Deutsche Bank And FinaXai Partner On Tokenized Funds Servicing

Table of Contents

Enhanced Efficiency and Reduced Costs in Funds Servicing

Tokenization, facilitated by finaXai's innovative technology, is poised to dramatically streamline funds servicing at Deutsche Bank. The core benefits lie in significant cost reduction and enhanced operational efficiency. By leveraging blockchain and its inherent capabilities, many previously manual processes are automated, leading to substantial savings and improvements.

- Automated transaction processing: Manual intervention is minimized, reducing human error and processing time.

- Real-time settlement: The immediate settlement of transactions eliminates delays, boosting liquidity and improving cash flow management.

- Reduced reliance on intermediaries: The decentralized nature of blockchain reduces the need for multiple intermediaries, thereby lowering costs and increasing speed.

- Improved transparency and auditability: A permanent, auditable record of all transactions enhances trust and security, simplifying compliance procedures. This enhanced transparency also contributes significantly to cost reduction by streamlining audits.

The Role of finaXai's Technology in Tokenization

finaXai plays a pivotal role in this transformation, providing the technological backbone for Deutsche Bank's foray into tokenized funds. Their robust blockchain platform offers a secure and scalable infrastructure for managing digital assets, including the creation and management of tokenized funds. The platform's features extend beyond simple tokenization; it offers comprehensive digital asset management capabilities.

- Secure and scalable blockchain infrastructure: finaXai’s platform is designed to handle high transaction volumes while ensuring data security and integrity.

- Robust smart contract functionality for automated processes: Smart contracts automate various aspects of funds servicing, including transaction processing, fee calculations, and compliance checks, reducing manual intervention and associated costs.

- User-friendly interface for managing tokenized assets: The platform is designed to be intuitive and easy to navigate, enabling efficient management of tokenized funds.

- Seamless API integration with existing financial systems: finaXai's platform seamlessly integrates with Deutsche Bank's existing infrastructure, minimizing disruption and maximizing efficiency.

Benefits of Utilizing Smart Contracts

The integration of smart contracts is key to the success of this initiative. These self-executing contracts automate key processes, leading to:

- Automation: Smart contracts automate various tasks, reducing manual effort and associated costs.

- Transparency: All transactions and agreements are recorded on the blockchain, creating a transparent and auditable trail.

- Security: The immutable nature of the blockchain enhances security and reduces the risk of fraud.

- Compliance: Smart contracts can be programmed to automatically enforce regulatory compliance, minimizing the risk of penalties.

Implications for the Future of Funds Servicing

This partnership between Deutsche Bank and finaXai has profound implications for the future of funds servicing. It signifies a significant step towards the wider adoption of tokenization and blockchain technology within the financial industry.

- Increased accessibility and participation in the financial markets: Tokenization lowers the barrier to entry for investors, making financial markets more accessible.

- Faster and more efficient cross-border transactions: Blockchain technology streamlines cross-border transactions, reducing delays and costs.

- Enhanced security and reduced fraud risk: The inherent security features of blockchain significantly reduce the risk of fraud and cyberattacks.

- Potential for new financial products and services: Tokenization opens doors for the creation of innovative financial products and services. This is a key driver of fintech innovation and digital transformation.

Conclusion

The collaboration between Deutsche Bank and finaXai using tokenized funds represents a paradigm shift in funds servicing. By leveraging blockchain technology and smart contracts, this partnership offers significant improvements in efficiency, cost savings, and security. This innovative approach not only benefits the participating institutions but also paves the way for a more transparent, secure, and efficient financial future. Learn more about the potential of tokenized funds servicing and how blockchain technology is reshaping the financial landscape. Visit the Deutsche Bank and finaXai websites for further information.

Featured Posts

-

Jw 24 Klmat Alshykh Fysl Alhmwd Bmnasbt Eyd Astqlal Almmlkt Alardnyt Alhashmyt

May 30, 2025

Jw 24 Klmat Alshykh Fysl Alhmwd Bmnasbt Eyd Astqlal Almmlkt Alardnyt Alhashmyt

May 30, 2025 -

Unveiling The Baim Collection Stories From A Lifetime Ago

May 30, 2025

Unveiling The Baim Collection Stories From A Lifetime Ago

May 30, 2025 -

Us Sanctions Targeting Countries With Censorship Of Online Platforms

May 30, 2025

Us Sanctions Targeting Countries With Censorship Of Online Platforms

May 30, 2025 -

Roland Garros 2024 Djokovic Gauff And Andreeva Secure Opening Round Wins

May 30, 2025

Roland Garros 2024 Djokovic Gauff And Andreeva Secure Opening Round Wins

May 30, 2025 -

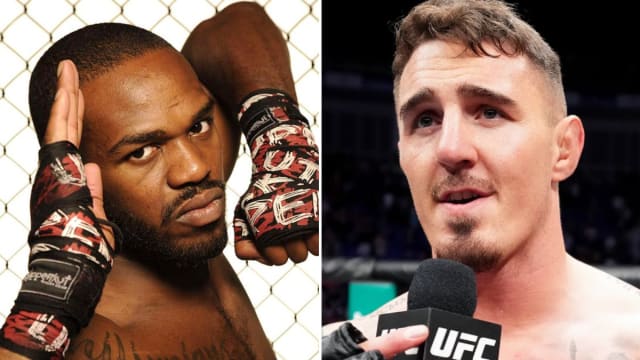

Jon Jones Mocks Tom Aspinall Amidst Ufc Return Delay

May 30, 2025

Jon Jones Mocks Tom Aspinall Amidst Ufc Return Delay

May 30, 2025