Deutsche Bank: Depositary Bank For Epiroc's ADR Programs

Table of Contents

Understanding the Role of a Depositary Bank in ADR Programs

A depositary bank, in the context of American Depositary Receipts (ADRs), acts as a crucial intermediary between a foreign company (like Epiroc) and US investors. They are responsible for several key functions that ensure the smooth and compliant trading of ADRs on US exchanges. Think of them as custodians, ensuring the safekeeping and efficient transfer of ownership of these securities.

-

Facilitating ADR Trading: Depositary banks like Deutsche Bank handle the issuance, registration, and transfer of ADRs, making them readily available for trading on US stock exchanges. This simplifies the process for US investors wanting exposure to international companies.

-

Record-Keeping and Shareholder Services: They maintain accurate records of ADR ownership, facilitating dividend payments and other shareholder communications. This is crucial for regulatory compliance and maintaining investor confidence. They act as a transfer agent, handling the complexities of shareholder transactions.

-

Regulatory Compliance: A key responsibility is ensuring compliance with all relevant US securities regulations. This involves adhering to reporting requirements and ensuring the integrity of the ADR program.

-

Distinction from other Intermediaries: It's important to differentiate a depositary bank from other entities involved in ADR trading, such as brokers and custodians. While custodians may hold the underlying securities, the depositary bank manages the ADR program itself. The selection of a reputable depositary bank is paramount; it directly impacts the efficiency and security of the entire process.

Benefits of Deutsche Bank as Epiroc's Depositary Bank

Deutsche Bank's selection as Epiroc's depositary bank offers several significant benefits for both the company and its investors.

-

Global Reach and Reputation: Deutsche Bank's extensive global network and strong reputation instill investor confidence. This is particularly important for international investments, as it signals trust and stability.

-

Enhanced Efficiency: Deutsche Bank's expertise in managing ADR programs translates to more efficient processing of transactions, minimizing delays and operational risks for both Epiroc and its investors.

-

Wider Investor Base: By partnering with a globally recognized bank, Epiroc gains access to a broader range of potential investors, increasing liquidity and potentially boosting the value of its ADRs.

-

Improved Transaction Processing and Reduced Operational Risks: The bank's infrastructure and experience minimize the risks associated with international transactions, creating a more streamlined and reliable process for all stakeholders.

Impact on Epiroc Investors

The choice of Deutsche Bank directly impacts the experience of Epiroc investors.

-

Simplified ADR Trading: Investors benefit from smoother and more efficient buying and selling of Epiroc ADRs, facilitated by Deutsche Bank's robust systems and processes.

-

Increased Market Liquidity: A well-managed ADR program, like the one facilitated by Deutsche Bank, increases the liquidity of Epiroc ADRs, making it easier for investors to enter and exit their positions.

-

Improved Access to Investment Opportunities: The partnership enhances access to this investment opportunity for a wider pool of US investors.

-

Streamlined Transactions and Reliable Shareholder Services: Investors benefit from reliable and efficient communication and transaction processing, minimizing administrative burdens. This contributes positively to overall Return on Investment (ROI).

Deutsche Bank's Expertise in Global Financial Markets

Deutsche Bank's long-standing presence in global financial markets brings significant expertise to Epiroc's ADR program.

-

Extensive Experience: Their decades of experience in managing complex international financial transactions provide a strong foundation for ensuring the smooth functioning of the ADR program.

-

Regulatory Navigation: They possess in-depth knowledge of the intricacies of US securities regulations, ensuring compliance and mitigating potential risks.

-

Risk Management: Their robust risk management practices provide an additional layer of security for Epiroc and its investors, ensuring the stability and security of the ADR program.

Conclusion

This article outlined the significant role Deutsche Bank plays as the depositary bank for Epiroc's ADR programs. We've explored the functions of a depositary bank, the advantages this partnership provides to Epiroc and its investors, and Deutsche Bank's overall expertise in the global financial market. Choosing a reputable depositary bank is crucial for the smooth functioning of ADR programs, and Deutsche Bank's involvement assures efficient and secure transactions for Epiroc and its stakeholders.

Call to Action: Learn more about investing in Epiroc ADRs and the benefits of Deutsche Bank's depositary services. Research Epiroc's ADR program and understand the role of a depositary bank in your investment strategy. Consider the implications of this relationship when making investment decisions related to Epiroc's American Depositary Receipts (ADRs) and Deutsche Bank's key role.

Featured Posts

-

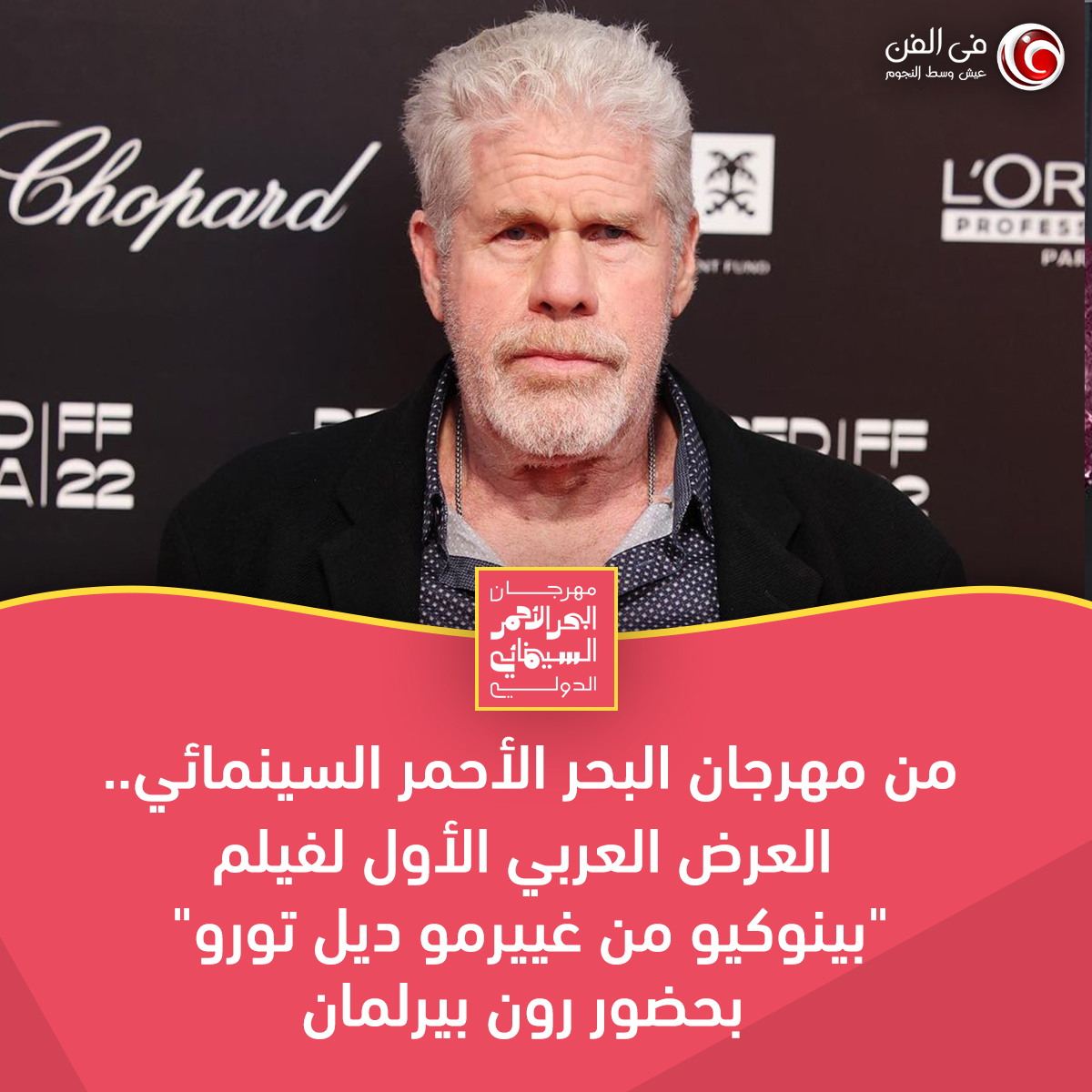

Almksyk Thtfl Dyl Twrw Yntsr Fy Jyrw Iytalya Khbr Eajl Mn Jrydt Alryad

May 30, 2025

Almksyk Thtfl Dyl Twrw Yntsr Fy Jyrw Iytalya Khbr Eajl Mn Jrydt Alryad

May 30, 2025 -

Pinar Deniz Kaan Yildirim Ogullari Fikret Hakan La Ilk Kare

May 30, 2025

Pinar Deniz Kaan Yildirim Ogullari Fikret Hakan La Ilk Kare

May 30, 2025 -

Update Kawasaki Versys X 250 2025 Warna Baru Dan Performa Andal

May 30, 2025

Update Kawasaki Versys X 250 2025 Warna Baru Dan Performa Andal

May 30, 2025 -

Agassi Rios Uno De Mis Principales Oponentes

May 30, 2025

Agassi Rios Uno De Mis Principales Oponentes

May 30, 2025 -

Deutsche Bank Investigates Data Center Security Incident Involving Contractor

May 30, 2025

Deutsche Bank Investigates Data Center Security Incident Involving Contractor

May 30, 2025