Dismissing High Stock Market Valuations: BofA's Rationale

Table of Contents

BofA's Argument: Low Interest Rates Justify Higher Valuations

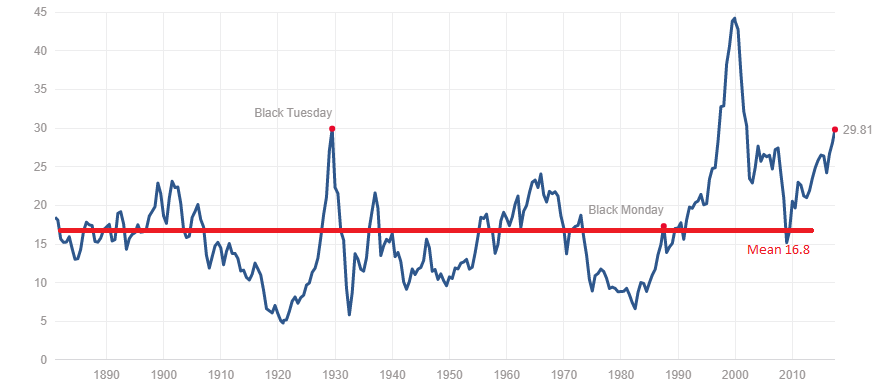

BofA's core argument rests on the powerful influence of low interest rates on company valuations. The relationship between interest rates and the stock market is inversely proportional; lower rates generally lead to higher valuations. This is because low interest rates allow companies to borrow money cheaply, boosting their earnings and, subsequently, justifying higher Price-to-Earnings (P/E) ratios.

-

Interest Rates and Company Valuations: Lower borrowing costs reduce the cost of capital for businesses, enabling them to invest more in expansion, research and development, and acquisitions. This translates directly into higher profits and increased shareholder value.

-

Low Borrowing Costs and Higher Profits: Companies can use readily available and inexpensive debt financing to fund profitable ventures, increasing their return on investment (ROI) and overall profitability. This increased profitability directly supports higher stock prices.

-

Examples of Beneficiaries: Many sectors have thrived in this low-interest-rate environment. Technology companies, for instance, often rely on debt financing for growth, and their valuations have soared. Similarly, real estate companies have benefitted from readily available mortgages, driving up property values and their related stock prices.

-

Supporting Data: While specific data points require referencing BofA's official reports, their analyses consistently highlight the impact of low interest rates on corporate earnings and subsequent market valuations. (Note: For precise data, refer to relevant BofA publications.)

The Role of Strong Corporate Earnings in Supporting Valuations

BofA also emphasizes the significant role of robust corporate earnings growth in supporting current stock market valuations. Strong earnings demonstrate the underlying health and profitability of companies, mitigating concerns about seemingly high P/E ratios.

-

Recent Corporate Earnings Reports: Recent financial reports across various sectors have revealed impressive earnings growth, exceeding many analysts' expectations. (Again, specific data would require referencing BofA reports).

-

Impact on Investor Sentiment: These strong earnings have bolstered investor confidence and sentiment, driving demand for stocks and further pushing up valuations. Positive earnings announcements often lead to immediate stock price increases.

-

Earnings Growth Outweighing Valuation Concerns: BofA's analysis suggests that the rate of earnings growth is sufficient to justify, at least partially, the current high valuations. This implies that the market isn't solely driven by speculative bubbles but also by solid fundamentals.

-

Strong Performing Sectors: Certain sectors, such as technology and healthcare, have exhibited particularly robust earnings growth, contributing significantly to the overall market valuation.

Addressing the Risk of Inflation

While acknowledging the potential threat of inflation, BofA doesn't view it as an immediate existential threat to the current market valuations. However, they have outlined strategies to mitigate this risk.

-

BofA's Perspective on Inflation Risks: BofA acknowledges the possibility of inflation rising and impacting corporate earnings and market valuations. However, they believe current levels are manageable.

-

Inflation Risk Management Strategies: Their investment strategies likely incorporate mechanisms to hedge against inflation, such as investing in inflation-protected securities or assets that tend to perform well during inflationary periods.

-

Hedging Mechanisms and Alternative Investments: Diversification across various asset classes and the inclusion of inflation-hedging instruments are likely key components of their risk management approach.

BofA's Long-Term Growth Outlook

A crucial element of BofA's rationale is their optimistic long-term outlook for the economy and the stock market. This positive forecast helps justify the current, relatively high valuations.

-

Economic Growth Forecast: BofA's economic forecasts (refer to their official reports for details) project continued, albeit perhaps slower, economic growth in the coming years.

-

Drivers of Future Growth: Potential drivers of future growth include technological advancements, ongoing globalization, and government investment in infrastructure.

-

Justifying Current Valuations: BofA argues that the current valuations are justifiable when considering the potential for sustained long-term growth and the relatively low interest rate environment.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's perspective on high stock market valuations is multifaceted, emphasizing the significance of low interest rates, strong corporate earnings, and a positive long-term economic outlook. While acknowledging the inherent risks, especially the potential for inflation, they present a compelling argument suggesting that current valuations aren't necessarily unsustainable. Understanding BofA's rationale on high stock market valuations is crucial for informed investment decisions. Dive deeper into their research and strategies to navigate the current market landscape effectively. Remember that market analysis is complex, and this article only presents one viewpoint. Always conduct your own thorough research before making any investment decisions.

Featured Posts

-

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 05, 2025

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 05, 2025 -

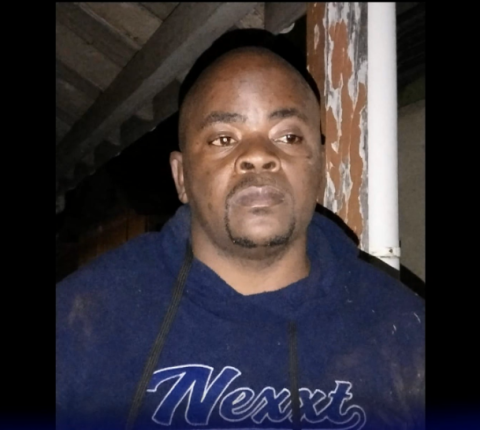

Discover The Countrys Top Business Locations A Detailed Guide

May 05, 2025

Discover The Countrys Top Business Locations A Detailed Guide

May 05, 2025 -

Actors And Writers Strike What It Means For Hollywood

May 05, 2025

Actors And Writers Strike What It Means For Hollywood

May 05, 2025 -

Ev Mandate Opposition Car Dealers Double Down On Concerns

May 05, 2025

Ev Mandate Opposition Car Dealers Double Down On Concerns

May 05, 2025 -

Aritzia And The Trump Tariffs How The Brand Is Adapting

May 05, 2025

Aritzia And The Trump Tariffs How The Brand Is Adapting

May 05, 2025

Latest Posts

-

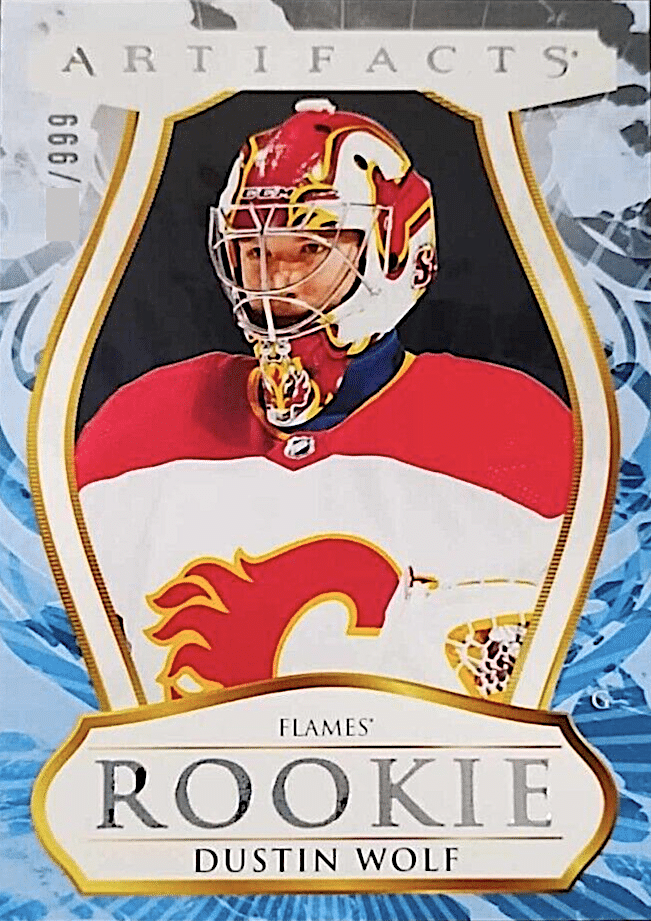

Calgary Flames Wolf Playoff Outlook And Calder Trophy Possibilities In Nhl Com Interview

May 05, 2025

Calgary Flames Wolf Playoff Outlook And Calder Trophy Possibilities In Nhl Com Interview

May 05, 2025 -

All Caps 2025 Capitals Playoff Strategy And Vanda Pharmaceuticals Inc Collaboration

May 05, 2025

All Caps 2025 Capitals Playoff Strategy And Vanda Pharmaceuticals Inc Collaboration

May 05, 2025 -

Vanda Pharmaceuticals Inc Partners With Capitals For 2025 Playoffs Initiatives

May 05, 2025

Vanda Pharmaceuticals Inc Partners With Capitals For 2025 Playoffs Initiatives

May 05, 2025 -

Us Tv Ratings For Stanley Cup Playoffs Fall Short Of Expectations

May 05, 2025

Us Tv Ratings For Stanley Cup Playoffs Fall Short Of Expectations

May 05, 2025 -

Stanley Cup Playoffs A Decline In Us Viewership Explained

May 05, 2025

Stanley Cup Playoffs A Decline In Us Viewership Explained

May 05, 2025