Dismissing Stock Market Valuation Concerns: Insights From BofA

Table of Contents

BofA's Key Arguments for a Bullish Outlook

Despite acknowledging the elevated levels of current stock market valuation, BofA maintains a relatively positive outlook for the market. Their bullish stance is supported by several key factors, suggesting that the current valuations are not necessarily unsustainable or indicative of an imminent crash.

Strong Corporate Earnings Growth

BofA projects continued robust earnings growth for corporations, a crucial factor in justifying current valuations. Their analysis points to several supporting factors:

- Strong revenue growth forecasts: The firm predicts sustained and significant revenue growth across various sectors, driven by both domestic and international economic activity.

- Robust profit margins: Despite rising input costs in some sectors, BofA anticipates healthy profit margins will continue, fueled by pricing power and efficiency gains.

- Potential for earnings surprises: The firm suggests that several companies have the potential to exceed analysts' expectations, leading to positive upward revisions in earnings estimates. This positive surprise factor could further support current valuations.

This sustained earnings growth, according to BofA, significantly mitigates concerns related to high valuations, suggesting that current prices are justified by future earnings potential. The keywords earnings growth, revenue growth, profit margins, and earnings surprises all reflect this positive forecast.

Low Interest Rates and Monetary Policy

The current environment of low interest rates and accommodative monetary policy plays a significant role in supporting higher valuations, according to BofA's analysis.

- Impact of quantitative easing: The effects of past quantitative easing programs continue to support asset prices, including stocks. This influx of liquidity into the market has contributed to higher valuations across various asset classes.

- Low borrowing costs for companies: Low interest rates enable companies to borrow capital at low costs, fueling investment, expansion, and ultimately, earnings growth.

- Sustained low interest rate environment: BofA's outlook anticipates a continued period of low interest rates, at least in the near term, further supporting higher valuations.

These factors contribute significantly to a positive market outlook, counterbalancing concerns about high stock valuations. The use of keywords like low interest rates, monetary policy, quantitative easing, and borrowing costs clearly emphasizes this point.

Technological Innovation and Disruption

Technological advancements and disruptive innovation are driving growth in specific sectors, justifying higher valuations in these areas. BofA highlights the following:

- Examples of high-growth tech sectors: Sectors like software, cloud computing, artificial intelligence, and biotechnology are experiencing rapid growth, attracting significant investment and commanding premium valuations.

- Disruptive technologies impacting valuations: The introduction of groundbreaking technologies reshapes industries, creating new opportunities and justifying higher valuations for companies at the forefront of innovation.

- Long-term growth potential: The long-term growth potential of these sectors is a significant driver of higher valuations, as investors bet on future returns.

This technological dynamism, according to BofA, warrants a more nuanced approach to valuation, recognizing the exceptional growth potential of certain sectors. The keywords technological innovation, disruptive technologies, high-growth sectors, and long-term growth highlight this perspective.

Addressing Common Valuation Concerns

While acknowledging the validity of some concerns, BofA addresses common criticisms regarding the high valuations in the market.

Rebuttal of High P/E Ratio Concerns

One of the most common concerns is the elevated Price-to-Earnings (P/E) ratio across the market. BofA counters these concerns by pointing out:

- Comparison to historical P/E ratios: While current P/E ratios are high compared to historical averages, BofA argues that comparing them directly without considering the low interest rate environment is misleading.

- Considering the impact of low discount rates: Low interest rates lead to lower discount rates used in valuation models, resulting in higher present values and consequently, higher justifiable P/E ratios.

- Focus on forward-looking P/E ratios: BofA emphasizes the importance of looking at forward-looking P/E ratios, which take into account projected future earnings, providing a more accurate reflection of current valuations.

Understanding these nuances is crucial to correctly interpreting the significance of high P/E ratios in the current context. The use of keywords like P/E ratio, price-to-earnings ratio, discount rates, and forward-looking P/E is essential for SEO purposes.

Addressing Concerns about Market Bubbles

The possibility of a market bubble is a recurring concern. BofA's analysis suggests that while market corrections are always possible, a full-blown crash is less likely. Their reasoning includes:

- BofA’s arguments against a bubble: They argue that the current market conditions are not mirroring the characteristics of previous bubbles, citing factors like strong fundamentals and the absence of widespread speculative excesses.

- Potential market corrections vs. a full-blown crash: BofA acknowledges the potential for market corrections, but emphasizes that these are normal market fluctuations, not necessarily indicative of a larger systemic collapse.

- Risk management strategies: BofA highlights the importance of diversified investment strategies and risk management techniques to mitigate potential downside risks.

These arguments contribute to a more cautious but still optimistic outlook, recognizing the possibility of fluctuations while downplaying the risk of a major market crash. Keywords like market bubble, market correction, risk management, and market crash are strategically used here.

Potential Risks and Caveats

Despite their generally positive outlook, BofA acknowledges several potential risks and limitations.

Geopolitical Risks and Uncertainty

Geopolitical events can significantly impact market performance. BofA highlights:

- Examples of geopolitical risks: These include trade wars, political instability in key regions, and escalating international tensions.

- Potential impact on earnings: Geopolitical uncertainties can negatively impact corporate earnings, dampening market sentiment.

- Strategies for mitigating risk: BofA emphasizes the importance of proactive risk management strategies to mitigate the impact of geopolitical shocks.

Understanding and addressing these risks is crucial for informed investment decisions. The keywords geopolitical risk, economic uncertainty, and market volatility ensure this section’s relevance in search results.

Inflationary Pressures

Rising inflation poses a significant risk to stock valuations. BofA considers:

- Impact of rising inflation on earnings: Increased inflation can erode profit margins and negatively impact corporate earnings.

- Potential for interest rate hikes: Central banks might respond to rising inflation by raising interest rates, potentially dampening economic growth and negatively affecting stock valuations.

- Inflation hedging strategies: BofA suggests investors should consider inflation hedging strategies to protect their portfolios from the erosive effects of inflation.

Understanding the potential impacts of inflation is crucial for mitigating risks. Keywords such as inflation, interest rate hikes, and inflation hedging are strategically used to enhance SEO.

Conclusion: Navigating Stock Market Valuations with BofA's Insights

BofA's analysis presents a compelling case for a positive market outlook, even with high valuations. Their bullish stance is primarily supported by projections of strong corporate earnings growth, a supportive monetary policy environment characterized by low interest rates, and the transformative potential of technological innovation. While acknowledging potential risks such as geopolitical uncertainty and inflationary pressures, BofA emphasizes the importance of proactive risk management strategies. By considering these insights, investors can develop more informed stock market valuation strategies. To further understand BofA's detailed analysis and incorporate its implications into your investment approach, we recommend exploring their latest research [link to BofA research if available]. Understanding the nuances of stock market valuation, navigating BofA market analysis, and developing effective high valuation investing strategies are crucial in today's dynamic market.

Featured Posts

-

Patience Pays Carney On Canadas Strategic Trade Stance With The Us

Apr 27, 2025

Patience Pays Carney On Canadas Strategic Trade Stance With The Us

Apr 27, 2025 -

Governments Autism Study Led By Known Anti Vaccination Activist

Apr 27, 2025

Governments Autism Study Led By Known Anti Vaccination Activist

Apr 27, 2025 -

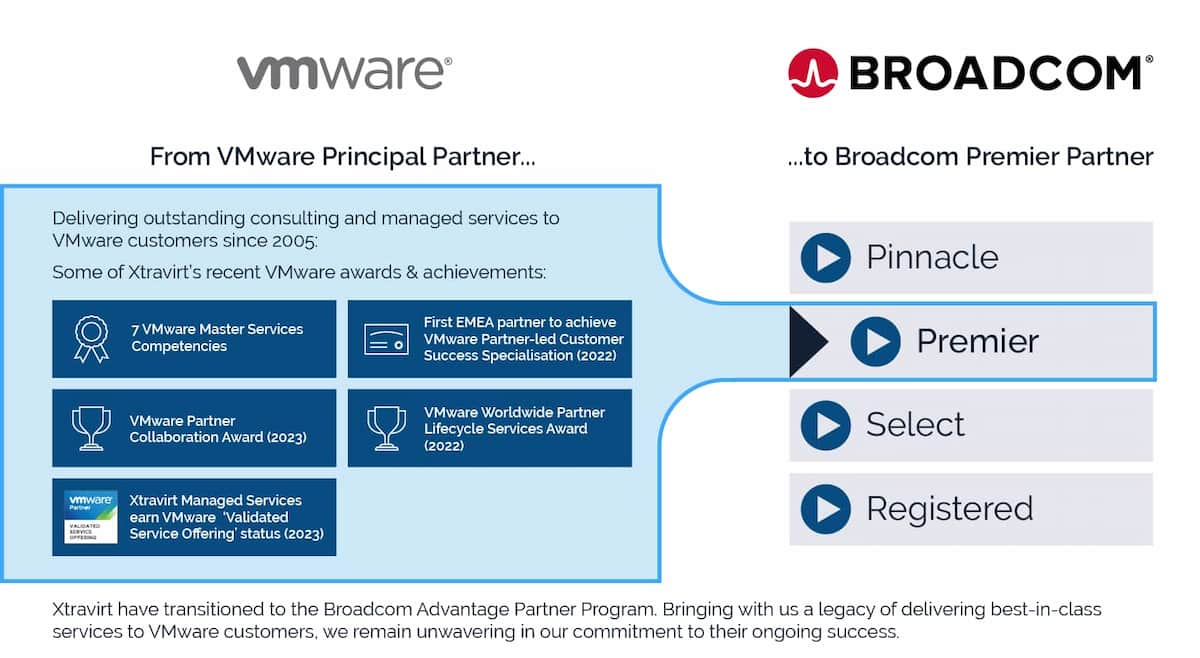

Broadcoms Proposed V Mware Price Hike An Unprecedented 1050 Increase

Apr 27, 2025

Broadcoms Proposed V Mware Price Hike An Unprecedented 1050 Increase

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Nbc 5 Report

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Nbc 5 Report

Apr 27, 2025 -

Ramiro Helmeyer A Dedication To Fc Barcelonas Glory

Apr 27, 2025

Ramiro Helmeyer A Dedication To Fc Barcelonas Glory

Apr 27, 2025

Latest Posts

-

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025