Direct Lender Personal Loans: No Credit Check Needed?

Table of Contents

Understanding Direct Lender Personal Loans

Direct lender personal loans are loans obtained directly from a financial institution, such as a bank, credit union, or online lender, without using a third-party broker. Unlike loans offered through brokers or intermediaries, direct lender personal loans offer several advantages. The most significant benefit is increased transparency; you interact directly with the lender throughout the entire loan process, from application to repayment. This direct communication often leads to a faster processing time and, depending on your creditworthiness and the lender's policies, potentially better interest rates.

- Avoid hidden fees common with brokers: Brokers often charge additional fees that are not always transparent. Direct lenders typically have simpler, more straightforward fee structures.

- Simpler application process: Dealing directly with the lender streamlines the application process, making it often quicker and easier than going through a broker.

- Direct communication with the lender: This allows for easier clarification of terms, faster responses to queries, and a more personalized experience.

The Reality of "No Credit Check" Personal Loans

The phrase "no credit check" is often misleading. While a traditional hard credit check, which impacts your credit score, might not be performed, lenders still assess your risk. They accomplish this by using alternative credit data or a soft credit pull, which doesn't affect your credit score. This assessment is crucial for lenders to determine your creditworthiness and the associated risk involved in lending you money. Consequently, borrowers with poor credit history or limited credit history should expect higher interest rates and potentially stricter lending criteria compared to those with good credit.

- Lenders use alternative data: This may include your employment history, bank statements, income verification, and other financial data points to gauge your ability to repay the loan.

- Expect higher APRs than those with good credit: The higher risk associated with borrowers lacking a strong credit history often translates to a higher annual percentage rate (APR) on the loan.

- "No credit check" often means a simplified credit assessment: It doesn't mean no assessment at all; it simply means a different approach to evaluating your creditworthiness.

Types of Alternative Credit Checks

Lenders utilize several methods to assess risk without solely relying on traditional credit scores. These alternative credit checks often involve:

- Bank statement analysis: Lenders review your bank statements to evaluate your income, expenses, and overall financial stability.

- Employment verification: Confirming your employment status and income provides lenders with assurance of your repayment ability.

- Alternative credit bureaus: Some lenders utilize alternative credit bureaus that collect data from sources beyond the traditional credit reporting agencies.

Finding Reputable Direct Lenders

Navigating the world of online lending requires caution. It is crucial to identify legitimate direct lenders and avoid predatory lenders who may charge exorbitant fees or have unfavorable terms. Here's how to find reputable direct lenders:

- Verify lender licensing and registration: Check if the lender is licensed and registered in your state or jurisdiction. This helps ensure they operate legally and adhere to consumer protection laws.

- Look for transparent fee structures: Avoid lenders with hidden fees or unclear fee schedules. A reputable lender will clearly outline all associated costs upfront.

- Read online reviews from other borrowers: Reviews provide valuable insights into a lender's reputation, customer service, and loan processing efficiency. Look for consistent positive feedback and avoid lenders with overwhelmingly negative reviews.

Alternatives to Direct Lender Loans with No Credit Check

If securing a direct lender personal loan proves challenging, explore alternative options:

- Secured loans using assets as collateral: Offering collateral, such as a car or savings account, can significantly improve your chances of loan approval, even with a poor credit history. However, be mindful of the risks involved in using assets as collateral.

- Seeking a co-signer with good credit: A co-signer with a strong credit history can vouch for your repayment ability, increasing your likelihood of loan approval and potentially securing better interest rates.

- Utilizing credit-building apps or secured credit cards: These tools can help you improve your credit score over time, making you a more attractive candidate for personal loans in the future.

Conclusion

While "direct lender personal loans with no credit check" are frequently advertised, it's essential to understand that lenders always assess risk. Although a traditional credit check might be bypassed, alternative methods are employed. Higher interest rates are expected for those with limited or poor credit history. Borrowers should carefully research and compare lenders to find the best option for their individual circumstances.

Call to Action: Before applying for a direct lender personal loan, thoroughly research your options and compare offers to find the most suitable and transparent loan for your needs. Remember to be cautious of lenders promising loans with "no credit check" and prioritize reputable, licensed direct lenders. Don't hesitate to explore alternative routes to secure financing if direct lender personal loans prove unsuitable.

Featured Posts

-

Alcaraz And Swiatek Contrasting Fortunes Ahead Of French Open

May 28, 2025

Alcaraz And Swiatek Contrasting Fortunes Ahead Of French Open

May 28, 2025 -

Homeowner Data At Risk Privacy Regulators Warning On New Cabinet Rules

May 28, 2025

Homeowner Data At Risk Privacy Regulators Warning On New Cabinet Rules

May 28, 2025 -

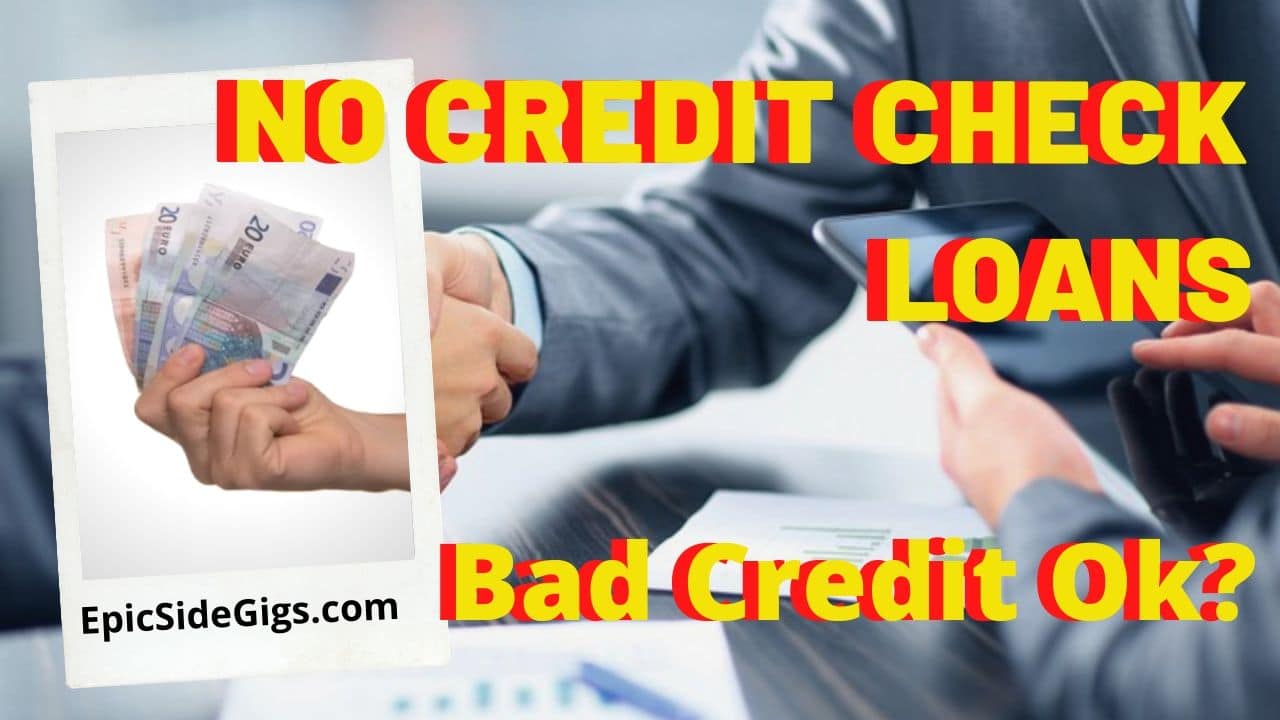

Info Cuaca Bali Besok Berawan Hujan Lokal Di Beberapa Wilayah

May 28, 2025

Info Cuaca Bali Besok Berawan Hujan Lokal Di Beberapa Wilayah

May 28, 2025 -

Prakiraan Cuaca Besok Di Bali Denpasar Diprediksi Hujan Lebat

May 28, 2025

Prakiraan Cuaca Besok Di Bali Denpasar Diprediksi Hujan Lebat

May 28, 2025 -

Analyzing Nintendos Current Trajectory Safe Bets And Potential Growth

May 28, 2025

Analyzing Nintendos Current Trajectory Safe Bets And Potential Growth

May 28, 2025

Latest Posts

-

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Controversee

May 30, 2025

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Controversee

May 30, 2025 -

Lutte D Influence A L Assemblee Nationale Rn Vs Lfi Sur La Question Des Frontieres

May 30, 2025

Lutte D Influence A L Assemblee Nationale Rn Vs Lfi Sur La Question Des Frontieres

May 30, 2025 -

Assemblee Nationale Tensions Entre Le Rn Et Lfi Le Role Des Questions Frontalieres

May 30, 2025

Assemblee Nationale Tensions Entre Le Rn Et Lfi Le Role Des Questions Frontalieres

May 30, 2025 -

Situation Critique A Florange Intervention Urgente Pour Les Rats A Bouton D Or

May 30, 2025

Situation Critique A Florange Intervention Urgente Pour Les Rats A Bouton D Or

May 30, 2025 -

Elections Assemblee Nationale Le Rn Tente De Contrer Lfi Sur Le Theme Des Frontieres

May 30, 2025

Elections Assemblee Nationale Le Rn Tente De Contrer Lfi Sur Le Theme Des Frontieres

May 30, 2025