Dismissing Stock Market Valuation Concerns: BofA's Argument

Table of Contents

BofA's Argument: Earnings Growth Outpaces Valuation Concerns

BofA's central thesis rests on the assertion that robust corporate earnings growth significantly outweighs the perceived high valuations. They believe that current price-to-earnings ratios (P/E), while seemingly high compared to historical averages, are justified by the strength and projected trajectory of corporate profitability.

- Strong Projected Earnings Growth: BofA projects strong earnings growth for the next few years, fueled by a combination of factors including economic recovery, technological advancements, and sustained consumer spending. Their models suggest a significant increase in earnings per share (EPS) across various sectors.

- Sustained Corporate Profitability: The bank points to evidence of sustained corporate profitability, highlighting strong return on equity (ROE) figures and healthy profit margins across multiple industries. This demonstrates the resilience of corporate earnings even in the face of economic headwinds.

- Undervaluation in Specific Sectors: While acknowledging high overall valuations, BofA identifies specific sectors where they believe current valuations may even represent undervaluation. This is based on their analysis of future growth potential and the strength of underlying businesses within those sectors. They emphasize that a blanket statement regarding overvaluation overlooks sector-specific dynamics. Detailed comparisons of current valuations to historical averages further support their arguments.

Addressing Inflation and Interest Rate Risks

Inflation and rising interest rates are legitimate concerns for investors. BofA acknowledges these risks but argues their impact on corporate earnings and stock valuations is manageable and already partially priced in.

- BofA's Inflation and Interest Rate Outlook: BofA's analysis suggests a gradual moderation of inflation, with interest rate hikes expected to peak sooner than some market forecasts predict. Their models incorporate various scenarios, demonstrating the resilience of the market even under less favorable conditions.

- Impact on Corporate Earnings and Valuations: While acknowledging the potential negative impact on corporate earnings from higher interest rates and persistent inflation, BofA emphasizes that many companies have already implemented cost-cutting measures and pricing strategies to mitigate these effects.

- Risk Mitigation Strategies: The bank emphasizes the importance of diversification and other risk mitigation strategies for investors. A well-diversified portfolio, carefully balanced across sectors and asset classes, can help to reduce the impact of unexpected economic shifts.

The Role of Technological Innovation and Secular Growth Trends

BofA highlights the transformative impact of technological innovation and long-term secular growth trends as key drivers of future earnings growth. These factors, they argue, significantly bolster their bullish outlook despite current valuation concerns.

- Disruptive Technologies Driving Growth: Examples include artificial intelligence (AI), cloud computing, and biotechnology, all of which are expected to fuel significant growth in specific sectors in the coming years.

- Secular Trends Boosting Corporate Earnings: Long-term trends like the growth of the global middle class, increasing demand for sustainable energy, and the expansion of e-commerce are highlighted as contributing to sustained corporate earnings growth.

- Impact on Specific Sectors and Industries: BofA's analysis points to the disproportionate impact of technological innovation and secular growth trends on specific sectors and industries, driving both strong earnings and valuation multiples in these segments.

Alternative Valuation Metrics and Their Implications

BofA's analysis doesn't solely rely on traditional P/E ratios. They incorporate alternative valuation metrics to provide a more holistic perspective.

- PEG Ratio and Other Metrics: They utilize metrics such as the Price/Earnings to Growth ratio (PEG ratio) and price-to-sales ratios to account for growth prospects. They also potentially employ discounted cash flow (DCF) models and other advanced valuation models to assess intrinsic value.

- Justification for Using Alternative Metrics: The bank justifies the use of these alternative metrics by arguing that they provide a more nuanced understanding of a company's value, incorporating growth projections and future cash flows.

- Support for Bullish Conclusion: BofA argues that the application of these alternative valuation metrics reinforces their conclusion that, despite high headline P/E ratios, many companies are not overvalued, particularly when considering future growth prospects.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Insights

BofA's analysis presents a compelling argument for dismissing some of the prevailing stock market valuation concerns. Their bullish outlook rests on strong projected earnings growth outpacing valuation multiples, the manageable nature of inflation and interest rate risks, and the significant influence of technological innovation and secular growth trends. The incorporation of alternative valuation metrics further supports their conclusions. Their insights offer investors a valuable perspective when assessing market valuations. We encourage you to delve deeper into BofA's research and consider their arguments when formulating your investment strategy. Understanding diverse viewpoints on stock market valuations is crucial for making informed investment decisions.

Featured Posts

-

Cassie Ventura Testifies Key Moments From The Sean Diddy Combs Sex Trafficking Trial

May 15, 2025

Cassie Ventura Testifies Key Moments From The Sean Diddy Combs Sex Trafficking Trial

May 15, 2025 -

An Obscure Apps Potential To Disrupt Metas Power

May 15, 2025

An Obscure Apps Potential To Disrupt Metas Power

May 15, 2025 -

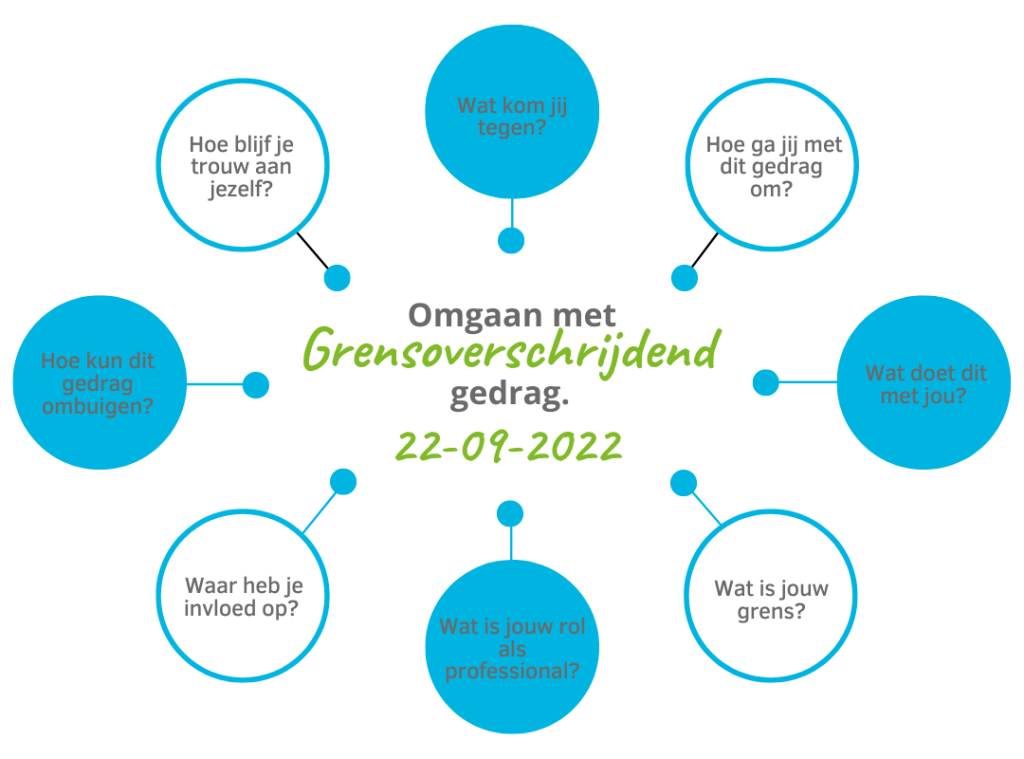

De Npo En De Aanpak Van Grensoverschrijdend Gedrag Vooruitgang En Uitdagingen

May 15, 2025

De Npo En De Aanpak Van Grensoverschrijdend Gedrag Vooruitgang En Uitdagingen

May 15, 2025 -

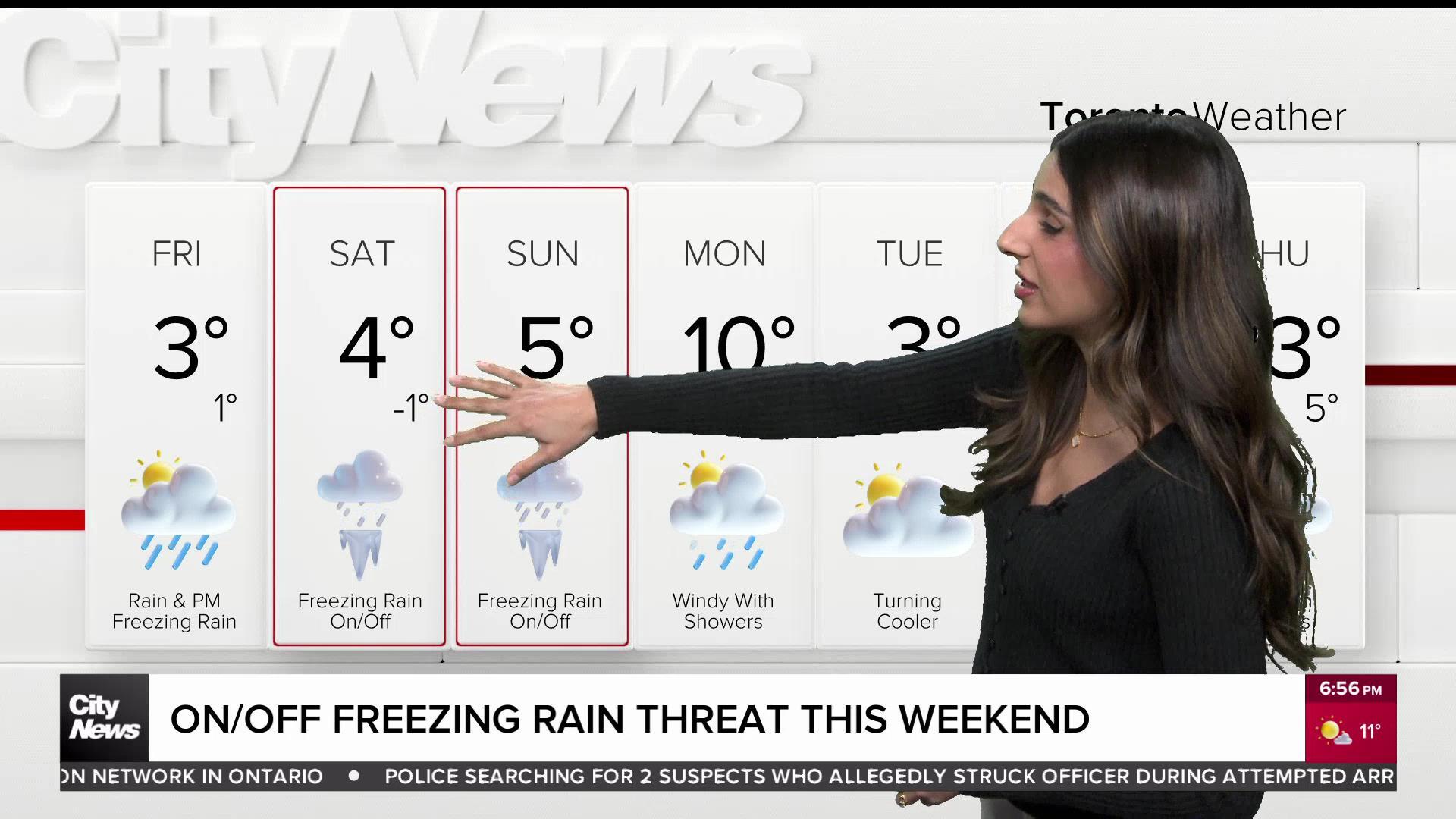

Ontarios Gas Tax Cut Permanent Relief And Highway 407 East Toll Removal

May 15, 2025

Ontarios Gas Tax Cut Permanent Relief And Highway 407 East Toll Removal

May 15, 2025 -

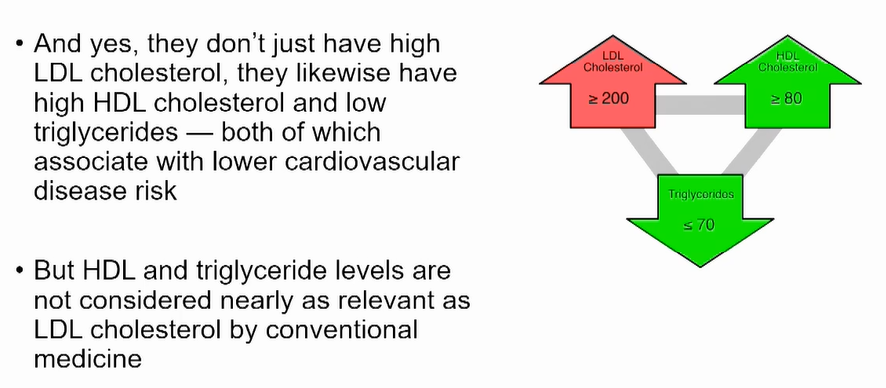

The Hemsley Hypothesis Can A Returning Ceo Revitalize United Health

May 15, 2025

The Hemsley Hypothesis Can A Returning Ceo Revitalize United Health

May 15, 2025

Latest Posts

-

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025 -

Analysis Dwyane Wades Perspective On Jimmy Butler Leaving Miami Heat

May 15, 2025

Analysis Dwyane Wades Perspective On Jimmy Butler Leaving Miami Heat

May 15, 2025 -

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025 -

Dwyane Wade On Jimmy Butlers Miami Heat Departure His Thoughts

May 15, 2025

Dwyane Wade On Jimmy Butlers Miami Heat Departure His Thoughts

May 15, 2025 -

Jimmy Butler The Missing Piece The Warriors Need Not Kevin Durant

May 15, 2025

Jimmy Butler The Missing Piece The Warriors Need Not Kevin Durant

May 15, 2025