Deutsche Bank's New Deals Team: Strengthening Its Position In Defense Finance

Table of Contents

The Growing Importance of Defense Finance

Global defense spending is experiencing a significant surge, creating a wealth of opportunities for financial institutions specializing in this sector. Increased geopolitical instability, the modernization of military equipment, and the rise of private military and security companies (PMSCs) are all key drivers of this growth. We're seeing substantial increases in defense budgets across key regions, particularly in Europe and the Asia-Pacific region. This translates to a massive demand for sophisticated financial solutions tailored to the unique needs of the defense industry.

- Increased geopolitical instability driving defense spending: The ongoing conflicts and rising tensions worldwide have led governments to significantly increase their defense budgets.

- Modernization of military equipment requiring significant financing: The development and procurement of advanced weaponry and technology necessitate substantial financial investments.

- Growing demand for sophisticated financial solutions within the defense sector: Defense projects often require complex financing structures, including export financing, project finance, and structured debt solutions.

- Rise of private military and security companies needing financial support: The increasing involvement of PMSCs in global security operations creates further demand for specialized financial services.

Deutsche Bank's New Deals Team: Composition and Expertise

Deutsche Bank's new deals team is structured to provide comprehensive financial services to the defense industry. The team comprises senior personnel with extensive experience in mergers and acquisitions (M&A), debt financing, and project finance within the sector. Their expertise goes beyond traditional banking, encompassing a deep understanding of the regulatory complexities surrounding defense transactions, significant international transaction experience, and specialized cybersecurity knowledge, crucial in this data-sensitive industry.

- Key personnel profiles and their relevant experience: The team boasts individuals with proven track records in handling large-scale defense contracts and transactions.

- Specific expertise in defense-related financing instruments: The team possesses in-depth knowledge of export financing, government contract financing, and other specialized instruments commonly utilized in defense projects.

- The team's ability to navigate complex regulatory environments (ITAR, EAR): A strong understanding of the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR) is essential for success in this sector, and this team possesses that expertise.

Strategic Advantages and Market Positioning

Deutsche Bank's competitive advantage in the defense finance market stems from its established global network, its existing client base within related industries, and its advanced technological capabilities. The bank possesses strong relationships with key players in the defense industry, including original equipment manufacturers (OEMs) and government agencies. Furthermore, Deutsche Bank has invested heavily in sophisticated risk assessment models specifically designed to evaluate the unique risks associated with defense projects.

- Strong relationships with key players in the defense industry (OEMs, governments): These pre-existing relationships provide the team with valuable access to deal flow and facilitate smoother transactions.

- Sophisticated risk assessment models specific to defense projects: The bank's ability to accurately assess and mitigate risk is a critical factor in attracting clients.

- Use of technology and data analytics to improve due diligence and efficiency: Leveraging technology streamlines processes and enhances the quality of due diligence.

- Deutsche Bank's global reach and understanding of international defense markets: The bank's international presence allows them to support clients involved in global defense projects.

Focus Areas for Deutsche Bank in Defense Finance

Deutsche Bank is targeting several key niches within the defense finance landscape. This includes financing for the development of advanced weapon systems, facilitating mergers and acquisitions within the defense sector, and financing infrastructure development for military bases and related facilities.

- Specific examples of recent deals or transactions undertaken by the team: While specifics may be confidential, general examples of deal types can be highlighted to showcase the team's activity.

- Geographical focus areas for their defense finance initiatives: Highlighting specific regions where Deutsche Bank is concentrating its efforts can further emphasize its strategic focus.

- Potential partnerships with other organizations within the defense ecosystem: Exploring potential collaborations with defense contractors or technology providers adds another layer of strategic depth.

Conclusion

The establishment of Deutsche Bank's new deals team represents a significant commitment to the burgeoning defense finance sector. By leveraging its extensive experience, global network, and specialized expertise, Deutsche Bank is well-positioned to become a leading player in this dynamic market. The bank's strategic focus on key areas within defense finance, combined with its robust risk management framework, promises a successful and impactful presence. To stay informed on the latest developments in Deutsche Bank's defense finance activities, and to explore how they can support your organization’s needs, visit [link to Deutsche Bank's relevant webpage]. Learn more about how Deutsche Bank is shaping the future of Deutsche Bank Defense Finance.

Featured Posts

-

Aeroport Permi Zakryt Podrobnosti O Snegopade I Zaderzhkakh Reysov

May 09, 2025

Aeroport Permi Zakryt Podrobnosti O Snegopade I Zaderzhkakh Reysov

May 09, 2025 -

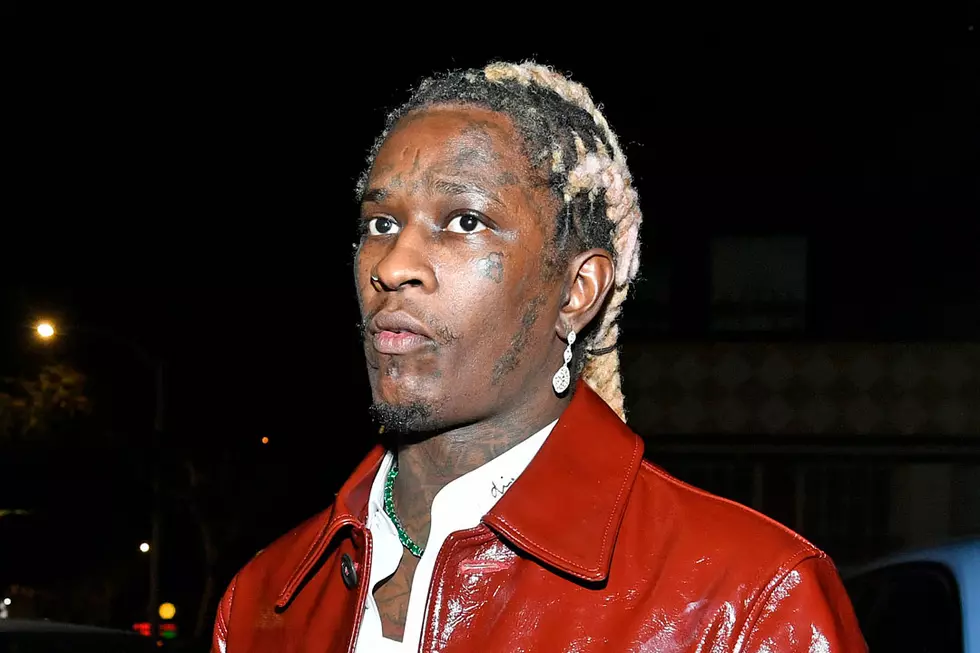

Young Thugs Upcoming Album Uy Scuti Release Date Speculation

May 09, 2025

Young Thugs Upcoming Album Uy Scuti Release Date Speculation

May 09, 2025 -

Imf To Review Pakistans 1 3 Billion Package Amidst India Tensions

May 09, 2025

Imf To Review Pakistans 1 3 Billion Package Amidst India Tensions

May 09, 2025 -

Uy Scuti Young Thugs New Album Expected Release Date

May 09, 2025

Uy Scuti Young Thugs New Album Expected Release Date

May 09, 2025 -

From 3 K Babysitter To 3 6 K Daycare Avoiding Costly Childcare Mistakes

May 09, 2025

From 3 K Babysitter To 3 6 K Daycare Avoiding Costly Childcare Mistakes

May 09, 2025