Did Trump Tariffs Influence The Bank Of Canada's April Interest Rate Consideration?

Table of Contents

The Economic Impact of Trump Tariffs on Canada

The Trump administration's imposition of tariffs on various goods, including Canadian lumber and aluminum, significantly impacted the Canadian economy. These "Trump tariffs," part of a broader trade war, created ripples throughout various sectors, affecting trade volumes, business costs, and overall GDP growth. Trump's trade protectionism disrupted established trade relationships and introduced significant uncertainty into the Canadian economic landscape.

- Decreased exports to the US in key sectors: The tariffs imposed directly hindered Canadian exports of lumber and aluminum to the US, leading to reduced revenues for Canadian businesses and a contraction in these key export-oriented sectors.

- Increased costs for Canadian businesses relying on US imports: Retaliatory tariffs imposed by Canada in response to the US tariffs increased the cost of US imports for many Canadian businesses, adding inflationary pressure to input costs.

- Potential inflationary pressures due to supply chain disruptions: The trade war and resulting tariffs disrupted established supply chains, impacting the availability and cost of goods, contributing to inflationary pressures within the Canadian economy.

- Weakening of the Canadian dollar: The uncertainty created by the trade war and the negative impact on Canadian exports contributed to a weakening of the Canadian dollar relative to the US dollar, further complicating the economic outlook. This impacted various sectors reliant on international trade.

The Bank of Canada's Mandate and Responsibilities

The Bank of Canada's primary mandate is to maintain price stability and full employment. This dual mandate necessitates a delicate balancing act, requiring the Bank to consider a multitude of economic indicators and external factors when making monetary policy decisions. External shocks, such as the trade wars initiated by the Trump administration, significantly complicate this process.

- Maintaining inflation within the target range: The Bank of Canada aims to keep inflation within a specific target range, typically around 2%. The inflationary pressures caused by Trump's trade protectionism presented a significant challenge to achieving this goal.

- Promoting sustainable economic growth: The Bank strives to foster sustainable and inclusive economic growth. Trade disruptions stemming from Trump tariffs created uncertainty and potentially dampened investment and economic growth.

- Assessing risks to the Canadian economy, including external shocks: A core function of the Bank of Canada involves monitoring and assessing various economic risks, including those emanating from external sources, such as international trade disputes. The impact of Trump tariffs formed a significant component of this risk assessment.

Analyzing the April Interest Rate Decision in the Context of Trump Tariffs

The Bank of Canada's official statement regarding the April 2023 interest rate decision did not explicitly mention Trump tariffs as a primary factor. However, the lingering economic effects of these tariffs, including persistent inflationary pressures and supply chain disruptions, were likely considered within the broader assessment of economic conditions. Analyzing the economic data from around April 2023 provides further context.

- Direct quotes from the Bank of Canada's press releases: While not explicitly mentioning Trump tariffs, the statements might reflect concerns about persistent inflationary pressures, which could indirectly be attributed to the lingering effects of these tariffs.

- Analysis of economic indicators relevant to the decision: Inflation rates, GDP growth, and unemployment figures around April 2023 were likely closely scrutinized by the Bank of Canada. Deviations from the expected trajectory could be partly linked to the lingering effects of past trade disruptions.

- Expert opinions from economists on the impact of tariffs on the Bank's decision: Various economists have offered differing perspectives on the weight of Trump tariffs in the Bank's April 2023 decision. Some argue their indirect effects were significant, while others point to other dominant factors.

Alternative Explanations for the Bank of Canada's Decision

While the lingering impact of Trump tariffs undoubtedly played a role, it's crucial to acknowledge other factors influencing the Bank of Canada's April 2023 interest rate decision. Attributing the decision solely to Trump's trade protectionism would be an oversimplification.

- Global economic slowdown: Global economic conditions, including potential slowdowns in key trading partners, can influence the Bank of Canada's decision-making.

- Domestic investment trends: Changes in domestic investment levels and consumer spending also play significant roles in shaping monetary policy decisions.

- Fluctuations in commodity prices: Canada's reliance on commodity exports makes it vulnerable to fluctuations in global commodity prices, which can impact inflation and economic growth, hence influencing the Bank's actions.

Conclusion

The potential influence of Trump tariffs on the Bank of Canada's April 2023 interest rate consideration is multifaceted and complex. While the Bank's official statement didn't explicitly mention them, the lingering effects on inflation, supply chains, and the overall economic landscape were undoubtedly factors in the decision-making process. Other global and domestic economic variables also played significant roles. To understand the full complexity, one needs to analyze a wide range of economic indicators and consider various expert opinions. To further understand the ongoing impacts of trade policies on the Bank of Canada's interest rate decisions, explore the Bank's official publications and continue the conversation around the influence of Trump tariffs on Canadian monetary policy.

Featured Posts

-

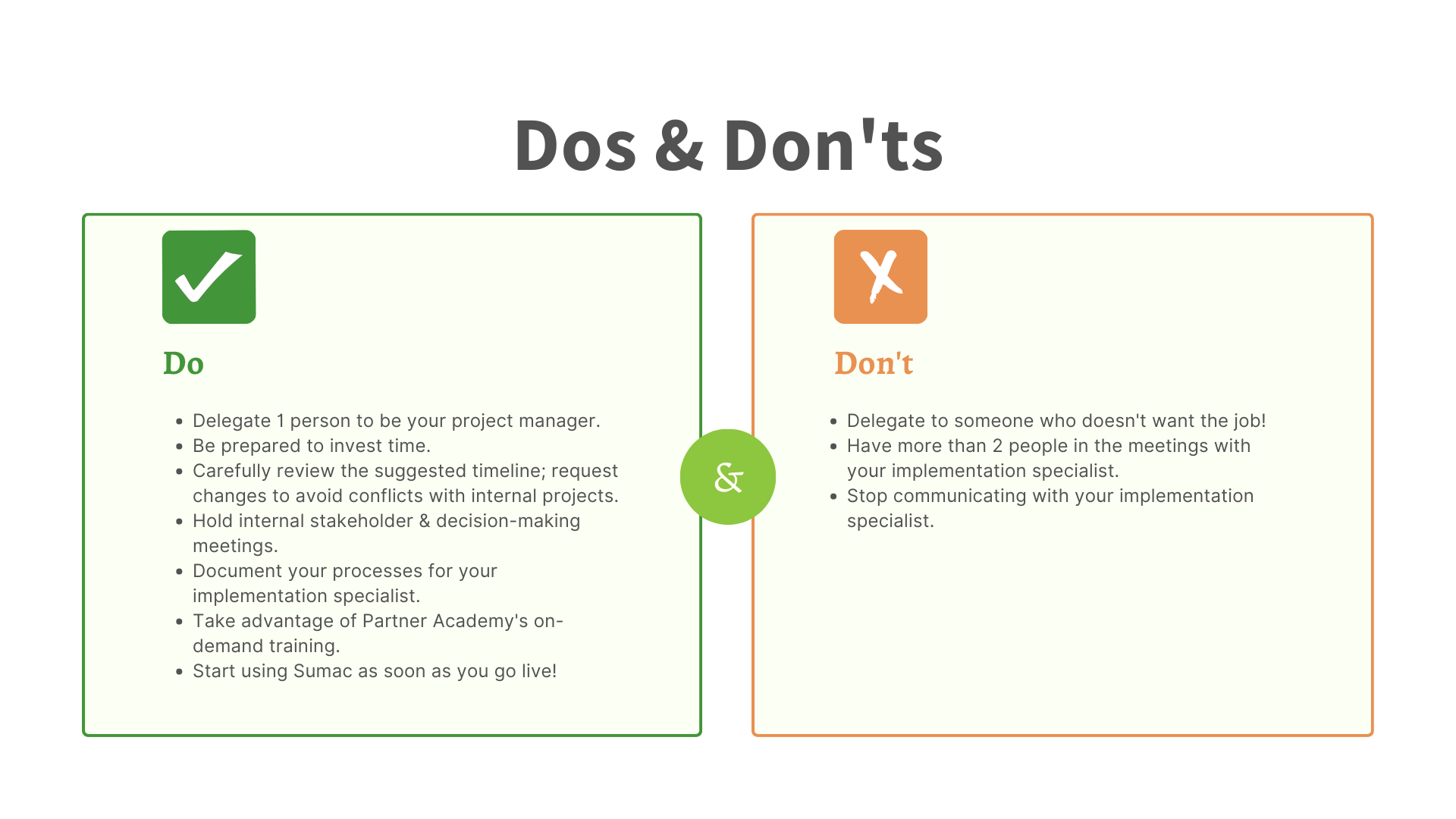

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

May 02, 2025

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

May 02, 2025 -

Avrupa Is Birligi Yeni Bir Doenem Basliyor

May 02, 2025

Avrupa Is Birligi Yeni Bir Doenem Basliyor

May 02, 2025 -

Fortnite Refund Indicates Potential Overhaul Of Cosmetic System

May 02, 2025

Fortnite Refund Indicates Potential Overhaul Of Cosmetic System

May 02, 2025 -

Help Tulsas Homeless Winter Clothing Drive At The Day Center

May 02, 2025

Help Tulsas Homeless Winter Clothing Drive At The Day Center

May 02, 2025 -

Energiecrisis Bio Based Scholen Zoeken Naar Alternatieven Voor Dieselgeneratoren

May 02, 2025

Energiecrisis Bio Based Scholen Zoeken Naar Alternatieven Voor Dieselgeneratoren

May 02, 2025