Direct Tribal Lender Loans: Guaranteed Approval Despite Bad Credit

Table of Contents

Understanding Direct Tribal Lender Loans

Direct tribal lender loans are offered by lending institutions owned and operated by Native American tribes. These loans differ from traditional loans offered by banks or credit unions primarily due to the unique legal and regulatory environment in which tribal lenders operate. "Tribal lenders" are financial institutions established on tribal land, leveraging tribal sovereignty to operate under different regulatory frameworks than state-licensed lenders.

- Tribal Sovereignty: This legal principle grants Native American tribes significant autonomy in governing their affairs, including financial regulations. This can lead to more flexible lending practices compared to traditional financial institutions.

- Flexible Lending Criteria: While not guaranteeing approval, tribal lenders often have more lenient credit score requirements than traditional lenders. They may place greater emphasis on factors like income and employment stability.

- Benefits and Drawbacks: Potential benefits include higher approval rates for those with bad credit and potentially faster processing times. However, it's crucial to be aware that interest rates and fees may be higher than with traditional loans. Thorough research is vital to compare offers and find the best terms.

Advantages of Direct Tribal Lender Loans for Bad Credit Borrowers

One of the most significant advantages of direct tribal lender loans is the potential for higher approval rates for individuals with bad credit. Traditional banks and credit unions often have stringent credit score requirements, making it difficult for those with a low credit history or past financial difficulties to secure loans.

- Higher Approval Rates: Tribal lenders may focus less on credit scores and more on income and repayment capacity, increasing the chances of approval even with a low credit score.

- Less Stringent Credit Score Requirements: Unlike traditional lenders who may automatically reject applications based on a low credit score, tribal lenders often consider other financial factors.

- Faster Processing Times: Some tribal lenders may offer faster loan processing than traditional institutions, providing quicker access to needed funds.

- Personalized Loan Terms: While not always the case, some tribal lenders may offer more personalized loan terms to suit individual financial situations.

Factors Affecting Approval for Direct Tribal Lender Loans

While direct tribal lender loans may offer a higher chance of approval for those with bad credit, approval isn't guaranteed. Several factors beyond your credit score will influence your application's success.

- Income and Employment: Stable income and consistent employment are crucial factors. Lenders want assurance that you can repay the loan.

- Debt-to-Income Ratio: Your debt-to-income ratio (DTI) – the percentage of your monthly income going towards debt payments – is a key indicator of your ability to manage additional debt. A lower DTI improves your chances of approval.

- Accurate Application Information: Providing accurate and complete information on your application is paramount. False information can lead to immediate rejection or even legal consequences.

- Understanding Loan Terms and Fees: Carefully review all loan terms, including interest rates, fees, and repayment schedule, before signing any agreement.

Finding Reputable Direct Tribal Lenders

The importance of researching and selecting a reputable direct tribal lender cannot be overstated. The lending landscape includes both legitimate and illegitimate operators. Protecting yourself from scams is crucial.

- Licensed and Registered Lenders: Verify that the lender is properly licensed and registered within their operating jurisdiction.

- Online Reviews and Testimonials: Check online reviews and testimonials from previous borrowers to gauge the lender's reputation and customer service.

- Avoid Guaranteed Approval Claims: Be wary of lenders promising guaranteed approval without proper verification. Legitimate lenders will assess your application thoroughly.

- Relevant Resources: Consult independent financial resources for guidance and advice before engaging with any lender.

Responsible Borrowing with Direct Tribal Lender Loans

Even with the potential benefits, responsible borrowing practices are essential. Understanding the terms and potential risks is crucial to avoid further financial hardship.

- Create a Budget: Before applying for any loan, create a detailed budget to ensure the loan payments are affordable within your current financial situation.

- Debt Consolidation or Credit Repair: Explore options for debt consolidation or credit repair to improve your financial standing before applying for a loan.

- Repayment Schedule and Default: Understand the loan's repayment schedule and the potential consequences of defaulting on payments.

Conclusion

Direct tribal lender loans offer a potential solution for individuals with bad credit seeking financial assistance. While they may have more lenient approval criteria than traditional lenders, it's crucial to understand the factors affecting approval and to choose a reputable lender. Remember, responsible borrowing is key. High interest rates and fees can exacerbate financial difficulties if not managed carefully. If you're seeking financial relief and need a loan despite bad credit, explore the option of direct tribal lender loans responsibly. Research carefully and choose a lender you trust. Remember to compare offers from multiple lenders before making a decision to ensure you are receiving the best possible terms for your individual circumstances.

Featured Posts

-

Close Eredivisie Title Race Ajax Leads Feyenoord And Psv Fight Back

May 28, 2025

Close Eredivisie Title Race Ajax Leads Feyenoord And Psv Fight Back

May 28, 2025 -

Gaza Ceasefire Deal On The Table Us Envoys Plea To Hamas

May 28, 2025

Gaza Ceasefire Deal On The Table Us Envoys Plea To Hamas

May 28, 2025 -

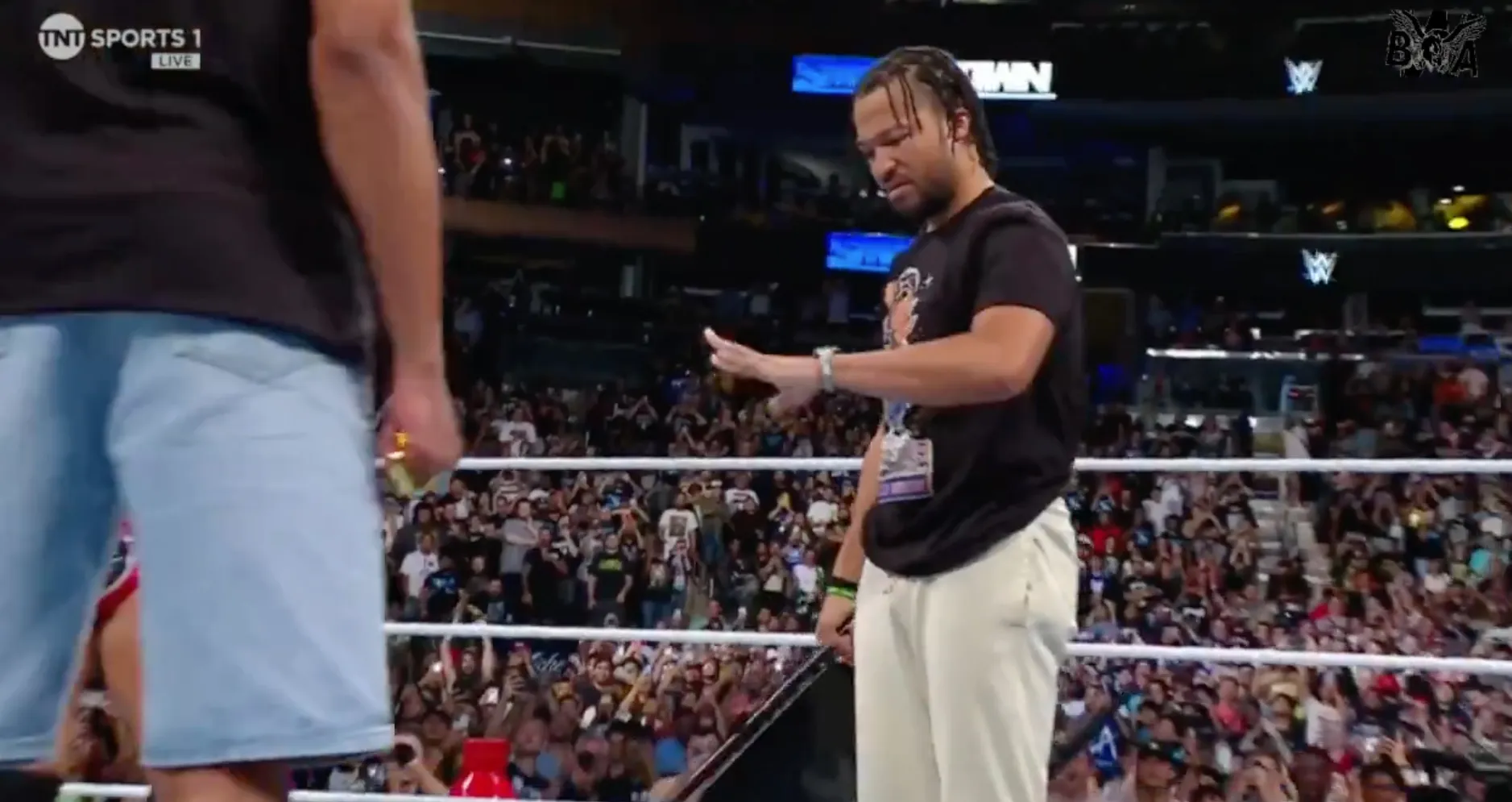

Nba News Jalen Brunson Addresses The Tyrese Haliburton Wwe Script

May 28, 2025

Nba News Jalen Brunson Addresses The Tyrese Haliburton Wwe Script

May 28, 2025 -

Update Cuaca Semarang Dan Jawa Tengah Hujan Diperkirakan Siang 22 April

May 28, 2025

Update Cuaca Semarang Dan Jawa Tengah Hujan Diperkirakan Siang 22 April

May 28, 2025 -

Sled Teylr Suift Khyu Dzhakman Zamesen V Skandala Mezhdu Bleyk Layvli I Dzhstin Baldoni

May 28, 2025

Sled Teylr Suift Khyu Dzhakman Zamesen V Skandala Mezhdu Bleyk Layvli I Dzhstin Baldoni

May 28, 2025

Latest Posts

-

France Vietnam Cooperation Renforcee Pour Une Mobilite Durable

May 30, 2025

France Vietnam Cooperation Renforcee Pour Une Mobilite Durable

May 30, 2025 -

Manifestation A Bordeaux Les Opposants A La Piste Secondaire Mobilises

May 30, 2025

Manifestation A Bordeaux Les Opposants A La Piste Secondaire Mobilises

May 30, 2025 -

L Autoroute A69 Justice Et Politique S Affrontent Sur Le Chantier

May 30, 2025

L Autoroute A69 Justice Et Politique S Affrontent Sur Le Chantier

May 30, 2025 -

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025 -

A69 Decisions Politiques Et Implications Judiciaires Du Projet Autoroutier

May 30, 2025

A69 Decisions Politiques Et Implications Judiciaires Du Projet Autoroutier

May 30, 2025