Deutsche Bank Bolsters Defense Finance With Dedicated New Deals Team

Table of Contents

The Growing Importance of Defense Finance

The defense finance sector is experiencing unprecedented growth, driven by a confluence of factors. The increasing demand for financial services within this sector reflects a complex and evolving global landscape. This requires specialized financial expertise and tailored solutions.

-

Rise in global defense spending: Global geopolitical instability and the ongoing modernization of military capabilities across numerous nations are leading to a significant surge in defense budgets worldwide. This increased spending translates directly into a higher demand for financing options for large-scale defense projects, acquisitions, and technological advancements.

-

Increased complexity of defense projects: Modern defense projects are increasingly complex, involving intricate technological integrations, international collaborations, and long-term development cycles. This complexity demands sophisticated financial structuring and risk management capabilities, far beyond what traditional financial institutions can offer.

-

Need for specialized financial expertise in navigating regulatory hurdles: The defense industry is heavily regulated, with strict export controls, sanctions, and compliance requirements. Navigating these complexities requires specialized expertise in international law, trade regulations, and financial compliance, ensuring transactions are conducted ethically and legally.

-

Growth in private investment in defense technologies: The rise of private investment in defense-related technologies, particularly in areas like artificial intelligence, cybersecurity, and autonomous systems, necessitates access to specialized financial services catering to the unique requirements of these ventures. This includes venture capital, private equity, and other investment vehicles specifically designed for the defense technology sector.

Deutsche Bank's New Deals Team: Structure and Expertise

Deutsche Bank's newly formed defense finance team is structured to provide comprehensive financial solutions tailored to the specific needs of the defense industry. The team comprises a diverse group of seasoned professionals with deep industry expertise.

-

Team Composition: The team includes experienced Relationship Managers responsible for building and maintaining client relationships, highly skilled Structuring Specialists adept at designing complex financial instruments, and seasoned Legal Counsel ensuring full regulatory compliance.

-

Areas of Expertise: The team possesses extensive experience across various aspects of defense finance, including mergers and acquisitions (M&A), project finance, debt financing, and equity investments. Their expertise spans advising on defense contractor acquisitions, financing large-scale defense projects, and providing financial solutions for innovative defense technologies.

-

Unique Capabilities: A key differentiator is the team’s deep understanding of international arms trade regulations and export control laws. This allows them to provide seamless guidance and support to clients navigating the intricacies of international defense transactions. This expertise is crucial in facilitating efficient and compliant transactions within the global defense sector.

Strategic Implications for Deutsche Bank

The creation of this dedicated team represents a significant strategic move for Deutsche Bank, offering several key advantages:

-

Increased market share: By specializing in defense finance, Deutsche Bank positions itself to capture a significant share of this rapidly expanding market, outpacing competitors who lack specialized expertise.

-

Enhanced reputation and brand recognition: Establishing itself as a leading player in defense finance enhances Deutsche Bank's reputation and brand recognition within the defense industry, attracting new clients and strengthening existing relationships.

-

Potential for new revenue streams and long-term growth: The defense finance sector presents a substantial opportunity for generating new revenue streams and achieving long-term sustainable growth. The specialized nature of the services offered ensures high profitability.

-

Competitive advantage: This dedicated team provides a significant competitive advantage over other financial institutions that lack the same depth of industry knowledge and specialized capabilities.

Impact on the Defense Industry

Deutsche Bank's initiative has far-reaching implications for the defense industry:

-

Improved access to capital: Defense companies will gain improved access to capital, facilitating faster project development, acquisitions, and technological innovation. This enhanced access directly contributes to the sector's overall growth.

-

Enhanced efficiency and speed in completing transactions: The specialized expertise of the team ensures that defense-related transactions are completed more efficiently and with greater speed, reducing delays and streamlining the process.

-

Facilitating innovation and growth: By providing access to capital and specialized financial expertise, the team facilitates innovation and growth within the defense sector, enabling companies to invest in cutting-edge technologies and expand their operations.

-

Potential impact on government defense procurement processes: The presence of a dedicated team specializing in defense finance may influence government procurement processes by offering more efficient and structured financing options for government-funded defense projects.

Conclusion:

Deutsche Bank's creation of a dedicated new deals team for defense finance demonstrates a strategic commitment to a rapidly growing sector. By assembling a team of highly specialized experts, Deutsche Bank is poised to capitalize on the increasing demand for sophisticated financial solutions within the defense industry. This initiative not only strengthens Deutsche Bank’s position in the market but also promises to benefit defense companies and the industry as a whole by providing more efficient and effective access to crucial financial resources. For companies seeking expert guidance and support in navigating the complexities of defense finance, Deutsche Bank’s new team offers a significant advantage. Learn more about Deutsche Bank's commitment to defense finance solutions by visiting [link to Deutsche Bank's website].

Featured Posts

-

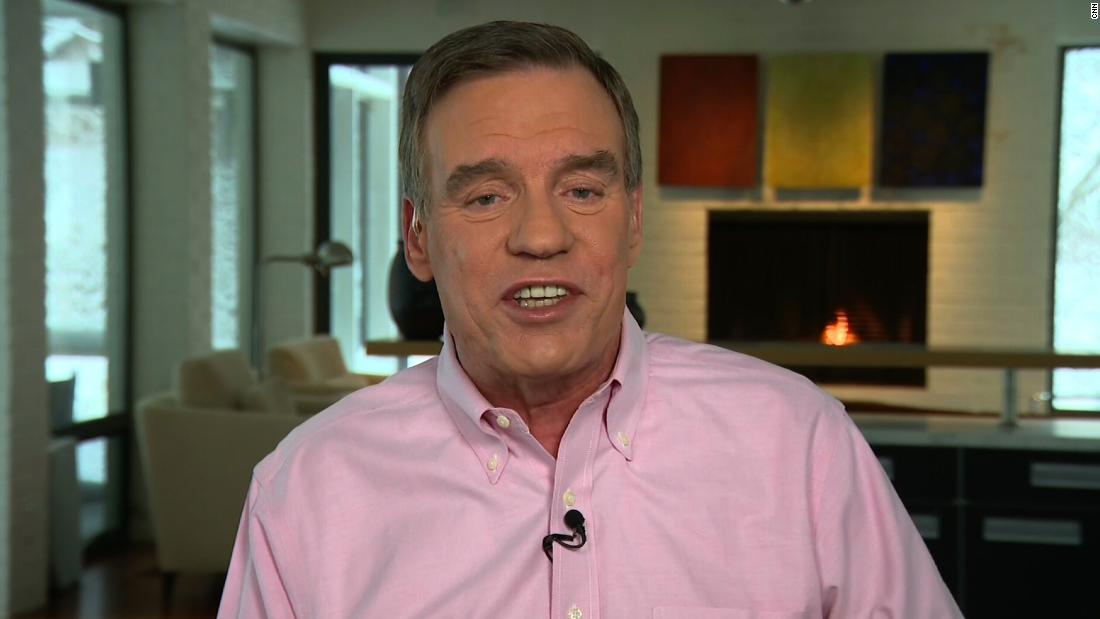

Mark Warner On Trumps Unwavering Tariff Stance

May 10, 2025

Mark Warner On Trumps Unwavering Tariff Stance

May 10, 2025 -

El Salvador Gang Violence And The Kilmar Abrego Garcia Case A Us Political Debate

May 10, 2025

El Salvador Gang Violence And The Kilmar Abrego Garcia Case A Us Political Debate

May 10, 2025 -

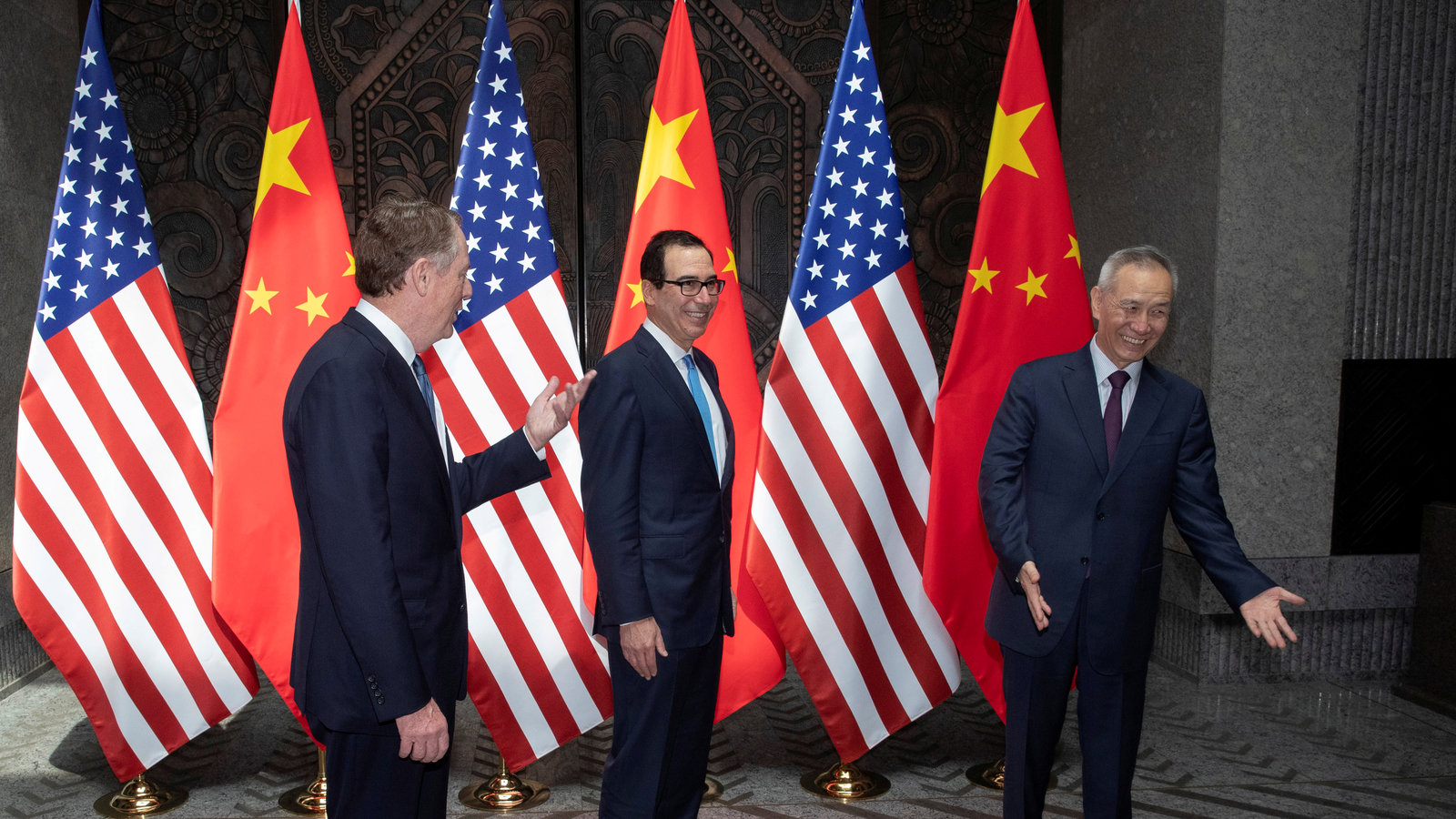

U S China Trade Talks Exclusive Focus On Security Concerns

May 10, 2025

U S China Trade Talks Exclusive Focus On Security Concerns

May 10, 2025 -

Potential Changes To Uk Visa Policy Restrictions On Certain Nationalities

May 10, 2025

Potential Changes To Uk Visa Policy Restrictions On Certain Nationalities

May 10, 2025 -

Le Tramway De Dijon S Agrandit Debut De La Concertation Pour La Ligne 3

May 10, 2025

Le Tramway De Dijon S Agrandit Debut De La Concertation Pour La Ligne 3

May 10, 2025