Deloitte's Forecast: A Significant Slowdown In US Economic Growth

Table of Contents

Key Factors Contributing to the Slowdown in US Economic Growth

Several interconnected factors are driving the projected slowdown in US economic growth. Understanding these elements is crucial for effective mitigation strategies.

Inflationary Pressures

Persistent inflation remains a significant headwind for US economic growth. Eroding purchasing power, it dampens consumer spending, a major engine of the US economy. This inflationary pressure stems from several sources:

- High energy prices: The global energy crisis, exacerbated by geopolitical events, has significantly increased energy costs for businesses and consumers, impacting everything from transportation to manufacturing.

- Supply chain disruptions: Ongoing supply chain bottlenecks continue to constrain production and drive up prices for various goods and services. The lingering effects of the pandemic and geopolitical instability contribute to these disruptions.

- Increased demand post-pandemic: The surge in demand following the pandemic has strained supply chains and contributed to price increases across many sectors. This pent-up demand is now facing the headwind of reduced consumer confidence and purchasing power.

- Impact on consumer confidence and spending: High inflation erodes consumer confidence, leading to reduced discretionary spending and impacting overall economic activity. Consumers are delaying major purchases and prioritizing essential goods.

Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes aim to curb inflation by cooling down the economy. However, these increases also carry the risk of triggering a recession. The higher borrowing costs impact both businesses and consumers significantly:

- Impact on business investment: Increased borrowing costs discourage businesses from investing in expansion, new equipment, and hiring, hindering growth and potentially leading to job losses.

- Increased mortgage rates and reduced housing market activity: Higher interest rates make mortgages more expensive, cooling the housing market and impacting related industries like construction and real estate. This slowdown in the housing sector can have ripple effects throughout the economy.

- Effect on consumer debt and spending: Higher interest rates increase the cost of borrowing for consumers, impacting their ability to finance purchases and potentially reducing consumer spending further. This contributes to the overall economic slowdown.

Geopolitical Uncertainty

The ongoing war in Ukraine and other geopolitical tensions contribute to global economic instability, significantly impacting US growth. This uncertainty creates ripples throughout the global economy:

- Energy price volatility: Geopolitical events continue to create volatility in energy prices, impacting businesses and consumers. This uncertainty makes planning and investment difficult for companies.

- Supply chain bottlenecks: Geopolitical instability further exacerbates existing supply chain issues, leading to production delays, shortages, and price increases. The uncertainty makes it hard to predict the future availability of key inputs.

- Uncertainty impacting investment decisions: Geopolitical uncertainty creates a climate of risk aversion, making businesses hesitant to invest and expand, further hindering economic growth. Investors are more cautious about committing capital in unstable environments.

Projected Impact on Key Sectors

The anticipated slowdown in US economic growth will differentially impact various sectors of the economy.

Manufacturing

The manufacturing sector is particularly vulnerable to the current economic headwinds. Reduced consumer demand and higher input costs are expected to significantly impact production and employment.

- Decline in production: As consumer spending slows, demand for manufactured goods will decrease, leading to a decline in production and potentially factory closures.

- Potential job losses: Reduced production and business investment in the manufacturing sector will likely lead to job losses and increased unemployment.

- Impact on supply chains: The slowdown will further impact already strained supply chains, creating a vicious cycle of reduced production and higher costs.

Housing Market

The housing market is already experiencing a significant cooling effect due to rising interest rates. This trend is expected to continue, with potential implications for the broader economy.

- Reduced home sales: Higher mortgage rates make homeownership less affordable, leading to a decline in home sales and impacting the real estate market.

- Potential price corrections: As demand softens, there is a potential for price corrections in the housing market, affecting homeowners and the construction industry.

- Impact on construction and related industries: Reduced home sales and construction activity will negatively affect related industries, such as lumber, appliances, and furniture.

Consumer Spending

Consumer spending, a key driver of US economic growth, is expected to weaken considerably as inflation erodes purchasing power and consumer confidence wanes.

- Reduced consumer confidence: High inflation and rising interest rates are eroding consumer confidence, leading to more cautious spending habits.

- Decreased discretionary spending: Consumers are likely to reduce spending on non-essential goods and services, impacting retail sales and other consumer-facing businesses.

- Impact on retail sales and other consumer-facing businesses: The reduction in discretionary spending will have a significant impact on businesses that rely on consumer spending for revenue.

Deloitte's Recommendations for Navigating the Slowdown

Deloitte's full report will likely offer specific strategies for businesses and policy recommendations to mitigate the impact of the economic slowdown.

Strategies for Businesses

Businesses need to adapt to the changing economic landscape by implementing strategies that enhance resilience and efficiency. This may include:

- Implementing cost-cutting measures to improve profitability.

- Diversifying revenue streams to reduce reliance on volatile sectors.

- Focusing on operational efficiency to improve productivity and reduce costs.

- Investing in technology to improve efficiency and competitiveness.

Policy Recommendations

Policymakers will need to carefully consider measures to support economic growth and mitigate the negative impacts of the slowdown. This might include:

- Targeted fiscal policies to support vulnerable sectors and households.

- Monetary policy adjustments to balance inflation control with economic growth.

- Investments in infrastructure and human capital to promote long-term growth.

Conclusion

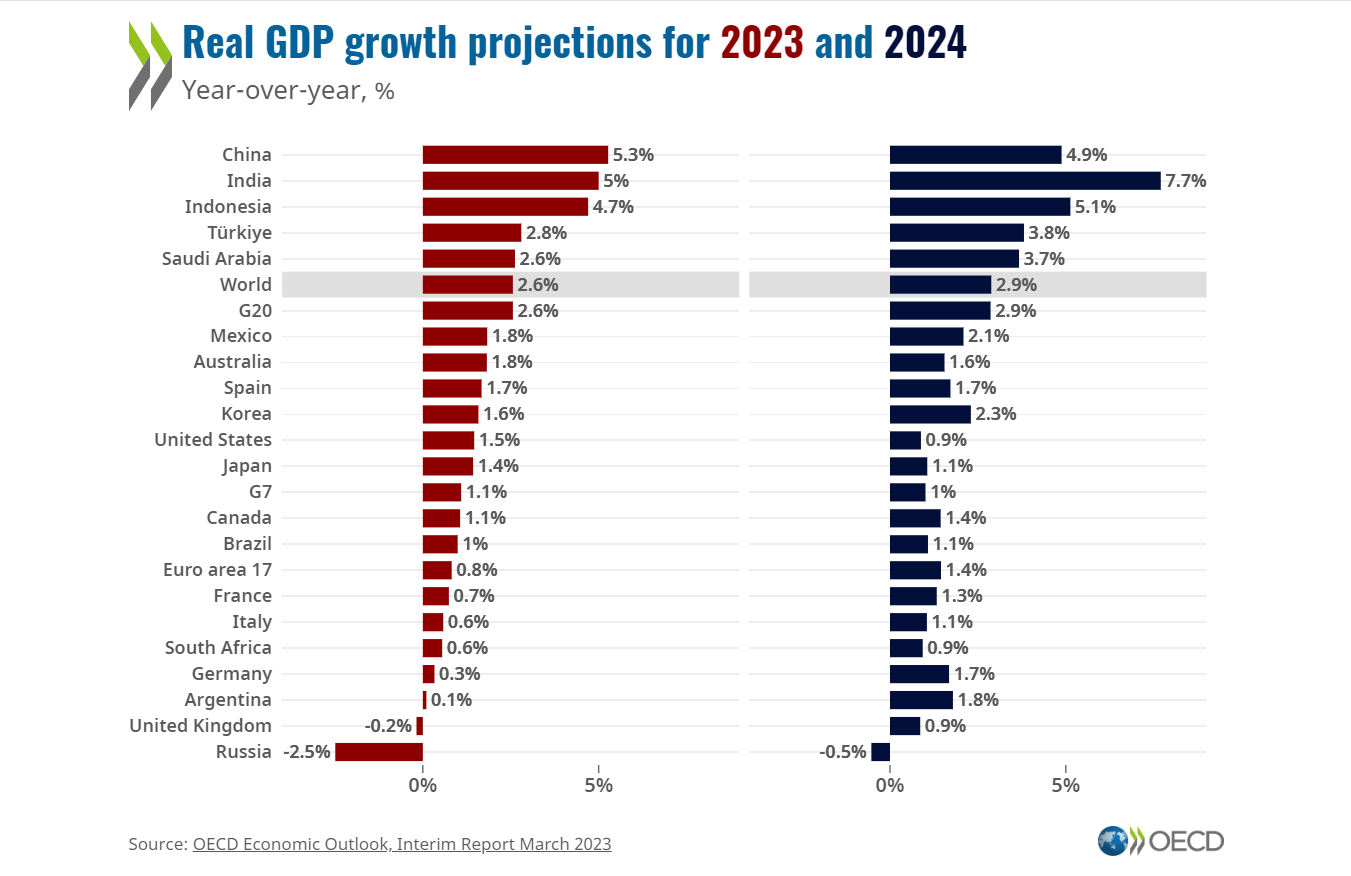

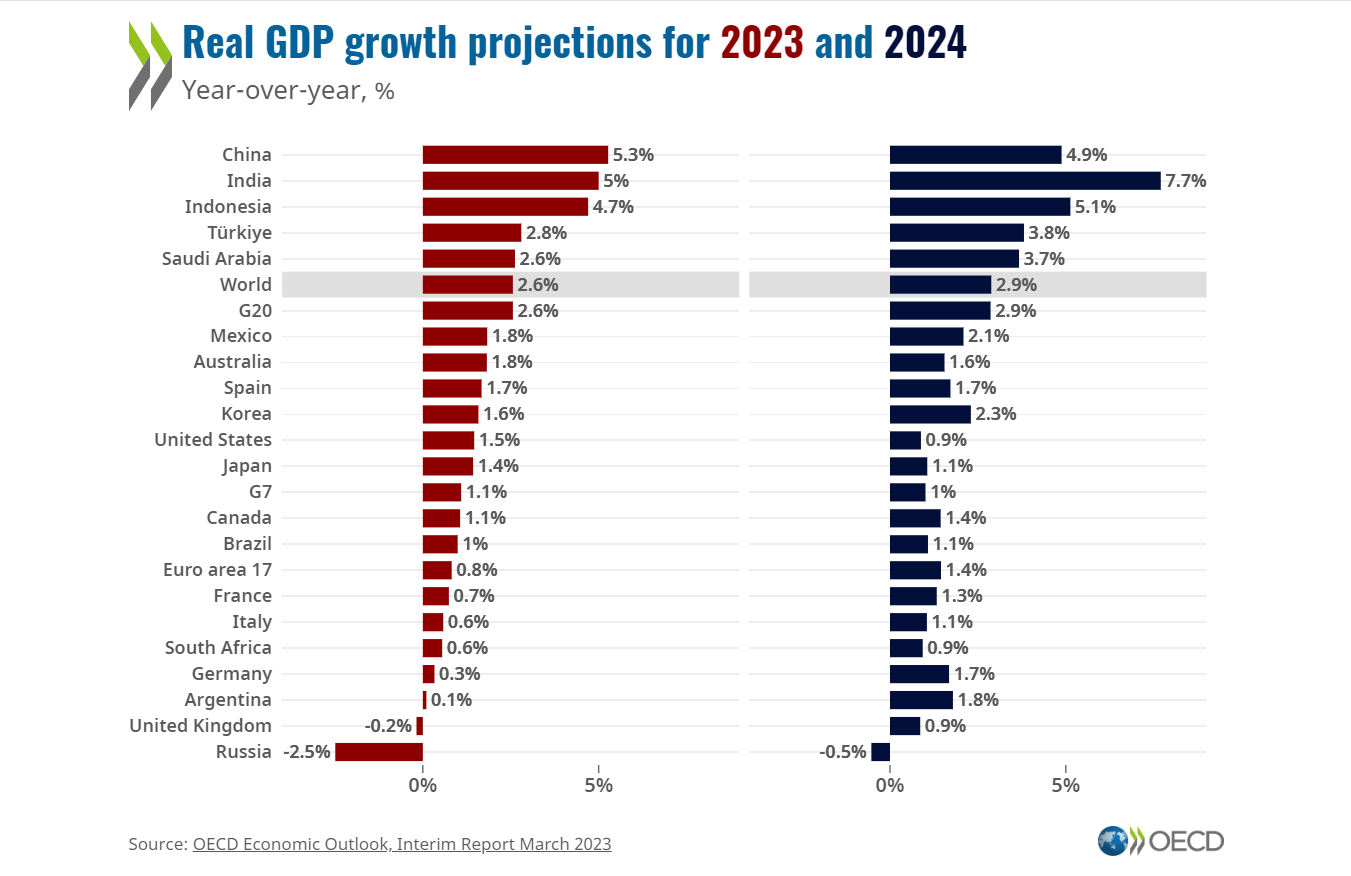

Deloitte's forecast of a significant slowdown in US economic growth presents a serious challenge. The confluence of inflationary pressures, rising interest rates, and geopolitical uncertainty paints a complex picture with potential negative consequences across various sectors. Understanding the key drivers of this slowdown and heeding Deloitte's recommendations – for both businesses and policymakers – is crucial for navigating this challenging period. Stay informed about further developments regarding US economic growth and adapt your strategies accordingly. Regularly review Deloitte's analyses and other reputable economic forecasts to make informed decisions and mitigate potential risks. Careful monitoring of US economic growth indicators is vital for successful business planning and investment decisions.

Featured Posts

-

Celebrating A Happy Day February 20 2025

Apr 27, 2025

Celebrating A Happy Day February 20 2025

Apr 27, 2025 -

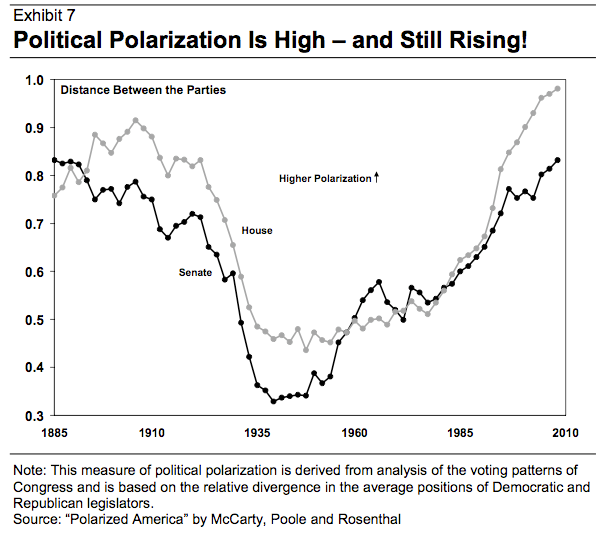

Political Polarization In Canada The Alberta Rest Of Canada Divide On Trump

Apr 27, 2025

Political Polarization In Canada The Alberta Rest Of Canada Divide On Trump

Apr 27, 2025 -

Ramiro Helmeyer A Dedication To Fc Barcelonas Glory

Apr 27, 2025

Ramiro Helmeyer A Dedication To Fc Barcelonas Glory

Apr 27, 2025 -

Lifting The Farm Imports Ban Progress In South Africa Tanzania Discussions

Apr 27, 2025

Lifting The Farm Imports Ban Progress In South Africa Tanzania Discussions

Apr 27, 2025 -

Canadian Voters Face Choice Trumps Trade Agenda And Carneys Concerns

Apr 27, 2025

Canadian Voters Face Choice Trumps Trade Agenda And Carneys Concerns

Apr 27, 2025

Latest Posts

-

Cybercriminals Office365 Scheme Millions Gained From Executive Inbox Breaches

Apr 28, 2025

Cybercriminals Office365 Scheme Millions Gained From Executive Inbox Breaches

Apr 28, 2025 -

Federal Investigation Millions Made From Executive Office365 Account Hacks

Apr 28, 2025

Federal Investigation Millions Made From Executive Office365 Account Hacks

Apr 28, 2025 -

Office365 Data Breach Hacker Makes Millions Targeting Executive Inboxes

Apr 28, 2025

Office365 Data Breach Hacker Makes Millions Targeting Executive Inboxes

Apr 28, 2025 -

Millions Stolen Office365 Breach Nets Criminal Millions Fbi Investigation Reveals

Apr 28, 2025

Millions Stolen Office365 Breach Nets Criminal Millions Fbi Investigation Reveals

Apr 28, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025