Did Warren Buffett Sell Apple At The Perfect Time? A Market Analysis

Table of Contents

Berkshire Hathaway's Apple Investment History

Berkshire Hathaway's journey with Apple stock is a compelling case study in long-term investment strategies. The initial investment, a strategic move, marked the beginning of a significant partnership between the legendary investor and the tech behemoth. Let's trace the key milestones:

- Year of initial Apple investment: Berkshire Hathaway started acquiring Apple stock in 2016.

- Approximate initial investment amount: While the exact initial investment amount isn't publicly available, it's known that Berkshire Hathaway significantly increased its holdings over subsequent years.

- Key dates of significant stock purchases/increases: Substantial purchases were made throughout 2016, 2017, and beyond, reflecting a strong belief in Apple's long-term growth potential.

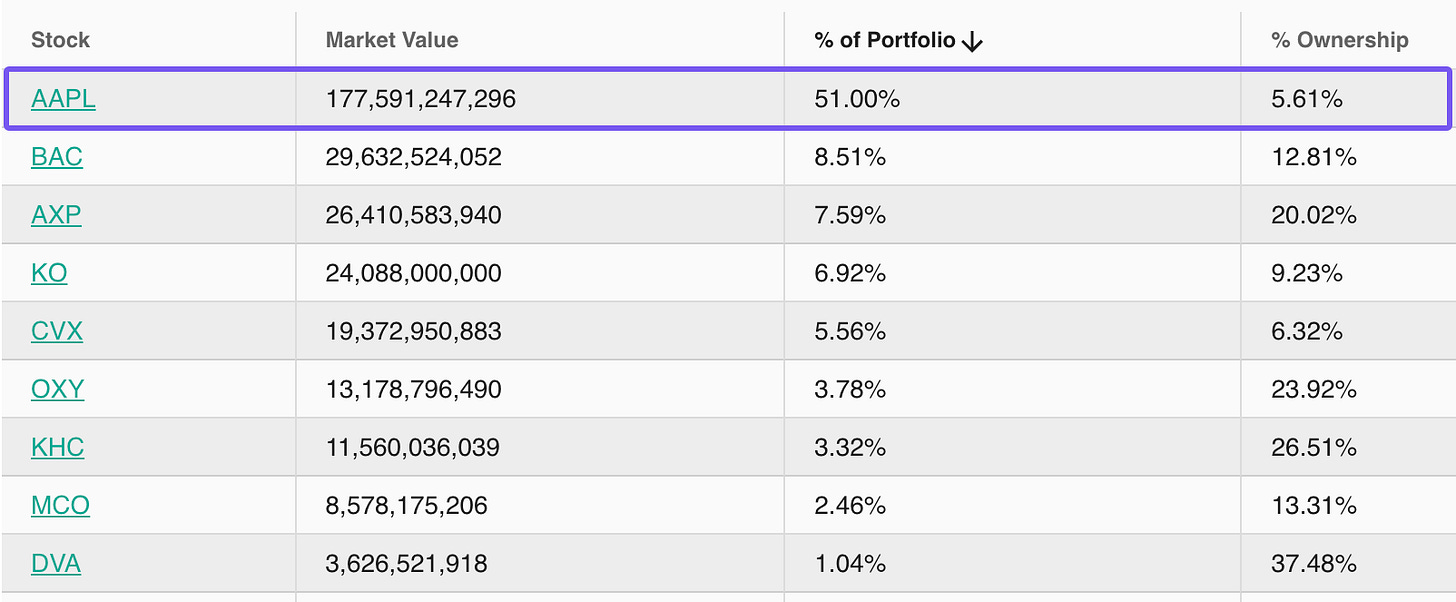

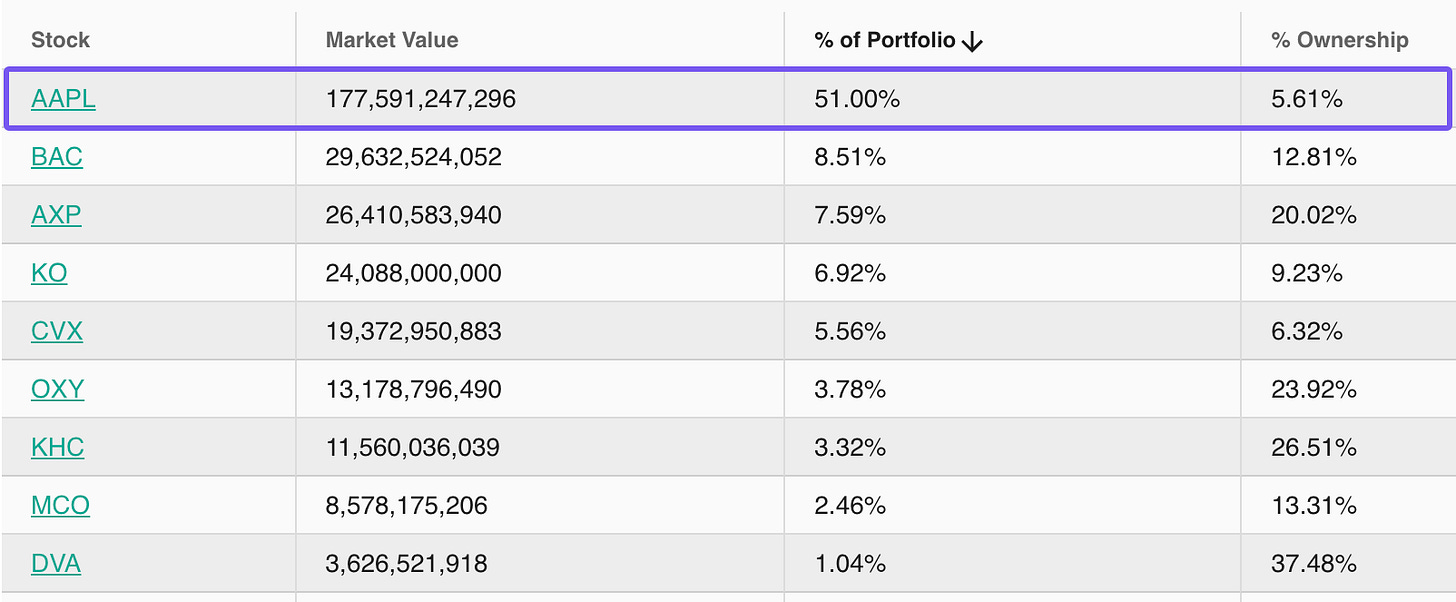

- Current holdings (as of October 26, 2023): As of the latest SEC filings, Berkshire Hathaway holds a significant stake in Apple, although the exact number of shares fluctuates due to periodic buying and selling.

- Any previous instances of partial selling and the reasons stated: Berkshire Hathaway has trimmed its Apple holdings on several occasions. While specific reasons are not always explicitly stated, it's often interpreted as a part of portfolio diversification or profit-taking strategies.

Market Analysis During the Period of Potential Apple Stock Sales

Analyzing the market climate surrounding Berkshire Hathaway's recent Apple stock adjustments is crucial. Several factors must be considered to evaluate whether the timing was optimal:

- Relevant economic indicators (inflation, interest rates, etc.): During the periods of potential Apple stock sales, macroeconomic factors like inflation and interest rate hikes have influenced overall market sentiment and investor behavior. Higher interest rates can lead to lower valuations for growth stocks.

- Performance of the tech sector during the period: The tech sector itself experienced volatility during this period. Growth stocks, including Apple, were affected by broader market trends and concerns about valuations.

- Key Apple product launches or events: New product releases and significant events like Apple's announcements regarding its services division and its ongoing transition to its own silicon chips have played a role in shaping investor expectations and Apple's stock performance.

- Apple's financial performance during this time (revenue, earnings, etc.): Apple's consistent strong financial performance, though facing some recent slowdown in growth, has played a significant role in maintaining investor confidence. However, concerns about supply chain disruptions and slowing global economic growth have influenced stock prices.

- Any significant news impacting Apple’s stock price: News regarding competition, regulatory challenges, or changes in consumer demand could create fluctuations in Apple's stock price.

Evaluating Buffett's Investment Strategy and Timing

Buffett's investment philosophy centers around identifying undervalued companies with strong fundamentals and holding them for the long term. His Apple investment aligns with this strategy. Analyzing the reasons behind Berkshire Hathaway's decisions:

- Summary of Buffett's core investment principles: Value investing, long-term perspective, understanding business models, and risk management are cornerstones of Buffett's approach.

- Potential reasons for selling Apple stock (e.g., profit-taking, repositioning portfolio): Profit-taking is a common reason for reducing holdings in any stock, particularly after substantial gains. Repositioning the portfolio to allocate capital elsewhere, diversifying investments, or responding to evolving market conditions might also influence decisions.

- Comparison to similar past decisions: It's instructive to compare Berkshire Hathaway's actions with previous investment decisions to discern any patterns or deviations from Buffett's typical strategy.

- Expert opinions on Buffett's decision-making process: Financial experts have offered varying interpretations of Buffett’s actions, highlighting the complexity of deciphering the legendary investor's motives.

Alternative Perspectives and Future Predictions

Opinions diverge sharply on whether Buffett's moves concerning Apple stock represent perfect timing:

- Opinions from different financial experts: Analysts hold diverse views, with some believing the sales were prudent given potential market headwinds, while others suggest that further growth opportunities remained.

- Arguments for and against Buffett’s timing being optimal: Arguments in favor cite potential market corrections and the need for diversification. Arguments against highlight Apple's continued growth potential and the strong fundamentals of the company.

- Predictions for future Apple stock performance: Future predictions for Apple stock are highly speculative, contingent upon various economic and industry factors.

- Potential risks and opportunities for Apple investors: Long-term investors should carefully weigh the risks of market volatility against the potential long-term growth of Apple's business.

Conclusion

Analyzing the Warren Buffett Apple Stock situation reveals a complex interplay of factors. Market conditions, Berkshire Hathaway's investment history, and the inherent uncertainties of market predictions all contribute to the difficulty of definitively declaring whether the timing of any sales was "perfect." While some argue that profit-taking and portfolio diversification were sound strategies, others point to Apple’s continued growth trajectory. Ultimately, the decision's success will only be fully apparent in hindsight.

Call to Action: Continue researching the Warren Buffett Apple Stock situation! Explore financial news sources, analyze Apple's financial reports, and engage in thoughtful discussions. Share your own perspectives in the comments below. Understanding Warren Buffett's investment strategies and market dynamics remains crucial for navigating the complexities of the stock market.

Featured Posts

-

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025 -

2025 Yankees Offensive Explosion 9 Home Runs Judges Historic Night

Apr 23, 2025

2025 Yankees Offensive Explosion 9 Home Runs Judges Historic Night

Apr 23, 2025 -

Ray Epps Defamation Lawsuit Against Fox News January 6th Falsehoods

Apr 23, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Falsehoods

Apr 23, 2025 -

Nine Stolen Bases Brewers Eclipse 33 Year Old Team Record

Apr 23, 2025

Nine Stolen Bases Brewers Eclipse 33 Year Old Team Record

Apr 23, 2025 -

Bu Aksamki Diziler 7 Nisan Pazartesi Tv Programi Rehberi

Apr 23, 2025

Bu Aksamki Diziler 7 Nisan Pazartesi Tv Programi Rehberi

Apr 23, 2025