Did Trump Tariffs Kill The Affirm Holdings (AFRM) IPO? A Deep Dive

Table of Contents

The Economic Climate Surrounding the AFRM IPO

The Impact of Trump Tariffs on Consumer Spending

The Trump tariffs, implemented as part of a broader trade war, significantly impacted the US economy. These tariffs led to:

- Increased Inflation: Higher prices on imported goods, resulting from tariffs, directly reduced consumer purchasing power. This is especially true for goods heavily reliant on imported components, affecting various sectors.

- Decreased Consumer Confidence: Uncertainty surrounding trade disputes and rising prices eroded consumer confidence, leading to a more cautious spending approach. Consumers were less likely to engage in discretionary spending, including purchases facilitated by BNPL services.

- Specific Goods Affected: Tariffs targeted numerous goods, including electronics, apparel, and furniture – items frequently purchased using Buy Now Pay Later options. This directly impacted Affirm's target demographic.

- Shift in Consumer Spending Patterns: Consumers reacted to increased prices by shifting purchasing habits, prioritizing essential goods and delaying non-essential purchases. This decrease in overall spending negatively affected the BNPL sector’s growth.

Economic data from the period, including consumer price index (CPI) reports and consumer confidence surveys, corroborate this negative impact on consumer spending.

The Global Trade War and Investor Sentiment

The Trump-era trade war created significant market volatility.

- Increased Market Volatility: The uncertainty surrounding trade negotiations led to significant fluctuations in market indices like the S&P 500 and Dow Jones Industrial Average.

- Decreased Investor Risk Appetite: Increased uncertainty caused investors to become more risk-averse, leading to a flight to safety and less investment in riskier assets, including newly public companies like Affirm.

- Impact on IPO Valuations: The negative investor sentiment directly impacted IPO valuations, potentially leading to lower pricing for the AFRM IPO than might have been seen under more stable economic conditions. Data on market indices and IPO performance during this period supports this observation.

Affirm's Business Model and Vulnerability to Macroeconomic Factors

The BNPL Sector's Sensitivity to Economic Downturns

The Buy Now Pay Later (BNPL) sector, while experiencing rapid growth, is inherently vulnerable to economic downturns.

- Increased Risk of Defaults: During periods of high inflation and potential job losses, consumers are more likely to default on their BNPL payments, impacting the profitability of BNPL companies.

- Correlation Between Spending Power and BNPL Usage: BNPL services thrive on consumer spending power. A decline in consumer spending, directly linked to Trump tariffs, inevitably reduces the demand for BNPL services.

Affirm's Specific Exposure to Tariff-Related Impacts

While Affirm's business model is diversified across various merchants, the company wasn't entirely immune to the indirect effects of the trade war.

- Merchant Base Impact: If a significant portion of Affirm's merchant base was heavily reliant on imported goods subject to tariffs, their sales might have declined, directly affecting Affirm's revenue.

- E-commerce Slowdown: A general slowdown in e-commerce, partly attributed to decreased consumer spending caused by tariffs, could have negatively affected Affirm's revenue streams.

- Mitigation Strategies: Affirm likely employed diversification strategies to reduce risk, but the extent of this mitigation and its effectiveness remains subject to further analysis.

Alternative Explanations for the AFRM IPO Performance

Market-wide Conditions Beyond Tariffs

The performance of the AFRM IPO wasn't solely determined by Trump tariffs. Other factors contributed:

- General Market Corrections: The broader market experienced corrections and fluctuations unrelated to trade wars. These market corrections could have independently affected the IPO's initial performance.

- Tech Sector Performance: The overall performance of the technology sector during the IPO period also played a role. A downturn in the tech sector would negatively impact technology IPOs like Affirm.

- BNPL Competition: The competitive landscape within the BNPL sector also influenced Affirm's IPO performance. The presence of established competitors and emerging players impacted market share and investor interest.

Specific Factors Related to Affirm's Business

Internal factors also influenced investor perception and the AFRM IPO's outcome:

- Business Model Strengths and Weaknesses: Affirm's business model, while innovative, had its inherent strengths and weaknesses that investors considered.

- Pre-IPO Financial Performance: Affirm's financial performance leading up to the IPO played a key role in shaping investor expectations.

- Investor Perception: Internal factors such as management team reputation and the company's overall narrative influenced investor perception and the IPO's success.

Conclusion

This deep dive explored the potential correlation between the Trump tariffs, the resulting economic climate, and the performance of the Affirm Holdings (AFRM) IPO. While the tariffs undoubtedly contributed to economic uncertainty and potentially impacted investor sentiment, a complete picture requires considering other macroeconomic conditions and Affirm’s internal factors. We've analyzed the impact of tariffs on consumer spending, investor confidence, and Affirm's specific business model vulnerabilities. The full extent of the tariffs’ impact on the AFRM IPO remains a complex question demanding further research.

Call to Action: To further understand the intricate relationship between trade policies and the financial markets, continue researching the impact of Trump tariffs and their effects on other IPOs. Understanding the interplay between global trade and the success of companies like Affirm is crucial for investors and business leaders alike. Stay informed about the evolving landscape of the Buy Now Pay Later (BNPL) sector and the ongoing effects of trade policies on the market. Learn more about how to assess the risks of investing in companies vulnerable to macroeconomic factors, especially in the face of future trade conflicts. Further investigation into the impact of Trump tariffs on the AFRM IPO is encouraged.

Featured Posts

-

On Transgender Day Of Visibility How A Gender Euphoria Scale Can Improve Mental Well Being

May 14, 2025

On Transgender Day Of Visibility How A Gender Euphoria Scale Can Improve Mental Well Being

May 14, 2025 -

Debate Erupts Spanish Broadcaster Questions Israels Eurovision Participation

May 14, 2025

Debate Erupts Spanish Broadcaster Questions Israels Eurovision Participation

May 14, 2025 -

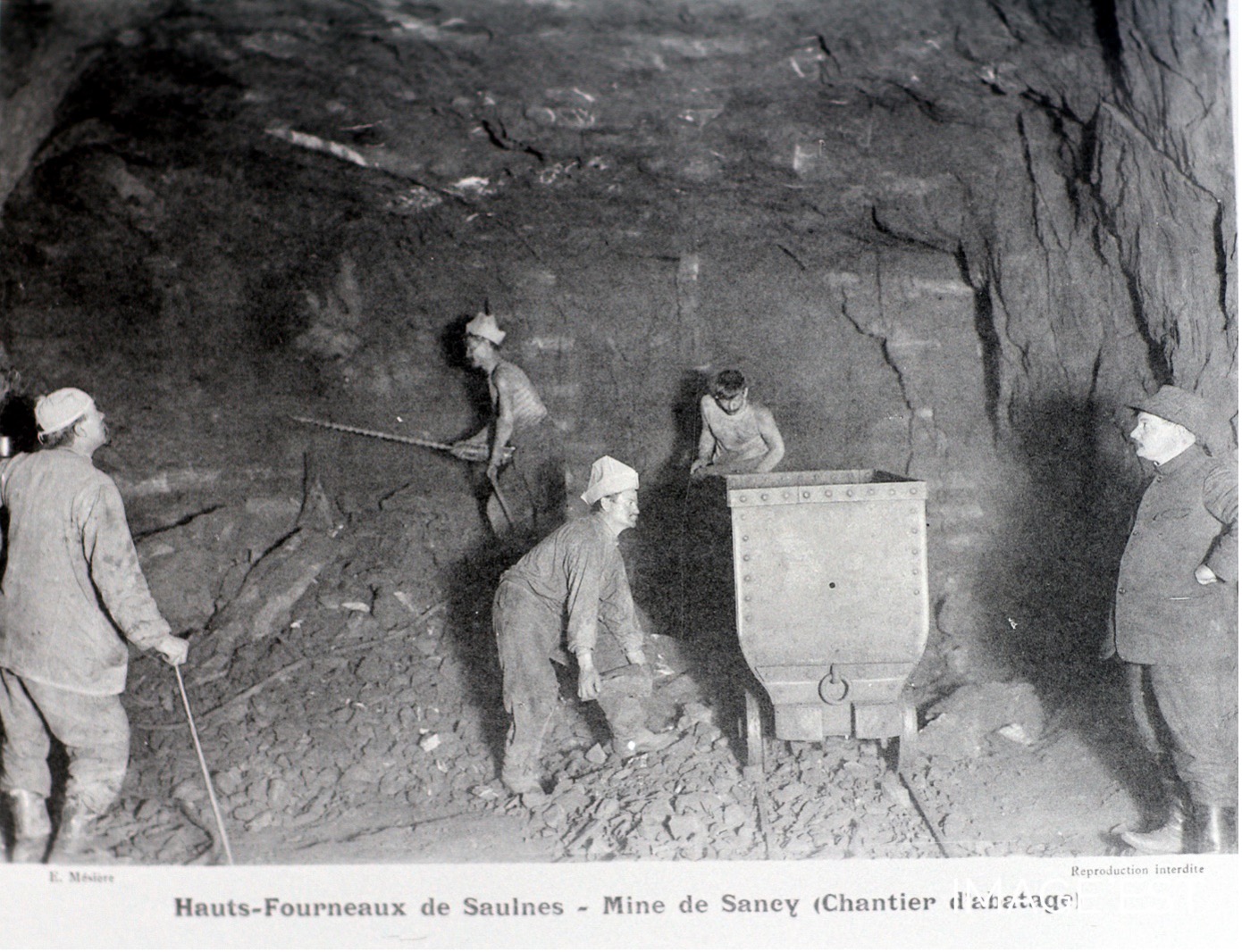

Oqtf Et Mineurs Le Choc Des Camarades Face A L Expulsion De Deux Collegiens

May 14, 2025

Oqtf Et Mineurs Le Choc Des Camarades Face A L Expulsion De Deux Collegiens

May 14, 2025 -

Dean Huijsen The Premier Leagues Latest Transfer Target

May 14, 2025

Dean Huijsen The Premier Leagues Latest Transfer Target

May 14, 2025 -

Guia Para Disfrutar Las Euforias Deleznables

May 14, 2025

Guia Para Disfrutar Las Euforias Deleznables

May 14, 2025