Decoding The Bitcoin Rebound: A Deeper Dive Into Market Signals

Table of Contents

Analyzing On-Chain Metrics for Bitcoin Rebound Signals

On-chain analysis provides crucial insights into the underlying health and activity of the Bitcoin network, offering valuable clues about potential price movements. A thorough understanding of these metrics can significantly improve your ability to predict a Bitcoin rebound.

Transaction Volume and Network Activity

Increased transaction volume and overall network activity often correlate with increased investor confidence and a potential Bitcoin rebound. High transaction volume suggests robust market participation and potentially indicates growing demand.

- High volume indicates increased trading activity: A surge in Bitcoin transaction volume often precedes price increases, suggesting a growing number of buyers are entering the market.

- Analyzing transaction sizes reveals investor sentiment: Large transactions, often associated with institutional investors, can signal significant bullish sentiment and contribute to a potential Bitcoin rebound. Conversely, a lack of large transactions might suggest a lack of strong institutional belief in an imminent rebound.

- Network activity metrics beyond volume: Examine metrics like the number of active addresses and the mean transaction fee, providing a more holistic view of network activity and its relationship to a potential Bitcoin rebound.

Miner Behavior and Hash Rate

The Bitcoin hash rate, a measure of the computational power securing the network, and miner behavior are leading indicators of network health and potential price increases.

- High and sustained hash rate suggests network strength: A consistently high hash rate indicates a healthy and secure network, suggesting less vulnerability and potentially influencing a Bitcoin rebound.

- Miner capitulation can signal a bottom: When miners are forced to sell their Bitcoin due to low profitability (miner capitulation), it often signals a market bottom, potentially setting the stage for a subsequent Bitcoin rebound. Monitoring miner revenue is critical here.

- Mining difficulty adjustments impact profitability: Understanding the dynamics of Bitcoin's difficulty adjustment algorithm, which adjusts mining difficulty every two weeks, helps assess miner profitability and its influence on the potential for a Bitcoin rebound.

Bitcoin Supply Distribution

The distribution of Bitcoin across different wallets offers valuable insights into potential price movements. The location of Bitcoin – on exchanges, in long-term holders' wallets, etc. – can significantly impact a potential Bitcoin rebound.

- Coins moving off exchanges indicate reduced selling pressure: A significant decrease in Bitcoin held on exchanges suggests that fewer coins are readily available for sale, potentially leading to price appreciation and a Bitcoin rebound.

- Accumulation by long-term holders signifies confidence: When long-term holders (those who haven't sold their Bitcoin for an extended period) accumulate more coins, it often indicates strong belief in Bitcoin's long-term value and potential for a rebound. This accumulation can reduce the available supply and fuel price increases.

- Analyzing Bitcoin supply shock events: Significant events causing a sudden reduction in circulating supply can significantly impact price, potentially triggering a substantial Bitcoin rebound.

Assessing Macroeconomic Factors Influencing Bitcoin Rebound

Macroeconomic factors play a significant role in Bitcoin's price. Understanding these influences is vital in predicting a potential Bitcoin rebound.

Inflation and Monetary Policy

Inflationary pressures and central bank monetary policies can significantly influence Bitcoin's price.

- Bitcoin as a hedge against inflation: Many view Bitcoin as a hedge against inflation, meaning its price tends to rise during periods of high inflation. This potential role as a safe haven can drive a Bitcoin rebound.

- Interest rate hikes impact risk appetite: Increased interest rates can reduce investor appetite for riskier assets like Bitcoin, potentially delaying or hindering a Bitcoin rebound.

- Quantitative easing and its impact: Monetary policies like quantitative easing can lead to increased inflation and potentially drive investors towards alternative assets such as Bitcoin, fueling a rebound.

Regulatory Landscape and Global Adoption

Regulatory changes and increasing global adoption directly influence Bitcoin's price and the potential for a Bitcoin rebound.

- Positive regulatory developments: Clearer regulatory frameworks and positive pronouncements from governments can boost investor confidence and trigger a Bitcoin rebound.

- Growing institutional adoption: Increased institutional investment in Bitcoin lends credibility and often results in price appreciation, contributing to a Bitcoin rebound.

- Expanding global adoption in emerging markets: Increasing adoption in developing countries can boost demand and influence a Bitcoin rebound.

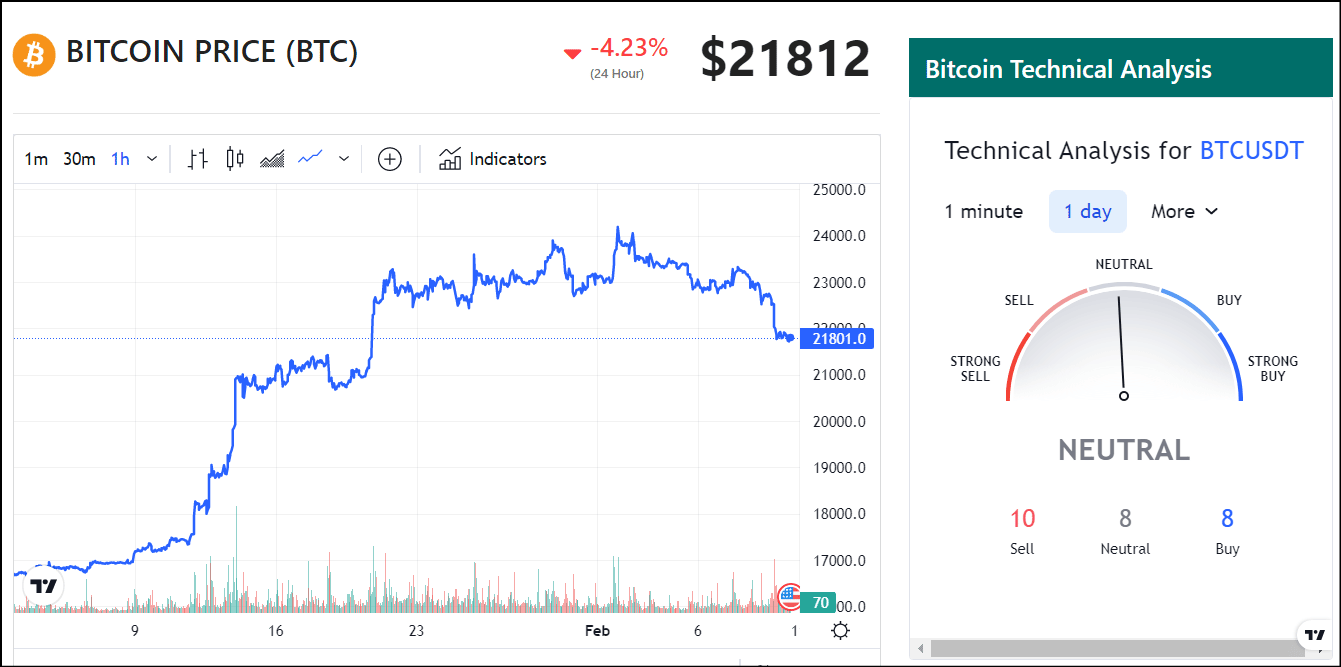

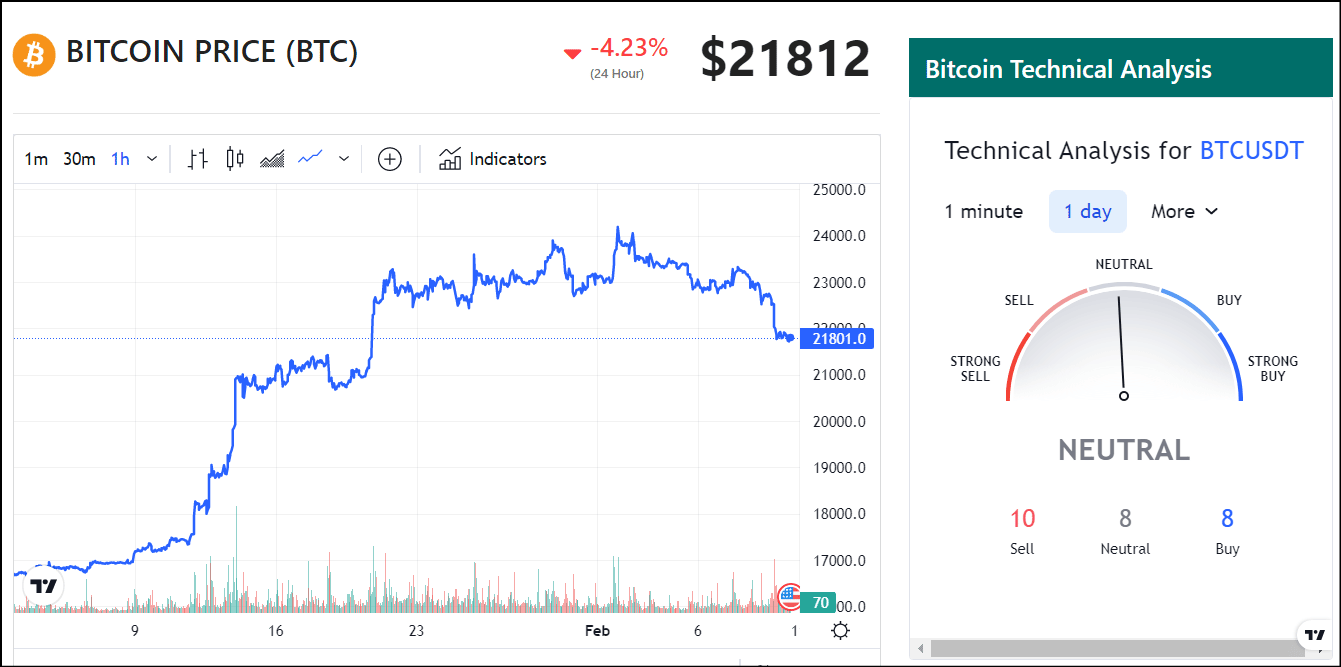

Technical Analysis for Predicting Bitcoin Rebound

Technical analysis uses historical price and volume data to predict future price movements, providing valuable insights into potential Bitcoin rebounds.

Chart Patterns and Indicators

Various technical indicators and chart patterns help identify potential buy or sell signals.

- Moving averages (MA): Moving averages smooth out price fluctuations to identify trends. A bullish crossover (when a shorter-term MA crosses above a longer-term MA) can signal a potential Bitcoin rebound.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A low RSI can indicate a potential buying opportunity and a Bitcoin rebound.

- Moving Average Convergence Divergence (MACD): The MACD identifies changes in momentum by comparing two moving averages. A bullish MACD crossover can signal a potential Bitcoin rebound.

- Head and Shoulders, Double Bottoms, etc.: Classic chart patterns can provide insights into potential support and resistance levels and predict future price movements – including potential Bitcoin rebounds.

Support and Resistance Levels

Support and resistance levels represent price areas where buying or selling pressure is expected to be strong.

- Breaching resistance levels is bullish: When the price breaks through a significant resistance level, it often signifies a strong bullish signal and increases the likelihood of a Bitcoin rebound.

- Support levels act as price floors: Support levels are areas where buying pressure is typically strong, potentially preventing further price declines and setting the stage for a Bitcoin rebound.

- Identifying key support and resistance: Using various technical tools and historical data to identify key support and resistance levels is crucial in predicting potential price reversals and Bitcoin rebounds.

Conclusion

Predicting a Bitcoin rebound requires a multi-faceted approach, incorporating on-chain metrics reflecting network activity and investor behavior, macroeconomic factors affecting overall market sentiment, and technical analysis to identify potential price turning points. By carefully analyzing on-chain data, macroeconomic trends, and technical indicators, you can gain valuable insights into the potential for a Bitcoin rebound and make informed investment decisions. Stay informed and continue to decode the signals of the Bitcoin market! Remember to always conduct thorough research and consider your personal risk tolerance before making any investment decisions related to Bitcoin or other cryptocurrencies.

Featured Posts

-

Stephen Kings The Long Walk From Book To Big Screen

May 08, 2025

Stephen Kings The Long Walk From Book To Big Screen

May 08, 2025 -

The Zuckerberg Trump Dynamic Implications For Social Media And Beyond

May 08, 2025

The Zuckerberg Trump Dynamic Implications For Social Media And Beyond

May 08, 2025 -

Winning Lotto Numbers Saturday Draw April 12 2025

May 08, 2025

Winning Lotto Numbers Saturday Draw April 12 2025

May 08, 2025 -

Is This Confirmation Jayson Tatum Ella Mai And A New Baby In A Commercial

May 08, 2025

Is This Confirmation Jayson Tatum Ella Mai And A New Baby In A Commercial

May 08, 2025 -

Este Betis Ya Historico Analisis De Su Trayectoria

May 08, 2025

Este Betis Ya Historico Analisis De Su Trayectoria

May 08, 2025