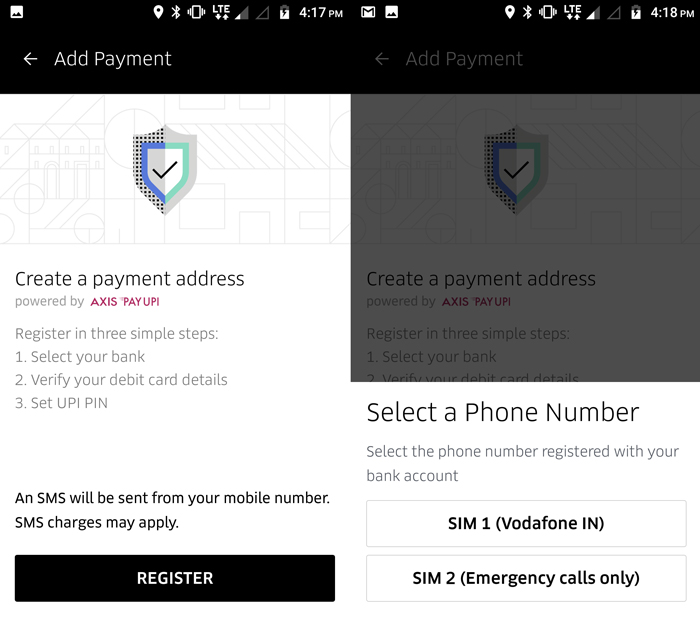

Can I Still Use Upi To Pay For Uber Auto Rides A Complete Guide

May 08, 2025

Can I Still Use Upi To Pay For Uber Auto Rides A Complete Guide

May 08, 2025 -

Brasil Vs Argentina Neymar En La Prelista Jugara

May 08, 2025

Brasil Vs Argentina Neymar En La Prelista Jugara

May 08, 2025 -

Darkseids Legion Attacks Dcs Superman July 2025 Solicits Revealed

May 08, 2025

Darkseids Legion Attacks Dcs Superman July 2025 Solicits Revealed

May 08, 2025 -

Cleveland Browns Add Experienced Wideout And Returner

May 08, 2025

Cleveland Browns Add Experienced Wideout And Returner

May 08, 2025 -

Saglik Bakanligi Personel Alimi Son Dakika 37 Bin Hekim Disi Personel Alimi Basvuru Sartlari Ve Tarihleri

May 08, 2025

Saglik Bakanligi Personel Alimi Son Dakika 37 Bin Hekim Disi Personel Alimi Basvuru Sartlari Ve Tarihleri

May 08, 2025